Fertility Services Market Size & Overview:

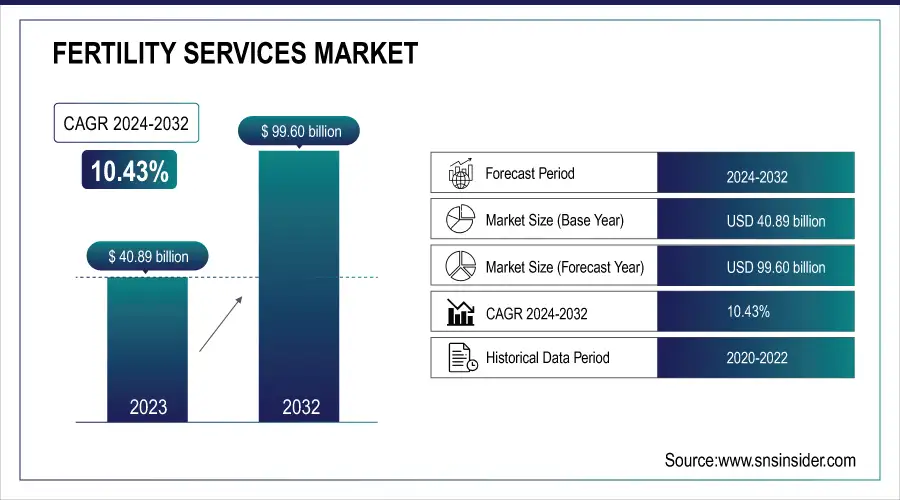

The Fertility Services Market Size was valued at USD 40.89 Billion in 2023 and is expected to reach USD 99.60 Billion by 2032 and grow at a CAGR of 10.43% over the forecast period 2024-2032.

The Fertility service market is growing due to advancements in assisted reproductive technologies and the increasing prevalence of infertility problems. Medical advances such as IVF (in vitro fertilization), ICSI (intracytoplasmic sperm injection), and genetic screening have made treatment more successful and viable as a service. We have also seen years of increased awareness and general acceptance of the services among the public who are either struggling to become pregnant or guaranteeing their fertility.

-

According to the Centers for Disease Control, IVF cycles are performed more than 330,000 times each year in the USA. Over 70% of these cycles use ICSI where male factor infertility exists, according to the Society for Assisted Reproductive Technology (SART).

-

A Fertility and Sterility study found that 85% of respondents support some form of health insurance coverage for infertility treatments. Moreover, almost 40% of IVF cycles now involve PGT to improve the chances of successful pregnancies.

The market is also driven by changing societal trends such as delayed parenthood due to the career approach, modified lifestyle changes, and increasing stress causing an impact on fertility. In addition, advancements in fertility preservation techniques including egg and sperm freezing attract those who wish to delay family building for a later time. Services providers are offering far more professional fertility services, as healthcare approaches and social initiatives have begun to reduce shame around infertility and allow at least partial specialization in this way.

To get more information on Fertility Services Markett - Request Free Sample Report

-

The American Society for Reproductive Medicine reported a surge of over 300% in egg-freezing cycles over the past decade. Additionally, a survey by the National Infertility Association found that 70% of respondents feel more comfortable discussing infertility issues now compared to five years ago, indicating a shift in societal attitudes.

Market Dynamics

Key Drivers:

-

Shifting Cultural Perspectives Normalize Fertility Treatments and Support for Family Building Goals

One of the other major factors for growth in the Fertility Services market is the changing trend of cultural and social aspects towards parenthood and Family Planning. In several areas, yet one more therapy does aid with having an infant right into the artistic standard and also is coming to be progressively preferred or even needed. People are having kids later to achieve a level of personal and financial comfort, which means many require assisted reproductive services. However, with strides to eliminate stigmas surrounding fertility services, fertility treatments are now a reasonable option for many individuals pursuing their family-building goals. These have contributed towards the normalization of gaining fertility support which has, in turn, affected acceptance people and couples are becoming more inclined to get help with their infertility issues.

-

According to the CDC, about 12% of women ages 15-44 have difficulty getting pregnant or carrying a pregnancy to term in the U.S. The National Infertility Association reports that 90% of respondents agree that infertility is a medical condition, suggesting growing awareness and acceptance. Daily, over half of those receiving fertility treatment described their family and friends as supportive (80%), a clear change in traditional attitudes around treatment assistance.

-

Transforming Fertility Services Through Digital Health Solutions and Telemedicine for Enhanced Patient Engagement

Digital health solutions and telemedicine are transforming the fertility services environment as they improve patient convenience cost-effectively. Telemedicine: The same advancements in technology that have helped with diagnosis and treatment also facilitate remote consultations. Telemedicine platforms make it easier for individuals to receive initial evaluations, counseling, and follow-up care from the comfort of their homes. Patients can also get access to education, track their cycles, and receive personalized advice regarding any lifestyle modifications needed via digital health tools. The application of data analytics only adds to the ability to tailor treatment options, increasing success rates through a better understanding of patient-specific issues related to fertility. All of this technology is making fertility care more efficient, available, and able to serve patients in a new, user-friendly manner.

-

According to research published in Fertility and Sterility, 70% of patients receiving fertility treatments are interested in telehealth for initial consultations and follow-ups.

-

Moreover, a study by the National Institutes of Health found that women who used a digital health tool for the management of fertility in 50% of cases were more engaged with their plan belonging to a particular treatment, which consequently enhances adherence and also increases chances of success.

Restrain:

-

Navigating Ethical Challenges and Emotional Struggles in the Fertility Services Market for Successful Outcomes

Treatments such as IVF and genetic screening are more available than in many other countries, although laws vary widely. This means that some areas have more tightened regulations on procedures or protocols and can pose obstacles for fertility clinics and how the patient can attain such services. Ethical implications are complex, in part due to the larger structures of concerns about embryo handling/growth and genetic modification techniques further complicating this issue societal attitudes affecting politics have slashed service offerings. Now, the second issue is the emotional and psychological impact on individuals and couples going through fertility treatment. It can be very stressful with additional physical and emotional side effects depending on how many treatment cycles are required. These stressors can result in treatment drop-offs and negatively impact patient outcomes if mental health support is not available, which highlights the importance of integrated counselling services at fertility clinics.

Fertility Services Market Segmentation Analysis

By Type

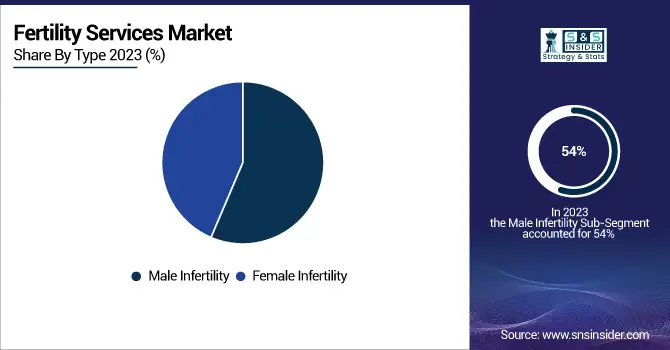

Male infertility dominated the market, accounting for a considerable 54% share in the year 2023 and is projected to register the fastest CAGR during the forecast period of 2024-2032. Among the reasons for this importance and progression are the progressive awareness and diagnosis of infertility issues among men, which are frequently related to lifestyle factors, environmental exposures, or age-related factors. The rising prevalence of circumstances related to male infertility for example erectile dysfunction and also advances in diagnostic tools have been expected to improve the accessibility of alternatives inside aided reproduction technologies programs throughout this strategy, along with within needs regarding sperm retrieval & ICSI occupying an elevated request.

By Treatment

In-vitro fertilization (IVF) dominated the market with an 87% share in 2023. The popularity of IVF can be attributed to its relatively higher success rates compared to other fertility treatments, especially in cases of complex infertility. Modern approaches to IVF such as preimplantation genetic testing combine traditional IVF with additional techniques and are becoming more efficient and accessible due to technological advancements. The combined approach on multiple levels has ensured that IVF is now the gold standard of fertility treatment, especially with people who may have previously had a less successful experience with other forms.

Artificial insemination is predicted to register the fastest CAGR during 2024-2032. It is considered more affordable and less invasive, plus it can be helpful for some individuals with certain types of infertility, particularly if the fertility issue isn't especially severe. It can become a more universal, affordable option in that artificial insemination is also frequently used in instances where individuals have no grave infertility problem. With people becoming more aware of this treatment and embracing it, its demand addition is likely to grow tremendously and will open new doors in the market of fertility services.

By End Use

Fertility clinics accounted for the majority of the fertility services market, with a significant 76% share in 2023. The reason for this dominance is that they specialize in reproductive health, providing all the services required in infertility treatments. Fertility clinics also want to remain equipped with the latest technologies and staffed with top specialists who can personalize care based on the public's healthcare needs. The way they provide an environment with all sensitivity due to one need to trust and go forward for help with fertility issues gives them a well-deserved market position.

Hospitals and other healthcare facilities are anticipated to grow with the fastest rate during the forecast period 2024 to 2032. The expansion is due to various reasons such as the rise in offering fertility services in general healthcare settings, which leads to easy access for a larger population. Because hospitals can provide more ancillary services (e.g. complete check-ups and surgery), it is more convenient for patients. Furthermore, given the heightened awareness of fertility problems and increasing societal demand for fertility treatment, hospitals are expected to widen their services to address this need which is driving market growth over the period.

Regional Analysis

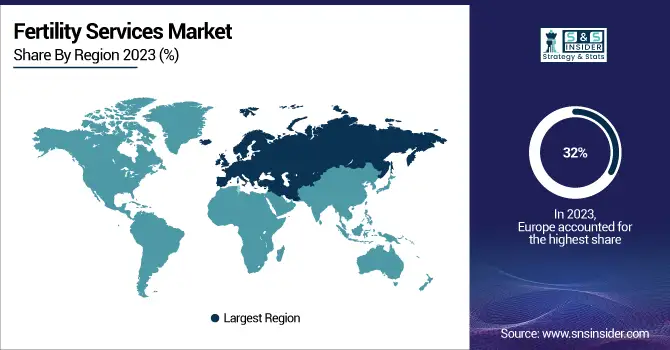

In 2023, Europe held a substantial share of 32% of the global fertility services market as the demand for assisted reproductive technology has increased in recent years owing to a rise in overall childbirths. This leadership is mainly owing to developed health infrastructures, a high level of knowledge about reproductive health, and extensive availability of assisted reproductive technologies. Spain and Denmark are two countries that stand out with quite progressive policies regarding fertility treatments (IVF, etc.), where they have funded IVF procedures via the state and where there are strict regulations on how well a clinic is run. Spain, in particular, is a great place for patients seeking high-quality fertility treatment at low prices to become extreme towards fertility tourism.

The Asia Pacific region is expected to grow the fastest CAGR from 2024to2032. Higher disposable incomes, an expanding middle class, along rising consciousness about infertility among the population have been leading to increased growth of this market million-dollar. Countries like India and China are investing more in ART infrastructure and services. In India, for example, the mushrooming of fertility clinics is being driven by the growing demand among its one billion people for IVF and other fertility treatments. Furthermore, government efforts to treat infertility and increase reproductive health will only add fuel to this growth. With changing perspectives on seeking help with reproductive issues, the fertility services market in the Asia Pacific is set to witness lucrative developments.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

Some of the major players in the Fertility Services Market are:

-

IVF Australia (IVF treatment, Egg freezing)

-

Fertility First (IVF cycles, Egg donation)

-

CCRM Fertility (Embryo banking, Fertility preservation)

-

IntegraMed Fertility (IVF services, Egg donation programs)

-

Mayo Clinic (IVF services, Fertility counseling)

-

New Hope Fertility Center (IVF treatment, Natural cycle IVF)

-

Oregon Reproductive Medicine (IVF services, Sperm donation)

-

Boston IVF (IVF cycles, Genetic testing)

-

Reproductive Medicine Associates of New Jersey (IVF services, Egg donation)

-

Shady Grove Fertility (IVF treatment, Donor egg program)

-

Zavitz Fertility & Reproductive Health (IVF cycles, Egg freezing)

-

Clinica de Fertilidad (IVF services, Sperm analysis)

-

RMA of New York (IVF treatment, Genetic testing)

-

Piedmont Reproductive Endocrinology Group (IVF services, Egg donation)

-

SIRM (Surgical egg retrieval, IVF treatment)

-

Bourn Hall Clinic (IVF cycles, Sperm retrieval)

-

IVF New Jersey (IVF services, Egg freezing)

-

Create Fertility (IVF treatment, Sperm donation)

-

Cleveland Clinic (IVF cycles, Fertility counseling)

-

The Fertility Center (IVF treatment, Egg freezing)

Some of the Raw Material Suppliers for Fertility Services Companies:

-

Thermo Fisher Scientific

-

Merck Group

-

Fisher Scientific

-

Hologic Inc.

-

Irvine Scientific

-

Sartorius AG

-

Eppendorf AG

-

VWR International

-

Corning Inc.

-

BD Biosciences

Recent Trends

-

In August 2024, Birla Fertility acquires IVF chain BabyScience in ₹500-crore push for 100 clinics by FY28.

-

In October 2024, The Ontario government is investing $150 million over two years to expand fertility services, enabling three times more people to qualify for government-funded in vitro fertilization (IVF), announced Finance Minister Peter Bethlenfalvy.

-

In August 2024, Republican presidential candidate Donald Trump announced that he would mandate government or insurance coverage for IVF fertility treatments if elected in November, a strategy aimed at attracting women and suburban voters.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 40.89 Billion |

| Market Size by 2032 | USD 99.60 Billion |

| CAGR | CAGR of 10.43% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Male Infertility, Female Infertility), • By Treatment (In-Vitro Fertilization (IVF), Artificial Insemination), • By End Use (Fertility Clinics, Hospitals and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IVF Australia, Fertility First, CCRM Fertility, IntegraMed Fertility, Mayo Clinic, New Hope Fertility Center, Oregon Reproductive Medicine, Boston IVF, Reproductive Medicine Associates of New Jersey, Shady Grove Fertility, Zavitz Fertility & Reproductive Health, Clinica de Fertilidad, RMA of New York, Piedmont Reproductive Endocrinology Group, SIRM, Bourn Hall Clinic, IVF New Jersey, Create Fertility, Cleveland Clinic, The Fertility Center |

| Key Drivers | • Shifting Cultural Perspectives Normalize Fertility Treatments and Support for Family Building Goals • Transforming Fertility Services Through Digital Health Solutions and Telemedicine for Enhanced Patient Engagement |

| Restraints | • Navigating Ethical Challenges and Emotional Struggles in the Fertility Services Market for Successful Outcomes |