Global Vitamins Market Size & Trends

Get more information on Vitamins Market - Request Sample Report

The Vitamins Market size was estimated at USD 5.93 billion in 2023 and is expected to reach USD 10.54 billion by 2032 at a CAGR of 6.64% during the forecast period of 2024-2032.

The vitamins market is witnessing robust growth, driven by increased health awareness, a focus on preventive care, and the growing prevalence of chronic diseases. According to the Nutrition Trends Survey, an estimated 88% of U.S. adults report using dietary supplements, with vitamins leading as the most consumed category. This trend highlights the growing consumer recognition of vitamins as essential to a healthy lifestyle.

Chronic diseases such as diabetes and cardiovascular ailments have amplified the importance of vitamins in managing nutritional deficiencies. For example, vitamin D is widely recommended to improve bone health and mitigate osteoporosis risk, while vitamin C is essential for immunity and tissue repair. Functional foods and beverages, including vitamin-fortified water, cereals, and snack bars, have gained popularity, catering to the demand for convenient yet nutritious options. Notable examples include products like Kellogg’s fortified cereals and Coca-Cola’s vitamin-infused beverages.

Technological advancements have further revolutionized the market with user-friendly formats. Gummies, for instance, have emerged as a preferred choice for children and adults alike, with brands like SmartyPants Vitamins and Olly Nutrition leading in this segment. Similarly, effervescent tablets, such as those by Berocca, offer a portable and fast-dissolving solution, enhancing compliance among busy consumers.

The COVID-19 pandemic catalyzed a surge in demand for immunity-boosting vitamins. According to the Council for Responsible Nutrition (CRN), vitamin D and C sales increased by over 50% in 2020, and the trend has sustained due to ongoing health consciousness. Additionally, personalized nutrition is becoming a defining factor, with companies like Care/of and Persona Nutrition providing tailored vitamin regimens based on individual health assessments.

Vitamins Market Dynamics

Drivers

-

The Growing Emphasis on Preventive Healthcare and Lifestyle Changes Are Major Drivers for The Vitamins Market.

With the prevalence of lifestyle-related disorders like obesity, diabetes, and cardiovascular conditions, consumers are increasingly adopting vitamins to bridge nutritional gaps and enhance overall wellness. Public health campaigns and greater awareness of the benefits of micronutrients—such as their role in immunity, mental health, and chronic disease prevention have further accelerated demand. This trend is particularly strong among millennials and Gen Z, who prioritize long-term health over-reactive treatments, resulting in a consistent shift toward proactive health management.

-

Innovation in Formulations and Delivery Methods

Product innovation has transformed the vitamins market, making supplements more accessible and appealing. Novel delivery methods, including gummies, effervescent tablets, liquid drops, and transdermal patches, have gained popularity, catering to diverse consumer preferences. These advancements address challenges like pill fatigue and improve compliance, especially among children and seniors. For example, gummy vitamins have become a favorite due to their palatability and ease of consumption, while liquid formulations allow for faster absorption.

-

Consumer Preferences for Sustainability and Clean Labels

A shift toward sustainable and plant-based lifestyles is significantly influencing the market. Consumers are increasingly seeking clean-label vitamins made from natural, non-GMO, and vegan-friendly ingredients. Brands offering transparency in sourcing and manufacturing processes are gaining traction, especially among eco-conscious buyers. The rise of plant-based diets and increasing allergies to synthetic additives have further amplified the demand for allergen-free and organic supplements. This trend aligns with broader movements toward ethical consumption, creating opportunities for companies to innovate and capture the loyalty of environmentally aware customers.

Restraints

-

The Vitamins Market Faces Significant Restraints Stemming from Stringent Regulatory Requirements and Quality Control Issues.

Regulatory bodies, such as the U.S. Food and Drug Administration and the European Food Safety Authority, impose strict guidelines on the manufacturing, labeling, and marketing of vitamin products. Compliance with these regulations can be costly and time-consuming, particularly for small and medium-sized enterprises. Additionally, the market is plagued by concerns over product authenticity and quality, with reports of adulterated or substandard supplements impacting consumer trust. The lack of universal standards for dietary supplements further complicates the landscape, leading to inconsistent product efficacy and safety. These challenges are exacerbated by misinformation in the market, where exaggerated claims about the benefits of certain vitamins can mislead consumers, resulting in skepticism and reduced adoption. Addressing these issues is critical for fostering growth and maintaining consumer confidence in the vitamins market.

Segmentation Analysis

Vitamins Market By Source

Synthetic vitamins held a dominant share of the market in 2023, accounting for 65% of total revenue. Their dominance is attributed to cost efficiency, ease of large-scale production, and longer shelf life compared to natural alternatives. These vitamins are widely incorporated into dietary supplements, fortified foods, and pharmaceutical applications, offering consistent potency and accessibility to a broader consumer base.

Natural vitamins are experiencing rapid growth due to increasing consumer demand for clean-label, organic, and plant-based products. The rising preference for minimally processed vitamins derived from fruits, vegetables, and other natural sources is a key driver. This trend aligns with the growing awareness about sustainability and health-conscious purchasing, propelling the segment forward.

Vitamins Market By Type

Vitamin B dominated the vitamin market in 2023, holding the largest share of 38.2%. This is due to its crucial role in various physiological functions, including tissue regeneration, nerve repair, and supporting metabolism. Vitamin B is widely used in the manufacturing of dietary supplements, pharmaceuticals, dairy products, and cosmetic formulations. Additionally, its importance during pregnancy for fetal development has further propelled its adoption. As the demand for health and wellness products grows, especially for energy, cognitive function, and skin health, Vitamin B continues to lead the market.

Vitamin D is expected to be the fastest-growing segment. Its significant role in bone health, immune system function, and overall well-being has driven its increased demand. With rising awareness of vitamin D deficiency and its impact on public health, more consumers are opting for vitamin D supplements. Additionally, its inclusion in fortified foods and personalized nutrition plans has expanded its reach. The COVID-19 pandemic also heightened focus on vitamin D's role in boosting immunity, further accelerating its growth in the market.

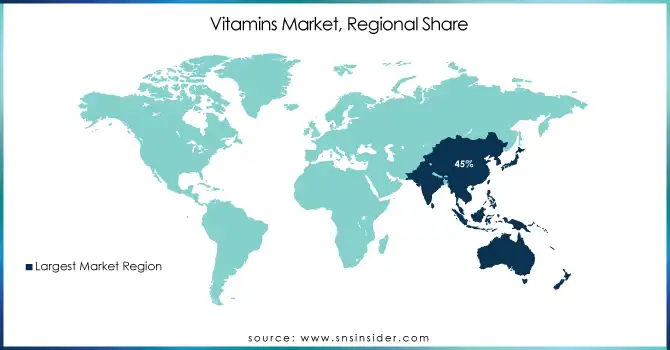

Vitamins Market Regional Outlook

The Asia-Pacific region dominated the vitamins market in 2023, accounting for the 42.3% market share. This dominance is driven by rapid urbanization, rising disposable incomes, and a growing health-conscious population in countries like China, India, Japan, and South Korea. As the middle class continues to expand, there is an increasing demand for dietary supplements, including vitamins, to address nutritional deficiencies and promote overall health. The rising prevalence of lifestyle diseases, coupled with a greater focus on preventive healthcare, has further fueled the market's growth.

In particular, countries like China and India have seen a significant rise in the consumption of vitamins, especially Vitamin D and Vitamin B, due to concerns over malnutrition and vitamin deficiencies among large sections of the population. Additionally, the region's growing interest in wellness, fitness, and natural health products has spurred demand for organic and plant-based vitamins, which are gaining popularity in the market.

Moreover, the presence of key local and international vitamin manufacturers, alongside improvements in distribution channels such as e-commerce, has made vitamins more accessible to a wider audience. The COVID-19 pandemic further amplified the demand for immunity-boosting vitamins like Vitamin D, propelling growth in this region. As a result, the Asia-Pacific market is poised for sustained growth in the coming years, driven by a combination of consumer health trends and expanding economic opportunities.

Need any customization research on Vitamins Market - Enquiry Now

Key Players:

-

ADM

-

Lonza Group

-

Adisseo

-

Vitablend Nederland BV

-

SternVitamin GmbH

-

Farbest-Tallman Foods Corporation The Wright Group

-

Zhejiang Garden Biochemical High-Tech Co., Ltd

-

NewGen Pharma

-

Resonac

-

BTSA BIOTECNOLOGÍAS APLICADAS SL

-

Cargill Incorporated

-

Archer Daniels Midland Company (ADM)

-

Ingredion Incorporated

-

Tate & Lyle PLC

-

Agrana Beteiligungs-AG

-

Grain Processing Corporation

-

Roquette Frères

Recent Developments

In Jan 2025, Mela Vitamins partnered with WNBA champions Azurá Stevens (LA Sparks) and Dana Evans (Chicago Sky) to promote wellness among women of color. This collaboration focuses on empowering communities of color to prioritize their health and tackle existing health disparities.

In Jan 2025, A Fairy Meadow GP warned individuals to carefully check the ingredients in their vitamin supplements after treating several patients who showed symptoms of poisoning from a common additive. This advisory came in light of multiple cases observed by the doctor.

| Report Attributes | Details |

| Market Size in 2023 | USD 5.93 Billion |

| Market Size by 2032 | USD 10.54 Billion |

| CAGR | CAGR of 6.64% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source [Natural, Synthetic] • By Type [VtaminB, VitaminE, VitaminD, VitaminC, VitaminA, VitaminK] • By Application [Healthcare Products, Food & Beverages (Infant Foods, Dairy products, Bakery & confectionary products, Beverages, Others), Feed, Personal care products] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Koninklijke DSM NV, Glanbia PLC, ADM, BASF, Lonza Group, Adisseo, Vitablend Nederland BV, SternVitamin GmbH, Farbest-Tallman Foods Corporation, The Wright Group, Zhejiang Garden Biochemical High-Tech Co., Ltd, NewGen Pharma, Rabar Pty Ltd., Resonac, BTSA BIOTECNOLOGÍAS APLICADAS SL, Cargill Incorporated, Archer Daniels Midland Company (ADM), Ingredion Incorporated, Tate & Lyle PLC, Agrana Beteiligungs-AG, Grain Processing Corporation, Roquette Frères. |

| Key Drivers | • The Growing Emphasis on Preventive Healthcare and Lifestyle Changes Are Major Drivers for The Vitamins Market. • Innovation in Formulations and Delivery Methods • Consumer Preferences for Sustainability and Clean Labels |

| Restraints | • The Vitamins Market Faces Significant Restraints Stemming from Stringent Regulatory Requirements and Quality Control Issues. |