Bluetooth Smart and Smart Ready Market Size & Trends:

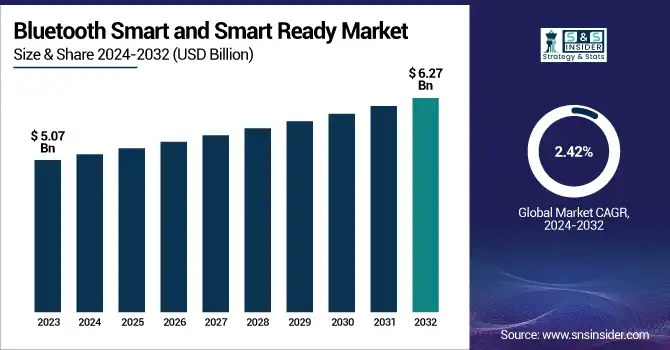

The Bluetooth Smart and Smart Ready Market was valued at USD 5.07 billion in 2023 and is expected to reach USD 6.27 billion by 2032, growing at a CAGR of 2.42% over the forecast period 2024-2032.

To Get more information on Bluetooth Smart and Smart Ready Market - Request Free Sample Report

The market is rapidly moving toward the adoption of technologies such as Bluetooth Smart and Smart Ready, owing to the increasing demand for low-power wide-area networks (LPWAN) used in consumer electronics, healthcare, and Internet of Things (IoT) devices. At least devices now provide better average battery life for targeted types (like wearables and smart home solutions). Upgrades of protocols such as Bluetooth 5.0, 5.2, etc.; are being widely adapted for enhanced data transfer along with power efficiency. Lower latency and longer-range capabilities only help to enable seamless connectivity across different use cases. The U.S. Bluetooth Smart and Smart Ready market grew rapidly on the back of the growth of smart home devices and wearables. In the smart home sector alone Bluetooth device shipments exceeded over 13% of all Bluetooth device shipments, which equals around 815 million Bluetooth-enabled products around the world. This trend was bolstered by the growth of wireless connectivity in consumer electronics and the wider Internet of Things (IoT) ecosystem.

The U.S. Bluetooth Smart and Smart Ready Market is estimated to be USD 1.36 Billion in 2023 and is projected to grow at a CAGR of 2.25%. Facilitated by increasing smartphone penetration, consumer demands seamless device connection, and the adoption of devices such as wireless audio devices and fitness trackers are expected to drive the growth of the U.S. Bluetooth Smart and Smart Ready market. Further accelerating the market is the promise of richer user experiences, better energy efficiency, and mainstream adoption into consumer and enterprise ecosystems.

Bluetooth Smart and Smart Ready Market Dynamics

Key Drivers:

-

Rising Demand for Low Energy Wireless Connectivity Drives Bluetooth Smart and Smart Ready Market Expansion

The increasing need for low-energy and efficient wireless interconnection propagation areas consists of the driver for the growth of the Bluetooth Smart and SMART READY market over the forecast period. The rise of IoT devices and the expansion of smartphone, tablet, and smart wearables usage greatly hastens the adoption of Bluetooth technologies. Bluetooth Smart Ready is already being employed in various automotive applications for infotainment, diagnostics, and hands-free communication aspects. Furthermore, as smart homes and industrial automation expand rapidly and more mobile, infield and modern automation systems proliferate that are increasingly dependent on reliable, interoperable wireless standards, market growth continues.

Restrain:

-

Compatibility Challenges and Security Concerns Restrain Bluetooth Smart and Smart Ready Market Adoption and Integration

Interoperability or fragmentation issues in Bluetooth versions and devices are one of the major restraints for the growth of Bluetooth smart and smart ready especially in the early periods of its implementation. The older tech like Bluetooth 5.0 shows remarkable upgrades yet, most legacy devices lack support for it, which leads to compatibility issues. This may restrict uninterrupted interconnectivity, especially in corporate and industrial settings where legacy and emerging frameworks work hand in hand. Moreover, privacy and data security are also issues, particularly in healthcare and wearable applications where very sensitive personal data is transmitted wirelessly. Although Bluetooth communication provides encryption protocols that can help protected devices with their communication, should Bluetooth not be updated regularly or implemented correctly, it could contain vulnerabilities.

Opportunity:

-

Bluetooth Advances Unlock Growth in Healthcare Smart Retail Industry 4.0 and Cross-Platform Innovation Potential

Bluetooth 5.0 and above has the potential to grow through emerging sectors like remote healthcare monitoring, smart retail solutions, and asset tracking. With its improved range, velocity, and broadcasting skills, it is a perfect suit for technology wearables and medical gadgets. Additionally, growing spending toward integrated smart infrastructure, along with the growing emergence of Industry 4.0, is likely to create significant demand for industrial measurement and diagnostics tools equipped with Bluetooth capabilities. With Bluetooth Low Energy (BLE) creating waves in the industry, there is plenty of room for manufacturers to truly innovate and provide unique value by focusing on cross-platform capabilities, security, AI, and edge computing.

Challenges:

-

Bluetooth Faces Performance and Efficiency Challenges in Complex Environments Requiring High Precision and Low Latency

The key obstacle is delivering consistent performance in assorted environments. Many different factors such as physical barriers, interference from other wireless technologies (like Wi-Fi or Zigbee), and different ranges may affect the reliability of Bluetooth connections. However, in high precision, low latency applications like those in industrial diagnostics or healthcare monitoring this variability impedes adoption. Other Limitations While power efficiency remains a key consideration in supporting high data rates and longer-range transmission while maintaining compactness, this still poses a technical challenge to developers. Bluetooth has come a long way and will continue with constant R&D and standardization, yet we still have challenges ahead that need to be overcome for Bluetooth to continue its growth in the market.

Bluetooth Smart and Smart Ready Market Segment Analysis

By Technology

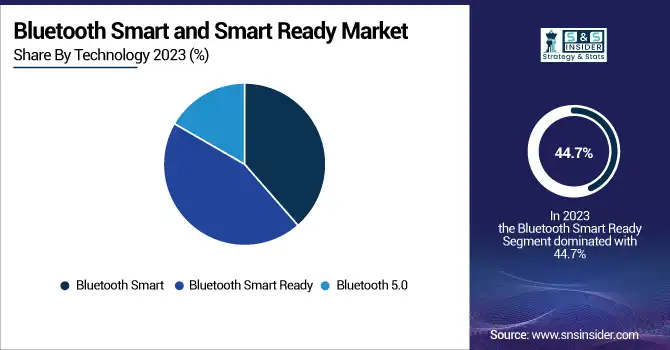

Bluetooth Smart Ready accounted for the largest share of the global market in 2023, at 44.7%, owing to backward compatibility with traditional Bluetooth and BLE devices. The widespread adoption of automotive infotainment systems, consumer electronics, and smart home applications was instrumental in cementing its dominant market position. This functionality of the technology to promote different kinds of devices made it the ideal solution for manufacturers who had their eyes set on future flexibility and expanding backward compatibility.

Between 2024 and 2032, Bluetooth 5.0 is anticipated to register the highest CAGR, owing to its better capabilities, including wide range, high-speed data transfer, and enhanced broadcasting capacity. This enables applications that ultimately feature wearable electronics, healthcare monitoring, and industrial IoT. Bluetooth 5.0 is primed to usher in the next developmental phase of innovation and connectivity across industries driven by increasing demand for high-performance low-power wireless solutions.

By Application

The automotive segment accounted for 21. 3% of the Bluetooth Smart and Smart Ready market in 2023. The primary reason behind this monopoly was the growing demand for Bluetooth-enabled hands-free calling, audio streaming, vehicle diagnostics, and advanced infotainment systems inside of vehicles. Bluetooth Smart Ready technology (Bluetooth classic or low energy) has emerged as one of the key enablers for these transformations since automakers continue to enhance in-vehicle connectivity.

The fastest CAGR from 2024 to 2032 is expected to be recorded for wearable electronics during this period due to rising consumer demand for smartwatches, fitness trackers, and health monitoring devices. Low energy consumption, higher data rates, and longer range make Bluetooth 5.0 the ideal candidate for wearable applications that must maintain constant communication without draining thousands of milliamperes. The health and fitness tech trend is expanding, coupled with more new sensor technologies into miniaturized sensors. Bluetooth-enabled wearables are indispensable for the next stage of market growth.

Bluetooth Smart and Smart Ready Market Regional Analysis

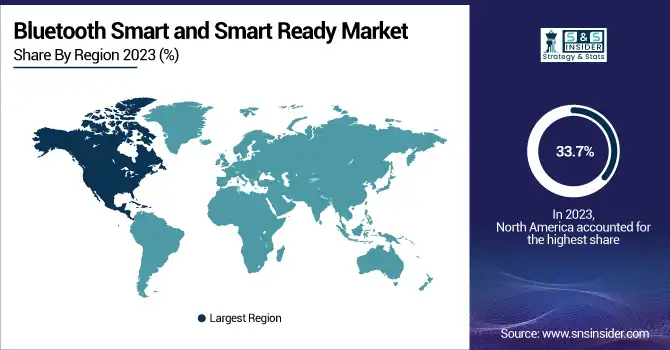

The largest share of the Bluetooth Smart and Smart Ready was held by North America in 2023, capturing 33.7% of the global revenue. This dominance is largely due to the early adoption of advanced wireless technologies in the region along with high demand from end-use industries, such as automotive, healthcare, and consumer electronics. Market growth is also driven by the penetration of market leaders such as Apple, Tesla, and General Motors who actively implement Bluetooth solutions in their products. Bluetooth connectivity is used everywhere, for example, Apple AirPods AirTags, and many other accessories depend on Bluetooth, and Tesla cars use Bluetooth for keyless entry, infotainment, and smartphone integration. Also used Bluetooth-enabled medical devices that are used in the healthcare industry across the U.S. are gaining popularity amongst people for patient monitoring and diagnostics.

The fastest CAGR from 2025 to 2032 is anticipated to be seen in the Asia Pacific, due to the rapid development of urbanization as well as the electronic manufacturing industry together with the increasing use of smartphones. China, Japan, South Korea, and India have seen a rising demand for Bluetooth-enabled wearables, smart home technologies, and industrial IoT applications. For instance, startup companies in the subcontinent are working on diagnostic equipment linked to a smartphone via Bluetooth, while Xiaomi and Samsung are pouring money and talent into Bluetooth-driven wearables. With a large Indian manufacturing base supported by a rapidly growing digital infrastructure, the region can be considered a key growth engine for the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Bluetooth Smart and Smart Ready Market are:

-

Apple Inc. (Apple Watch)

-

Samsung Electronics Co., Ltd. (Galaxy Buds)

-

Sony Corporation (Sony WH-1000XM5)

-

Microsoft Corporation (Surface Pen)

-

Intel Corporation (Intel Wireless-AC 9560)

-

Qualcomm Technologies, Inc. (Snapdragon Bluetooth SoC)

-

Nordic Semiconductor (nRF52840 SoC)

-

Texas Instruments Incorporated (CC2640R2F Bluetooth MCU)

-

Broadcom Inc. (BCM4343W Bluetooth Combo Chip)

-

STMicroelectronics (BlueNRG-M2 module)

-

Fitbit Inc. (Fitbit Charge 5)

-

Garmin Ltd. (Garmin Forerunner 255)

-

Huawei Technologies Co., Ltd. (Huawei Band 7)

-

Xiaomi Corporation (Mi Smart Band 8)

-

LG Electronics Inc. (LG Tone Free Earbuds)

Recent Development

-

In January 2024, Sony India launched the Float Run WI-OE610, no-pressure wireless sports headphones designed for runners with an off-ear design for comfort and safety.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.07 Billion |

| Market Size by 2032 | USD 6.27 Billion |

| CAGR | CAGR of 2.42% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Bluetooth Smart, Bluetooth Smart Ready, Bluetooth 5.0) • By Application (Automotive, Building & Retail, Wearable Electronics, Healthcare, Accessories, Industrial Measurement and Diagnostics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apple Inc., Samsung Electronics Co., Ltd., Sony Corporation, Microsoft Corporation, Intel Corporation, Qualcomm Technologies, Inc., Nordic Semiconductor, Texas Instruments Incorporated, Broadcom Inc., STMicroelectronics, Fitbit Inc., Garmin Ltd., Huawei Technologies Co., Ltd., Xiaomi Corporation, LG Electronics Inc. |