Anti-aging supplements Market Report Scope & Overview:

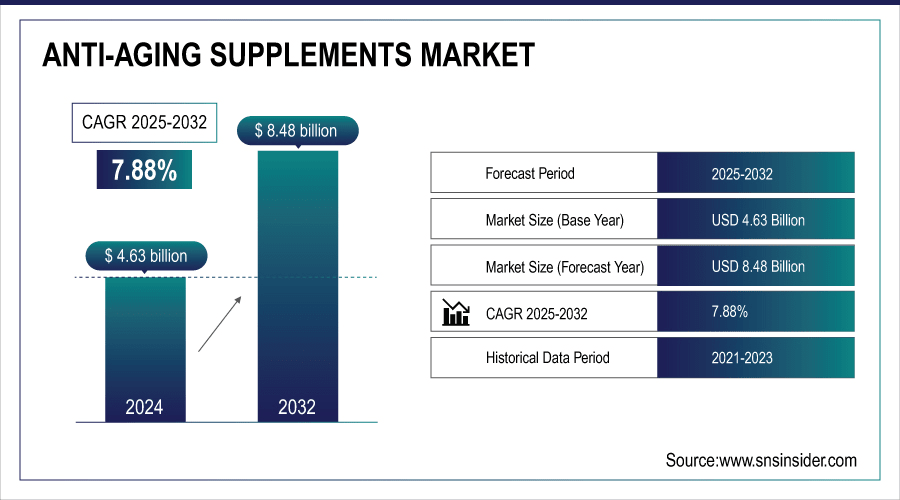

The Anti-aging supplements Market size was valued at USD 4.63 billion in 2024 and is expected to reach USD 8.48 billion by 2032, growing at a CAGR of 7.88% over the forecast period of 2025-2032.

The Anti-aging supplements Market growth trend heavily depends on the Global increase in the geriatric population is a key factor for the growth of the anti-aging supplements market. With life spans getting longer, the over-60 age group is growing at a fast pace, leading to a bigger consumer base in search of better health, vitality, and looks. Wrinkles, joint pain, exhaustion, and memory — those bothersome developments of aging are driving the use of supplements, including collagen, vitamins, NMN, and antioxidants, among people over 60. The seniors of today are more health-conscious and health proactive, interested in longevity and quality of life. This increased focus on prevention and beauty from within is driving market growth globally.

For instance, according to the WHO, Globally, life expectancy at birth reached 73.3 years in 2024, an increase of 8.4 years since 1995. The number of people aged 60 years and older worldwide is projected to increase from 1.1 billion in 2023 to 1.4 billion by 2030. This trend is particularly evident and rapid in developing regions.

For instance, on 30 Aug 2024, Nicotinamide mononucleotide (NMN), a crucial intermediate in NAD+ + synthesis, can rapidly transform into NAD+ + within the body after ingestion. NMN plays a pivotal role in several important biological processes, including energy metabolism, cellular aging, circadian rhythm regulation, DNA repair, chromatin remodeling, immunity, and inflammation.

To Get More Information On Anti-aging supplements Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2024: USD 4.63 Billion

-

Market Size by 2032: USD 8.48 Billion

-

CAGR: 7.88% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Anti-aging supplements Market Trends

-

Breakthrough discoveries and therapeutic advancements by specialists strengthen formulation credibility and consumer trust.

-

Digital platforms and healthcare advocates amplify awareness of wellness options, driving widespread uptake.

-

Emergence of novel blends, delivery formats, and nutrition strategies broadens application across multiple needs.

-

Collaborations, distribution ecosystems, and wellness-support programs expand reach and international presence.

-

Ongoing assessments to refine efficacy, acceptance, and protection promote long-term usage and medical incorporation globally.

Anti-aging supplements Market Growth Drivers:

-

Rising Demand for Beauty-from-Within Products Is Driving the Anti-Aging Supplements Market Growth

The increasing trend of beauty from within is an essential factor supporting the growth of the anti-aging supplements market. In today’s market, consumers are seeking out natural options for improving their appearance, both through cosmetics and through improved skin, hair, and nails from the inside. This 4-in-1 beauty supplement has been a rising star in personal care to reduce fine lines, enhance skin firmness, and promote healthy aging. It’s a phenomenon that is particularly strong among women aged 25-55, driven by a mix of wellness culture, social media, and influencer marketing. Highlights: Beauty-based antiaging supplements have grown rapidly around the world.

-

Adoption of Smart Procurement & Tracking Systems is the Key Driver of the Anti-Aging Supplements Market Growth

The increasing attention to preventive healthcare is a significant factor driving the anti-aging supplements market. Instead of treating age-related problems, the market is looking to prevent them through nutrition on an everyday basis, and in this effort, consumers are looking for solutions to keep looking young and healthy. This transformation has fueled interest in supplements with ingredients such as collagen, antioxidants, NMN, CoQ10, and vitamins to fight wrinkles, fatigue, joint pain, and cellular decline.

For instance, on 26 Jun 2024, NMN increases the lifespan of female mice by 8.5% but does not increase the lifespan of male mice, perhaps because NMN metabolism is increased in females.

Individuals see these products as a part of a broader overall health strategy and not as urgent remedies. A younger (30–60) health-aware, digital-aware, healthy aging, and longevity spender. We see this predominantly among a health-motivated, digitally savvy, but also health-consumption-motivated group.

Anti-aging supplements Market Restraints:

-

Adverse Effects and Allergic Reactions are Restraining the Anti-Aging Supplements Market Growth

The adverse effects and allergic reactions are the major limiting factors for the anti-aging supplements market. Although it is advertised as safe, its ingredients may have side effects, particularly for those who are sensitive. For instance, animal collagen from a marine or bovine source might cause allergic reactions, while high doses of CoQ10 or resveratrol can cause digestive issues. Even some herbal extracts can cause drug/medication interactions. Such safety concerns, especially for the elderly or in chronic care, contributed to hesitation or cessation of usage. Without standardized dosing and limited regulatory oversight, the potential for misuse is increased, which negatively impacts consumer confidence and adoption in this space.

For instance, on 30 Apr 2025The U.S. Food and Drug Administration notified consumers of a recall for a “healthy aging” supplement. The recall, initiated due to an undeclared allergen, has been officially labeled a Class 1 recall, meaning it poses a high risk to consumers.

Anti-aging supplements Market Segmentation Analysis

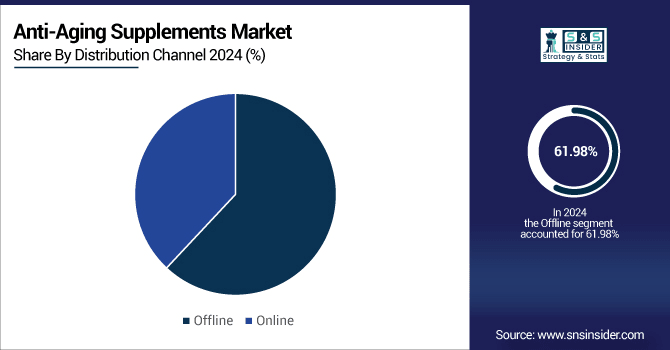

By Distribution Channel

The Offline segment has the largest share of the Anti-aging supplements industry. High consumer preference for purchase in store, primarily in pharmacies, health stores, and supermarkets, where they can visibly inspect products and receive professional advice, as well as have trust in terms of safety and authenticity. This becomes especially pressing to the elderly, who may feel less at ease using the internet to shop. Contributing to this is the availability of pharmacist advice, face-to-face explanations, and brand equity built through their presence on the retail shelf. Offline media also enables consumers to purchase our products on the spot and take them home, eliminating the delay for orders to be shipped, which is especially important to those consumers who are searching for trusted anti-aging products in developed and emerging markets.

The Online segment is emerging as the fastest-growing segment in the Anti-aging supplements market. The launch of online retail and the mobile shopping boom fuel DTC brands' sales. Clients, particularly those in the young and digital-savvy demographics, enjoy the ease of buying supplements online to compare products, see reviews, and get complete information on ingredients. Social media advertising, influencer endorsements, and subscription models have contributed substantially to online sales growth. Other contributory factors to this surge include e-commerce discounts, delivery to a customer’s house, and access to a greater number of products on global platforms like Amazon, iHerb, and others.

By Ingredient

The Collagen was the dominant segment in the global Anti-aging supplements Market, with a 69.22% market share in 2024. For skin firmness, hydration, and wrinkles. With age, natural collagen levels drop, resulting in visible aging signs. Collagen is something of an elixir when it comes to these signs of ageing, helping to improve hydration as well as the structural support of our skin for a healthier and more youthful skin. What’s more, there are many easy ways to incorporate collagen into your routine, in the form of powders, capsules, and drinks. Clinically proven and dermatologist- and beauty influencer-approved, collagen has become a go-to ingredient in “beauty-from-within” products. Its strong consumer confidence, increasing demand, and incredible efficacy are why it remains at the top of the market.

NMN is the fastest-growing segment in the Anti-aging supplements Market with the highest CAGR of 9.12% in the forecast period, owing to its newfound function in cellular health and longevity. NMN is a precursor of NAD+, an essential coenzyme that decreases in level when people get older, and is involved in energy generation, DNA repair, and cellular function. According to research, NMN may slow down aging processes, increase metabolism, and improve brain and cardio health. Increased awareness, media attention, and clinical studies have fueled consumer interest, particularly in the U.S. and Japan. Its status as “The Next-Generation Science-Backed Supplement” is accelerating a fast pace of adoption with health-conscious adults aged 35-60 around the world.

By Application

In 2024, the Hair, Skin, and Nail Care segment dominated the Anti-aging supplements Market with a 40.52% market share. Consumers are now demanding tangible, outward results via internal health solutions. Supplements, for example, directed at this segment may contain collagen, biotin, hyaluronic acid, and antioxidants, all of which can help keep skin elastic, reduce wrinkles, make hair stronger, and improve nails. Much of the interest has been fueled by beauty-from-within trends, in which consumers, women aged 25–55 in particular, are increasingly focusing on long-term beauty through nutrition. Effective influencer marketing, the endorsement from dermatologists, and an increasing social media exposure have also contributed to the adoption of these supplements, with hair, skin, and nail care seeing the highest demand and purchase.

The Energy and Stamina segment is emerging as the fastest-growing segment in the Anti-aging supplements Market trend, with a CAGR of 8.38%. owing to a growing demand among aging adults for ways to fight fatigue, loss of energy, and a decrease in physical activity levels. As the body grows older, the natural power resources within it decline as a result of reduced efficiency of mitochondria and hormonal changes. 1/ Those NAD+/ CoQ10 supplements, ginseng, and B vitamins: essential for restoring the sustenance of your daily energy and endurance! A significant driver is a higher proportion of 35–65-year-old adults who are pursuing an active, sport and fitness-oriented lifestyle, and who are trying to stay fit and perform at work. Rising attention towards the cellular energy aiding support and overall aging has spurred the growth of the segment throughout the globe.

By Formulation

Capsules held a dominant Anti-aging supplements Market share of 40.22% of the global Anti-aging supplements industry in 2024. Because they are convenient to consume, therapeutically, and are more stable than powders or liquids. Extended Release Capsules offer better stability of ingredients, particularly sensitive compounds such as NMN, CoQ10, and resveratrol, encouraging better delivery and absorption. The format is ideal for busy consumers wanting a no-fuss supplement regimen. One key contributing factor is the growing need for wellness convenience on the go and on-the-road solutions, in particular for a young professional and an aging population. Capsules are the product delivery choice for anti-aging formulations due to their mass acceptance, delivery assurance, and pharmaceutical-like attributes.

Powder plays a very vital role in the anti-aging supplements market growth, with the fastest growing CAGR of 9.02%. owing to its adjustable dose, quicker distribution, as well as its ability to be taken with food or drink. Consumers are turning to powders as they tend to be far more concentrated with active ingredients (collagen, hyaluronic acid, superfood blends, to name a few), meaning they are better for visible anti-aging results. The key driving factor is the increasing demand for functional beverages and wellness smoothies, especially among health-conscious millennials and health freaks. Furthermore, powders attract consumers who have challenges swallowing tablets and seek a flavored, pleasant consumption experience, prompting the explosive development of powders worldwide.

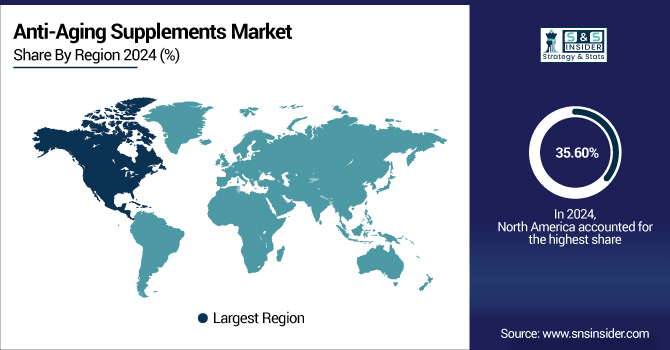

Anti-aging supplements Market Regional Analysis:

North America Anti-aging supplements Market Insights

North America serves as the leading region in the anti-aging supplements market, with a significant market share of 35.60% as of 2024. This leadership is fuelled by high health consciousness, wealth of purchasing power, and the willingness of consumers for the early adoption of wellness trends. There are a lot of big players in the space, including Life Extension, GNC, and Thorne HealthTech, that provide clinically proven anti-aging products. On the other hand, a large and rapidly aging population turns to supplements such as collagen, NMN, CoQ10, and resveratrol for anti-aging and beauty-from-within effects, especially those 40 and over. With well well-established healthcare infrastructure in place, a robust online and offline retail sector, increasing focus on preventive healthcare, the North America anti-aging supplements market is the momentum in the global anti-aging supplements market share.

Get Customized Report as Per Your Business Requirement - Enquiry Now

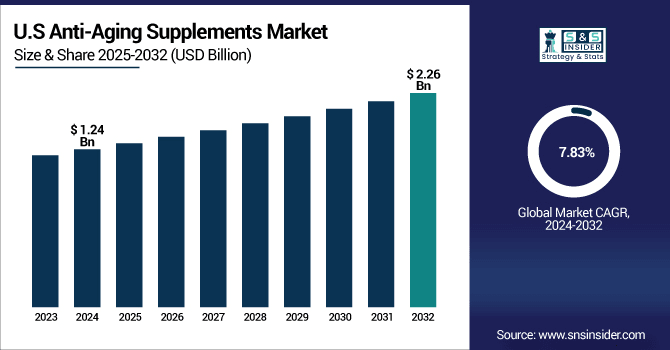

U.S. Anti-aging supplements Market Insights

The U.S. Anti-aging supplements Market was valued at USD 1.24 billion in 2024 and is expected to reach USD 2.26 billion by 2032, growing at a CAGR of 7.83% from 2025-2032.

The U.S. leads in the Anti-aging supplements Market share. The rise in evidence-based innovations is one of the major trends in the U.S anti-aging supplements market analysis, which is contributing to the market growth. Consumers today, especially those 35 and older, want products that they know work and that have been tested in clinical studies. It has resulted in a demand for advanced ingredients that represent forward thinking, such as NMN (Nicotinamide Mononucleotide), NAD+ booster, resveratrol, and CoQ10 that provide research-backed support for cellular energy, DNA repair, and longevity. Brands like Thorne HealthTech, Elysium Health, and Life Extension set the bar with their science-backed formulations. Such products typically incorporate improved delivery systems for increased absorption.

Europe Anti-aging supplements Market Insights

The second position is occupied by Europe on the basis of a rising population over age 40, increasing awareness about health, prevention, and demand for preventive wellness products. In Germany, France, Italy, and the UK, consumer interest in supplements for skin health, energy, and longevity is growing. The market in Europe is doing well due to very strict regulations, which guarantee the consumers the quality and effectiveness of the product. Also, strong knowledge of scientifically proven ingredients including collagen, resveratrol, CoQ10, and NMN, has boosted demand, particularly for those 40 years old and up. Manufacturers with a large presence of major pharmaceutical and nutraceutical companies, along with high demand in traditional drug stores and online channels, give Europe a considerable share of the anti-aging supplements in the global market. it is a significant region for market expansion and product innovation.

Asia-Pacific Anti-aging supplements Market Insights

The Asia-Pacific Anti-aging Supplements market is the fastest growing with the highest CAGR of 8.39%, owing to the widespread occurrence of age-related diseases and disorders and the rise in disposable income levels and associated health issues among the aged populace in countries like China, Japan, India, and South Korea. The region is urbanizing at a quick pace, and the burgeoning middle class is being swept along in a wave of interest in preventive health and beauty-from-within solutions. Fueled by a growing aging population and shifts in lifestyle, consumers are turning to collagen, hyaluronic acid, NMN, and even herbal antioxidants to help keep them looking young, feeling active, and well.

Increase in online retail sales channels and high awareness towards digital health has become one of the significant growth factors of anti-aging supplements in the Asia Pacifi. The internet has also helped to make them accessible to premium anti-ageing supplements are readily available, being marketed to consumers on websites all around the world and in some instances, recommended to consumers by their favourite influencers and/or wellness industry gurus via social media. Furthermore, culturally accepted herbs and traditional ingredients were added to modern formulas to enhance the market soundness. Innovative product releases are also contributing to the region, where you see players introducing flavors, packaging, and recipe formulation suited to the local tastes. These factors are facilitating Asia-Pacific in becoming one of the key and important players in the global anti-aging supplements market during the upcoming years.

Latin America (LATAM) and Middle East & Africa (MEA) Anti-aging supplements Market Insights

The Middle East and Africa are projected to show limited penetration in the anti-aging supplements market owing to less awareness, low spending capacities in most countries, and an underdeveloped healthcare sector. For most parts of this region, the demand is for basic healthcare and nutrition rather than products that are preventive or wellness-based, like anti-ageing supplements. Plus, more advanced products like NMN, CoQ10, or collagen are also relatively rare, and even more so outside of major cities. In some markets, cultural attitudes to aging and beauty could also stifle demand. Regulatory hurdles, the lack of advertisements, and support for conventional drugs also stand in the way of growth. And even as younger, urban-based consumers are beginning to warm to the idea of wellness, many of those barriers also make this region among the lowest in penetration and market share globally industry, she noted.

There is also a trend of increasing demand for anti-aging supplements in the Latin American market on account of increasing health awareness, rising middle-class population, and changing beauty and wellness trends in the region. Brazil, Mexico, and Argentina are among the largest and most cosmopolitan, contributing countries, with health-aware, aging, supplement-using consumers and a growing demand for skin, hair, and overall health and vitality-related supplements. The interest in less activating supplements, like collagen, vitamins, and herbal-based supplementation, is on the rise, contender because it is more of a perceived natural approach, and the other, simply a more affordable option. The market still faces challenges, including economic uncertainty, day-to-day variation between regions and an uneven playing field in terms of regulation and access to premium offerings, but the growth of internet penetration and e-commerce multi-vendor businesses is increasing the availability of products. Social media influencers and beauty trends have also changed consumer behavior.

Anti-aging supplements Market Key Players:

Some of the Anti-aging supplements Market Companies are:

-

Nestlé Health Science

-

Amway Corporation

-

Herbalife Nutrition Ltd

-

Now Foods

-

Life Extension

-

GNC Holdings Inc

-

Thorne HealthTech

-

Oziva

-

The Nature’s Bounty Company

-

Nu Skin Enterprises, Inc.

-

AbbVie (formerly Allergan)

-

Blackmores Limited

-

NeoCell (part of Clorox)

-

Cureveda

-

Decode Age

-

BASF SE

-

Archer Daniels Midland Company (ADM)

-

Cargill Incorporated

Anti-aging supplements Market Competitive Landscape:

Nestlé, founded in 1866 and headquartered in Vevey, Switzerland, is the world’s largest food and beverage company. It operates across nutrition, health, and wellness sectors, with a diverse portfolio including dairy, infant nutrition, coffee, bottled water, and medical nutrition, aiming to improve quality of life through science-based products.

-

On Dec 12, 2024, Nestlé scientists discover bioactive nutrients to support muscle health and healthy longevity. As the world's population continues to age, it's more important than ever to understand the mechanisms behind aging. Nestlé is exploring science-based nutritional solutions for specific age-related health conditions, such as muscle loss and physical fatigue.

Herbalife, founded in 1980 and headquartered in Los Angeles, California, USA, is a global nutrition company specializing in dietary supplements, weight management products, and personal care items. It operates through direct selling, with a presence in over 90 countries, focusing on promoting healthier lifestyles and community-driven wellness initiatives worldwide.

-

On 24 Feb 2025, Herbalife also touted a management restructuring plan “designed to bring leadership closer to its markets.” The program is expected to cut as much as $80 million in management costs in 2025.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.63 billion |

| Market Size by 2032 | USD 8.48 billion |

| CAGR | CAGR of 7.88% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Ingredient (Collagen, Resveratrol, Vitamins, Minerals, Hyaluronic Acid, NMN, Others) •By Application(Hair, Skin, and Nail Care, Bone and Joint Health, Energy and Stamina, Others) •By Formulation(Capsules, Tablets, Powder, Others) •By Distribution Channel(Offline, Online) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Nestlé Health Science, Pfizer Inc, Amway Corporation, Herbalife Nutrition Ltd, Now Foods, Life Extension, GNC Holdings Inc, Thorne HealthTech, Oziva, Nature’s Bounty |