Wireless Audio Device Market Report Scope & Overview:

Get More Information on Wireless Audio Device Market - Request Sample Report

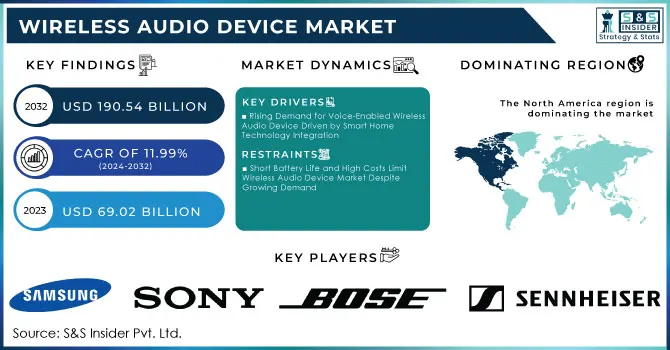

The Wireless Audio Device Market Size was valued at USD 69.02 Billion in 2023 and is expected to reach USD 190.54 Billion by 2032 and grow at a CAGR of 11.99% over the forecast period 2024-2032.

The Wireless Audio Device Market growth prospects are primarily because of the increasing demands for superior quality and seamless audio experience. The trend for wireless connectivity and ease of use, brought about by these kinds of devices wireless headphones, earbuds, and speakers gaining popularity more and more. Technologies, for example, better Bluetooth and Wi-Fi-enabled solutions, make it easier and easier for users to connect their audio systems from various sources, like a smartphone or home entertainment system, etc.

As the audio quality increases and battery life remains long, more of the tech-savvy consumers tend towards Wireless Audio Device and thus fuel this market. Thus, another pertinent aspect here is that companies are shifting their focus towards ergonomic designs and feature-rich sounds to factor into the ever-evolving tastes of customers. The Wireless Audio Device market in the USA experienced significant growth in 2023, with sales estimated to be around nearly 46.4 million units. In 2024, it is likely to rise to about 60.8 million units. The rapid growth of the market has been witnessed due to the rapid adoption of true wireless earbuds and other Wireless Audio Device driven by the enhancement in technology and increased demand by consumers.

Integrating smart technologies, voice assistants, for example, is raising demand for these products since consumers seek to interact more frequently and hands-free. Moreover, wireless audio products have become a must-have in gaming, entertainment, and fitness fields, with a constant need for high-quality audio performance. Furthermore, individuals beginning to work remotely or engage in virtual communication have led to increased demand for wireless noise-canceling headsets that have further enhanced their productivity.

Wireless Audio Device Market Dynamics

Key Drivers:

-

Rising Demand for Voice-Enabled Wireless Audio Device Driven by Smart Home Technology Integration

Major drivers in the growth of the market of Wireless Audio Device are penetration rates, particularly for voice-enabled assistants. The adoption of smart home technology continues to grow, as consumers see value in seamless control via hands-free interfaces and interaction with the smart home systems of Amazon Alexa, Google Assistant, and Apple's Siri. These voice-enabled wireless audio products allow users to control calls, playback, and even smart appliances with simple voice commands. As demand for smart homes and IoT-connected devices increases, the demand for more integrated and convenient lifestyles through wireless audio products does as well.

-

Enhanced Audio Quality and Connectivity Fueling Wireless Audio Device Market Growth and Innovation

Another fundamental driver is the increasing consumer appetite for high-quality audio and reliable wireless connectivity for seamless enjoyment. Advances in Bluetooth and Wi-Fi technologies better the audio of wireless equipment, while faster speeds and less latency increase the speed of connections. Such people as those who use entertainment, exercise, and gaming applications appreciate the high-quality audio without interruption. Better battery life and charging speeds have come to make such wirelessly enabled devices viable for longer usability, which is a prime driver in the adoption of these products in several applications. This focus on superior audio performance is fueling competition and innovation in the market.

Restrain:

-

Short Battery Life and High Costs Limit Wireless Audio Device Market Despite Growing Demand

Short battery lives for several devices are one of the major limitations in the Wireless Audio Device Market. Even though improvements have been made, because improvements only help in dealing with the issue, frequent recharges created by very long usage periods have become a developing concern that adversely impacted convenience and consumers' overall satisfaction. Another limitation is the premium price commanded by wireless audio products, making mass adoption restricted by such price-conscious consumers. Thus, connectivity issues, such as interference or delay in signals, may prevent market growth in areas with intense wireless traffic. All these considerations aside, the growing demand for wireless and portable audio solutions steadily increases market growth.

Key Market Segments

By Product

The true wireless hearables/earbuds segment was the market leader with over 32% market share in 2023. It is estimated that TWS earbuds will also be trendier, especially in the Gen Z population, as they appear more simple, comfortable, and fashionable in design than traditional wired headphones and add to the appeal of a person's looks.

The earphones segment is likely to grow at a CAGR of 12.96% during the forecast period. Technological advancements in wireless connectivity, audio quality, and downsizing have transformed earphones into high-tech electronics. The freedom of wireless earbuds from the constraints of conventional wired alternatives has appealed fully to consumers, particularly busy ones. This transition has been accelerated due to the widespread availability of smartphones as well as music streaming services that enable easy consumption of audio anywhere on the move.

By Technology

The largest market share in 2023 is recorded by the Bluetooth segment with a share of more than 26%. In the Wireless Audio Device market, technology development seems to represent a middle way between innovation, convenience, and connectivity. The bone of contention is that the constant improvement in Bluetooth technology, which started as a simple tool for wireless data transmission, grew into a cornerstone for seamless audio experiences. Bluetooth Low Energy has now consumed much less battery, and devices could therefore work for a longer period.

The Wi-Fi segment is likely to have growth at a CAGR of 12.95% as it offers seamless, high-quality wireless audio experience across multiple devices and platforms. It also guarantees the ease of connecting itself with a smartphone, a tablet, or a laptop while Wi-Fi enhances data transfer by backing up to more significant bit rates along with higher sound qualities. The combination of these technologies enables streaming audio uninterrupted over longer distances, and consumers like those in the entertainment, gaming, and fitness sectors appeal to this segment. This adoption of smart home systems and IoT devices that equally work on Bluetooth and Wi-Fi is further fuelling the growth of this segment.

By Functionality

In 2023, the smart device segment held the largest share, which was more than 57%. The interplay of technical progress, customer need for convenience, and an increasing range of integrated experiences is raising the demand for turning conventional audio devices into multipurpose hubs that perform audio entertainment, connectivity, and smart functionality smoothly.

The smart devices segment is anticipated to grow at a CAGR of 12.78% during the forecast period. The main driver of the wireless audio device market in the smart device segment has been the rising penetration of voice assistants such as Amazon Alexa, Google Assistant, and Apple Siri. The latter offers hands-free operation across audio playback, calls, and even the control of smart home systems via voice commands. Increased demand for smart home and IoT devices with convenience and seamless integration is making the wireless audio product, which integrates built-in voice assistance, a hotspot and is driving growth within the segment.

By Functionality

The residential/individual area accounted for the largest market share of 36% in 2023. Various consumer preferences, technical developments, and lifestyle changes are driving the growth of the residential and individual application areas in the market. Wireless Audio Device represent the transformational solutions wherein homes become networked hubs and personalized sound experiences are valued.

Automotive is expected to grow at a CAGR of 12.84% over the forecast period. The growth of the automotive segment is driven by converging factors that redefine in-car entertainment and connectivity. The increased number of cars connected wirelessly provides an easily seamless way to enhance the driving experience of users, as well as streaming music, podcasts, and even navigation instructions, all directly to their car's audio systems.

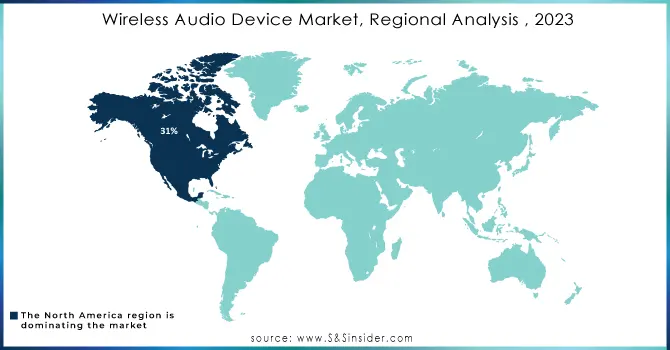

Wireless Audio Device Market Regional Analysis

In 2023, North America dominated the market share of 31% of the total market, due to technological innovations in audio products, the growing demand for high-quality audio from consumers, and alterations in lifestyle preferences. This is considered a hub of major tech companies and startups; therefore, the region takes the lead in wireless communication progress. As a result, front-line technologies such as Bluetooth, Wi-Fi, and proprietary protocols are incorporated into audio products.

The Asia Pacific region is expected to dominate in terms of the highest CAGR at 12.81% during the period of the forecast. This growth will be spurred by technological advancements coupled with new regulations concerning e-waste management in the region. The ever-swelling and enormous middle class in the region increases demand for the latest audio solutions, including wireless headphones, earbuds, and speakers, and the increasing adoption of smartphones boosts this demand further.

Need Any Customization Research On Wireless Audio Device Market - Inquiry Now

Key Players in Wireless Audio Device Market

Some of the major players in the Wireless Audio Device Market are:

-

Apple Inc. (AirPods, HomePod)

-

Samsung Electronics (Galaxy Buds, AKG Wireless Headphones)

-

Sony Corporation (WH-1000XM5, WF-1000XM5)

-

Bose Corporation (Bose SoundLink, Bose QuietComfort Earbuds)

-

Sennheiser Electronic (Momentum True Wireless, HD 450BT)

-

Jabra (GN Group) (Jabra Elite 85t, Jabra Move Style Edition)

-

JBL (Harman International) (JBL Live 660NC, JBL Tune 225TWS)

-

Beats by Dre (Apple Inc.) (Beats Studio Buds, Beats Fit Pro)

-

Plantronics (Poly) (BackBeat Pro 2, Voyager 5200)

-

Bang & Olufsen (Beoplay H95, Beoplay E8)

-

Skullcandy (Crusher Wireless, Indy Evo)

-

Logitech (Ultimate Ears Wonderboom, Zone Wireless)

-

Anker Innovations (Soundcore) (Soundcore Liberty Air 2 Pro, Soundcore Motion+)

-

Sonos (Sonos One, Sonos Roam)

-

V-Moda (Roland Corporation) (Crossfade Wireless, Forza Metallo Wireless)

-

Philips (Philips T8505, Philips Fidelio L3)

-

Pioneer Electronics (Pioneer SE-C8TW, Pioneer Rayz Plus)

-

Bowers & Wilkins (PX7 S2, PI5 True Wireless)

-

Marshall Headphones (Marshall Monitor II ANC, Marshall Mode II)

-

Shure Incorporated (Shure Aonic 50, Shure SE215 Wireless)

Recent Trends

-

In September 2024, WiSA Technologies, Inc a leading innovator in wireless audio technology for intelligent devices and next-generation home entertainment systems, announced that its WiSA E wireless immersive audio software has been embedded into an Amlogic reference design and is now available for customer implementation. Amlogic will be showing its WiSA-E-enabled STB reference design at the IBC show in Amsterdam.

-

In June 2024, Honeywell, Hong Kong-based global electronic products manufacturer Secure Connection expanded its India presence with a new personal audio product range, including three wireless Bluetooth speakers, under Honeywell branding. The newly launched speakers include the Suono P300 and P400 under the Platinum series and the Trueno U300 in the Ultimate Series.

-

In August 2024, Apple-owned audio brand, Beats launched Beats Solo Buds true wireless earphones, Beats Solo 4 on-ear headphones, and Beats Pill portable Bluetooth speaker in India.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 69.02 Billion |

| Market Size by 2032 | USD 190.54 Billion |

| CAGR | CAGR of 11.99% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product (Earphone, Headphone, True Wireless Hearables/Earbuds, Speaker Systems, Soundbars, Headsets, Microphones, Others), • by Technology (Bluetooth, Wi-Fi, Bluetooth + Wi-Fi, Airplay, Others) By Functionality (Indoor, Outdoor), • by Application (Residential/Individual, Residential, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apple Inc., Samsung Electronics, Sony Corporation, Bose Corporation, Sennheiser Electronic, Jabra (GN Group), JBL (Harman International), Beats by Dre (Apple Inc.), Plantronics (Poly), Bang & Olufsen, Skullcandy, Logitech, Anker Innovations (Soundcore), Sonos, V-Moda (Roland Corporation), Philips, Pioneer Electronics, Bowers & Wilkins, Marshall Headphones, Shure Incorporated |

| Key Drivers | • Rising Demand for Voice-Enabled Wireless Audio Devices Driven by Smart Home Technology Integration • Enhanced Audio Quality and Connectivity Fueling Wireless Audio Devices Market Growth and Innovation |

| RESTRAINTS | • Short Battery Life and High Costs Limit Wireless Audio Devices Market Despite Growing Demand |