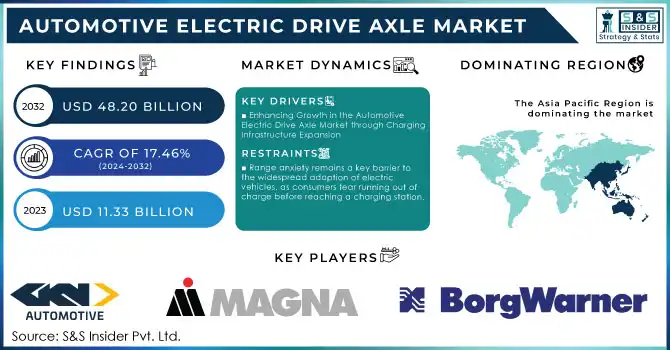

Automotive Electric Drive Axle Market Key Insights:

The Automotive Electric Drive Axle Market size was valued at USD 11.33 Billion in 2023 and will reach USD 48.20 Bn by 2032 and grow at a CAGR of 17.46% over the forecast period of 2024-2032.

Get More Information on Automotive Electric Drive Axle Market - Request Sample Report

The Automotive Electric Drive Axle Market growth is fueled by a range of government regulations and incentives promoting the adoption of electric vehicles (EVs) and advancing the development of electric drive axles. In the United States, the Biden-Harris Electric Vehicle Charging Action Plan has allocated USD 7.5 billion to enhance EV charging infrastructure, accelerating the adoption of electric vehicles and driving demand for electric powertrains, including electric drive axles. The Federal EV Incentives Program also offers up to USD 7,500 in rebates for consumers purchasing electric cars, further incentivizing automakers to integrate electric drivetrains into their offerings.

The Automotive Electric Drive Axle Market is expected to see continuous growth, driven by government policies, subsidies, and incentives aimed at reducing emissions and boosting electric vehicle adoption. For Instance, in India, the FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) scheme has committed ₹10,000 crore (around USD 1.2 billion) to foster EV adoption, focusing on reducing the cost of electric vehicles and their key components like electric drive axles. Additionally, the Union Budget 2024 supports the growth of sustainable mobility, offering subsidies for EVs and green infrastructure, which will further fuel the demand for electric drivetrains. In Australia, the government’s incentives of up to USD 5,000 for electric vehicle buyers, coupled with plans to expand charging infrastructure, are set to accelerate the transition to EVs. The country’s target of having 50% of new car sales be electric by 2030 will significantly increase demand for electric powertrains, including electric drive axles. In Europe, the European Green Deal and stricter CO2 emission standards are driving automakers to enhance electric drivetrains, aiming to have 30 million electric cars on the road by 2030.

Automotive Electric Drive Axle Market Dynamics

Drivers

-

Enhancing Growth in the Automotive Electric Drive Axle Market through Charging Infrastructure Expansion

The expansion and improvement of electric vehicle (EV) charging infrastructure play a critical role in driving the demand for Automotive Electric Drive Axles. As more widespread and efficient charging networks are developed, the adoption of electric vehicles is accelerating, indirectly boosting the need for electric drivetrains and components like electric drive axles. For instance, the Bipartisan Infrastructure Law (BIL) in the United States has allocated USD 7.5 billion to enhance EV charging infrastructure, which is expected to significantly reduce range anxiety and improve consumer confidence in EVs. According to J.D. Power's 2024 U.S. Electric Vehicle Experience (EVX) Public Charging Study, improvements in charging station availability and faster charging times have enhanced the overall user experience, leading to greater EV adoption.

In Europe, Tesla and other automakers continue to expand charging networks, further fostering EV penetration. Additionally, the Scottish Futures Trust notes that efforts in countries like the UK focus on developing ultra-fast charging hubs, with the aim to have more than 6,000 public charging points by 2025. These advancements in charging infrastructure directly support the growth of Automotive Electric Drive Axles by creating a more favorable environment for electric vehicles, leading to higher demand for electric powertrains. As charging stations become more accessible and faster, EVs with electric drive axles will become an increasingly attractive option for consumers.

Restraints

-

Range anxiety remains a key barrier to the widespread adoption of electric vehicles, as consumers fear running out of charge before reaching a charging station.

As many consumers fear that their electric vehicles (EVs) will run out of charge before reaching a charging station range anxiety remains a key restraint in the growth of the automotive electric drive axle market. Despite improvements in battery technology, the perceived limitations of EV range continue to deter potential buyers from fully adopting electric vehicles, directly impacting the demand for electric drive axles. Research shows that range anxiety is a top concern for EV owners, particularly those who travel long distances or reside in areas with insufficient charging infrastructure. Studies reveal that 60% of consumers worry about running out of charge on long trips, while 41% hesitate to purchase an EV due to concerns over battery range.

Automotive Electric Drive Axle Market Segment Analysis

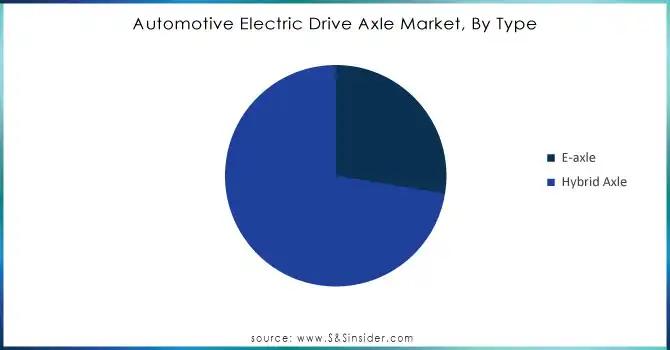

By Type

The Hybrid Axle segment dominated the Automotive Electric Drive Axle market in 2023, accounting for around 73% of revenue, and its leadership is expected to persist. Hybrid vehicles, which combine an internal combustion engine and an electric motor, offer improved fuel efficiency and reduced emissions compared to traditional vehicles. Key factors driving this dominance include the increasing adoption of hybrid vehicles, regulatory incentives, and a consumer preference for vehicles that balance electric benefits with conventional engine performance. Hybrid axles are essential in managing power distribution, optimizing efficiency, and reducing environmental impact. While fully electric vehicles are growing, hybrid axles will continue to play a significant role, particularly in markets where hybrid vehicles are more widely adopted.

Need Any Customization Research On Automotive Electric Drive Axle Market - Inquiry Now

By Drive Type

The Front Wheel Drive (FWD) segment accounted for the largest revenue share of around 46% in the Automotive Electric Drive Axle market in 2023 and is expected to maintain this dominance. FWD systems are favored for their cost efficiency, as they are cheaper to manufacture compared to all-wheel drive (AWD) or rear-wheel drive (RWD) systems. They offer space optimization, with the engine and transmission located at the front, freeing up room for passengers and cargo. FWD vehicles are known for their fuel efficiency and are highly preferred for urban driving, where compact cars and crossovers dominate. Regulatory support and consumer demand for efficient, affordable EVs further boost FWD’s position in the market, ensuring continued growth through 2032.

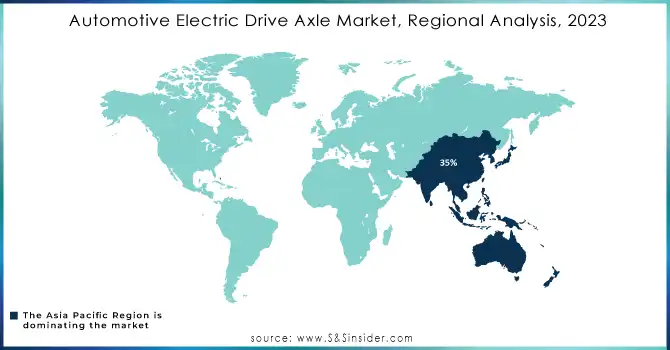

Automotive Electric Drive Axle Market Regional Overview

The Asia-Pacific region held a dominant 35% share of the Automotive Electric Drive Axle market in 2023 and is expected to retain its leadership in the coming years. Key drivers include high EV demand, especially in China, where government initiatives, incentives, and environmental policies are propelling large-scale production of electric and hybrid vehicles. Major automotive manufacturers such as BYD, Toyota, Hyundai, and Honda, based in Japan, South Korea, and China, are increasingly integrating electric drive axles into their EV models to meet the rising demand for electric mobility. Government policies in APAC, particularly China’s aggressive EV sales targets and infrastructure development, further support this growth. Additionally, the region leads in technological advancements in electric drive systems, enhancing the efficiency and affordability of EVs. The expanding charging infrastructure and improvements in battery technology also foster the adoption of EVs, boosting the demand for electric drive axles. As a result, APAC remains a key player in this market.

North America emerged as the fastest-growing region in the Automotive Electric Drive Axle market, driven by key factors supporting the rapid adoption of electric vehicles (EVs). The U.S. has seen significant EV market growth, bolstered by government policies such as the Biden administration’s incentives and tax credits, spurring demand for electric drive axles. Stringent emissions regulations and subsidies in North America are encouraging automakers to increase EV production, with the U.S. and Canada setting ambitious EV adoption targets. Major automakers like Tesla, General Motors, and Ford are investing heavily in the development of more efficient electric drive axles and advanced drivetrains, enhancing vehicle performance and range. Additionally, the expansion of EV charging infrastructure across North America is boosting consumer confidence and supporting the wider adoption of EVs. These factors collectively position North America as the fastest-growing region in the automotive electric drive axle market.

Key Players in Automotive Electric Drive Axle Market

Some of the major players in Automotive Electric Drive Axle Market with their product:

-

GKN Automotive (eDrive Axle, Electric Drive Units, Axle Modules)

-

ZF Friedrichshafen AG (eDrive Axle, Electric Axles, Powertrain Solutions for EVs)

-

Magna International (Magna eDrive Systems, Electric Axles for Passenger Vehicles)

-

BorgWarner Inc. (eAxles, Electric Drive Modules, Integrated Electric Drive Systems)

-

Dana Incorporated (Spicer Electrified eDrive Axles, Electric Vehicle Axles)

-

Schaeffler Group (Electromobility solutions, Axle drive for EVs)

-

Valeo (Valeo e-Drive Systems, Integrated Electric Drive Axles)

-

Bosch Mobility Solutions (eAxle Systems, Electric Powertrain Solutions)

-

Delphi Technologies (Electrified Powertrains, Electric Drive Axles for EVs)

-

Continental AG (Electric Axle Drive Units, eDrive Technologies)

-

Nidec Corporation (Nidec Electric Axle Systems, Electric Drive Motors)

-

Hitachi Astemo Ltd. (eAxle Systems, Electric Drive Solutions)

-

Hyundai Motor Group (Electric Axle Drives for EVs)

-

Renesas Electronics Corporation (Powertrain Integrated Circuits for eDrive Axles)

-

Elaphe Propulsion Technologies (In-wheel eDrive Systems, Electric Axles)

-

ePropelled (eDrive Systems for Electric and Hybrid Vehicles)

-

Tesla Inc. (Tesla Electric Drive Units, In-house eDrive Axles for EVs)

-

YASA Limited (Axial Flux Motors, Electric Drive Axles)

-

Infinitum Electric (Axial Flux Motors for Electric Drive Axles)

-

Rivian Automotive (Rivian Electric Drive Units, Integrated Axles for EVs)

-

BYD Auto Co., Ltd. (Electric Axles and Powertrains for EVs)

-

Nissan Motor Co., Ltd. (Nissan e-Drive Axles for Electric Vehicles)

-

Toyota Motor Corporation (Electric Drive Axles for Hybrid and Electric Vehicles)

-

Fisker Inc. (Electric Drive Axles for EVs)

-

Aisin Seiki Co. (Electric Axle Systems, EV Powertrains)

-

Porsche AG (Porsche Electric Drive Axle for EVs, Taycan Drive Units)

-

General Motors (GM) (GM Ultium Drive Systems, Electric Drive Axles)

-

BMW Group (BMW Electric Drive Axles for EVs)

-

Ford Motor Company (Ford eAxles for EVs, Integrated Drive Systems)

List of suppliers of raw materials in the Automotive Electric Drive Axle Market:

-

Albemarle Corporation

-

Sumitomo Electric Industries, Ltd.

-

Nippon Steel Corporation

-

BASF SE

-

Umicore

-

Dow Inc.

-

Molycorp (now part of MP Materials)

-

Vallourec S.A.

-

Volkswagen Group Components

-

Johnson Matthey

-

POSCO

-

Henkel AG & Co. KGaA

-

Advanced Battery Concepts

-

SABIC (Saudi Basic Industries Corporation)

-

ThyssenKrupp AG

-

3M Company

-

LG Chem

-

SGL Carbon

-

Kobe Steel Ltd.

-

Alcoa Corporation

-

Eurasian Resources Group

-

Kraton Polymers

-

Maxim Integrated

-

Vestas Wind Systems

-

Shanghai Shenda Co., Ltd.

-

Wuhan Iron and Steel Corporation

-

Hanwa Co., Ltd.

-

China Northern Rare Earth Group High-Tech Co., Ltd.

-

GKN Powder Metallurgy

Recent Developments:

-

07.05.2024 – BorgWarner has received follow-up orders from Xpeng to supply HVH220 hairpin electric motors for two new SUV models, with production set to begin in 2025. Additionally, BorgWarner's new torque vectoring system, ‘eTVD’, will debut in the Polestar 3 SUV, enhancing stability and traction.

-

14 Oct 2024 – GM Defense unveiled a tactical vehicle based on the Chevrolet Silverado 2500HD ZR2, featuring a dual-motor powertrain and a diesel range extender. This EV prototype offers Silent Drive and Silent Watch modes for stealth operations, although its range remains undisclosed.

-

Mar 14, 2024 – Nissan is reportedly in early talks with Honda to co-develop a new modular electric axle and shared EV platform, aiming to produce affordable EVs to compete with Chinese-made rivals.

-

Feb 8, 2024 – Magna introduced its new eDS Duo rear drive system, capable of delivering 8000 Nm of torque and 726 kW of power. The system, 20% smaller and 93% efficient, has received an order for a high-end vehicle platform from a North American OEM.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 11.33 Billion |

| Market Size by 2032 | USD 48.20 Billion |

| CAGR | CAGR of 17.46% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(E-axle, Hybrid Axle) • By Drive Type(Front Wheel Drive, Rear Wheel Drive, All Wheel Drive) • By Vehicle Type(Passenger Cars, Light Commercial Vehicles, Heavy Duty Trucks, Buses and Coaches) • By Electric Vehicle Type (Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs)) • By Sales Channel (OEMs, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GKN Automotive, ZF Friedrichshafen AG, Magna International, BorgWarner Inc., Dana Incorporated, Schaeffler Group, Valeo, Bosch Mobility Solutions, Delphi Technologies, Continental AG, Nidec Corporation, Hitachi Astemo Ltd., Hyundai Motor Group, Renesas Electronics Corporation, Elaphe Propulsion Technologies, ePropelled, Tesla Inc., YASA Limited, Infinitum Electric, Rivian Automotive, BYD Auto Co., Ltd., Nissan Motor Co., Ltd., Toyota Motor Corporation, Fisker Inc., Aisin Seiki Co., Porsche AG, General Motors (GM), BMW Group, and Ford Motor Company. |

| Key Drivers | • Enhancing Growth in the Automotive Electric Drive Axle Market through Charging Infrastructure Expansion |

| Restraints | • Range anxiety remains a key barrier to the widespread adoption of electric vehicles, as consumers fear running out of charge before reaching a charging station. |