In Vitro Fertilization (IVF) market Report Scope & Overview:

Get more information on In Vitro Fertilization (IVF) Market - Request Sample Report

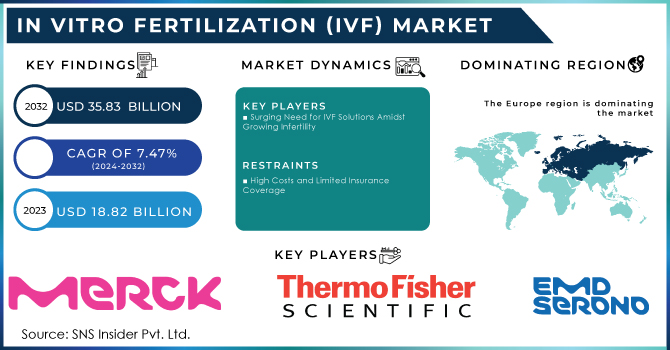

The In Vitro Fertilization (IVF) Market was valued USD 18.82 billion in 2023, anticipated to reach USD 35.83 billion by 2032 with a compound annual growth rate at 7.47% during the forecast period 2024-2032.

Increasing infertility cases across the globe is the major factor for the growth as well as acceleration of in vitro fertilization market. According to the World Health Organization (April 2023), approximately 17.5% of adults worldwide experience infertility. This highlights a significant global need for accessible fertility care. Men and women are equally affected by infertility, with male infertility contributing to roughly 30% of cases (American Pregnancy Association). Several factors, including the trend towards later marriage and childbearing, are contributing to a rise in the use of In Vitro Fertilization (IVF) procedures. It also allows the groundbreaking of saving your eggs to postpone childbearing in favor of pursuing your career for women. The reason for the growth of this market is due to increased dependency on fertility treatments.

In the United States, in vitro fertilization (IVF) demand is on the rise because of increasing infertility rates with approximately 1 in 10 women and men experiences difficulties conceiving naturally. This statistic of 10% is so substantial that in essence has led to an increase demand for assisted reproductive technology including IVF. Also, as family services become available around the campus. As 2021 clearly demonstrated, a full one in eight women end up using them; the number of births accomplished through ART exceeded 86000. IVF procedures is the king, making up over 99% of Assisted reproductive technology (ART). All of that amounts to the IVF process and it makes evident just why so many people are relying on this method when they cannot fall pregnant naturally.

Better techniques in IVF such as egg/sperm cryopreservation, vitrification (rapid freezing), and assisted hatching also support better success rates. Similarly, the advent of newer techniques like Percutaneous Epididymal Sperm Aspiration (PESA) and Testicular Sperm Extraction (TESE) is helping us in retrieving sperm from males. The most recent example of this is the merger between AI solutions company AIVF Ltd. and Genea Biomedx (medical devices), which sees both leveraging their technologies to offer a personalized IVF system that's cost-efficient, as well meeting more systemic needs. Rising trend of medical tourism making it possible for low budget overseas IVF treatment.

Market Dynamics

Drivers

-

Surging Need for IVF Solutions Amidst Growing Infertility

Increasing environmental pollution, changes in genetics and an increase in age-related problems and comorbidities- especially it is one of the main global issues called infertility. The increased number of infertility cases further heightens the demand for IVF treatments as couples look to address their struggles with conception. Better and improved IVF techniques are leading to a greater number of successes, obviously for all the reasons married couple with infertility affecting them heading towards this technology. New methods that are more patient-friendly such as needle-free IVF procedures could also add to demand. There are public service campaigns that raise awareness about issues of fertility, available methods (e.g. IVF) and contributing factors (most commonly postponement). We expect that this growing public awareness will lead to more couples seeking treatment. The launch of new IVF facilities and the development of improved ART services provide more options for patients and improve accessibility to treatment.

Restraints

-

High Costs and Limited Insurance Coverage

A single IVF cycle is usually priced between USD 15,000 and USD 30,000 but the costs could reach over USD 40,000 if more than one treatment (cycle) are needed to achieve a successful pregnancy. IVF treatment is often not covered by insurance, making it extremely unaffordable for many lower-income individuals. Only 15 states currently require private insurance to cover IVF, but these mandates do not apply to self-insured employer plans which are used by most workers. Adding to the inaccessibility, Medicaid coverage also varies by state for fertility services and is optional.

Key Segmentation

By Instrument

-

Disposable Devices

-

Culture Media

-

Cryopreservation Media

-

Embryo Culture Media

-

Ovum Processing Media

-

Sperm Processing Media

-

-

Equipment

-

Sperm Analyzer Systems

-

Imaging Systems

-

Ovum Aspiration Pumps

-

Micromanipulator Systems

-

Incubators

-

Gas Analyzers

-

Laser Systems

-

Cryosystems

-

Sperm Separation Devices

-

IVF Cabinets

-

Anti-vibration Tables

-

Witness Systems

-

Other

-

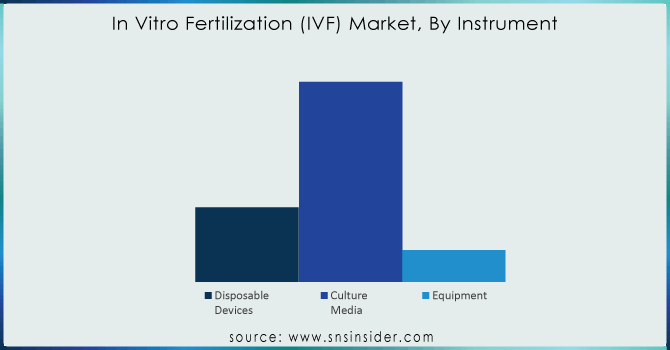

The culture media market dominated the in vitro fertilization (IVF) with nearly 60.20% in 2023 of its revenue shares contributed by this segment. This dominance is driven by two reasons: every strong financial input to the R&D in this field and continuous improvements of culture media itself. FUJIFILM Irvine Scientific, for instance launched a specialised oil to improve embryo culture after the cut-off (July 2022).

Else, the Disposable Devices segment is estimated to grow at highest CAGR in upcoming years. The growth is due to the launch of disposable tools including slides, needles and chambers by corporates. The first generation of these products deal with the key requirements in sterility and compliance as part of an IVF process. The utilization of some other disposable slides (sperm counting), imaging-based systems, for the isolation of top motile sperm or using microchips has already entered into present mainstream.

Need any customization research on In Vitro Fertilization (IVF) Market - Enquiry Now

By Procedure Type

-

Fresh Donor

-

Frozen Donor

-

Fresh Non-donor

-

Frozen Non-donor

The in vitro fertilization (IVF) market leader in egg source is frozen, non-donor eggs with 59.31% in 2023. This dominance is predicted to continue with the fastest growth rate due to their affordability compared to fresh, non-donor eggs and the minimally invasive retrieval process. However, the fresh donor egg segment shows promise for significant growth. A 2020 report indicates that nearly 1,500 ART cycles used fresh donors, resulting in a high live-birth delivery rate. This suggests a rising demand for fresh donor eggs.

Challenges cloud the fresh donor segment while some clinics offer risk-sharing plans for multiple cycles with fresh embryos, concerns linger about the inconsistency of sperm donor screening. Regulations surrounding fresh sperm donation also vary, with some regions mandating quarantine periods for HIV testing. Additionally, limited public funding for fertility treatments using donated gametes for same-sex couples and single parents in certain areas creates another obstacle.

By Providers

-

Fertility Clinics

-

Hospitals & Others Setting

Fertility clinics are leading the market with 63.22% in 2023 revenue share. This dominance originates from various causes. For starters, growing adoption of assisted reproductive technologies (ART) means rising requirement for dedicated fertility clinics. The expansion in the number of these clinics and ART centers is a vast improvement that date we thought was long way off but we now need to focus on improving access for patients. The third reason for you to consider visiting a fertility clinic is that they can be more affordable than hospitals. On the other hand, these clinics usually have expert professionals on board which might mean that you end up with better results and fewer side effects. Similarly, hospitals are full of sick people, making the chances for Hospital-Acquired Infections (HAIs) far more likely than in a quality-controlled environment such as a fertility clinic.

While those settings still have a place in the in vitro fertilization market, given clinics' dominance already existing trends are forecast to continue. Some patients benefit from a broader-spectrum of care offered at many multispecialty hospitals that provide IVF services as well. Non-hospital-based IVF treatments are usually cheaper since they do not require the typically expensive labor regimen with highly skilled staff employed to conduct these procedures (which is what bins up price of training and employing already pricey specialist-surgeon-doctors). The cost point is clear, in particular for developed countries.

Regional Analysis

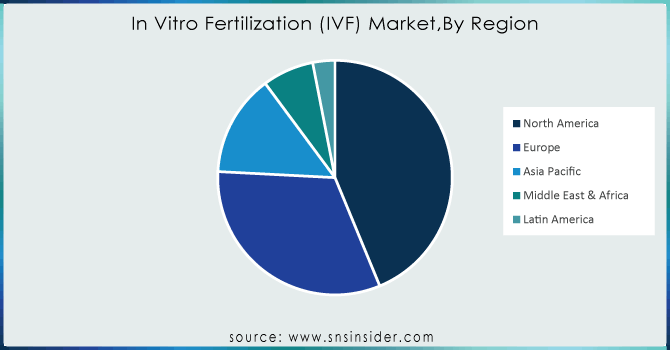

Europe will be at the helm of global in vitro fertilization market chart, holding 36.7% share in revenues procured through sales of every IVF product sold world over in 2023 The strategic regime of this power results from a mixture of circumstances. Americans looking for IVF at an affordable price visit countries like the Czech Republic on medical tourism trips. In Europe, the innovation continues with approval of Fairtility's AI-based embryo assessment tool received in July 2022 to bring great promise for better IVF success rates.

The in vitro fertilization market is also lucrative for growth in the coming years especially in North America. Infertility rates are notoriously increasing, and those numbers may be growing due to unhealthy lifestyle factors like eating habits, stress or even obesity. The in vitro fertilization market is expected to be driven by standardization of procedures, automation in the field, and government funding for egg & sperm storage. In addition, the large number of couples in North America who are unable to conceive without help (one in eight), creates new demand.

A similar trend can also be observed in the Asia Pacific in vitro fertilization market. Medical tourism also helps in its growth, similar to Europe. Moreover, a rising number of foreign enterprises providing products in order to non-urban parts within the region is usually driving market growth. Transformative regulatory reforms to create a fertile environment for IVF, decreasing birth rates (expected at 2.1 children per woman in the year 2022) and an ageing population are some of the factors anticipated to propel market growth within Asia Pacific region. Moreover, numerous organizations like Asia Pacific Initiative on Reproduction (ASPIRE) are piling efforts in creating awareness about infertility and ART services which is likely to escalate the region as a promising contender in in vitro fertilization market.

Regional Analysis

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

EMD Serono, Inc. (Merck KGaA), Cook Medical LLC, Bayer AG., Vitrolife EMD Serono, Inc. Thermo Fisher Scientific, Ferring B.V., Genea, Biomedx, The Cooper Companies, FUJIFILM IrvineScientific Merck & Co,,Inc and other key market players.

Recent Developments Of The In Vitro Fertilization Market

-

June 2023: Life Whisperer platform, an AI-powered tool that supports clinical decision-making in IVF procedures., Fujifilm Irvine Scientific.

-

May 2023: Merck KGaA also unveils its "Fertility Counts" program aimed to combat the social and economic impact from low fertility rates in Asia Pacific.

-

May 2023: Ovation Fertility is merged with US Fertility to form an expanded platform of further developed fertility care and IVF services throughout the United States.

-

April 2023: Boston IVF Secures Three-Year Pact with Cryoport for Safe and Efficient Passage of Reproductive Materials in U.S.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 18.82 billion |

| Market Size by 2032 | US$ 35.83 Billion |

| CAGR | CAGR of 7.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

|

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | EMD Serono, Inc. (Merck KGaA), Cook Medical LLC, Bayer AG., Vitrolife EMD Serono, Inc. Thermo Fisher Scientific, Ferring B.V., Genea, Biomedx, The Cooper Companies, FUJIFILM IrvineScientific Merck & Co,,Inc |