Alternative Protein Market Key Insights:

Get E-PDF Sample Report on Alternative Protein Market - Request Sample Report

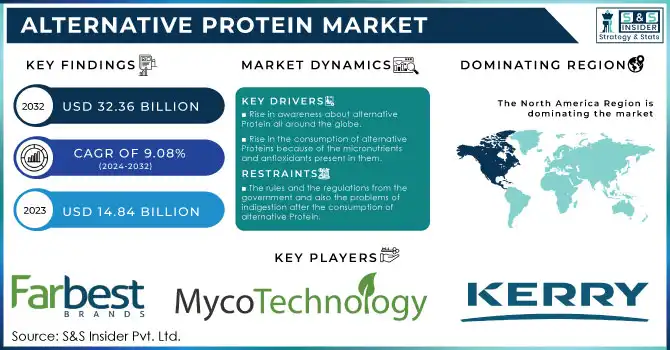

The Alternative Protein Market size was valued at USD 14.84 billion in 2023 and is expected to grow to USD 32.36 billion by 2032, with a growing at CAGR of 9.08% over the forecast period of 2024-2032.

The rise in demand for alternative Proteins is the driving factor for the alternative Protein market. There are many other factors which contribute to the rise in demand for the alternative market the major ones include the interest of the investors in this market as the demand and the consumption of alternative Protein market is increasing. The nutrients present in alternative Protein and the health benefits which comes after the consumption of alternative Protein is the driving factor of the alternative Protein market. As the adaptation of the veganism trend is going all around the globe the demand for alternative Protein is very high. Alternative Protein is also considered as the substitute for plant-based Protein. The meat-based Protein may have an adverse effect due to the unhygienic and side effects of consuming meat-based Protein; alternative Protein is mainly considered clean Protein. The rise of cardiovascular diseases due to the increase in cholesterol levels and obesity issues is also the driving factor for alternative Protein as the demand increases, People are getting aware due to the results of alternative Protein.

Impact Of COVID-19

Covid 19 had a good impact on the alternative market due to the rise in demand. The major reason behind the growth was the rise in awareness of the zoonotic viral disease, according to the experts the consumption of alternative Protein leads to helping reduce the symptoms which gave alternative Protein a boom. The rise in the awareness of the alternative Protein and the micronutrient antioxidants present in the alternative Protein was the driving factor for the alternative Protein market during the covid 19. During covid, 19 consumption of healthy food was the priority and the improvement of the immune system because of which alternative Protein demand increased, meat-based Protein was not an option for vegetarians so alternative Protein was considered a better option.

Market Dynamics

Drivers

-

Rise in awareness about alternative Protein all around the globe.

-

Rise in the consumption of alternative Proteins because of the micronutrients and antioxidants present in them.

Restrain

-

The rules and the regulations from the government and also the problems of indigestion after the consumption of alternative Protein.

Opportunities

-

Increase in technological advancement in the ogranic food and beverage sector.

-

The acceptance and ongoing veganism trend all around the globe.

Challenges

-

The other available option like plant-based protein.

-

The perception of people regarding the benefits associated with meat-based Protein.

-

Stringent regulatory compliances.

Impact of Russia Ukraine War

The supply chain problems due to the global route’s disruptions are the major concern for the alternative Protein market. The restrictions which were imposed by the governments regarding the exports and imports caused a negative impact on the alternative Protein market which also led to the problem of price fluctuation for basic commodities and resources, whereas an increase in prices of transportation also had a direct impact on the alternative Protein market.

Impact of the Ongoing Recession

According to the experts during the recession alternative Protein is said to work as an alternative option for meat-based Protein because of the price difference between the alternative Protein and meat-based Protein. The buying pattern among the consumers will lead to a positive effect on the alternative Protein market. The mild recession won’t have a great impact on the buying decisions of consumers as experts say the importance of consuming Protein-based foods is increasing day by day.

Key Market Segmentation:

By Source

-

Plant Protein

-

Algae Protein

By Application

-

Food and beverages

-

Dietary replacers

-

Animal feed

By Distribution channel

-

Chemist

-

Supermarkets

-

Online store

Regional Analysis

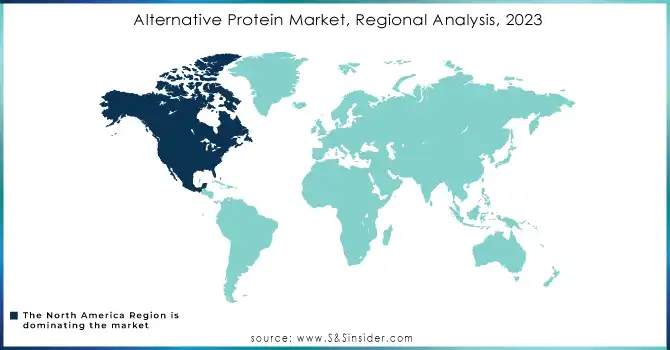

North America is said to have the highest share of the alternative Protein market compared to the other regions due to the increase in the awareness of the health benefits of the consumption of alternative Protein, also the increase in the ongoing trend of veganism in the developed cities of North America.

APAC is also considered to be a growing region due to the adaption of alternative Protein and the rise in awareness of the benefits of consuming Protein-based Protein the technological advancement in the food and beverage industry is the major driving factor for alternative-based Protein.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major key players are Farbest brands, Mycotechnology, Kerry group plc, String Bio, Calysta inc, Cargill incorporated, Archer Daniels midland company, Glanbia Plc, Axiom foods, Armstrong cricket farm georgia, beneo GmbH, Roquette ferres, now foods, tate and lyle, Angel yeast co.

| Report Attributes | Details |

| Market Size in 2023 | US$ 14.84 Bn |

| Market Size by 2032 | US$ 32.36 Bn |

| CAGR | CAGR of 9.08% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By source (Plant Protein, Algae Protein, Insect Protein) • By Application (Food and beverages, Dietary replacers, Animal feed) • By Distribution Channel (Chemist, Supermarkets, Online store) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Farbest brands, Mycotechnology, Kerry group plc, String Bio, Calysta inc, Cargill incorporated, Archer Daniels midland company, Glanbia Plc, Axiom foods, Armstrong cricket farm georgia, beneo GmbH, Roquette ferres, now foods, tate and lyle, Angel yeast co. |

| Key Drivers | • Rise in awareness about alternative Protein all around the globe. • Rise in the consumption of alternative Proteins because of the micronutrients and antioxidants present in them. |

| Market Opportunities | • Increase in technological advancement in the food and beverage sector. • The acceptance and ongoing veganism trend all around the globe. |