Asian Food Market Report Scope & Overview:

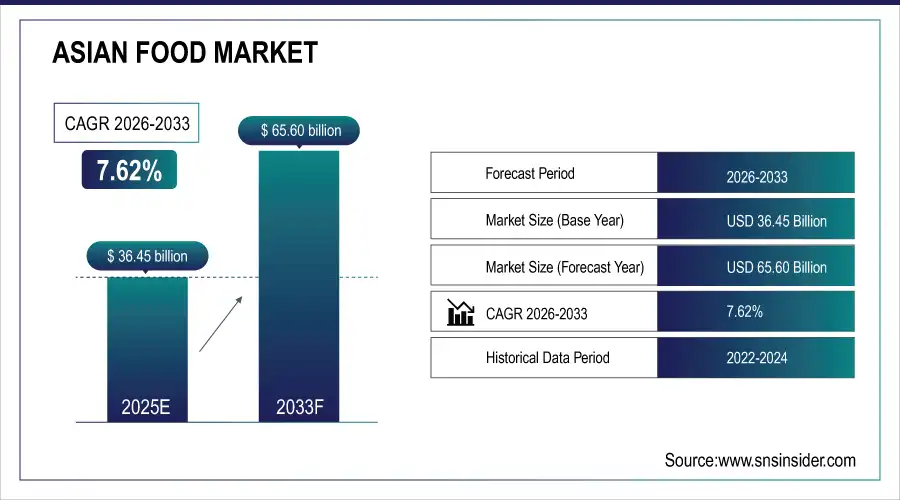

The Asian Food Market Size was valued at USD 36.45 billion in 2025E and is expected to reach USD 65.60 billion by 2033, growing at a CAGR of 7.62% over the forecast period of 2026-2033.

To Get more information on Asian Food Market - Request Free Sample Report

The Asian Food Market is experiencing significant growth due to a combination of demographic, economic, and lifestyle factors. Expansion of modern retail formats, e-commerce platforms, and efficient cold chain logistics has further enhanced accessibility, making it easier for consumers to purchase a wide variety of Asian food products. Innovation in Flavors, packaging, and artisanal offerings, along with the growing influence of international cuisines, has also fuelled market growth.

Technological advancements are revolutionizing the food processing landscape. The market for food processing technology is projected to grow to USD 30 billion by 2024. Automation and Artificial Intelligence (AI) are increasingly being integrated into processing plants, with over 60% of food manufacturers in India expected to adopt these technologies by 2025

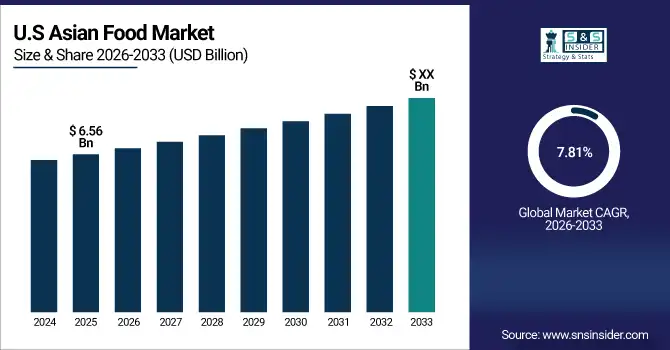

U.S. Asian Food Market Insights

The U.S. Asian Food Market was valued at USD 6.56 billion in 2025E and is projected to grow significantly by 2033 with 7.81% CAGR. Growth is fueled by consumer preference for premium, artisanal, and non-dairy Asian Food. Investments in R&D, particularly for plant-based alternatives and functional ingredients, are supporting market expansion. Retail expansion through supermarkets, specialty stores, and online platforms strengthens adoption, while government incentives for small-scale artisanal production further enhance penetration.

Market Size and Forecast:

-

Asian Food Market Size in 2025E: USD 36.45 Billion

-

Asian Food Market Size by 2033: USD 65.60 Billion

-

CAGR: 7.62% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Key Asian Food Market Trends

-

Rising demand for convenience and ready-to-eat meals due to urbanization and busy lifestyles.

-

Growth of plant-based, dairy-free, and functional foods driven by health-conscious consumers.

-

Increasing premiumization and artisanal product offerings in snacks, sauces, and desserts.

-

Expansion of e-commerce and online grocery platforms boosting market accessibility.

-

Adoption of sustainable and eco-friendly packaging across product lines.

-

Rising popularity of regional and ethnic flavors leading to innovative product launches.

-

Integration of technology and automation in food processing for efficiency and safety.

-

Growth in foodservice and QSR (Quick Service Restaurant) channels, supporting ready-to-eat and packaged foods.

Asian Food Market Growth Driver

-

Rising Demand for Premium & Artisanal Asian Food

Consumers across Asia and globally are increasingly seeking high-quality, authentic Asian food products made with natural ingredients and traditional techniques. This trend has encouraged artisanal brands like Grom and Amorino to open new stores and production facilities across Europe, North America, and Asia-Pacific. Governments in Italy and other European countries have provided small business grants and subsidies for local artisanal food production, supporting market growth. Social media campaigns and influencer marketing have enhanced consumer awareness and repeat purchases. Additionally, investments in small-batch production units, flavor innovation, and specialized cold chain infrastructure have accelerated the ability of artisanal brands to meet rising demand. For instance, Grom recently invested USD 12 million to expand its production line in Asia-Pacific in 2024 to serve growing premium food demand.

Asian Food Market Restraint

-

High Production Costs and Seasonal Demand Fluctuations

Producing premium Asian food involves expensive raw materials, specialized equipment, and skilled labor, which result in high operational costs. Seasonal demand fluctuations, particularly during festival periods and summer months, further strain profitability. Artisanal and premium food production costs can be 3–5 times higher than conventional products, challenging pricing strategies. Unless companies invest in production optimization, cold chain expansion, and inventory management, maintaining consistent margins year-round is difficult. For example, in 2023, Talenti faced seasonal stock shortages in North America due to high demand spikes during summer, highlighting the need for investment in scalable production and distribution infrastructure.

Asian Food Market Opportunity

-

Large-Scale Investments and International Expansion

Asian food brands are actively investing in global expansion to capture emerging markets with rising disposable incomes and urbanization. For instance, Unilever expanded its Talenti production and distribution network into Asia-Pacific and North America in 2024, aiming to meet growing premium and ready-to-eat food demand. Governments in India, Indonesia, and Southeast Asia offer incentives such as tax breaks, grants, and support for foreign direct investment in food processing, boosting growth prospects. Strategic collaborations with e-commerce platforms and major retailers have enabled brands to reach wider audiences. Additionally, new product launches, such as premium frozen meals and artisanal sauces, are further driving market penetration in both urban and semi-urban areas.

Asian Food Market Segment Highlights:

-

By Product Type: Instant Noodles – 35% share (largest); Prepared Meals fastest-growing at 7.5% CAGR, driven by urbanization and increasing demand for ready-to-eat meals.

-

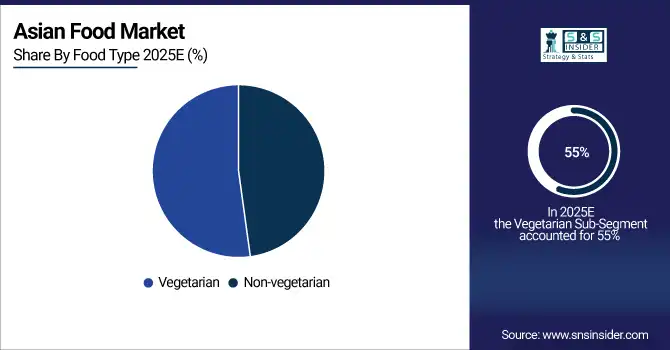

By Food Type: Vegetarian – 55% share (largest); non-vegetarian fastest-growing at 6.8% CAGR, supported by rising disposable incomes and premium protein offerings.

-

By Distribution Channel: Hypermarkets/Supermarkets – 50% share (largest); Online Sales Channels fastest-growing at 7.9% CAGR, fueled by e-commerce penetration and convenience-focused consumers.

Asian Food Market Segment Analysis:

By Product Type

Instant Noodles continue to dominate the market with a 38% share in 2025, driven by convenience, affordability, and widespread retail availability across urban and semi-urban areas. Prepared Meals are the fastest-growing sub-segment, expected to register a CAGR of 7.5%, fueled by busy lifestyles, rising disposable incomes, and the expansion of ready-to-eat meal offerings in supermarkets and online platforms. Innovation in flavors and portion sizes further supports growth in this segment.

By Food Type

Vegetarian Asian Food holds a 55% market share in 2025, maintaining dominance due to cultural preferences, health-conscious consumption, and established vegetarian product lines in Asia and Europe. Non-vegetarian Asian Food is the fastest-growing segment, projected at a CAGR of 6.8%, as consumers increasingly seek protein-rich meals, premium meat options, and convenience-oriented non-vegetarian products. Expansion of cold chain logistics and ready-to-cook formats supports this growth.

By Distribution Channel

Hypermarkets and Supermarkets dominate with a 50% market share in 2025, benefiting from organized retail growth, bulk sales, and strong brand presence. Online Sales Channels are the fastest-growing sub-segment, growing at a CAGR of 7.9%, due to the rising popularity of e-commerce platforms, home delivery services, and mobile ordering apps. Investments in logistics infrastructure and last-mile delivery have significantly expanded accessibility.

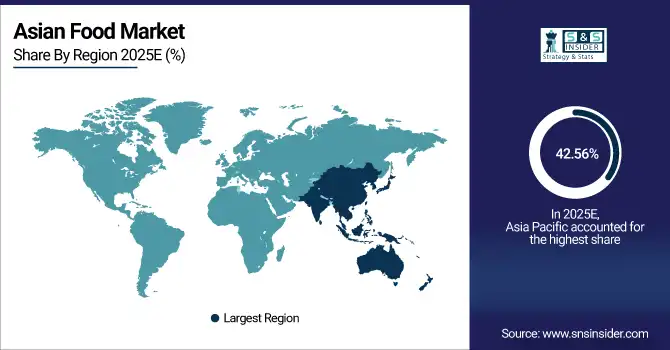

Asian Food Market Regional Analysis

Asia Pacific Asian Food Market Insights

Asia Pacific is the largest market with a 42.56% share in 2025, emerging as a rapidly growing region due to urbanization, rising disposable incomes, and exposure to global food trends. Lower manufacturing costs, expanding retail networks, and favorable government policies for food processing and plant-based production support growth. China and Japan are the leading markets, with local players investing in premium and artisanal Asian Food facilities and plant-based innovation. E-commerce adoption and cold chain infrastructure further increase accessibility in semi-urban and urban centers, driving strong CAGR growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe Asian Food Market Analysis

Europe holds a market share of around 18.34% in 2025, driven by strong consumer preference for artisanal, premium, and plant-based Asian Food products. Key markets include Germany, Italy, and France, where investments in industrial and artisanal production facilities, cold chain logistics, and flavor innovation are substantial. Demand is further supported by well-established retail chains, specialty Asian Food stores, and government policies promoting sustainable dairy alternatives and local food production. Robust tourism in urban and leisure destinations also increases consumption of artisanal Asian Food.

North America Asian Food Market Insights

North America holds a market share of 23.67% in 2025 and is one of the fastest-growing regions in the Asian Food market. Growth is supported by mature dairy and plant-based supply chains, high consumer awareness of premium and artisanal products, and strong retail and e-commerce penetration. The U.S. leads the region with high disposable income, health-conscious consumer trends, and advanced production and cold chain logistics. In 2025, major players such as Talenti and Unilever expanded production facilities and online delivery networks to meet domestic and export demand. Rising consumer interest in plant-based and functional Asian Food also drives innovation and product diversification.

Latin America (LATAM) and Middle East & Africa (MEA) Asian Food Market Insights

LATAM and MEA hold 7.43% and 8.00% market share in 2025, respectively, and are developing but strategically important markets. Brazil leads LATAM, supported by a strong dairy industry and growing demand for premium and plant-based Asian Food. Chile and Argentina are investing in cold chain and retail infrastructure to expand artisanal offerings. In MEA, countries such as the UAE and Saudi Arabia are seeing rising adoption of premium and imported Asian Food, backed by increasing disposable income and growth in the hospitality sector. Government initiatives promoting food industry investment, tourism, and sustainable production practices further support market growth.

Competitive Landscape for Asian Food Market:

Unilever PLC

Unilever is a leading global Asian Food manufacturer, offering a wide range of dairy and plant-based Asian Food brands, including Talenti and Magnum.

-

In February 2025, Unilever launched a new artisanal Asian Food production facility in Italy to expand its premium and plant-based Asian Food portfolio for European and North American markets.

Nestlé S.A.

Nestlé produces and distributes Asian Food across multiple segments, focusing on premium, functional, and non-dairy offerings.

-

In March 2025, Nestlé introduced a new line of protein-enriched and low-sugar Asian Food in North America to cater to health-conscious consumers.

Froneri International Ltd.

Froneri is a joint venture specializing in frozen desserts, with a strong presence in both retail and foodservice channels.

-

In January 2025, Froneri opened a new industrial Asian Food plant in Germany to scale production of artisanal and classic flavors for European markets.

Asian Food Messina

Asian Food Messina is renowned for its artisanal and innovative Asian Food flavors, emphasizing limited editions and premium ingredients.

-

In April 2025, the company expanded its international footprint by launching stores in Singapore and Hong Kong to target high-demand urban markets.

Asian Food Market Key Players

Some of the Asian Food Companies

-

Nestlé S.A.

-

Unilever PLC

-

Ajinomoto Co., Inc.

-

Tingyi (Cayman Islands) Holding Corp.

-

Monde Nissin Corporation

-

JBS S.A.

-

Wilmar International Limited

-

China Mengniu Dairy Company Limited

-

Yamazaki Baking Co., Ltd.

-

BRF S.A.

-

COFCO Corporation

-

Olam International

-

Hain Celestial Group, Inc.

-

Dabur India Limited

-

Marico Limited

-

Ajisen Ramen Co., Ltd.

-

Meiji Holdings Co., Ltd.

-

Amul (Gujarat Cooperative Milk Marketing Federation)

-

Indofood Sukses Makmur Tbk

-

Charoen Pokphand Foods Public Company Limited

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD36.45 Billion |

| Market Size by 2033 | USD 65.60 Billion |

| CAGR | CAGR of7.62% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type: (Instant Noodles, Prepared Meals, Snacks, Sauces & Condiments, Others) • By Food Type: (Vegetarian, Non-vegetarian) • By Distribution Channel: (Hypermarkets/Supermarkets, Convenience Stores, Grocery Stores, Online Sales Channels, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Nestlé S.A., Unilever PLC, Ajinomoto Co., Inc., Tingyi (Cayman Islands) Holding Corp., Monde Nissin Corporation, JBS S.A., Wilmar International Limited, China Mengniu Dairy Company Limited, Yamazaki Baking Co., Ltd., BRF S.A., COFCO Corporation, Olam International, Hain Celestial Group, Inc., Dabur India Limited, Marico Limited, Ajisen Ramen Co., Ltd., Meiji Holdings Co., Ltd., Amul (Gujarat Cooperative Milk Marketing Federation), Indofood Sukses Makmur Tbk, Charoen Pokphand Foods Public Company Limited |