AUTOMOTIVE BATTERY MANAGEMENT SYSTEM MARKET KEY INSIGHTS:

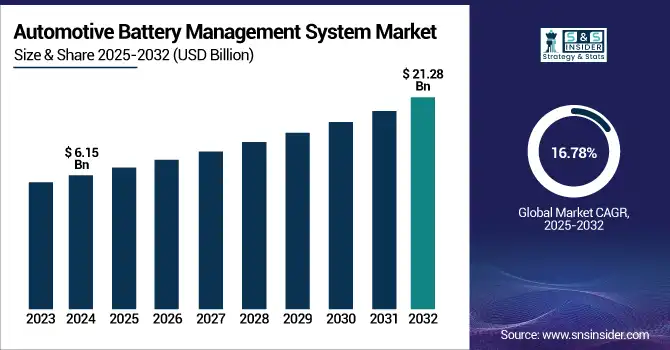

The Automotive Battery Management System Market size was valued at USD 6.15 billion in 2024 and is expected to reach USD 21.28 billion by 2032, growing at a CAGR of 16.78% over the forecast period of 2025-2032.

To Get more information on Automotive Battery Management System Market - Request Free Sample Report

Automotive Battery Management System (BMS) Market is emerging rapidly due to the high demand for electric vehicles across the globe along with hybrid electric vehicles. With the world pushing toward sustainability and curbing carbon emissions, the role of BMS has thus become critical in terms of ensuring that auto batteries-primarily lithium-ion batteries-run efficiently, safely, and last long. It is responsible for monitoring the conditions of the batteries, including voltage, temperature, and charge, and manages the distribution of energy.

In 2023, new policies were announced, which will raise the bar for battery safety and performance requirements for EV makers indirectly, stimulating innovation in battery management technologies. For instance, in the USA, there is a direct promotion of domestic production of electric vehicles as well as battery technologies in the Inflation Reduction Act, of 2022 through tax credits and investments in clean energy infrastructure. Such inducements are creating an eco-friendly atmosphere through which automotive BMS technology can boom. France and Germany, being two of Europe's biggest automobile giants, are also not lacking behind in the game. France is planning to completely ban fossil fuel vehicles by 2035. The government offers quite attractive incentives for buying Electric vehicles. Germany is also heading for full electrification of the automobile space by providing subsidies and building a robust electric vehicle infrastructure.

Market Dynamics:

Key Drivers:

- The adoption of electric cars across the globe is driving the growth in battery management systems.

Electric cars are gradually gaining their way in the market; this is where the demand for efficient and reliable BMS or Battery Management Systems is getting on the rise. For instance, According to Globle EV outlook 2023, sales of electric vehicles rose to a record in 2022, accounting for 14% of all new cars sold around the globe. China with 60%, followed by Europe with 17% penetration, and then the U.S., whose portion is 8% from new car purchases. As a whole, over 10 million electric cars were sold worldwide. Additional projections from the year 2023 would witness further growth with an estimation of 18% share in world car sales for EVs, which represents the outcome of policy support along with increasing demand from customers. This growth increased because of the incentives, subsidies, and carbon emission rules becoming strict. More EVs on the roads, manufacturers should ensure that such vehicles' BMS technology should be robust, to ensure the maximum life of the battery and high performance with more safety, creating demand for the BMS solution.

Restraints:

- Advanced Battery Management System has a high price that limits the adoption.

Incorporation of advanced BMS technology is highly costly, particularly on lower-end electric vehicles; hence this is one of the large restraint factors in the automotive battery management system market. Since BMS plays a vital role in achieving the safety, longevity, and performance of batteries, the technology used in their integration with electric vehicles forms complex software as well as sophisticated hardware, such as sensors and controllers, thereby increasing the cost, which might be a limitation to automakers; at least, to the developing economies or cost-sensitive segments of the automotive industry. For example, the high-end electric vehicle makers like Tesla and Porsche can easily absorb the more expensive BMS technologies, but not the low-end models in price-sensitive markets like India and Southeast Asia.

Segmentation Analysis:

By Components

Battery sensors play a critical role in modern automotive battery management systems by continuously monitoring parameters such as voltage, temperature, and current. This data ensures optimized battery performance, longevity, and safety, especially in electric and hybrid vehicles. With growing concerns around thermal runaway and battery degradation, advanced battery sensors are gaining traction across OEMs and aftermarket solutions. Their integration enables real-time diagnostics and enhances energy efficiency, making them indispensable for next-gen automotive power systems.

Battery ICs are projected to witness the fastest growth within the automotive battery management system market, driven by rising demand for compact, energy-efficient, and intelligent control units. These integrated circuits enable precise battery monitoring, cell balancing, and fault detection. As the automotive industry pivots toward electric mobility and smart energy solutions, the adoption of advanced battery ICs is accelerating. Their role in ensuring battery safety, reliability, and performance positions them as a vital enabler of electric vehicle innovation.

By Vehicle Type

Commercial vehicles, including trucks, buses, and delivery vans, are increasingly incorporating battery management systems to support the shift toward electrification and compliance with emission regulations. These systems enhance battery efficiency, extend service life, and ensure operational safety in demanding, high-load applications. With logistics and fleet operations emphasizing uptime and cost-efficiency, BMS solutions in commercial vehicles are becoming essential for reducing downtime and optimizing energy usage, particularly in urban delivery and long-haul electric vehicle deployments.

Passenger cars are expected to lead the growth trajectory in the automotive battery management system market, fueled by accelerating consumer adoption of electric vehicles and hybrid models. Automakers are integrating sophisticated BMS technologies to support performance, range optimization, and battery health monitoring. The increasing focus on user safety, connected car ecosystems, and government incentives for EV adoption is driving widespread deployment of battery management solutions in the passenger vehicle segment, making it a major growth contributor.

By Battery Type

Lead-acid batteries continue to be utilized in automotive applications due to their low cost, reliability, and well-established supply chain. Although primarily used in conventional vehicles for starter, lighting, and ignition functions, they are also present in micro-hybrid systems and some electric vehicle support functions. Battery management systems for lead-acid types help optimize charging cycles, prevent overcharging, and extend battery lifespan. Despite facing competition from newer chemistries, lead-acid remains relevant in specific low-voltage and backup applications.

Solid-state batteries are poised to drive the fastest growth in the battery management system market as the automotive sector eyes their commercial viability. Offering superior energy density, safety, and lifespan compared to traditional chemistries, these batteries require highly advanced BMS to manage their unique characteristics. As OEMs invest heavily in solid-state R&D and prototype deployments, the demand for specialized BMS solutions tailored to this battery type is set to surge, signaling a transformative shift in EV power architecture.

By Battery Capacity

Battery capacities ranging from 201 to 500 kWh are primarily used in heavy-duty electric commercial vehicles, including electric buses and long-haul trucks. These batteries support extended driving ranges and higher load capacities, making them essential for fleet operations and public transport systems transitioning to clean energy. Battery management systems in this segment focus on thermal regulation, power distribution, and real-time diagnostics to ensure safety and efficiency under demanding operating conditions, contributing to improved vehicle uptime and operational performance.

The segment with more than 500 kWh battery capacity is projected to experience the fastest growth, driven by advancements in high-capacity electric mobility solutions such as electric trucks, off-highway vehicles, and future autonomous transport platforms. These large battery packs demand highly intelligent and scalable BMS solutions capable of managing thermal loads, ensuring precise cell balancing, and enhancing safety protocols. The rise in demand for high-energy vehicles supporting longer operational hours and ranges is accelerating adoption in this segment.

Regional Analysis:

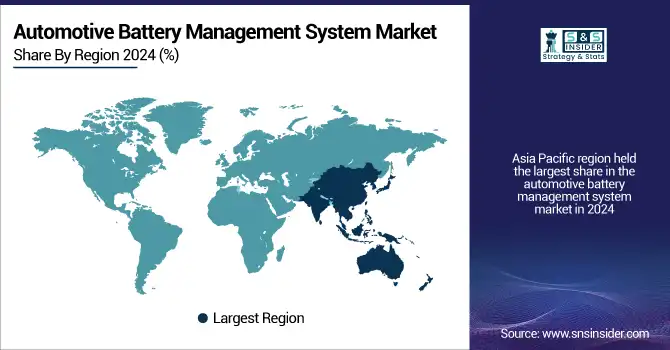

The Asia Pacific region held the largest share in the automotive battery management system market in 2024. Region-dominant growth leads to new electric vehicle adoption in key nations China, Japan, and South Korea. China is also at the world's forefront in electric vehicle production and sales, largely driven by reasonably strong government support, in terms of direct subsidy incentives, improving charging infrastructure, and so on. Moreover, CATL and BYD - the leader in the battery manufacturing field - is located in the region. Over the years, the presence of these leaders has helped create a grip on the Asia Pacific market.

The Asia Pacific region will show the fastest CAGR in the given forecast period of 2024-2032. The growth in the region is primarily spurred by direct investments in electric mobility, the promotion of cleaner transport by the government, and technological advancements in battery technologies. Japan and South Korea, followed by China, are likely to maintain a lead in advancements in battery management systems, thereby further catapulting growth in the regional market in the forthcoming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

KEY PLAYERS

Some of the major Automotive Battery Management Systems Companies are Robert Bosch GmbH, Continental AG, Denso Corporation, LG Chem, Panasonic Corporation, Samsung SDI, Tesla Inc., BYD Company Limited, Johnson Matthey, Hitachi Automotive Systems, Valeo, A123 Systems.

RECENT TRENDS

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 6.15 Billion |

| Market Size by 2032 | USD 21.28 Billion |

| CAGR | CAGR of 16.78 % from 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Components (Battery IC, Battery Sensor, and Other Components), • By Propulsion Type (IC Engine Vehicle and Electric Vehicle (HEV, PHEV, and BEV)), • By Vehicle Type (Passenger Cars and Commercial Vehicles) • By Battery Type (Lithium-ion, Lead-acid, Nickel-based, Solid-state), • By Battery Capacity (Less than 100 kWh, 100-200 kWh, 201-500 kWh, More than 500 kWh) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Robert Bosch GmbH, Continental AG, Denso Corporation, LG Chem, Panasonic Corporation, Samsung SDI, Tesla Inc., BYD Company Limited, Johnson Matthey, Hitachi Automotive Systems, Valeo, A123 Systems. |

| Key Drivers | • The adoption of electric cars across the globe is driving the growth in battery management systems. • Government policies that promote investment in EV infrastructure boost the growth of BMS Market. |

| Restraints | • Advanced Battery Management System has a high price that limits the adoption. |