Smart Retail Market Size & Growth Trends:

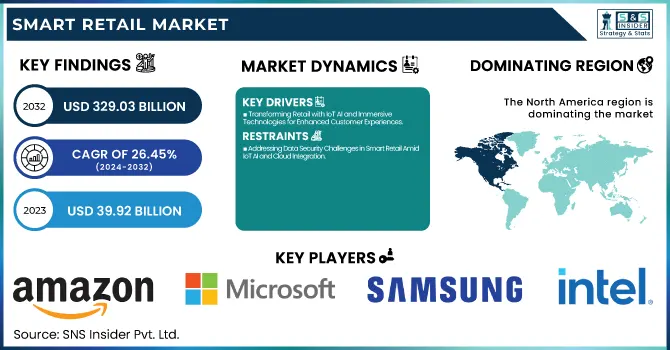

The Smart Retail Market Size was valued at USD 39.92 billion in 2023 and is expected to reach USD 329.03 billion by 2032, growing at a CAGR of 26.45% over the forecast period 2024-2032. The landscape of the Smart Retail market is changing quickly, whereby adoption and deployment of AI, IoT, and data analytics solutions to improve customer experience has become prevalent recently. Retailers are using these technologies to achieve better operational efficiency while processing a larger number of transactions in a smaller amount of time, tracking inventory, and tailoring their marketing efforts. This includes increased infrastructure and technology such as smart shelves, digital signage, and automated systems, making for dwindling store capabilities. These innovations enhance retailer efficiency by minimizing costs, streamlining staff productivity, and increasing customer interaction. Since then, they began adopting smart solutions to remain competitive in the competitive retail space.

To Get more information on Smart Retail Market - Request Free Sample Report

The Smart Retail market in the U.S. accounted for USD 9.33 billion in 2023 and is anticipated to extend a 26.2% CAGR over the forecasted years of 2024 to 2032. This growth was driven by the adoption of AI, IoT-enabled devices, and data analytics solutions. As such, improved customer experiences, automated checkout infrastructure, and intelligent shelves are pivotal drivers for reshaping retail functionality in this region.

Smart Retail Market Dynamics

Key Drivers:

-

Transforming Retail with IoT AI and Immersive Technologies for Enhanced Customer Experiences

The key drivers for this market expansion are the adoption of Internet of Things (IoT) and Artificial Intelligence (AI) technologies enabling retailers to improve the customer experience with personalized marketing, automated inventory management, and smart checkout systems. Petermans notes that demand for cashless, contactless, and digital payment solutions was already on the rise globally, but this trend has further accelerated the uptake of smart retail solutions, particularly after the onset of the pandemic. Meanwhile, in-store experiences are being enhanced through augmented reality (AR) and virtual reality (VR) to visualize products interactively. Also, with increased adoption of omnichannel retail strategies along with digital signage to enhance customer engagement driving the market growth.

Restrain:

-

Addressing Data Security Challenges in Smart Retail Amid IoT AI and Cloud Integration

One of the big challenges is the data security and privacy threats that arise due to smart retail solutions. With the growing adoption of IoT devices, AI-driven systems, and cloud platforms, retailers are generating huge volumes of customer data. This data needs to be stored, processed, and protected from cyber threats securely as well. Any misuse or breach of such data can have huge repercussions on consumer trust and brand reputation. Moreover, smart retail technology integration usually entails heavy changes to the existing IT architecture and can also be a technical hurdle to implementation.

Opportunity:

-

Unlocking Growth in Smart Retail with Data Analytics Automation and Emerging Market Expansion

Growth opportunities in the smart retail market are driven by the increasing adoption of data-driven insights for improved decision-making. Big data analytics is used by retailers to predict customer behavior, optimize inventory, and improve operational efficiency. Furthermore, the rising adoption of robotics and automation in warehouses and retail stores will provide a significant growth opportunity. Asia-Pacific and Latin America will also be potential factors for demand owing to increased urbanization and digital transformation in the retail sector. Since this market is constantly developing, retailers that invest in smart shelves, electronic price labels, and facial recognition for personalized shopping experiences will be perfect to take advantage of this growth market.

Challenges:

-

Overcoming Skill Gaps and Integration Challenges for Seamless Smart Retail Technology Implementation

The key challenge is the availability of skilled human resources for managing and working with these technologies which require a new set of skills to be learned and developed, especially for AI-machine learning and automation in retail environments. The need for professional help in data analysis, system integration, and cybersecurity makes retailers dependent on people with such skills, as without them there will be a disturbance in the seamless functioning of the system. Additionally, the lack of interoperability between different smart retail solutions could lead to compatibility challenges and hinder retailers from unifying operations across multiple platforms. Outfit devices, software, and retail systems will need to connect, hands-free solutions are an ongoing investment that needs to be planned almost since implementing smart devices. Solving these problems is the key to realizing truly smart retail innovations for businesses.

Smart Retail Market Segment Analysis

By Solution

The hardware segment accounted for the largest share of 63.5% in the smart retail market in 2023 with the increasing implementation of smart devices like smart shelves, electronic shelf labels, POS systems, and digital signage. This hardware is essential for ensuring smooth customer interactions, better store automation, and efficient inventory management. Growing traction of Internet of Things (IoT)-powered devices and systems for a wide range of applications, along with advanced sensor-based systems, played an instrumental role in the improvement of hardware market position.

From 2024 to 2032, the software segment is anticipated to experience the highest CAGR. This growth is propelled by the increasing popularity of AI-powered analytics, cloud-based solutions, and customer relationship management (CRM) tools. With the growing adoption of data analytics and machine learning solutions used in customer engagement, marketing personalization, and decision-making, retailers are investing more in software to drive market growth.

By Application

The visual marketing segment accounted for the largest share in 2023, holding 29.7% of the smart retail market. The market has been growing due to the growing demand for digital signage, interactive displays, and video walls that promote customer engagement, and improve the in-store experience. By implementing marketing tools, retailers can engage consumers with more dynamic content, customized offers, and targeted ads leading to greater sales and customer retention.

Smart payment system segment is expected to have the fastest CAGR from 2024 to 2032. This growth is driven by the increasing usage of contactless payments, digital wallets, and mobile payment solutions. More consumers are>enjoying cashless transactions, due to comfort and safety reasons. Moreover, the improvement of biometric authentication and QR code-based payments is also contributing to the speed and security of the payment process, which will encourage smart payment systems in the retail sector.

Smart Retail Market Regional Outlook

North America accounted for the largest share of 32.6% owing to the rapid adoption of disruptive retail technologies along with the presence of robust digital infrastructure. Retail behemoths, including Walmart, Amazon Go, and Best Buy have spent large amounts of money in smart retail, such as AI-based inventory management, voice-activated smart shelves, and checkout-free stores to improve customer experience. Amazon Go stores are a prime example of cashier-less technology powered by computer vision and sensor fusion technology, where customers can shop without traditional checkouts. Besides, the rapid proliferation of smart payment and contactless payment solutions in the area also fuelled the adoption of mobile wallets in the regional market.

Asia-Pacific region to register the highest CAGR between 2024 and 2032 thanks to rapid urbanization, increasing smartphone penetration, and digitization of retail. Smart retail solutions are being adopted at a faster growth rate across other countries such as China, Japan, and India. Alibaba has stores in China named Hema, which use smart carts, face recognition payments, and app-based shopping, to combine the physical retail experience with the digital one. In a similar vein, 7-Eleven Japan has introduced automation of restocking processes and self-service checkout kiosks to operate efficiently and provide ample customer convenience respectively fuelling the rapid growth of the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Smart Retail Market are:

-

Amazon (Amazon Go)

-

Microsoft (Microsoft Dynamics 365)

-

IBM (IBM Watson)

-

Intel Corporation (Intel RealSense)

-

NVIDIA (NVIDIA Metropolis)

-

Cisco Systems (Cisco Meraki)

-

Google (Google Cloud AI)

-

Samsung Electronics (Samsung MagicINFO)

-

LG Electronics (LG Smart Shelf)

-

Oracle Corporation (Oracle Retail Cloud Services)

-

SAP SE (SAP Customer Activity Repository)

-

Honeywell (Honeywell Movilizer)

-

Zebra Technologies (Zebra SmartSight)

-

Alibaba Group (Alibaba Ling Shou Tong)

-

Fujitsu (Fujitsu Market Place)

Recent Trends

-

In March 2024, Amazon Pay announced plans to extend its Smart Stores service, partnering with 150 brands to enhance digital payment experiences.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 39.92 Billion |

| Market Size by 2032 | USD 329.03 Billion |

| CAGR | CAGR of 26.45% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Hardware, Software) • By Application (Visual Marketing, Smart Label, Smart Payment System, Intelligent System, Others (Robotics, Analytics)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon, Microsoft, IBM, Intel Corporation, NVIDIA, Cisco Systems, Google, Samsung Electronics, LG Electronics, Oracle Corporation, SAP SE, Honeywell, Zebra Technologies, Alibaba Group, Fujitsu. |