Autonomous Vehicle ECU Market Report Scope & Overview

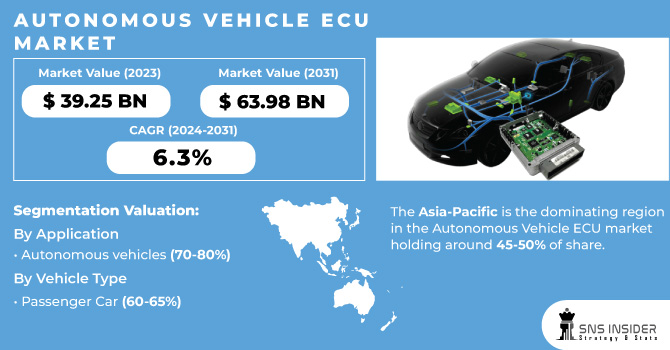

The Autonomous Vehicle ECU Market Size was valued at USD 39.25 billion in 2023 and is expected to reach USD 63.98 billion by 2031 and grow at a CAGR of 6.3% over the forecast period 2024-2031.

The electronic control unit (ECU) is the vital component of a car, managing functions like engines, entertainment systems, and advanced driver-assistance systems (ADAS) through sensors and components. Autonomous vehicle ECUs are especially crucial for safety features like lane departure monitoring and collision avoidance. This market is driven by stricter government safety regulations, a growing demand for ADAS features, and rising vehicle sales. To improve safety and traffic flow, car manufacturers are developing new technologies. Affordable advanced safety features like blind spot detection and automatic emergency braking are also boosting the market. Stringent regulations, like mandatory ABS systems further propel market growth. The main driver, however, is the concerning rise in accidents due to human error, like fatigue from long drives.

Get more information on Autonomous Vehicle ECU Market - Request Free Sample Report

MARKET DYNAMICS:

KEY DRIVERS:

-

Advanced Sensor Tech Drives Growth in Autonomous Vehicle ECU Market

Autonomous vehicles rely heavily on advanced sensors for safe navigation. This market thrives because of constant improvements in LiDAR, radar, cameras, and other perception systems. These high-tech sensors are the crucial part of the car, feeding real-time data on the environment to the Electronic Control Unit (ECU), the vehicle's brain. This vital data allows the ECU to make critical decisions and navigate autonomously.

-

Automotive Industry Collaboration Drives Innovation in Autonomous Vehicle ECUs

RESTRAINTS:

-

The high cost of developing and integrating advanced sensors and powerful processors in ECUs can limit adoption.

-

Concerns regarding data security and potential hacking vulnerabilities in autonomous vehicle ECUs can deter market expansion.

OPPORTUNITIES:

-

Advancements in sensor technology like LiDAR and radar will create a demand for more powerful ECUs to process the complex data.

-

Growing adoption of ADAS features in regular vehicles can serve as a stepping stone towards autonomous ECUs.

CHALLENGES:

-

High Development Costs hinders Autonomous Vehicle ECU Market Growth

Bringing complex autonomous vehicle ECUs to market is expensive. Extensive testing in various situations is crucial to guarantee safety and reliability, driving up development costs. This can be a barrier for smaller companies. The challenge lies in optimizing testing procedures to make them more efficient without sacrificing safety. Thus, ensuring safe and reliable ECUs requires thorough testing across different situations, making development costly.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine disrupts the promising growth of the Autonomous Vehicle ECU market. Disruptions to production and export of vital car parts, including the semiconductors essential for ECUs, could cause a temporary decline of 15-20% in ECU production. This setback impacts not only the autonomous vehicle but also the broader ADAS market that relies on similar technology. The slowdown extends to raw material supplies, as both Russia and Ukraine are key players in certain materials needed for ECU manufacturing. The war's overall impact on the market depends on the conflict's duration and the effectiveness of alternative supply chains. While the short-term outlook is decreased, the long-term growth prospects of the Autonomous Vehicle ECU market remain positive, driven by the above factors like stricter safety regulations and rising demand for ADAS features.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can disrupt the promising growth of thew autonomous vehicle ECU market. Consumer spending typically limits during economic downturns, potentially leading to a 10-15% decline in overall vehicle sales. This directly translates to a decrease in demand for new vehicles, including those equipped with advanced ECUs. Additionally, economic hardship can force car manufacturers to prioritize short-term profits over long-term investments in cutting-edge technologies like autonomous driving. This may lead to delays in research and development projects focused on next-generation ECUs.

KEY MARKET SEGMENTS:

By Application

-

Autonomous vehicles

-

Semi-autonomous vehicles

Autonomous vehicles is the dominating sub-segment in the Autonomous Vehicle ECU Market by application holding around 70-80% of market share. This dominance is driven by the sheer complexity of these vehicles. They require powerful ECUs capable of handling massive amounts of data from various sensors (LiDAR, radar, cameras) and making real-time decisions for safe navigation in dynamic environments.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Vehicle Type

-

Passenger car

-

Light commercial vehicle

-

Heavy commercial vehicle

Passenger is the dominating sub-segment in the Autonomous Vehicle ECU Market by vehicle type holding around 60-65 % of market share. The passenger car segment is much larger than commercial vehicles. Secondly, there's a growing consumer demand for comfort and safety features in passenger cars, pushing the adoption of ADAS and paving the way for autonomous technology.

REGIONAL ANALYSES

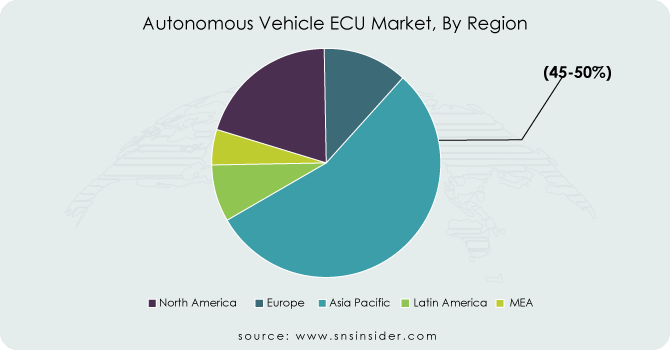

The Asia-Pacific is the dominating region in the Autonomous Vehicle ECU market holding around 45-50% of share. This region's rising automotive industry, creates a massive market for these specialized ECUs. The government support for autonomous vehicle development and the growing popularity of electric vehicles, which often come equipped with advanced driver-assistance systems, further fuel market growth in this region.

North America is the second highest region in this market with a 30-35% share, due to the presence of major automakers like Ford, GM, and Tesla who are heavily invested in autonomous technology.

Europe boasts the fastest growth with a 20-25% of share due to its stringent safety regulations. These regulations push car manufacturers to adopt advanced driver-assistance systems and autonomous technologies, requiring high-performance ECUs.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Continental AG (Germany), Robert Bosch (Germany), Infineon Technologies AG (Germany), Hitachi, Ltd. (Japan), Intel Corporation (U.S.), Nvidia Corporation (U.S.), and Renesas Electronics Corporation (Japan), ZF Friedrichshafen AG (Germany), NXP Semiconductors N.V. (Netherlands), Autoliv Inc. (Sweden) and other key players.

Continental AG (Germany)-Company Financial Analysis

RECENT DEVELOPMENT

-

In June 2020: NXP Semiconductors and Microsoft joined forces in a strategic partnership to create new automotive solutions. This collaboration indicates potential for advancements in the automotive industry.

-

In July 2020: Autoliv, a leading automotive safety company, has introduced the EyeQ5 Advanced Driver Assistance System (ADAS). This system is designed to enhance safety on the roads by providing features like lane departure warning and collision avoidance.

-

In August 2020: Continental AG has introduced the car security with their new Automotive Cyber Security Suite. This advanced system offers increased protection against cyberattacks, making vehicles safer on the road.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 39.25 Billion |

| Market Size by 2031 | US$ 63.98 Billion |

| CAGR | CAGR of 6.3% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Autonomous vehicles, Semi-autonomous vehicles) • By Vehicle Type (Passenger car, Light commercial vehicle, Heavy commercial vehicle) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Continental AG (Germany), Robert Bosch (Germany), Infineon Technologies AG (Germany), Hitachi, Ltd. (Japan), Intel Corporation (U.S.), Nvidia Corporation (U.S.), and Renesas Electronics Corporation (Japan), ZF Friedrichshafen AG (Germany), NXP Semiconductors N.V. (Netherlands), Autoliv Inc. (Sweden) |

| Key Drivers | • Advanced Sensor Tech Drives Growth in Autonomous Vehicle ECU Market • Automotive Industry Collaboration Drives Innovation in Autonomous Vehicle ECUs |

| Restraints | • The high cost of developing and integrating advanced sensors and powerful processors in ECUs can limit adoption. • Concerns regarding data security and potential hacking vulnerabilities in autonomous vehicle ECUs can deter market expansion. |