Ascorbic Acid Market Report Scope & Overview:

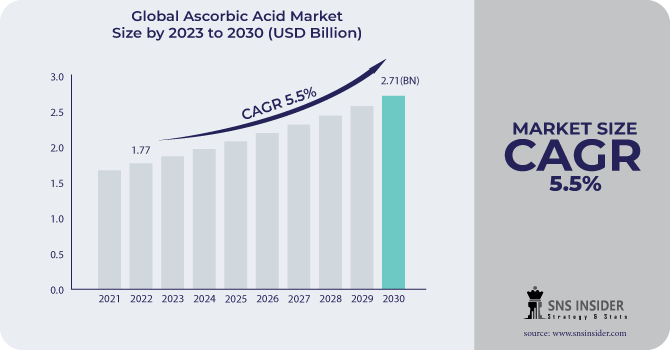

The Ascorbic Acid Market size was USD 1.77 billion in 2022 and is expected to Reach USD 2.71 billion by 2030 and grow at a CAGR of 5.5 % over the forecast period of 2023-2030.

Ascorbic acid is a water-soluble vitamin that is beneficial to people suffering from serious illnesses. Ascorbic acid is primarily produced to be used as an antioxidant. Ascorbic acid is mostly employed in the pharmaceutical, food & beverage, personal care, and other industries. The pharmaceutical business is the largest consumer of ascorbic acid followed by food & beverage.

Based on Application, the Food and beverage segment dominates which is attributable to the industry's rapid expansion, ascorbic acid is increasingly used as an addition and preservative in nutritive foods and beverages. Ascorbic acid's low pH minimizes microbial development, contamination, and deterioration while slowing or stopping oxidation preserves color and freshness, and prevents microbiological growth.

In the pharmaceutical sector, ascorbic acid is highly valued since it is used to treat and prevent vitamin C deficiency. Additionally, it aids in the body's absorption of iron, which is necessary for the creation of red blood cells. Additionally, ascorbic acid is utilized as an antioxidant in aqueous pharmaceutical formulations, as a pH adjuster for injectable solutions, and as a supplement for oral infections.

MARKET DYNAMICS

KEY DRIVERS

-

High demand in the fortified food and beverage industries

The demand for fortified foods and drinks is rising along with the increasing populations that are becoming more health conscious. To prevent illnesses or treat existing health problems, consumers, mainly in affluent and developing nations are increasingly turning to nutrient-based and other goods with functional components. Ascorbic acids are expected to have significant growth in the future due to their wide range of applications as a flavoring ingredient, preservative, and taste enhancer in confectionery, bread, sauces, and other items. The market for ascorbic acid is expanding because of the increased demand for foods and beverages that have been fortified. The influence of these drivers is expected to grow significantly as more individuals become aware of the benefits of ascorbic acid.

-

The rising population of health conscious consumers

RESTRAIN

-

Adverse Side Effects of Ascorbic Acid

Some people may experience negative side effects from ascorbic acid such as vomiting, nausea, heartburn, and headaches. The likelihood that a patient would experience these adverse effects increases with the amount of ascorbic acid they take and the period of consumption. More than 2000 mg per day is considered potentially harmful and can have a variety of negative effects. Therefore, if consumers are worried about the potential adverse effects, they might be reluctant to buy ascorbic acid supplements. Additionally, there may be more regulation of the ascorbic acid industry as a result of the possibility of side effects.

OPPORTUNITY

-

Potential health benefits of Ascorbic acid

Ascorbic acid has been found to be helpful in the treatment of several illnesses, such as cancer, age-related macular degeneration, cataracts, and the common cold. It is involved in several bodily processes, including immune system operation, collagen synthesis, wound healing, iron absorption, and preservation of teeth, cartilage, and bone. The capacity of ascorbic acid to inhibit melanoma cell proliferation and speed up apoptosis, as demonstrated by in vitro research, is also expected to drive the market ahead throughout the projected period.

-

Rising applications of ascorbic acid in other sectors

CHALLENGES

-

Government Regulations

Ascorbic acid and other food preservatives and color additives are rigorously regulated and observed for their safe usage by the Food and Drug Administration. The FDA specifically specifies that ascorbic acid is a generally recognized safe (GRAS) ingredient for use as a vitamin or dietary supplement as well as a chemical preservative in foods. The acceptable daily intake of ascorbic acid has been defined at 2,000 milligrams by the European Food Safety Authority (EFSA). Hence, government rules and regulation on sales and consumption may impede the growth.

IMPACT OF RUSSIA-UKRAINE WAR

The ascorbic acid market has been significantly impacted by the Russia-Ukraine conflict. Ascorbic acid is one of Russia's main exports, and the war has disrupted supply networks which has led to increased prices. China's lockdowns, the Russian conflict in Ukraine, rising U.S. inflation, and severe weather continued to endanger fragile supply networks. Ascorbic acid prices rose 30% in March 2022, according to a report by the Food and Agriculture Organization of the United Nations (FAO). Shipping ascorbic acid from Russia to other nations is now challenging and expensive due to the war. Ascorbic acid demand has fallen in end-user industries like food and beverage, pharmaceuticals, healthcare, cosmetics, and others as a result of this price increase.

IMPACT OF ONGOING RECESSION

The recession has impacted the price of vitamin C in North America was on the decline. Between April and June 2023, the CFR Los Angeles price negotiations decreased from USD4550/Mt to USD4020/Mt. Globally, consumers' demand for ascorbic acid in food and beverage, pharmaceutical, healthcare, cosmetic, and other industries has decreased. Despite conflicting opinions on vitamin costs, the nation's nutraceuticals business has seen conflicting trends. Price discussions for vitamin C USP grade FOB Shanghai, China, decreased from USD2900 per tonne to USD2580 per tonne in June 2023.

MARKET SEGMENTATION

by Form

-

Powder

-

Liquid

by Application

-

Food & Beverage

-

Pharmaceuticals & Healthcare

-

Feed

-

Cosmetics

-

Beauty and Personal Care

-

Animal Feed

.png)

REGIONAL ANALYSIS

The Ascorbic Acid Market in Europe is expected to grow due to significant advancements in chemical studies and an increase in the geriatric population suffering from various ailments that can be prevented by the usage of ascorbic acid supplements. The UK ascorbic acid market is expected to rise steadily at a CAGR of 5.7% in the forecasted period. Also, the demand for ascorbic acid is rising in food & beverage, pharmaceuticals, cosmetics, and other end-users.

Asia Pacific region is fastest growing as ascorbic acid sales in India are predicted to expand at a 6.8 % CAGR between 2022 and 2030. Furthermore, ascorbic acid demand in China is predicted to expand rapidly, with the market growing at a CAGR of 6% over the next ten years. Because of low-cost manufacturing activities in these countries, ascorbic acid consumption in Asian countries, particularly India, China, and Japan, is expected to expand rapidly. Because of this property, enterprises have been able to enter the functional food and beverage sector with novel bioactive substances such as ascorbic acid. The rise of the pharmaceutical business is notable in the regional market, pushing ascorbic acid demand.

North America will account for nearly 31% of market growth in the forecasted period. this region provides the most potential growth for manufacturers. Also, the US ascorbic acid market is expected to produce a share of roughly 90% in North America.

The rising demand for cosmetics items, pharmaceuticals, and food additives in the food & beverage industry would have a substantial impact on the growth of the ascorbic acid market in this area. The market in this area will expand at a slower pace than the market in Asia Pacific.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Ascorbic Acid Market are Merck KGaA, Koninklijke DSM NV, Shandong Luwei Pharmaceutical Co. Ltd., Northeast Pharmaceutical Group Co. Ltd, BASF SE, Aland Nutraceuticals Group, CSPC Pharmaceutical Group Limited, Pharmavit, FUJIFILM Corporation, Botanic Healthcare, Bactolac Pharmaceutical Inc., Foodchem International Corporation, and other key players.

Koninklijke DSM NV-Company Financial Analysis

RECENT DEVELOPMENTS

In 2022, Merck KGaA and Mersana Therapeutics formed a collaboration to develop new immunostimulatory antibody-drug conjugates. This collaboration supports Merck KGaA's internal knowledge and ADC strategy in Darmstadt, Germany.

In 2022, Nobel Panacea, a leading provider of cutting-edge skincare technologies in the United States, launched a vitamin C solution that contains 20% pure L-ascorbic acid. It tackles vital symptoms of aging such as wrinkles and lines, as well as elasticity loss and hyperpigmentation.

In 2022, Firmenich merged with Royal DSM. Four business divisions of DSM-Firmenich, including food & beverage, health & nutrition, and animal nutrition, generate combined sales of over 11.5 billion euros.

| Report Attributes | Details |

| Market Size in 2022 | US$ 1.77 Billion |

| Market Size by 2030 | US$ 2.71 Billion |

| CAGR | CAGR of 5.5 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Form (Powder, Liquid) • By Application (Food and Beverage, Pharmaceuticals, Healthcare, Beauty and Personal Care, and Animal Feed) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Merck KGaA, Koninklijke DSM NV, Shandong Luwei Pharmaceutical Co. Ltd., Northeast Pharmaceutical Group Co. Ltd, BASF SE, Aland Nutraceuticals Group, CSPC Pharmaceutical Group Limited, Pharmavit, FUJIFILM Corporation, Botanic Healthcare, Bactolac Pharmaceutical Inc., Foodchem International Corporation |

| Key Drivers | • High demand in the fortified food and beverage industries • The rising population of health conscious consumers |

| Market Restrain | • Adverse Side Effects of Ascorbic Acid |