Assisted Reproductive Technology (ART) Market Size & Overview:

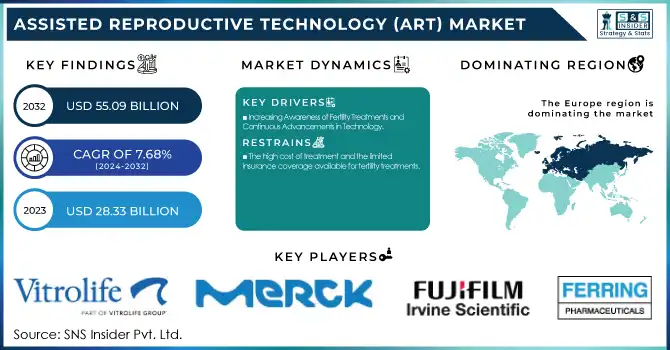

The Assisted Reproductive Technology (ART) Market was valued at USD 28.33 billion in 2023 and is projected to reach USD 55.09 billion by 2032, growing at a CAGR of 7.68%. This report offers insights into the increasing incidence of infertility and geographic trends in ART procedures, as well as success rates by treatment. The report also addresses the most recent technological developments in ART, with a focus on innovations that are enhancing treatment results. It also discusses demographic and societal changes, including increased childbearing delay and increased awareness of fertility preservation, that are fueling demand for ART services worldwide.

Get more information on Assisted Reproductive Technology Market - Request Sample Report

Assisted Reproductive Technology (ART) Market Dynamics

Drivers

-

Increasing Awareness of Fertility Treatments and Continuous Advancements in Technology.

As increasing numbers of individuals and couples face infertility, they are turning to ART alternatives, driving demand for treatments such as IVF, ICSI, and egg/sperm cryopreservation. Specifically, advances in technology such as genetic screening, embryo freezing, and better IVF culture media have improved treatment success rates considerably, increasing the effectiveness and availability of ART. An ASRM study puts almost 1 in 8 couples at risk of being infertile, and therefore, there is an increased worldwide demand for ART procedures. Greater acceptance of ART by society coupled with more widespread media coverage further diminished the taboo associated with the use of assisted reproductive techniques. The popularity of fertility preservation treatments like egg freezing has also widened the market base. With advancing technology, ART procedures are becoming less invasive, more affordable, and have greater success rates, which also fuels the market.

Restraints

-

The high cost of treatment and the limited insurance coverage available for fertility treatments.

The cost of an IVF cycle can be between USD 10,000 and USD 15,000, excluding other costs such as medication, diagnostics, or freezing of embryos. In most nations, fertility services are not included in basic health insurance policies and are thus unaffordable for the majority of the population. This economic hurdle deters most prospective patients from seeking ART, especially in developing countries where proper medical care may be scarce. For example, in the US, even with the development of ART, most insurance policies do not include full coverage for fertility procedures, resulting in out-of-pocket costs that many families cannot meet. Although some nations, like Denmark and Belgium, have comprehensive coverage of ART, the absence of universal access on an international scale is a key issue to market growth on a broader scale.

Opportunities

-

The expansion of fertility services and increasing government support.

Governments in most nations are acknowledging the significance of fertility treatments and are starting to provide more assistance through healthcare reforms, subsidies, or inclusion in public insurance programs. For example, nations such as Israel and France offer government-subsidized ART treatments, which are made available to a larger population. Furthermore, the emerging trend of fertility tourism offers a special opportunity in that people from nations with limited access to ART are going to countries that have advanced fertility services at affordable rates. Additionally, the increasing use of fertility preservation techniques like sperm and egg banking for people who postpone childbearing for professional or personal reasons increases market growth even further. The increase in fertility clinics, particularly in the newly industrializing markets of India and China, is generating greater demand for ART therapies, propelling market growth. Advances in technologies also present chances for creating low-cost, minimal-invasive forms of ART technology, stimulating future adoption.

Challenges

-

The ethical concerns surrounding reproductive technologies and regulatory barriers in different regions.

The moral controversy surrounding ART, especially about embryo selection, gene editing, and the use of donor eggs and sperm, has resulted in different regulations in different countries. In certain countries, ART procedures are strictly regulated or prohibited, constraining the potential of the market in those countries. For instance, Germany and Italy have very strict legislation around ART that limits access to some procedures, including the utilization of donor eggs or embryos. Such regulatory barriers can be limiting for both healthcare providers and patients, making it difficult for ART to be used on a broad scale. Also, public debates regarding the morality of gene editing and genetic screening technologies like CRISPR add to the difficulties faced by the market. Others have argued that the potential for "designer babies" may pose ethical concerns, making it difficult for the world to embrace sophisticated ART practices. These ethical and regulatory issues, if not properly addressed, may stifle the growth of the market and limit the advancement of new ART therapies.

Assisted Reproductive Technology (ART) Market Segmentation Insights

By Type

In 2023, the In-vitro fertilization (IVF) category led the Assisted Reproductive Technology (ART) market globally, capturing a massive 92.1% of the overall revenue. IVF has emerged as the go-to form of assisted reproduction because of its high success rate and prevalence across the globe. The expansion of the IVF segment is driven by factors such as technological improvements in reproductive technology, advances in embryo culture technology, and greater knowledge of genetic screening. The fact that IVF can treat a broad array of infertility issues, including male infertility, tubal issues, and unexplained infertility, has made it the preferred option for most couples desiring fertility treatment. The significant prevalence of IVF is also to be understood by the growing awareness among the population for the treatment and increased acceptability in diverse populations.

Artificial Insemination (AI) is the most rapidly expanding category in the ART market. AI is less invasive and affordable than IVF, hence a more attractive choice for increasing numbers of patients looking for fertility therapy. Greater accessibility of AI and growing awareness of its advantages are driving its fast expansion. It is especially in vogue for mild male infertility, the use of donor sperm, or when couples opt for a simpler procedure. As more people become aware of the advantages of AI, its usage is going to continue growing, offering a worthwhile alternative to IVF for those who need affordable fertility solutions.

By End-use

In 2023, the fertility clinics & other settings segment held the largest share of the global ART market, generating over 80.2% of the total revenue. Fertility clinics have been the major setting for ART treatments for many years, providing specialized treatment and customized fertility services that are critical to success in reproductive technology. Fertility clinics offer sophisticated diagnostic equipment, individualized treatment plans, and a caring environment for patients who are undergoing ART procedures. The dominance of fertility clinics is also driven by the growing demand for ART, as well as the growing number of fertility treatment options available to patients. The presence of established and expert-run clinics has increased the accessibility and efficacy of ART services. Fertility clinics are likely to maintain their dominant position during the forecast period, based on their expertise, specialized care, and increasing patient demand.

The hospital and others category is the fastest-growing end-use segment of the ART market. Hospitals are now providing ART treatments as part of their services on fertility, with patients enjoying the additional benefit of being offered comprehensive healthcare in one location. Hospital-based ART services have grown mainly because reproductive medicine is increasingly being integrated into mainstream healthcare, which allows these services to be made more accessible to a wider population.

Assisted Reproductive Technology Market Regional Analysis

Europe was the leading region in the Assisted Reproductive Technology (ART) market, capturing the highest share as a result of well-developed healthcare infrastructure, favorable government policies, and rising awareness about fertility treatments. The UK, Spain, and Germany are among the leading nations to adopt ART, with well-established fertility centers and a high success rate of the procedure. Europe is also favored by good insurance coverage and publicly funded ART programs, which increase access to treatment. For instance, in France and Denmark, ART treatments are extensively covered by national healthcare programs, leading to increased adoption rates. In addition, there has been an increase in fertility tourism in Europe, with neighboring countries' patients making journeys for ART care because of the good standards of care and legislation that provide for a range of ART procedures. Apart from IVF and ICSI, Europe has also witnessed development in newer ART technologies like genetic screening and embryo freezing, which has further established the continent as the global leader in the ART market.

Need any customization research on Assisted Reproductive Technology Market - Enquiry Now

Key Players

-

Cosmos Biomedical Ltd. - Sperm Processing Kits, Embryo Transfer Catheters

-

Microm U.K. Ltd. - Embryo Culture Media, IVF Laboratory Equipment

-

CooperSurgical, Inc. - Gavi IVF System, EmbryoScope, Fertility Preservation Devices

-

FUJIFILM Irvine Scientific - ART Culture Media, Oocyte Handling Products

-

Cryolab Ltd. - Cryopreservation Systems, Cryogenic Vials

-

Vitrolife AB - Embryo Culture Media, IVF Consumables

-

European Sperm Bank - Donor Sperm, Sperm Cryopreservation Kits

-

Bloom IVF Centre - IVF Services, Embryo Culture Media

-

Merck KGaA - Oocyte Cryopreservation Products, IVF Media

-

Ferring B.V. - Ovarian Stimulation Products, ART Drugs

-

Hamilton Thorne, Inc. - CASA (Computer Assisted Semen Analysis) Systems, Micromanipulation Systems

-

Nikon Corporation - Inverted Microscopes for IVF, Imaging Systems

-

Nidacon International AB - Sperm Processing and Freezing Products, IVF Consumables

-

Laboratoire CCD - Sperm Preparation Media, IVF Kits

-

Esco Micro Pte. Ltd. - IVF Incubators, Sperm Sorting Systems

Recent Developments

In Feb 2025, GenPrime, a prominent network of fertility clinics in Asia and North America, formed a strategic partnership with Genea Fertility, a leading Australian fertility service provider since 1986. This collaboration aims to enhance fertility treatment services and elevate the quality of care for patients in Thailand and Southeast Asia, offering world-class treatment options.

In Nov 2024, SpOvum launched an AI-powered platform designed to enhance patient support in assisted reproductive technology (ART). The platform delivers personalized, fact-based information tailored to individual ART concerns by utilizing indexed medical guides to provide accurate, customized responses.

| Report Attributes | Details |

| Market Size in 2023 | USD 28.33 billion |

| Market Size by 2032 | USD 55.09 Billion |

| CAGR | CAGR of 7.68% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type [In-vitro fertilization (IVF) (Fresh Donor, Frozen Donor, Fresh Non-Donor, Frozen Non-Donor), Artificial Insemination (Intrauterine Insemination, Intracervical Insemination, Intravaginal Insemination, Intratubal Insemination)] • By End-use [Fertility Clinics & other settings, Hospitals and others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cosmos Biomedical Ltd., Microm U.K. Ltd., CooperSurgical, Inc., FUJIFILM Irvine Scientific, Cryolab Ltd., Vitrolife AB, European Sperm Bank, Bloom IVF Centre, Merck KGaA, Ferring B.V., Hamilton Thorne, Inc., Nikon Corporation, Nidacon International AB, Laboratoire CCD, Esco Micro Pte. Ltd. |