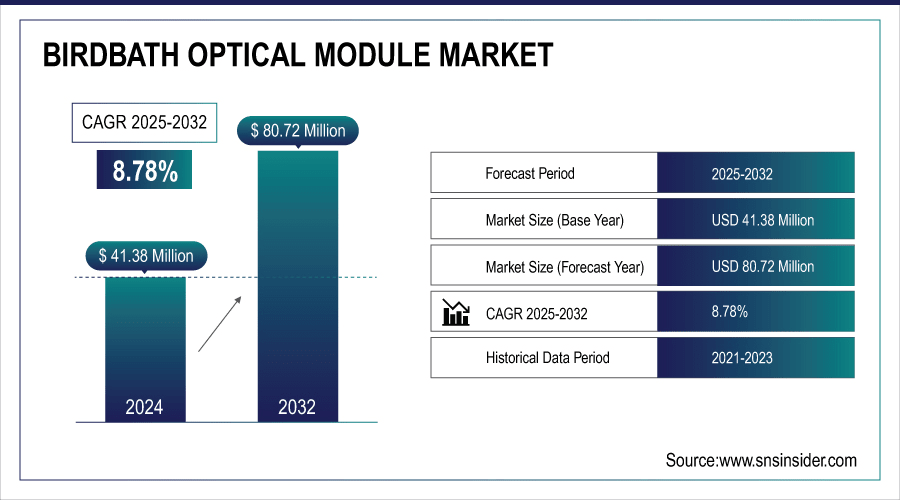

BirdBath Optical Module Market Size & Growth:

The BirdBath Optical Module Market Size was valued at USD 41.38 million in 2024 and is expected to reach USD 80.72 million by 2032 and grow at a CAGR of 8.78 % over the forecast period 2025-2032.

To Get More Information On BirdBath Optical Module Market - Request Free Sample Report

The global birdbath optical module market growth is driven by the increase of BirdBath optics in providing immersive user interfaces across a wide range of domains such as consumer electronics, automotive HUDs, and remote industrial operations. Ongoing advancement of lightweight, power-efficient construction and scalable production is driving uptake.

According to research, Recent advancements have reduced BirdBath module weight by up to 20% and improved power efficiency by 15%, facilitating broader adoption.

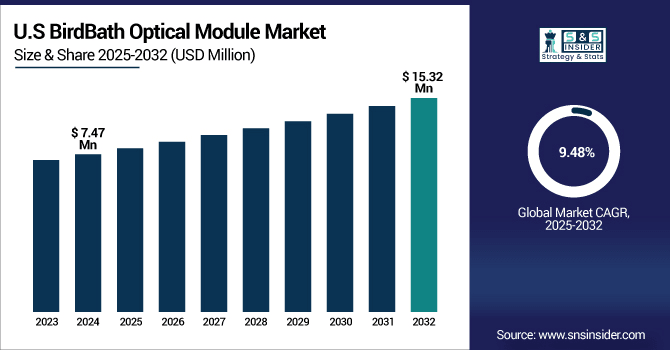

The U.S. BirdBath Optical Module Market size was USD 7.47 million in 2024 and is expected to reach USD 15.32 million by 2032, growing at a CAGR of 9.48 % over the forecast period of 2025–2032.

The US market growth is attributed to rising demand for AR/VR devices in consumer electronics, defense, and enterprise industries. Moreover, mounting investments provided by U.S.-headquartered tech giants in the mixed reality space and growing consumer preference towards augmented experiences are augmenting the market growth.

BirdBath Optical Module Market Dynamics

Key Drivers:

-

Advanced coatings and lens innovations enhance brightness, contrast, and visual comfort across diverse environments

Optical coatings and lens design are advancing for enhanced brightness, contrast, and thermal stability. These enhancements will render the BirdBath modules more suitable for different environmental conditions and higher resolution display panels. Improved visual performance minimizes eye fatigue and enhances visual comfort, promoting extended use of AR/VR products. With increasingly demanding consumer and industrial applications, BirdBath optics with improved lens designs as well as anti-reflective coatings are being preferred. This performance advantage is driving their demand across industries such as gaming, education, and telemedicine, which rely on high-quality images presented in a comfort-first manner for better user experience and maintaining user loyalty.

According to research, recent advancements in optical coatings have achieved up to a 30% boost in brightness and a 25% enhancement in contrast ratios, greatly improving image clarity in BirdBath modules.

Restrain:

-

Limited FOV and edge distortion issues affect immersive experience in high-performance applications

Technical challenges such as field-of-view (FOV) and image distortion continue to limit their widespread adoption. Although the BirdBath optics are beneficial for their design and cost because of the spherical-to-planar optics, thicker optics that bring obtainable FOVs without visual degradation must still be solved. Peripheral image may be confused and lead to edge distortion, which affects the users' sense of immersion. These deficiencies are particularly problematic in enterprise and simulation training scenes where spatial awareness and visual accuracy are paramount. As end user requirements continue to increase and use cases favor even better optical performances, solving these trade-offs once for all is crucial for manufacturers looking at high-end professional or industrial applications.

Opportunities:

-

Rising integration in AI-powered consumer wearables fuels mass-market adoption and user engagement

Growing demand for AI-enabled consumer products and smart interfaces stimulates integration of BirdBath optics in future AR wearables. AI concept glasses and smart personal assistant equipment need the visually-friendly optical module for the real-time overlay of information and interaction. Low power consumption and high light efficiency of BirdBath optics make it possible to integrate these small consumer applications. As global brands battle to provide increasingly context-aware visual experiences and tighter digital/physical crossover, BirdBath modules will help to fuel deeper user engagement enabling new commercial opportunities for the consumer electronics market.

According to research, Devices featuring BirdBath modules report a 15–20% increase in user engagement time due to enhanced visual experience and real-time AI interaction.

Challenges:

-

Frequent hardware upgrades and short product cycles increase development costs and sales volatility

Short product life cycles and quick design turnovers make it difficult to justify long term investment in BirdBath optics. With AR/VR devices changing rapidly, optical modules need to be upgraded or replaced often to fit new device specs as well user requirements. This repetitive iteration process results in higher R&D cost and inventory risk for the manufacturer. Then there's the potential for people to hold off and wait for a new model of something to come out, which could also impact sales consistency. Balance innovation and stability to remain profitable for companies, and the industry needs to continue producing modular and upgradable optics for OEMs to keep up with the fast innovation time lines.

BirdBath Optical Module Market Segment Analysis:

By Type

FOV: Less Than 45 Degrees segment dominated the BirdBath Optical Module Market with the highest revenue share of about 52.01% in 2024. This dominance is attributed to the segment’s compatibility with AR/VR compact devices, for which a narrow field of view is desired for reduced power consumption and simplified lens design. These systems are perfect for enterprise and consumer applications where size and focus are more important than full hemisphere coverage. While companies like Kopin Corporation have been pushing this segment forward with R&D into microdisplay optics tailored to small FOV use-cases, for applications like industrial wearables or training simulators – where being super accurate is crucial.

FOV: Above 50 Degrees segment is expected to grow at the fastest CAGR of about 10.14% from 2025–2032. Growth is fueled by demand for wide-view immersive experiences, such as those found in gaming, entertainment and military simulation. These modules have wider environmental knowledge and more realistic than ever, providing the important supports to next-generation spatial computing devices. Birdbath optical module market companies like Goertek Inc., are well-invested in wide-FOV optics to drive a next-generation of AR/VR head-mounted displays. The segment’s evolution is also buoyed by progress in waveguide and freeform optics, which enable broader views without added device bulk.

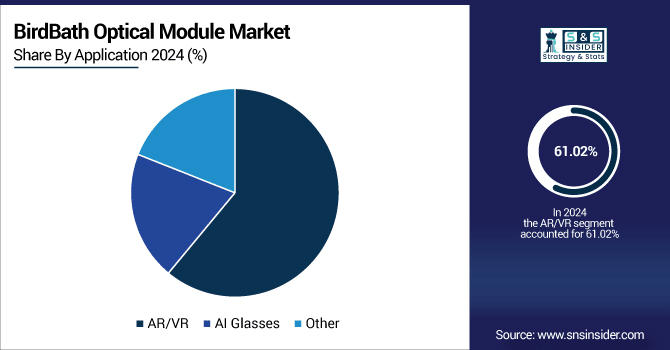

By Application

AR/VR segment dominated the highest BirdBath Optical Module Market share of about 61.02% in 2024. This is due to the increasing AR/VR market in consumer as well as enterprise, such as gaming, virtual training, healthcare, and remote collaboration. BirdBath optics enables much‐needed trade‐off between weight and image quality, offering compact and light optics, which are compatible with AR/VR headsets. Sony Group Corporation has played a key role in shaping this space by embedding our BirdBath modules within cutting-edge displays for high-end mixed reality headsets which are establishing new benchmarks for realistic, life-like engagement.

AI Glasses segment is expected to grow at the fastest CAGR of about 10.09% from 2025–2032. due to the growing use of smart wearable devices with features like data overlays in real time, translation, navigation, productivity support etc. Thin and power-efficient, BirdBath’s optical modules are suitable for always-on AI-powered smart glasses. Fields of view and image quality are two other areas that Luxshare Precision Industry type firms are investing heavily into R&D to implement in a pair of everyday smart glasses, bringing in a new era of AI-augmented vision and lightweight tech-enhanced eyewear for consumers and professionals.

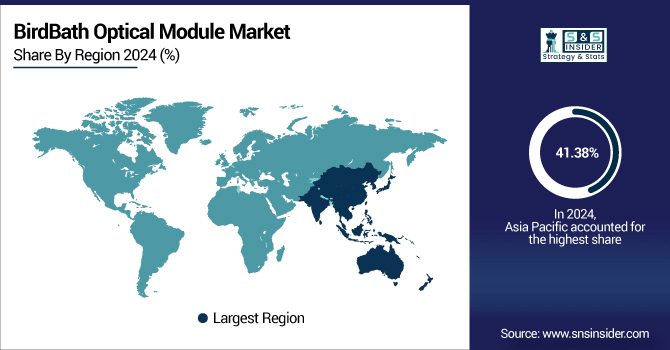

BirdBath Optical Module Market Regional Insights:

Asia Pacific dominated the BirdBath Optical Module Market with the highest revenue share of about 41.38% in 2024. This is primarily because the region possesses the well-established network of electronics manufacturing hub in countries such as Japan, China, and South Korea, which is home to the top OEMs and optical component suppliers. Increased consumer appetite for AR/VR devices, early adoption of smart technologies, and significant investment in display innovation have also played in favour of the region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China is the top country in the Asia Pacific BirdBath Optical Module Market, due to its fast-advancing technology, manufacturing on a low-cost basis, and ever-expanding consumer interest in AR/VR devices. With great efforts made toward optics R&D and partnerships with global tech companies, its lead in the market can only strengthen.

North America is expected to grow at the fastest CAGR of about 10.15% from 2025 to 2032. This expansion is driven by the growing investment in immersive tech in sectors from a defense, health, education and entertainment. Regional expansion is supported by the proliferation of large technology companies such as Meta and Microsoft, in addition to government and enterprise adoption of AR/VR solutions. In addition to the innovation-friendly environment and high spending power in the region, there is also growing demand for advanced optical module integration the region.

The U.S. is leading the North American BirdBath Optical Module Market, fueled by superior research infrastructure, huge investment in augmented and virtual reality, and a strong group of consumers interested in already researched Incremental Wearable Technology that enables rapid growth and development in the market.

The BirdBath Optical Module Market in Europe is expanding at a constant growth rate as the use of AR/VR technology in healthcare, manufacturing and automotive sectors increasing. Leading countries such as the Germany, France and the UK are offering research and development to the promotion of optical advances. Rising demand for digital and smart industry solutions is also leading to greater levels of cooperation between technology providers and end-users throughout the region.

Germany leads the BirdBath Optical Module Market in Europe due to having an excellent manufacturing base, a strong optics industry, and early adoption of AR/VR. Its emphasis on Industry 4.0 and the willingness to invest in immersive technologies has led to sustained demand across various sectors, most notably automotive and industrial.

In Middle East & Africa region, UAE leads the overall BirdBath Optical Module Market owing to high investment to developing smart infrastructure, AR/VR in healthcare and education related technologies. In Latin America, Brazil heads the list, also because of its growing tech, consumer electronics and govtech sectors, as well as the encouragement of transformations and innovation by the government.

BirdBath Optical Module Companies are:

Major Key Players in BirdBath Optical Module Market are SeeYA Technology, Beijing NED, Huynew, Ningbo Hongyi Photoelectric Technology, Lumentum, Intel, Hamamatsu Photonics, Jenoptik, Thorlabs, Coherent

Recent Development:

-

In March 2025, Huynew launched the BB41 module, a cost-effective BirdBath optical solution featuring a 0.49-inch Micro-OLED display. It offers a ≥40° field of view, diopter adjustments from -6D to 0D, and weighs only 8g per monocular module.

-

In December 2023, SeeYA launched the SY049WDG09 optical module featuring a 0.49-inch Micro-OLED display with a 1920x1080 resolution and a 43° field of view. The module supports diopter adjustments from 0D to -5D and boasts a 19mm eye relief.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 41.38 Million |

| Market Size by 2032 | USD 80.72 Million |

| CAGR | CAGR of 8.78% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (FOV: Less Than 45 Degrees, FOV: 45-50 Degrees, FOV: Above 50 Degrees) • By Application (AR/VR, AI Glasses, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | SeeYA Technology, Beijing NED, Huynew, Ningbo Hongyi Photoelectric Technology, Lumentum, Intel, Hamamatsu Photonics, Jenoptik, Thorlabs, Coherent. |