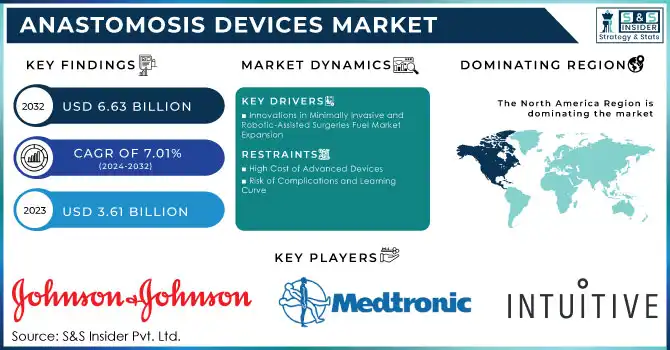

Anastomosis Devices Market Size Analysis:

The Anastomosis Devices Market Size was valued at USD 3.61 billion in 2023 and is expected to reach USD 6.63 billion by 2032 and grow at a CAGR of 7.01% over the forecast period 2024-2032.

Get More Information on Anastomosis Devices Market - Request Sample Report

The anastomosis devices market is experiencing significant growth, propelled by the rising incidence of surgical cases and advances in surgical technologies. Cardiovascular disorders, a leading cause of mortality worldwide, necessitate precise and reliable surgical tools. According to the American Heart Association, over 523 million people globally are affected by cardiovascular diseases, emphasizing the critical need for advanced anastomosis devices in procedures like coronary artery bypass grafting. Similarly, the increasing prevalence of gastrointestinal disorders and the growing number of bariatric surgeries, driven by the obesity epidemic, are further bolstering demand for these devices. Accidental cases also play a significant role in driving the growth of the anastomosis devices market. Trauma-related injuries, such as severe abdominal or gastrointestinal injuries from accidents, often require surgical interventions involving anastomosis procedures. These accidents, which result in ruptured organs or complex internal injuries, necessitate the use of anastomosis devices to restore continuity to the digestive tract or vascular structures. As the number of road accidents, industrial accidents, and other trauma-related injuries rises globally, the demand for anastomosis devices also increases. The increasing prevalence of such incidents, particularly in regions with high accident rates, is expected to contribute to the expansion of the market, driving the adoption of advanced anastomosis technologies to improve patient outcomes and recovery times.

Innovations in anastomosis technology, such as magnetic compression devices and automated suturing systems, have revolutionized surgical practices. For instance, the FDA's recent breakthrough designation for magnetic anastomosis technology underscores its potential to enhance precision and reduce postoperative complications during gastrointestinal surgeries. Reports from Surgical Endoscopy highlight the significant benefits of robotic-assisted anastomosis procedures, including improved accuracy, reduced recovery times, and fewer complications, making them increasingly popular in clinical settings.

Additionally, organ transplantation surgeries, which require high precision during vascular and tissue anastomosis, are rising. Studies from the Organ Donation Alliance reveal that over 100,000 patients in the U.S. are on transplant waiting lists annually, showcasing the growing reliance on innovative surgical tools to improve outcomes. Devices such as the FDA-approved Viola clampless proximal anastomosis device have transformed vascular surgeries, eliminating the need for traditional clamping and reducing associated risks.

Minimally invasive surgical procedures have gained immense traction due to shorter recovery times and reduced patient trauma. Anastomosis devices are critical components in these procedures, making them indispensable in modern surgical practices. Continuous advancements in materials, such as bioabsorbable options, and the integration of robotic systems are expected to further elevate the standard of care, driving sustained growth in this market.

Anastomosis Devices Market Dynamics

Drivers

-

Innovations in Minimally Invasive and Robotic-Assisted Surgeries Fuel Market Expansion

The anastomosis devices market is propelled by rising surgical needs across various medical fields, supported by advancements in technology and growing demand for minimally invasive procedures. According to recent data, cardiovascular surgeries account for over 30% of all surgical interventions globally, emphasizing the demand for reliable anastomosis solutions. In gastrointestinal surgery, the adoption of minimally invasive techniques has surged, with studies showing a 50% reduction in postoperative complications when advanced devices like automated suturing systems are utilized.

The increasing prevalence of obesity, affecting 13% of the global adult population, has driven a rise in bariatric surgeries, which rely on precise anastomosis techniques. Additionally, the need for organ transplantation is expanding, with over 100,000 annual transplants performed globally, requiring advanced vascular anastomosis devices to ensure successful outcomes.

Innovations like the Viola clampless proximal anastomosis device, which eliminates the need for traditional clamps, and FDA-approved magnetic compression devices highlight the market's technological progress. Robotic-assisted surgeries, supported by devices designed for enhanced dexterity and precision, are now employed in over 20% of complex surgical cases, according to Surgical Endoscopy.

Furthermore, advancements in bioabsorbable materials for anastomosis devices offer better patient safety and reduced long-term complications, aligning with the shift toward patient-centric healthcare. Collectively, these factors, combined with growing surgical case volumes, underline the dynamic growth and potential of the anastomosis devices market.

Restraints

-

High Cost of Advanced Devices

The premium pricing of innovative anastomosis devices, particularly robotic-assisted and bioabsorbable models, may limit their adoption, especially in cost-sensitive regions and healthcare systems.

-

Risk of Complications and Learning Curve

Despite technological advancements, the complexity of using sophisticated anastomosis devices requires specialized training and improper usage can lead to complications, hindering widespread acceptance in some surgical settings.

Anastomosis Devices Market Segmentation Analysis

By Product

Disposable anastomosis devices were the dominant segment in 2023, accounting for a significant share of the market. These devices are favored for their convenience, reduced risk of cross-contamination, and the growing preference for single-use solutions in hospitals and surgical centers. As the global focus on infection control intensifies, the disposable segment's share of the market dominated by 60.0% in 2023. Their one-time-use nature ensures sterility, which is a major factor driving their preference for high-risk surgeries like cardiovascular and gastrointestinal procedures. Additionally, disposable devices are cost-effective for healthcare providers who avoid the costs associated with cleaning and sterilizing reusable instruments.

Reusable anastomosis devices are the fastest-growing segment, with an increasing number of healthcare facilities opting for these devices due to their long-term cost-effectiveness. The reusable segment is expected to see a growth rate of 10% annually. As medical facilities strive to reduce costs in the long term while maintaining high-quality outcomes, reusable devices offer a more sustainable solution, especially in established healthcare settings. The adoption of these devices is further supported by innovations in materials and designs that enhance their durability and ease of use. The growing trend towards environmentally conscious medical practices also supports the growth of the reusable segment, making it a key area of expansion.

By Application

Cardiovascular surgery was the dominant application segment in 2023, accounting for over 40.0% of the overall anastomosis devices market. The high prevalence of cardiovascular diseases, combined with the increasing number of cardiovascular surgical procedures globally, contributed significantly to this dominance. Cardiovascular surgeries such as coronary artery bypass grafting (CABG) and aortic surgeries demand reliable anastomosis solutions, driving the need for advanced devices. The growing adoption of minimally invasive and robotic-assisted cardiovascular procedures further boosts the demand for precise and efficient anastomosis devices in this field.

Gastrointestinal surgery emerged as the fastest-growing application segment, with a projected growth rate of 12% annually. This growth is largely attributed to the increasing number of bariatric surgeries, the rise in gastrointestinal diseases, and the widespread adoption of minimally invasive techniques in this field. As minimally invasive surgeries continue to gain traction, advanced anastomosis devices, such as automated suturing systems, play a critical role in improving outcomes and reducing postoperative complications. The increasing shift towards outpatient care and faster recovery times in gastrointestinal surgeries further enhance the demand for innovative anastomosis devices in this segment.

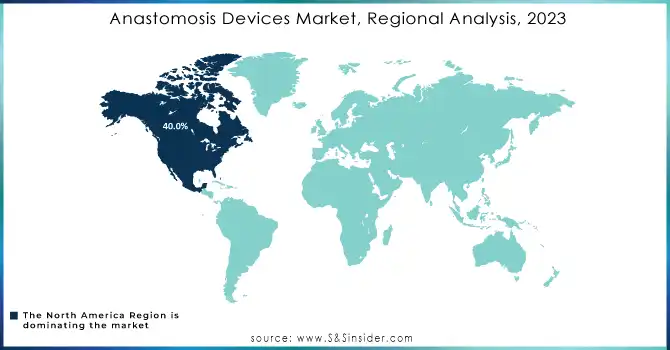

Regional Insights

North America held the largest market share, accounting for over 40.0% of the global market in 2023. The dominance of this region can be attributed to the high prevalence of cardiovascular diseases, obesity, and gastrointestinal disorders, along with the advanced healthcare infrastructure and strong adoption of innovative technologies. The U.S. leads the market, supported by substantial investments in healthcare and ongoing innovations in anastomosis devices, including robotic-assisted surgery technologies.

Europe is the second-largest market, contributing around 30% to the global market. The region has seen a rising demand for advanced surgical procedures, particularly in the cardiovascular and gastrointestinal fields. Countries such as Germany, France, and the U.K. are investing in high-tech medical devices, which is propelling market growth. Additionally, Europe’s strong regulatory framework supports the use of safe and efficient anastomosis devices in surgeries.

Asia-Pacific (APAC) is the fastest-growing region, with a projected annual growth rate of 10%. The rapid increase in healthcare access, rising surgical case volumes, and growing awareness of advanced surgical techniques in countries like China, India, and Japan are key drivers. The region’s rising healthcare expenditure and the expanding middle-class population are expected to continue boosting demand for anastomosis devices.

Need Any Customization Research On Anastomosis Devices Market - Inquiry Now

Anastomosis Devices Market Key Players

-

Johnson & Johnson (Ethicon, Inc.) – Endo Stitch, Proximate, Intracorp Staplers

-

Medtronic Plc – HeartString Proximal Anastomosis System, Tri-Staple

-

B. Braun Melsungen – Gastrointestinal Suturing Devices, Vascular Anastomosis Devices

-

Intuitive Surgical Inc. – da Vinci Surgical Systems, EndoWrist Stapler

-

Artivion, Inc. – Cardio-PA, Artivion Anastomosis Systems

-

Mizuho Medical Co., Ltd (MIZUHO Corporation) – Vascular Anastomosis Devices

-

Getinge – Endo GIA Staplers, FlowSurgical Anastomosis System

-

Peters Surgical – Anastomosis Sutures, Surgical Staplers

-

Baxter – Vascular Anastomosis Devices, BioSuture Stapler

-

Vascular Graft Solutions Ltd. – Vascular Anastomosis Devices

-

Medline Industries, LP – Surgical Sutures, Anastomosis Staplers

-

Seger Surgical Solutions – Suturing Devices for Anastomosis

-

LivaNova PLC – Coronary Anastomosis Devices, Vascular Graft Solutions

-

MAQUET Holding – TA Staplers, Anastomosis Systems

-

Novare Surgical Systems – Surgical Suturing Devices, Anastomosis Kits

-

Vitalitec International – Vascular Anastomosis Devices, Surgical Suturing Systems

Recent Developments in the Anastomosis Devices Market

-

In Nov 2024, GI Windows Surgical raised USD 37 million to advance the clinical development and commercialization of its Flexagon self-forming magnet technology. The funding will support the continued development of the Flexagon system, which uses magnetic anastomosis to enable less invasive surgical procedures and aims to revolutionize tissue fusion and delivery systems in anastomosis technology.

-

In Sept 2024, GT Metabolic Solutions received FDA de novo clearance for its first-generation MagDI system, designed for side-to-side duodeno-ileal anastomosis. The system utilizes magnetic compression anastomosis to eliminate the need for bowel incisions, reduce technical variability, and avoid leaving foreign materials behind during minimally invasive procedures.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.61 billion |

| Market Size by 2032 | US$ 6.63 billion |

| CAGR | CAGR of 7.01% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Disposable, Reusable) • By Application (Cardiovascular surgery, Gastrointestinal surgery, Others) • By End-use (Hospitals, Ambulatory care centers and clinics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Johnson & Johnson (Ethicon, Inc.), Medtronic Plc, B. Braun Melsungen, Intuitive Surgical Inc., Artivion, Inc., Mizuho Medical Co., Ltd (MIZUHO Corporation), Getinge, Peters Surgical, Baxter, Vascular Graft Solutions Ltd., Medline Industries, LP, Seger Surgical Solutions, LivaNova PLC, MAQUET Holding, Novare Surgical Systems, Vitalitec International, GT Metabolic Solutions, and GI Windows Surgical. |

| Key Drivers | • Innovations in Minimally Invasive and Robotic-Assisted Surgeries Fuel Market Expansion |

| Restraints | • High Cost of Advanced Devices • Risk of Complications and Learning Curve |