Athleisure Market Report Scope & Overview:

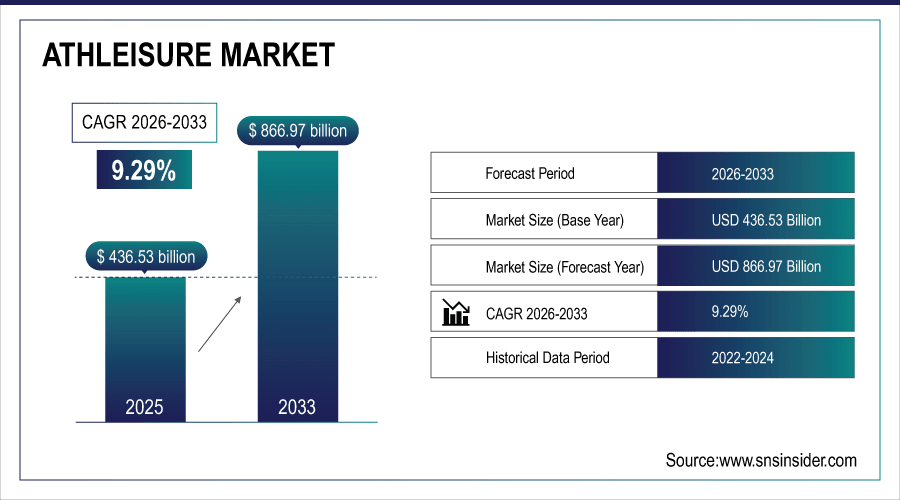

The Athleisure Market was valued at USD 436.53 Billion in 2025E and is projected to reach USD 866.97 Billion by 2033, growing at a CAGR of 9.29% during the forecast period 2026–2033.

The athleisure industry includes tops, bottoms, footwear, outerwear, accessories, and other products designed for both sports and casual wear. Major applications include fitness activities, casual outings, workplace wear, and travel. Key end users are men, women, children, and unisex consumers. The market is expected to grow steadily through 2033, driven by rising health and fitness awareness, increasing demand for comfortable yet stylish clothing, and the influence of social media and fashion trends worldwide.

Footwear accounted for 18% of the Athleisure market in 2025, driven by increasing demand for comfortable yet stylish shoes suitable for both sports and casual wear.

To Get More Information On Athleisure Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 436.53 Billion

-

Market Size by 2033: USD 866.97 Billion

-

CAGR: 9.29% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Athleisure Market Trends:

-

Tops accounted for around 22% of overall market share in 2025, due to their versatility for workouts and casual wear.

-

Bottoms made up 20%, reflecting growing demand for leggings, joggers, and shorts for both fitness and leisure.

-

Footwear held 18%, driven by the trend of stylish, comfortable shoes suitable for sports and daily activities.

-

Outerwear and accessories together represented 15%, focusing on functional and fashionable designs.

-

Online retail contributed 25% of overall distribution, fueled by e-commerce growth and social media influence.

U.S. Athleisure Insights:

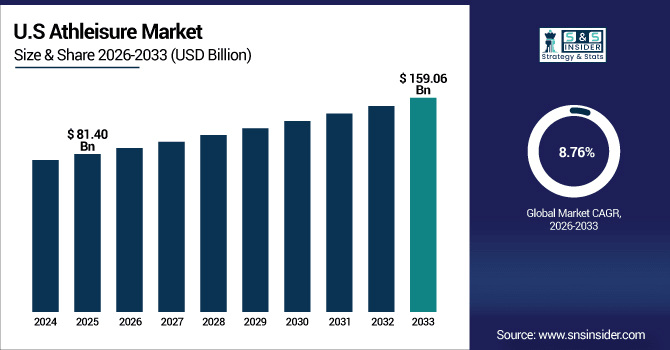

The U.S. Athleisure Market reached USD 81.40 Billion in 2025E and is projected to hit USD 159.06 Billion by 2033, growing at a CAGR of 8.76%. Growth is fueled by rising fitness awareness, demand for versatile activewear, social media influence, and strong e-commerce adoption across urban consumers.

Athleisure Market Growth Drivers:

-

Growing Consumer Preference for Versatile, Stylish, and Comfortable Clothing Drives Athleisure Market Expansion Globally.

The athleisure market growth is driven by rising health and fitness awareness and the demand for versatile, comfortable clothing. By 2025, global consumption reached over 2.1 billion units, with tops and bottoms accounting for 22% and 20% of total usage, respectively. Footwear contributed 18%, while outerwear and accessories made up 15%. Online retail accounted for 25% of overall distribution, highlighting the impact of e-commerce and digital shopping trends.

Rising health and fitness awareness drove 28% of athleisure purchases in 2025, reflecting increasing consumer focus on active lifestyles and comfort.

Athleisure Market Restraints:

-

High Production Costs and Seasonal Fashion Trends Restrict Profitability and Slow Expansion in the Athleisure Market.

High production costs and seasonal fashion trends restrict growth in the athleisure market. In 2025, 23% of small and mid-sized manufacturers reported rising manufacturing expenses, while 17% experienced slower sales during off-season periods. These challenges limit the ability to expand product lines and invest in marketing or innovation. Consequently, even with growing consumer interest in versatile, comfortable, and stylish apparel for sports, casual, and travel purposes, overall market growth faces temporary constraints globally.

Athleisure Market Opportunities:

-

Growing Adoption of Digital Fitness Platforms and Online Retail Channels Creates New Expansion Opportunities for Athleisure Market.

Growing digital fitness platforms and online retail channels are driving athleisure market expansion. Online channels accounted for 25% of total sales in 2025, with consumers purchasing 0.53 billion units and specialty stores contributing 0.28 billion units through e-commerce. Social media and influencer campaigns fueled a 30% consumer-adoption share, highlighting untapped potential. These opportunities are expected to accelerate as digital fitness engagement and online shopping continue rising globally through 2033.

Rising demand for sustainable and eco-friendly athleisure products accounted for 12% of total market adoption in 2025, reflecting increasing consumer preference.

Athleisure Market Segmentation Analysis:

-

By Product Type, Tops held the largest market share of 22.45% in 2025, while Accessories are expected to grow at the fastest CAGR of 11.37%.

-

By Application, Sports & Fitness contributed the highest market share of 28.63% in 2025, while Travel & Outdoor is forecasted to expand at the fastest CAGR of 12.25%.

-

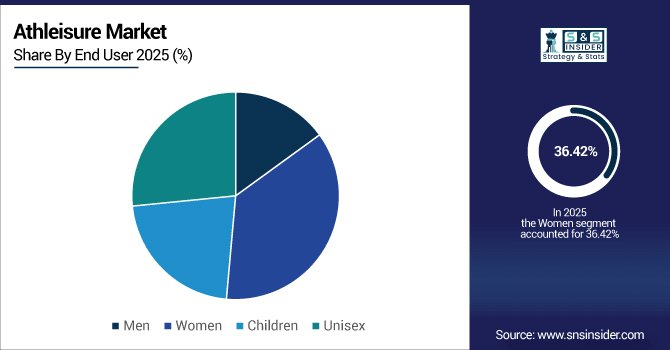

By End User, Women held the largest share of 36.42% in 2025, while Unisex is anticipated to grow at the fastest CAGR of 11.14%.

-

By Distribution Channel, Online Retail accounted for the dominant share of 25.32% in 2025, while Brand Outlets are projected to grow at the fastest CAGR of 12.05%.

By End User, Women Dominate, Unisex Segment Grows Rapidly:

In 2025, women accounted for 0.91 billion units of athleisure purchases, spanning casual, fitness, and office-friendly designs. The unisex segment reached 0.39 billion units, appealing to younger audiences favoring gender-neutral fashion. Increasing urbanization, social media influence, and demand for versatile wardrobes are expected to propel the unisex segment to 0.88 billion units by 2033, offering brands new opportunities through collaborations and limited-edition launches.

By Product Type, Tops Retain Market Leadership, Accessories Gain Popularity:

In 2025, tops accounted for 0.47 billion units, widely adopted for workouts, casual wear, and office-athleisure hybrid styles. Accessories, including hats, socks, and gym bags, reached 0.21 billion units, gaining traction among style-conscious and eco-friendly consumers. With increasing focus on functional fashion and personalized styling, accessories are expected to grow rapidly to 0.45 billion units by 2033, fueled by online sales, influencer promotions, and collaborations with sportswear brands globally.

By Application, Sports & Fitness Leads, Travel & Outdoor Expands Fastest:

In 2025, sports and fitness activities consumed 0.62 billion units, driven by gym-goers and home fitness enthusiasts. Travel and outdoor applications reached 0.27 billion units, reflecting rising adventure tourism and weekend active wear usage. With consumers seeking multipurpose clothing for both activity and leisure, travel & outdoor athleisure is expected to expand to 0.56 billion units by 2033, supported by sustainable fabrics, functional designs, and digital marketing campaigns.

By Distribution Channel, Online Retail Leads, Brand Outlets Expand Fastest:

In 2025, online retail accounted for 0.53 billion units, reflecting the convenience of digital shopping and influencer-driven purchases. Brand outlets contributed 0.29 billion units, benefiting from experiential retail and loyalty programs. As e-commerce continues to grow and brands focus on direct-to-consumer strategies, brand outlets are expected to reach 0.61 billion units by 2033, supported by pop-up stores, interactive experiences, and integration with digital fitness communities.

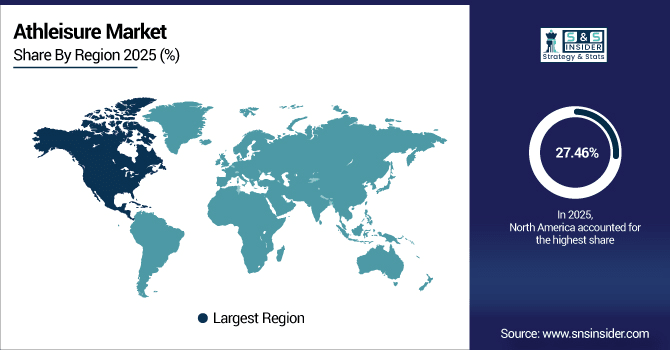

Athleisure Market Regional Analysis:

North America Athleisure Market Insights:

In 2025, North America accounted for 27.46% of the global athleisure market, with approximately 145 million pieces sold. Sports and fitness applications contributed 80 million pieces, casual and workplace wear 38 million pieces, and travel/outdoor athleisure 27 million pieces. Online retail served 35 million pieces, reflecting the rise of digital shopping. Market expansion is expected through 2033, fueled by growing health awareness, social media influence, and demand for versatile, stylish activewear.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Athleisure Market Insights:

The U.S. athleisure market sold over 210 million pieces in 2025, with 95 million pieces used for sports and fitness, 62 million for casual and workplace wear, and 53 million for travel and outdoor activities. Online retail contributed 88 million pieces, fueling growth through e-commerce adoption and social media influence.

Asia-Pacific Athleisure Market Insights:

The Asia-Pacific athleisure market, the fastest-growing region, is projected to expand at a CAGR of 10.30% through 2033. In 2025, over 380 million pieces were consumed: China led with 145 million, Japan with 95 million, and India with 70 million. Online retail accounted for 120 million pieces, reflecting rapid e-commerce adoption. Rising fitness awareness, urbanization, and demand for versatile, stylish activewear are expected to sustain strong regional growth.

China False Athleisure Market Insights:

In 2025, China consumed over 145 million athleisure pieces, with 65 million for sports and fitness, 40 million for casual wear, and 25 million for travel/outdoor activities. Online retail processed 50 million pieces, while specialty stores handled 35 million, supporting rapid market expansion in China through 2033, driven by rising fitness awareness and urban lifestyle trends.

Europe Athleisure Market Insights:

Europeans purchased over 125 million athleisure pieces in 2025, with Germany (38 million), the UK (32 million), and France (28 million) as the largest consumers. Sports and fitness applications accounted for 55 million pieces, casual wear 40 million, and travel/outdoor 30 million. Online retail processed 42 million pieces, while specialty stores handled 33 million. Market growth through 2033 will be supported by rising fitness awareness, urban lifestyles, and increasing e-commerce adoption.

Germany Athleisure Market Insights:

In 2025, the German athleisure market accounted for over 38 million pieces, with 16 million for sports and fitness, 12 million for casual wear, and 6 million for travel/outdoor activities. Online retail handled 14 million pieces, while specialty stores processed 10 million, supporting growth through 2033 with rising fitness awareness and versatile activewear demand.

Latin America Athleisure Market Insights:

In 2025, Latin America consumed over 52 million athleisure pieces, led by Brazil, Mexico, and Argentina. Sports and fitness applications accounted for 25 million pieces, casual wear 15 million, and travel/outdoor usage 12 million. Online retail processed 18 million pieces, supporting market growth through 2033, driven by rising fitness awareness, urban lifestyles, and increasing e-commerce adoption.

Middle East and Africa Athleisure Market Insights:

As of 2025, the Middle East & Africa consumed over 28 million athleisure pieces, with 12 million for sports and fitness, 9 million for casual wear, and 7 million for travel/outdoor activities. Strong regional growth is driven by rising health awareness, urban lifestyles, and increasing adoption through online retail channels.

Athleisure Market Competitive Landscape:

Nike is a global leader in the athleisure market, offering a wide range of products including sportswear, footwear, and active lifestyle apparel. In 2025, the company launched over 1,200 products across more than 190 countries. Nike’s market strength comes from its direct-to-consumer stores, online platforms, and flagship experiences. Continuous innovation in sustainable fabrics, smart footwear, and personalized products, along with high-profile athlete endorsements and marketing campaigns, reinforces its dominance and drives widespread consumer adoption.

-

In September 2025, Nike launched NikeSKIMS with Kim Kardashian, featuring 58 inclusive, body-sculpting athleisure pieces. It blends performance and everyday wear with sizes XXS–4X and global availability.

Adidas is a major player in the global athleisure market, offering over 900 athleisure and performance product lines in 2025 across 160 countries. Its Originals line, along with collaborations with designers and influencers, drives strong consumer engagement. Innovative offerings such as hybrid footwear and sustainable apparel, supported by a robust online presence, position Adidas as a leading brand, appealing to both fitness enthusiasts and lifestyle-focused consumers worldwide.

-

In September 2025, Adidas and Noah Lyles released a limited-edition capsule with Crunchyroll, merging anime aesthetics with athletic wear.

Lululemon is a leading brand in the premium athleisure market, offering over 500 new product styles in 2025 across yoga, fitness, and lifestyle categories. With more than 550 stores worldwide and increasing online adoption, the company focuses on high-quality fabrics, performance-oriented designs, and versatile athleisure wear. Community-driven marketing, influencer collaborations, and strong customer loyalty reinforce Lululemon’s dominance in the global athleisure segment.

-

In June 2025, Lululemon introduced the Go Further Capsule for enhanced performance and comfort. The collection, developed at its FURTHER lab, launched globally in select regions.

Athleisure Market Key Players:

Some of the Athleisure Market Companies are:

-

Nike

-

Adidas

-

Lululemon

-

Puma

-

Under Armour

-

Anta Sports

-

Skechers

-

Fila

-

ASICS

-

Reebok

-

On Running

-

Gymshark

-

Athleta (Gap Inc.)

-

Outdoor Voices

-

Sweaty Betty

-

Beyond Yoga

-

Adanola

-

Girlfriend Collective

-

ALO Yoga

-

Lorna Jane

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 426.53 Billion |

| Market Size by 2033 | USD 866.97 Billion |

| CAGR | CAGR of 9.29% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Tops, Bottoms, Footwear, Outerwear, Accessories, Others) • By Application (Sports & Fitness, Casual Wear, Workplace, Travel & Outdoor, Others) • By End User (Men, Women, Children, Unisex, Others) • By Distribution Channel (Online Retail, Specialty Stores, Department Stores, Brand Outlets, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Nike, Adidas, Lululemon, Puma, Under Armour, Anta Sports, Skechers, Fila, ASICS, Reebok, On Running, Gymshark, Athleta (Gap Inc.), Outdoor Voices, Sweaty Betty, Beyond Yoga, Adanola, Girlfriend Collective, ALO Yoga, Lorna Jane |