Beer Adjuncts Market Report Scope & Overview:

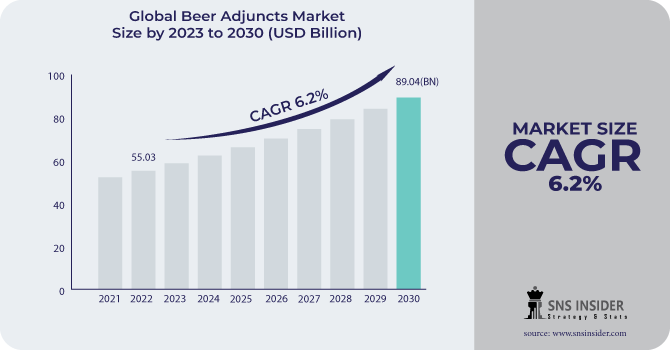

The Beer Adjuncts Market size was USD 55.03 billion in 2022 and is expected to Reach USD 89.04 billion by 2030 and grow at a CAGR of 6.2% over the forecast period of 2024-2031.

Beer's four primary components are malted barley, yeast, water, and hops. The purpose of adjuncts is to improve the qualities that the four basic ingredients added to beer. They can be infused like a huge tea bag in the tank or added whole at any stage of the brewing process, from the wort to fermentation to right before bottling. Some adjuncts increase the original quantity of sugar in the wort, while others change the fermentation process or give the beer a distinctive flavor or aroma.

Get More Iformation on Beer Adjuncts Market - Request Free Sample Report

Based on Type the market is segmented into unmalted grains, cassava, sugar, potatoes, and other products. The segment of unmalted grains held the maximum market share in the beer adjuncts market. The unmalted rice segment revenue registered at $11.5 billion in 2022.

Beer is typically made from unmalted grains, especially corn, in Europe and North America. Additionally, unmalted grains help to increase the levels of bioactive compounds and give the beer unique organoleptic characteristics. Due to its widespread availability at a lower price, it helps brewers reduce their entire production costs.

MARKET DYNAMICS

KEY DRIVERS

-

Increasing breweries by expanding the production of beer

Adjunct demand is mostly driven by microbrewers and craft brewers who are broadening their product variety to include new flavors. The number of breweries in the global beer market is increasing, particularly in developing countries. This is attributed to rising consumer disposable income, increased popularity of craft beers, and increased raw material availability. The growing number of breweries is raising demand for beer adjuncts, which are used to improve the flavor, fragrance, and texture of beer.

RESTRAIN

-

High cost of beer production

-

Problems of technical issues and discrepancies in quality

Production of beer adjuncts can be a challenging operation since managing the processing of adjuncts can lead to variable quality. Additionally, the flavor and aroma of beer may occasionally be impacted by the inclusion of adjuncts, which can be challenging for brewers to overcome. Cost reduction is a crucial factor when employing a variety of adjuncts in the production of beer. Brewers can replace expensive malt with less expensive local grains like corn, rice, and sorghum. Technical challenges might arise when brewing with adjuncts made of unmalted grains and cereals, especially at higher concentrations.

OPPORTUNITY

-

Increase investment in innovating new flavors

In order to guarantee a steady supply of high-quality raw materials, businesses are investing in an integrated business model, which should make it easier for them to work with those commodities. The major actors on the world stage make the necessary investments to boost the production of raw resources. Due to the industry's contribution to the GDP of the country, the creation of jobs, the creation of value, and the development of income for local farmers, the governments of numerous nations are formulating a national policy to grow the brewery sector. As a result, the government seeks investment from all pertinent parties to develop a comprehensive policy for the industry.

CHALLENGES

-

Stringent regulations on ingredients used in beer

Some governments have established strict limitations on the use of beer additives. This is due to concerns about the product's safety and quality. The European Union, for example, has severe limits on the use of sugar in beer, whereas the United States has prohibitions on the use of corn syrup in beer. These limitations may make it harder for brewers to use adjuncts, stifling industry expansion.

IMPACT OF RUSSIA UKRAINE WAR

Russia and Ukraine together contribute to 18% of the world's barley production and 30% of its exports. Trade flows and thus the available supply of barley around the world have already been negatively impacted by the war. Production of malting barley, in particular, could be further decreased by competition from other crops with better gross margins. In addition, there are logistical problems and greater energy expenses, which have an impact on the manufacturing and cost of beer. As of mid-March 2022, the malting premium in France has even briefly become negative and is around USD 14/mt. Also, the Beer's quality is influenced by the barley's quality.

Some beers, including witbiers, hefeweizens, and many Belgian varieties, also contain wheat as an ingredient. Ukraine is the fifth-largest exporter of wheat in the world, according to the Food and Agriculture Organization of the UN. The full impacts indicate pressures on the brewing sector that will drive up the price of beer.

IMPACT OF ONGOING RECESSION

Russia produced 13% of the world's barley while Ukraine will produce 5% in 2022. The war has led to disruption in supply in China, Europe, and other countries. In 2022 China has become the largest importer of barley from Ukraine, accounting for nearly 70%. Western European malting barley costs are about 50% higher than they were a year ago. The expense of barley is just one component of the rising costs of beer. Therefore, the price of beer adjuncts had been indirectly impacted by the scarcity of barley, wheat, and other ingredients.

MARKET SEGMENTATION

by Type

-

Unmalted Grain

-

Unmalted Rice

-

Unmalted Corn

-

Other

-

-

Potatoes

-

Sugar

-

Cassava

-

Other

by Form

-

Liquid

-

Dry

.png)

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS

Asia Pacific is dominating the market in terms of market share. The market is expanding at a CAGR of 7.2% throughout the forecasting period. The Asian region is the largest supplier of rice, thus Asian manufacturers are ready to invest in producing rice-based beers, which further paves the way for the expansion of the worldwide market for beer adjuncts. The significant rise in beer consumption around the world will make it difficult for manufacturers to find raw materials, particularly barley.

North America is now recognized as one of the world's major beer consumers, owing to a strong economy, rising disposal income, and customer affiliations. Corn grits are largely produced in the United States, and as a result, they are the most widely used adjunct in mass-market beer, owing to their minimal extract residue, taste, color, and smoothness-enhancing capabilities.

The European beer adjuncts market is growing at a CAGR of 4.5% progressively. Countries like France, Poland, and Spain are the larger markets for beer adjuncts furthermore, regional brewers introducing new products using locally grown raw materials push the industry growth.

Developing countries in Latin America, the Middle East and Africa are adopting diverse adjuncts such as buckwheat malt and sorghum for brewing beers, which has raised global demand for the commodity.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Anheuser-Busch InBev SA/NV, China Resources Beer Company, Heineken N.V., Carlsberg Breweries A/S, Molson Coors Brewing Company, Tsingtao Brewery Co. Ltd, Kirin Holdings Company Ltd, Constellation Brands, Asahi Group Holdings Ltd, Cervejaria Petropolis S/A, and other key players are mentioned in the final report.

China Resources Beer Company-Company Financial Analysis

RECENT DEVELOPMENTS

In 2023 AB InBev invested €31 million in tech, including for the brewing of beers. These investments include the expansion of no- and low-alcohol brewing capabilities.

In 2023 Carlsberg completed the acquisition of Waterloo Brewing in Canada. Growing our company in desirable minor markets like Canada is one of our SAIL'27 strategy's top targets. Our possibilities for growth in the Canadian market have greatly improved as a result of the acquisition of Waterloo Brewing.

In 2022 Molson Coors invested $60 million in its Canadian breweries' capacity to produce a variety of malt and spirits-based beverages

| Report Attributes | Details |

| Market Size in 2022 | US$ 55.03 Billion |

| Market Size by 2030 | US$ 89.04 Billion |

| CAGR | CAGR of 6.2 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Unmalted Grain, Potatoes, sugar, cassava, and other) • By form (Liquid, Dry) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Anheuser-Busch InBev SA/NV, China Resources Beer Company, Heineken N.V., Carlsberg Breweries A/S, Molson Coors Brewing Company, Tsingtao Brewery Co. Ltd, Kirin Holdings Company Ltd, Constellation Brands, Asahi Group Holdings Ltd, Cervejaria Petropolis S/A |

| Key Drivers | • Increasing breweries by expanding the production of beer |

| Market Challenges | • Stringent regulations on ingredients used in beer |