Electric Vehicle Charger Operations and Maintenance Services Market Report Scope:

Get More Information on Electric Vehicle Charger Operations and Maintenance Services Market - Request Sample Report

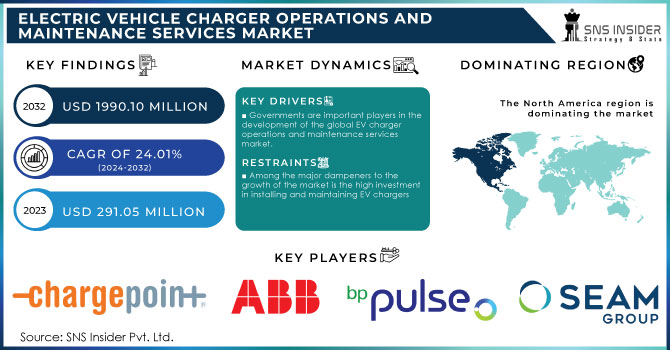

The Electric Vehicle Charger Operations and Maintenance Services Market was valued at USD 291.05 million in 2023, is expected to grow to around USD 1990.10 million by 2032 with a CAGR of 24.01% over the period of 2024-2032

Operations and maintenance services of electric vehicle (EV) chargers will be in great demand as the number of electric vehicles increases and strong infrastructure support is necessary for them. With the world ushering in sustainable transport solutions, increased installation of charging stations is necessary to support the rising electric vehicles. Installing the chargers alone, though, is never sufficient for efficient system running and maintenance to avoid system failure, charging downtime, and customer dissatisfaction. This requirement is rising demand for dedicated charger operations and maintenance services. Governments are increasingly stepping forward to expedite the green transition. As many as 55% of all countries have introduced tax incentives or subsidies towards accelerating the installation of EV chargers. Private sector players are also eager to establish a foothold in this promising segment by capitalizing upon opportunities in charging infrastructure, with development concerning ever more efficient, scalable, and reliable charging infrastructures. In parallel, the growth in charging technologies such as wireless charging, ultra-fast chargers, is pushing market growth further and creating greater opportunities for operations and maintenance service providers. Consequently, this makes the EV charger operations and maintenance services market a core enabler of the wider EV revolution and ensuring the reliability and safety of charging infrastructure for users of electric vehicles.

Technological advancements with both the battery and charging technologies are driving the adoption of electric vehicles, with that increasing demand for charger operations and maintenance services. Ultra-fast chargers can now charge vehicles in under 30 minutes and demand specialized maintenance capabilities to manage the complexities involved with high-power equipment; wireless charging is also emerging as a new technology, providing more convenient charging solutions. Such complex equipment needs to be constantly in an operative state in order to self-sustain itself; therefore, this needs further increase the requirement for service providers who can provide technical capabilities to sustain advanced infrastructure systems.

Electric Vehicle Charger Operations and Maintenance Services Market Drivers:

-

Governments are important players in the development of the global EV charger operations and maintenance services market.

As clean energy continues to gain pace everywhere around the globe, various governments are embracing some of the most ambitious electric vehicle adoption targets. For example, as it set a target of reducing at least 55% in CO2 emissions by 2030, one of the instruments put in place to achieve this includes the adoption of electric vehicles. Currently, most of the governments in the world have incentives in terms of tax breaks, grants, and subsidies for installing EV chargers. The incentives do not just encourage charging stations' installation but also create a demand for services that operate and maintain the infrastructures so that they can function smoothly. For instance, India has a Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme that includes subsidies to install public EV chargers. The measures are already driving private investment in the sector, and maintenance and operational services will be critical for such charging network success in the long run.

-

Electric vehicles are being sold worldwide in exponential numbers.

Sales of EVs, for instance, are projected to be over 11 million units in the year 2023 as compared to 6.6 million in 2022. The more the electric vehicles marketed and sold, the more the prospects of high demand for EV chargers. It is important to note that these chargers need a maintenance check regularly to function correctly, and this makes the operations and maintenance services very essential. Furthermore, with the projected rise in sales volume for EVs within the next decade, the increasing demand for reliable and efficient charging networks is most likely to make way for all service providers. For example, it has been forecasted that by 2030, electric vehicles alone will make up more than 30% of the total number of vehicles sold worldwide, thereby indicating high requirements for maintaining a well-refurbished infrastructure of EV charging.

Market Restraints:

-

Among the major dampeners to the growth of the market is the high investment in installing and maintaining EV chargers.

Installing high-speed as well as wireless chargers for electric vehicles requires significant investment in infrastructure and technology. For instance, a DC fast charger would cost anything from USD 50,000 to USD 100,000. As a matter of fact, that would be much more expensive than installing standard residential chargers. The cost is very high, causing this development to be totally unfeasible for small- and medium-sized enterprises (SMEs) that may find it difficult to justify the initial expenditure, not to mention the maintenance costs involved. Moreover, at times, the government incentives and public funding available are usually inadequate to meet all the expenses incurred, especially for underdeveloped regions. Regular costs for maintenance also present a barrier, as preventive measures, monitoring systems, and repair services all add up to what it takes in keeping EV chargers in good working order.

-

Limited Charging Infrastructure in Rural Areas:

Progress is observable in the urban areas whereas rural areas with developing countries face a minimal presence of charging infrastructures. The unavailability of charging stations in these areas hampers the take-off of electric vehicles, and hence the operations and maintenance services. For example, countries like India and Brazil, where a vast percentage of the population lives in rural areas, infrastructure hardly is under progress. In those regions, customers are afraid of losing easy access to charging services while opting for electric vehicles. In the absence of proper infrastructure, the market for EV charger operations and maintenance services would not expand any further than the urban centers.

Market Segmentation Analysis:

By Charger Type

Market growth for Electric Vehicle Charger Operations and Maintenance Services is driven primarily by the increasing adoption of electric vehicles (EVs) and, subsequently, their needs for efficient charging solutions. Some type-level diversity can be observed through analysis of market segments by charger type. Level 2 chargers are still very popular for their good balance of charging speed and cost. They can hold almost 60% of the whole market share since they are applied widely at homes and commercially. Up to 25%, the reason behind their popularity holds is that Level 1 chargers can only be installed at home with slow charging. In the meantime, Level 3 chargers or DC fast chargers are fast becoming preferred by both urban and highway segments accounting for about 15% in terms of market share because this permits EVs to be charged at a much quicker speed to allow travel over long distances.

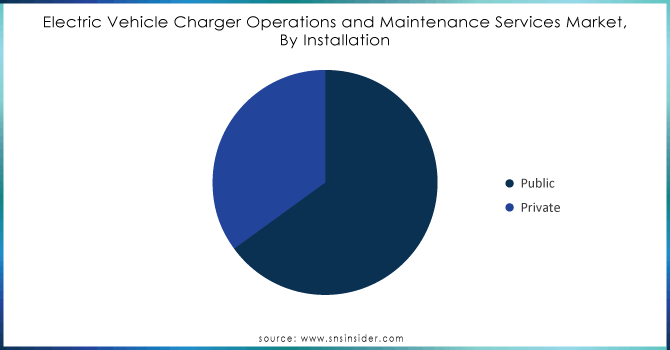

By Installation:

The market is further split into public and private chargers depending on the installation types. Public charging stations comprise a larger share, about 70 per cent due to the improved urban infrastructure supportive for higher acceptance of EVs. Private installations, mostly at private homes, account for 30 per cent of the market, but with incentives encouraging owners to set up their charging station at home. As the market for EVs grows, so will the operations and maintenance services for these charging systems. In other words, operations and maintenance will be part of what makes these systems reliable and efficient for public and private users.

Need any customization research on Electric Vehicle Charger Operations and Maintenance Services Market- Enquiry Now

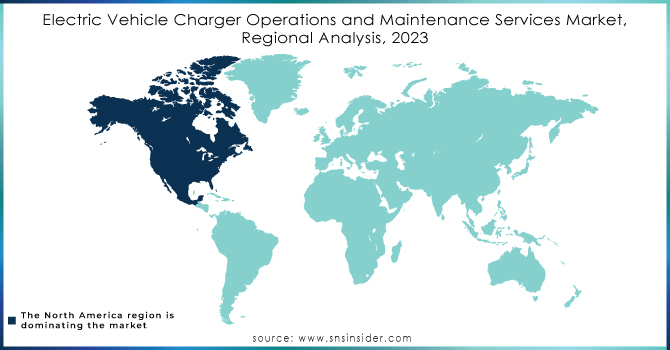

Market Regional Analysis:

The emerging market for Electric Vehicle (EV) Charger Operations and Maintenance (O&M) Services would be on high speed when global demand for electric vehicles speeds up, as 30 million electric vehicles will sell by 2030. North America is the leader in this transformation, heavily backed by fantastic government incentives and high network infrastructure. For instance, in the United States, EV sales have been on an upsurge due to incentives like tax credits worth up to USD 7,500 per vehicle as well as investments in charging stations. In 2023, electric vehicles sold increased around 70%, which naturally created a higher demand for reliable O&M services. Meanwhile, the champion for sustainable transport in Europe goes very strong there, pushing through stringent emissions regulations and an ambitious target for the adoption of electric vehicles. Europe aims at ensuring that by 2030, 55% of all new car sales will be electric. The region saw a rise of 25% in the sales of electric vehicles alone last year, making it a hub for innovation in charging technologies and service delivery. Asia-Pacific, especially China, is the leader because its policies are very aggressive in encouraging EV usage; so are the sales that would cross 20 million units by 2025 and have a good investment also in the charging network for allowing scope to be kept open for specialization in maintenance services for this infrastructure.

Although the Latin American and Middle Eastern markets are still developing, Latin America's EV market is forecasted to witness a compound annual growth rate of 15% between 2024 and 2032. As those regions start to establish infrastructure for EVs, O&M service demand will automatically increase because the global market value for EV charger O&M services is estimated to reach USD 8 Million by 2030. Beneath this rests the unique challenges and opportunities for each region-how best to adapt strategies to the localised dynamics of a market, so the charging stations stay running at maximum efficiency.

Key Players:

-

ChargerPoint, Inc.: (Level 2 Charging Stations, DC Fast Charging Solutions)

-

ABB: (Terra 54 DC Fast Charger, ABB Ability™ Energy Management Solutions)

-

bp pulse: (bp pulse Rapid Charging Network, Smart Charging Solutions)

-

EVA Global: (EVA Charging Network, Charging Station Management Software)

-

SEAM Group: (EV Charging Station Installation Services, Maintenance and Support Services for EV Chargers)

-

ChargerHelp: (ChargerHelp! Mobile App for EV Charger Support, On-site Maintenance Services for Charging Stations)

-

BTC Power: (BTC Dual Port EV Charger, BTC Charging Management Software)

-

eFaraday: (eFaraday EV Charging Solutions, Integrated Charging Management Platform)

-

Pearce Renewables: (EV Charging Infrastructure Solutions, O&M Services for Charging Stations)

-

Vital EV Solutions: (EV Charger Installation Services, Maintenance and Operations Support for Charging Networks)

-

Electrify America: (Electrify America Fast Charging Stations, Charging Network Management Services)

-

Greenlots: (Greenlots Charging Network, Open Charge Point Protocol (OCPP) Solutions)

-

ChargePoint Holdings, Inc.: (ChargePoint Home Flex, ChargePoint Commercial Charging Solutions)

-

Blink Charging: (Blink Level 2 Charging Stations, Blink DC Fast Charging Solutions)

-

SemaConnect: (SemaConnect Networked Charging Stations, Charging Management Software)

-

EVBox: (EVBox Elvi Charging Station, EVBox Software for Charge Point Management)

-

Wallbox: (Wallbox Pulsar Plus, Wallbox Supernova DC Fast Charger)

-

FLO: (FLO Home Charging Station, FLO Network for Public Charging)

-

IONITY: (IONITY High-Power Charging Stations, IONITY Network Management Services)

-

Shell Recharge: (Shell Recharge EV Charging Stations, Shell Recharge Network Management Solutions)

Recent Developments:

ABB: It recently launched a service program for the new year, which involves monitoring their charging stations 24/7 and preventive maintenance to reduce downtime for high-speed chargers.

ChargePoint has partnered with fleet operators in North America, thereby offering real-time maintenance solutions. Commercial downtime for EV chargers was reduced by 20%. For fleet operations, such as this, ensuring that all chargers are at a nearly optimal level will have an immense effect on business continuity.

Siemens AG has signed an agreement with the Indian government for the installation of more than 10,000 fast chargers by 2026, accompanied by its service package for maintenance of the infrastructure to ensure long term sustainability. The move is part of India's efforts towards pushing forward electric mobility as part of its environmental initiatives.

Shell Recharge has just expanded its portfolio of maintenance services as it entered the UK and Germany in the wireless charging solutions. Such a decision complements high demand for seamless charging systems in urban centers and strongly reinforces Shell's presence in the EV infrastructure market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 291.05 Million |

| Market Size by 2032 | USD 1990.10 Million |

| CAGR | CAGR of 24.01% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Charger Type :(Level 1, Level 2, Level 3) • By Installation: (Public, Private) • By Application: (Commercial, Residential) • By End-use: (Logistics, Retail, Universities, Commercial, Transport, Real Estate) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ChargerPoint, Inc., ABB, bp pulse, EVA Global, SEAM Group, BTC Power, ChargerHelp, Greenlots, Blink Charging, SemaConnect, EVBox, Wallbox, FLO, IONITY and others |

| Key Drivers | • Governments are important players in the development of the global EV charger operations and maintenance services market. |

| RESTRAINTS | • Among the major dampeners to the growth of the market is the high investment in installing and maintaining EV chargers. |