Antibiotics Market Size and Trends:

Get more information on Antibiotics Market - Request Free Sample Report

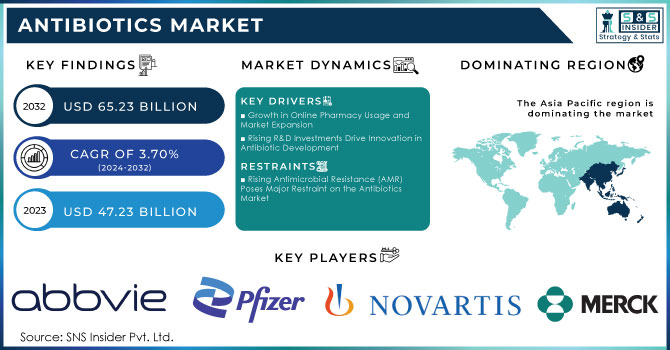

The Antibiotics Market Size was valued at USD 47.23 billion in 2023 and is expected to reach USD 65.23 billion by 2032, growing at a CAGR of 3.70% from 2024-2032.

The antibiotics market worldwide is on the rise, fueled by increasing global cases of infectious diseases coupled with heightened concerns over antimicrobial resistance (AMR), giving way to a flourishing antibiotics market. AMR is expected to kill as many as 10 million people each year by 2050 unless new antibiotics are developed in time. As a result, this scenario leads to an estimated 154 million antibiotic prescriptions per year at outpatient visits in the United States alone. This statistic highlights the need for both auditing of and reduced access to antibiotics in addressing AMR. This mounting need points to a global health crisis that calls for action and intervention.

Rising trends in self-medication and increasing consumer awareness for lesser infections are perceived to be major drivers for retail pharmacies emerging as preferred sources of antibiotics. When patients are seeking treatment more conveniently, retail pharmacies are stepping up to the plate. Moreover, the significant market of USD 20+ billion generated per year by online pharmacies is changing how we deliver healthcare. Such online services can be useful because they allow for home delivery and more readily accessible prescription and nonprescription antibiotics. The digitization of healthcare is expected to fuel additional market growth by making digital health a part of normative patients' lives.

In the future, emerging challenges due to AMR will require new treatment modalities and substantial investments–between USD 250 million and USD 400 million annually for research and development. This substantial investment gap underlines the time-sensitive challenge of antibiotic research advancement keeping pace with increasing resistance. Further, it is becoming crucial that regulatory strategies needed to utilize antibiotics optimally and responsibly are developed. This may include individualized therapies, and optimizing antibiotic effectiveness while lessening the chance of the spread of resistance. Such a diverse approach is key to maintaining bacterial infections over the next few years.

MARKET DYNAMICS

DRIVERS

-

Growth in Online Pharmacy Usage and Market Expansion

The global pandemic crisis of COVID-19 had an even greater impetus to the growth of digital pharmacies in many countries. The pharmaceutical industry has greatly changed with the rise of e-commerce platforms — in 2020 alone, distance-selling pharmacies sold a total number of 42 million items worldwide. User percent online pharmacies in the United Kingdom in 2023 is estimated to be close up to almost double and get a score of an average of 60% by year-end. The rise in consumer demand and preference for being delivered to home & the convenience of getting antibiotics are factors responsible for escalating growth. This further develops the online pharmacy segment as it grows in tandem with digital healthcare coming to form part of daily life, and transforms how medications are used/delivered.

-

Rising R&D Investments Drive Innovation in Antibiotic Development

Pharmaceutical companies are expected to invest heavily in R&D (research and development) of antibiotics, which will promote market expansion over the next few years as they try to overcome issues related to resistant bacterial strains. In the U.S., pharmaceutical industry costs for R&D alone topped USD 100 billion in 2022, proof that innovation is getting more expensive. The increasing value of the investment is spurring innovation in antibiotic discovery and attracting alternative therapies to fight emerging resistance. There is growing emphasis on the development of biologics and targeted antibiotics for targeting resistant infections. Continued investment in R&D will continue to be essential as we see more maturity within next-generation experimental approaches that can provide breakthrough therapies and forward market expansion.

RESTRAINTS

-

Rising Antimicrobial Resistance (AMR) Poses Major Restraint on the Antibiotics Market

Antimicrobial Resistance (AMR) is considered to be a major limiting factor for the antibiotics market. In the United States alone, upwards of 2.8 million infections take place every year resulting in more than 35,000 deaths as a consequence of resistant bacteria. These resistant infections increasingly limit the utility of already existing antibiotics, as few options remain for treating them and those that do exist are rapidly becoming more expensive. The slow rate of making new antibiotics, combined with the increasing resistance only just adds to this problem further. The rapid, unchecked rise of AMR is a major global threat to human health and the utility of antibiotics; it highlights that new antibiotic development urgently requires innovation as well as more funding.

SEGMENT ANALYSIS

BY TYPE

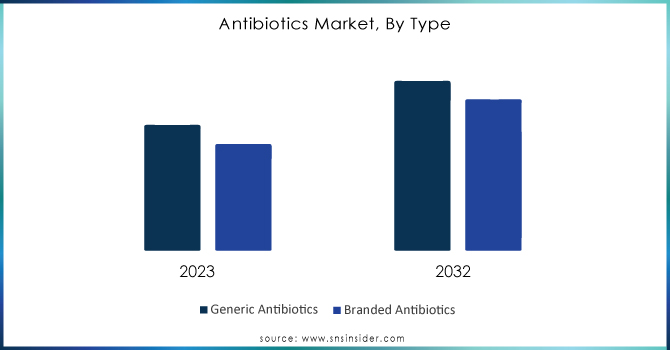

Generic antibiotics constitute the largest share of market revenue capturing around 54% in 2023. This is because they are cost-effective whereas the generic versions can go to up some scale compared to their branded counterparts. With the patent expiration on older antibiotics, more go generic and this gives them a big preference in many health settings, especially those coming from low-income regions. Their well-proved safety profiles and efficacy further entrench their role as a go-to treatment for the whole spectrum of bacterial infections.

The branded antibiotics segment is expected to increase at the highest compound annual growth rate of 4.01% during the period under review, from 2024 to 2032. This is because of more demand for novel antibiotics to combat more dangerous resistant forms of bacteria. Branded products, especially biologics and targeted therapies, are more specialized treatments, and as the threat of antimicrobial resistance continues to grow, more funds are needed to produce these new, effective treatments. This requires a higher price but is enough to push the growth in branded antibiotics even though they have a higher cost.

Need any customization research on Antibiotics Market - Enquiry Now

BY ACTION MECHANISM

Cell wall synthesis inhibitors led the antibiotics market, with a 51% share of revenue in 2023, mainly because they are used for the treatment of almost all bacterial infections. Highly effective beta-lactams such as penicillins and cephalosporins remain the first choice in most hospitals and an absolute requirement to treat both trivial and intricate infections, thus unchallenged leadership. Higher application and highly documented efficacy have kept them in a high position.

Protein Synthesis Inhibitors are expected to grow at the highest CAGR of 4.94% in the forecast period between 2024-2032 due to an increase in antimicrobial resistance. Macrolides and tetracyclines along with other drugs are gaining popularity as primary antibiotics for resistant infections. The increase in multi-drug resistant bacteria will urge people to have demand for such bacteria with these antibiotics. In that light, this trend accounts for the number of people to rely on protein synthesis inhibitors during fighting resistant bacterial strains.

BY APPLICATION

Respiratory infections dominated the antibiotics market with almost 29% of revenue generated in 2023. This is primarily because such conditions as pneumonia, bronchitis, and COPD all have a very high incidence and often lead to a bacterial infection that requires antibiotic therapy. Respiratory infections also often affect many vulnerable populations, including older people and immunocompromised subjects, which further increases demands for effective antibiotic therapies.

UTIs are expected to grow at the highest CAGR of 5.12% during the study period from 2024 to 2032 primarily because of increased chronic diseases like diabetes and rising antibiotic resistance in bacteria that cause a UTI. Women are more prone to UTIs, which keeps the demand for antibiotics constantly on the radar in both ambulatory and hospital care settings. This phase will accelerate market growth further through its concentration on treatment developments that will be more effective in treating resistant strains.

BY END USE

Hospital pharmacies make up approximately 48% of the total revenue in 2023 and are major market players. This is due mainly to the fact that they are essential for the control of severe infections in inpatient settings. Hospitals take up a prominent position among antibiotic consumers in the treatment of complicated and acute infections. They thus tend to have the highest demand for such broad-spectrum and targeted therapies. Moreover, hospital pharmacies tend to have a higher variant of specialized antibiotics, which explains their high market hold.

The online pharmacy market will register the highest growth, with a CAGR of 4.73% from 2024 to 2032. Convenience, home delivery, and accessibility are all increasing and greatly contribute to it. As the use of e-commerce and telehealth gains momentum, people increasingly make prescriptions and even over-the-counter antibiotics through these virtual services. This is likely to continue with greater ease in ordering medications from the comfort of home.

BY DRUG CLASS

Penicillin is expected to remain the leading product segment of the antibiotics market with over 30% revenue share in 2023. Thus, its universal applicability for the treatment of bacterial infections makes it the undisputed champ and leader antibiotic in practice. The fact that penicillin is cheap, widely available, and preferentially recommended as the first-line treatment for several infections has helped its continued dominance on the market.

Cephalosporins are anticipated to be the fastest growing class, with a growth rate of 5.14%, from 2024-2032 This is due to their broad-spectrum activity and efficient performance against resistant bacterial strains. As antimicrobial resistance (AMR) surges forward, the advent of cephalosporins becomes more significant as a backup for curing various infections and is favored in both hospital-acquired and community-acquired settings.

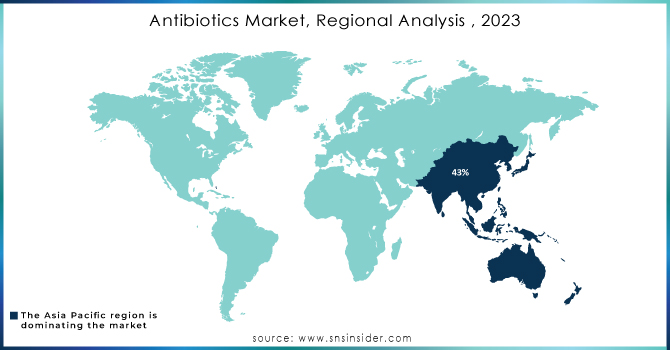

REGIONAL ANALYSIS

Asia Pacific region maintains dominance in the antibiotics market, accounting for 43% of global revenue in 2023 due to several crucial determinants, the growth of resistance prompts action. A principal driver is the immense need for antibiotics because of vast populations and growing healthcare demands. In China alone, resistance incurs an estimated economic burden of USD 77 billion with USD 35 billion in direct costs and USD 42 billion indirectly. This underscores the pressing requirement for effective antibiotic therapy. Rising awareness of growing resistance further spurs investment in novel antibiotic advancement and innovative treatment strategies.

North America is anticipated to rise at a rate above 4.66% yearly through 2032 largely impelled by strong emphasis on pharmaceutical research and evolution. The region offers a robust regulatory framework and a well-established healthcare system, cultivating innovation in antibiotic therapies and promoting efficacious treatment protocols. Heightening cognizance about resistance has also triggered initiatives to boost stewardship practices and develop new antibiotics. In addition, collaboration between academic institutions and industry is enabling advances in drug discovery, further propelling market growth in North America as demand for powerful bacterial treatments ascends.

LATEST NEWS-

-

In 2024, Pfizer's New antibiotic combination for patients with limited available treatment options in multidrug-resistant infections received a positive opinion from the CHMP. This does indicate that Pfizer is committed to solving some of the world's key healthcare challenges in antibiotic resistance.

-

In March 2024, Wockhardt released promising results from its candidate antibiotic Zidebactam/Cefepime, which in turn demonstrated efficacy in treating a refractory drug-resistant skull bone infection and pneumonia in a patient who had undergone a renal transplant.

KEY PLAYERS

-

AbbVie, Inc. (Avsola, Mavyret)

-

Pfizer Inc. (Zithromax, Tygacil)

-

Novartis AG (Kymriah, Lucentis)

-

Merck & Co., Inc. (Invanz, Cubicin)

-

Teva Pharmaceutical Industries Ltd. (Cipro, Pyrimethamine)

-

Lupin Pharmaceuticals, Inc. (Lupin’s Levofloxacin, Amoxicillin)

-

Viatris, Inc. (Amoxicillin, Meropenem)

-

Melinta Therapeutics LLC (Vabomere, Baxdela)

-

Johnson & Johnson (US) (Sivextro, Levaquin)

-

F. Hoffmann-La Roche AG (Switzerland) (Rocephin, Tarceva)

-

AstraZeneca PLC (UK) (Cilastatin/Imipenem, Meropenem)

-

Bayer AG (Germany) (Cipro, Avelox)

-

Abbott Laboratories (US) (Augmentin, Omnicef)

-

Eli Lilly and Company (US) (Cilastatin/Imipenem, Ertapenem)

-

Bristol-Myers Squibb Company (US) (Zyvox, Orencia)

-

Astellas Pharma Inc. (Japan) (Cresemba, Mycamine)

-

Cipla Ltd (India) (Ciprofloxacin, Azithromycin)

-

Shionogi & Co., Ltd. (Japan) (Fetroja, Astellas)

-

KYORIN Pharmaceutical Co., Ltd. (Japan) (Bunamiprom, Kyorin's Amoxicillin)

-

Nabriva Therapeutics PLC (Ireland) (Zyvox, SIVEXTRO)

-

GSK Plc (Augmentin, Zantac)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 47.23 Billion |

| Market Size by 2032 | USD 65.23 Billion |

| CAGR | CAGR of 3.70% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Class (Cephalosporin, Penicillin, Fluoroquinolone, Macrolides, Tetracycline, Aminoglycosides, Sulfonamides, Others) • By Type (Branded Antibiotics, Generic Antibiotics)) • By Action Mechanism (Cell Wall Synthesis Inhibitors, Protein Synthesis Inhibitors, DNA Synthesis Inhibitors, RNA Synthesis Inhibitors, Mycolic Acid Inhibitors, Others) • By Application (Skin Infections, Respiratory Infections, Urinary Tract Infections, Septicemia, Ear Infection, Gastrointestinal Infections, Others) • By End Use (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AbbVie, Inc., Pfizer Inc., Novartis AG, Merck & Co., Inc., Teva Pharmaceutical Industries Ltd., Lupin Pharmaceuticals, Inc., Viatris, Inc., Melinta Therapeutics LLC, Johnson & Johnson, F. Hoffmann-La Roche AG, AstraZeneca PLC, Bayer AG, Abbott Laboratories, Eli Lilly and Company, Bristol-Myers Squibb Company, Astellas Pharma Inc., Cipla Ltd, Shionogi & Co., Ltd., KYORIN Pharmaceutical Co., Ltd., Nabriva Therapeutics PLC, GSK Plc |

| Key Drivers | •Growth in Online Pharmacy Usage and Market Expansion • Rising R&D Investments Drive Innovation in Antibiotic Development |

| RESTRAINTS | • Rising Antimicrobial Resistance (AMR) Poses Major Restraint on the Antibiotics Market |