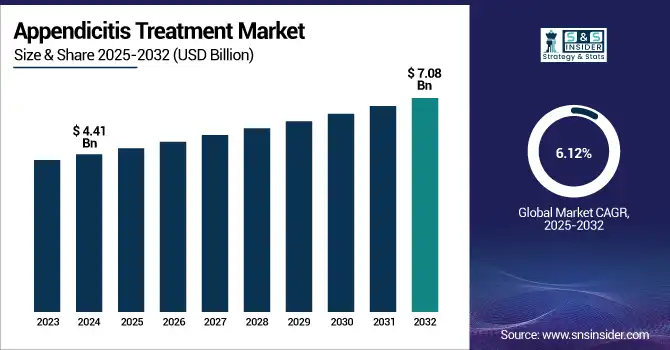

Appendicitis Treatment Market Size Analysis:

The Appendicitis Treatment Market size was valued at USD 4.41 billion in 2024 and is expected to reach USD 7.08 billion by 2032, growing at a CAGR of 6.12% over 2025-2032.

The global appendicitis treatment market is growing on account of the growing severity of appendicitis, advancements in diagnostic techniques, and a shift in treatment practices. An estimated 17.7 million incident cases of appendicitis were reported globally in 2019, with the largest incidence rates observed in adolescents and young adults, according to the Institute for Health Metrics and Evaluation (IHME). In the U.S. appendicitis therapeutic market, appendicitis results in over 280,000 hospital discharges per year are as reported by the CDC, which also reports that more than 2% of emergency visits are due to appendicitis. With laparoscopic appendectomy becoming a first-line surgical modality that is favored in more than 90% of surgical cases in high-income countries, there is an increasing need for advanced surgical tools and imaging equipment.

To Get more information on Appendicitis Treatment Market - Request Free Sample Report

In 2024, Stanford University created an appendicitis predictive algorithm of imaging and clinical data, demonstrating a 25% decrease in negative appendectomy rates, a massive improvement for appendicitis treatment companies trying to adopt digital health tools.

The growing popularity of treating appendicitis non-operatively with antibiotics is turning out, especially with research, such as the APPAC study, to be helpful 72% of the time after a year in simple cases. Current and updated guidelines, such as the 2023 ACEP guidelines, highlight NOM as an appropriate treatment modality for a subgroup of patients. Growth of investment in diagnostic and imaging (AI-based ultrasound and low-radiation CT scans) aids in improving detection accuracy, especially among pediatric and pregnant patients. In a review (2025), diagnostic AI models for appendicitis increased detection accuracy to 95% and decreased unnecessary surgeries.

From the supply side, hospitals are adopting rapid diagnostic infrastructures and post-surgery recovery devices, with telehealth follow-up gradually being adopted post-appendectomy, especially in the U.S. and Europe. Government activities, such as reimbursement policies for both laparoscopic procedures and antibiotic therapy, also add to the growth of the appendicitis treatment market. Moreover, the increasing prevalence of acute appendicitis due to public health awareness campaigns and increasing availability of emergency surgical care in developing economies is also driving the appendicitis treatment market size.

For instance, after COVID, a 30% spike in the Global Nonsurgical Management Protocols was observed, which was a reflection of the Journal of Gastroenterology (2024), attributed to strain on the hospital and also backed by fresh multi-center trials, thereby deforming the landscape of the appendicitis treatment market trends in Asia-Pacific and North America.

Appendicitis Treatment Market Dynamics:

Drivers:

-

Appendicitis Treatment Market is Being Propelled by Several Clinical, Technological, and Policy-Driven Developments

Growing preference for minimally invasive surgeries has led to a higher prevalence of laparoscopic and robotic surgeries, which, in turn, is backed up by hospitals’ investment in robotic surgery equipment. In developed countries, more than 92% of appendectomies are now done laparoscopically, and this has led to a decrease in complications and hospital days, as follows in a report of 2024 about gastrointestinal surgery.

Increasing public awareness and early diagnosis, with the increased availability of diagnostic imaging, in particular with POCUS, are also enlarging the market. It is considered early and accurate detection with the assistance of artificial intelligence (AI), such as Aidoc, cleared by the U.S. FDA in 2023. The enhanced R&D effort in antibiotics for non-surgical treatment has resulted in superior resistance-conscious regimens.

Recommendations of organizations, such as the American College of Surgeons (ACS) and the European Association for Endoscopic Surgery (EAES), suggest the use of patient-specific steps in order to increase the diversity of the procedures. In addition, post-COVID expansion of telemedicine is increasing the availability of follow-up care and decreasing the strain on hospitals, particularly in the pediatric population. Investment in surgical innovations and diagnostic precision instruments by both private and government sectors would further supplement growth prospects, where there was an increase by 18% YoY in 2024, in venture capital investments in medtech, as reported by CB Insights, driving the global appendicitis treatment market.

Restraints:

-

Infrastructure Gaps, Reimbursement Hurdles, and Diagnostic Limitations Hinder the Growth of the Appendicitis Treatment Market

A common problem is the similarity of symptoms with other abdominal pathologies, resulting in a diagnostic error in 15% of emergency care visits. Diagnosis is often delayed by limited access to advanced imaging (low-dose CT or high-definition ultrasound) and a shortage of trained radiologists in rural and under-resourced healthcare settings. Reimbursement issues are also an obstacle in many places, as developing countries' insurance companies do not cover NOM or newer antibiotic formulations, and this makes availability a challenge. Additionally, there are no global standardized clinical guidelines, resulting in disparity in treatment protocols, particularly in the case of paediatric and geriatric patients.

Regulatory stalling on the clearance of AI-based diagnostic software in some geographies also stifles the uptake of innovation. For instance, the European MDR laws have stalled several imaging device approvals and adoption across EU Hospitals. Also, concerns about antibiotic resistance are complicating the possibility of employing NOM widely, with a 2023 Lancet Infectious Diseases report finding that 20%–30 % of NOM cases led to a higher recurrence rate within five years, so many doctors are being cautious.

Appendicitis Treatment Market Segmentation Analysis:

By Type

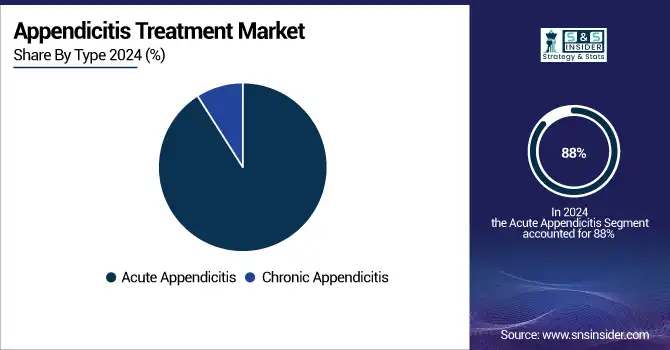

Acute appendicitis led the appendicitis treatment market in 2024 and accounted for about 88% of the total diagnosed cases globally. Its preponderance is ascribed to the acute onset of symptoms, high frequency, and the urgent need for medical or surgical intervention. Acute cases are usually fraught with intense pain and complications, so health care providers are also pressured by the need to make quick diagnostic and therapeutic decisions, especially in emergencies. On the other hand, chronic appendicitis is increasing most rapidly, largely due to more awareness and better imaging tools that allow the detection of recurrent low-grade inflammation that was previously missed.

By Treatment

Laparoscopic surgery was the dominant treatment type in 2024, accounting for 68% of all procedures performed. The growth is led by its minimally invasive approach, short recovery period, lower rates of post-operative complications, and more widespread access to laparoscopic instrumentation. Medication is the fastest expanding category, primarily for uncomplicated appendicitis, with increasing clinical evidence and recognition of non-surgical treatment. Research and newer antibiotic schedules have confirmed the success of conservative treatment, encouraging wider application, particularly in children and the elderly.

By End-user

Hospitals remained the most prominent end-users in 2024, accounting for 74% of appendicitis treatments. They have the upper hand as they can control both surgical and non-surgical care, imaging technologies, and 24-hour emergency care. Ambulatory Surgical Centers (ASCs) are estimated to be the fastest growing end-user segment owing to the increasing need for minimally invasive laparoscopic appendectomies within a day. ASCs provide lower-cost options with shorter time to treatment and are more and more being outfitted with high-tech diagnostic and surgical facilities.

Regional Analysis:

North America held a major share of the appendicitis treatment market; the region's key market drivers are sophisticated healthcare infrastructure, high surgical volumes, and adoption of advanced treatment options.

The U.S. appendicitis treatment market size was valued at USD 1.18 billion in 2024 and is expected to reach USD 1.73 billion by 2032, growing at a CAGR of 4.95% over 2025-2032. The U.S. led the regional market in 3 of the defect-factured appendectomy procedures, due to well-established emergency care facilities and a higher number of laparoscopic procedures. The region’s leadership is also supported by high R&D spending and favorable reimbursement policies. Canada’s market is expanding on account of burgeoning penetration of healthcare digitization and a rise in diagnostic access. Despite being a novice, Mexico is gradually improving access to minimally invasive techniques. The region has regulatory clarity with several FDA approvals of AI diagnostic tools and robotic surgical systems, assisting in the clear management of appendicitis.

Europe is the second-largest market for appendicitis treatment due to the extensive prevalence of institutions with public healthcare and standardized surgery. Germany is at the forefront in the region because of its strong hospital infrastructure and relatively higher use of the latest laparoscopic instruments. This is changing progressively in countries including the U.K. and France, where paediatric-based non-operative management (NOM) protocols are being developed. Europe’s fastest-growing market is in Italy, owing to the rising government investment in healthcare and the growth of ambulatory surgical centers. AI-enhanced diagnostic imaging is increasingly being adopted in countries such as Spain and Poland, increasing early identification and preventing unnecessary surgery.

The Asia Pacific region is the fastest-growing region in the global appendicitis treatment market on account of a growing population, an increasing number of surgeries, and the modernization of healthcare. China leads the region with the largest number of appendicitis cases globally due to an increasing rate in hospital facilities equipped to deal with appendicitis and rapid urbanization. The country is also highly investing in robotic surgery systems, and laparoscopic equipment import is anticipated to grow over 20% YoY in 2024. Another highly growing market is India, owing to the increasing insurance coverage, rising awareness, and various initiatives that the government has taken, such as under the policies, including Ayushman Bharat. Japan has been established for taking up precision diagnostics, while South Korea is growing as a regional base for medical apparatus exports and care models led by telemedicine.

Get Customized Report as per Your Business Requirement - Enquiry Now

Appendicitis Treatment Market Key Players:

Leading appendicitis treatment companies operating in the market comprise Johnson & Johnson, Medtronic plc, Baxter International Inc., B. Braun Melsungen, Stryker Corporation, Boston Scientific Corporation, Smith & Nephew plc, Cook Medical, Olympus Corporation, and Integra LifeSciences.

Recent Developments in the Appendicitis Treatment Market:

In May 2024, HCG Cancer Centre advanced appendix cancer treatment by successfully implementing the HIPEC (Hyperthermic Intraperitoneal Chemotherapy) procedure, significantly improving outcomes for patients with peritoneal surface malignancies and marking a major step in precision oncology in India.

In June 2023, Pfizer announced positive Phase 3 results for its novel antibiotic combination, aztreonam-avibactam, demonstrating efficacy against serious bacterial infections caused by multidrug-resistant pathogens. The development supports its potential as a treatment option for complicated intra-abdominal infections, including appendicitis.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.41 billion |

| Market Size by 2032 | USD 7.08 billion |

| CAGR | CAGR of 6.12% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Acute Appendicitis, Chronic Appendicitis) • By Treatment (Surgery, Laparoscopic Surgery, Open Laparotomy, Medication, and Others) • By End-user (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Johnson & Johnson, Medtronic plc, Baxter International Inc., B. Braun Melsungen, Stryker Corporation, Boston Scientific Corporation, Smith & Nephew plc, Cook Medical, Olympus Corporation, and Integra LifeSciences. |