Brewing Enzymes Market Report Scope & Overview:

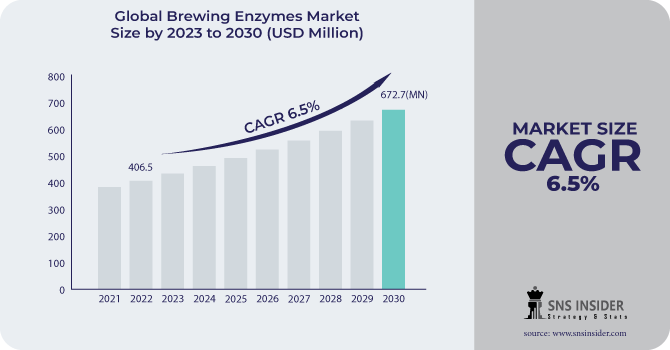

The Brewing Enzymes Market size was USD 406.5 million in 2022 and is expected to Reach USD 672.7 million by 2030 and grow at a CAGR of 6.5 % over the forecast period of 2023-2030.

Brewing enzymes catalyze the chemical processes during the brewing process. They are employed to convert complicated carbohydrates into less complex sugars so that yeast can ferment those sugars to create alcohol. The increased demand for alcoholic beverages, as the young population grows and customers' rising disposable income, will help the market thrive.

Based on type, the market is segmented into Amylase, Alphalase, Protease, and Others. In 2022, The amylase category dominated the market, accounting for 39% of total market revenue of $170.25 million. Amylase is a powerful enzyme that converts complicated sugar molecules into simpler sugar molecules. Amylase is frequently used in the brewing business due to its low cost.

Based on process, the mashing & fermentation segment dominated the market with a revenue share of around 49% in 2022. Mashing is the process of converting sugar molecules into fermentable sugars. Mashing and fermentation can be performed on a variety of microorganisms, demonstrating versatility. As a result, the mashing and fermentation process's scalability, consistency, high quality, improved control, and diversity will help the sector dominate the market throughout the projection period.

MARKET DYNAMICS

KEY DRIVERS

-

Rising beer consumption in developing company

Rapid urbanization, rising disposable income, and expanding beer consumption have prompted beer manufacturers to seek techniques to maximize their beer production. Beer manufacturers provide various flavors and fragrances while maintaining consistent product quality. Enzymes are used to improve beer production, cut costs, and shorten production time. The advantages of brewing enzymes allow for greater beer production while maintaining quality at a low cost. As a result, the increasing use of brewing enzymes in the beer manufacturing industry will fuel market expansion.

-

The increasing number of beer stores, bars, pubs, and restaurants

RESTRAIN

-

Increasing popularity of traditional brewing practices

The rising popularity of wine flavors and authentic beer prepared with traditional brewing techniques is expected to limit the growth of the brewing enzymes market. The unwillingness of microbrewery owners to adopt industrial brewing techniques instead of traditional methods, given that these methods are their unique selling point, will also hinder the market's growth.

-

High cost of brewing enzymes

OPPORTUNITY

-

Demand for enzymes to raise beer production capacity

Enzymes are those proteins that act as biocatalysts and increase the rate of a chemical reaction. Brewing enzymes play an important role in the production of beer during the processing stages such as germination, fermentation, mashing, and clarification. Enzymes can be used to break down starches into sugars, which are then fermented by yeast to produce alcohol. This can help to speed up the brewing process and improve the yield of beer.

CHALLENGES

-

Absence of uniform regulation

Several countries manufacture brewing enzymes, and every country has its own set of standard rules and regulations that must be followed when producing, packing, maintaining, storing, and distributing brewing enzymes. For example, in the European Union, enzymes are classified as food additives and are subject to strict regulations. The market's growth is hampered by a lack of standardization or streamlined processes, regulations, norms, and guidelines. The inconsistencies and lack of accountability can cause uncertainty among customers, market participants, and other stakeholders, stifling market growth.

IMPACT OF RUSSIA UKRAINE WAR

The Russia-Ukraine war is having a significant impact on the global brewing industry, including the supply of brewing enzymes. Ukraine is a major producer of barley, which is a key ingredient in beer. In Europe, barley prices have increased by about 30% since the start of the war. This is due to war that has disrupted the global supply of barley, driving up prices and making it more difficult for brewers to source the raw materials they need. Russia is a major producer of enzymes used in brewing. The war has caused production to decline in Russia, and it is unclear when it will resume. This has led to shortages of enzymes in the global market, and prices have risen sharply.

IMPACT OF ONGOING RECESSION

In 2023, the brewing enzymes market is estimated to decline by 7% compared to 2022. This is related to a decrease in beer demand as people spend less on discretionary items such as beer during the recession. According to the Beer Index, the cost of producing beer is currently 62% higher than it was two years ago. Also, as a result of the war and changing weather patterns, the cost of raw materials such as barley and malt has risen dramatically in recent months. The COVID-19 outbreak and the war in Ukraine have both impacted the global supply chain. This has made obtaining brewing enzymes and other important chemicals more complex and expensive for brewers.

MARKET SEGMENTATION

By Source

-

Microbial

-

Plant

By Type

-

Amylase

-

Alphalase

-

Protease

-

Others

By Form

-

Liquid

-

Dry

By process

-

Malting

-

Wort Separation & Filtration

-

Mashing & Fermentation

-

Maturation

By Application

-

Beer

-

Wine

.png)

REGIONAL ANALYSIS

North America has a vast regional market for brewing enzymes in 2022. The increasing demand for craft beer and specialty brews is driving the expansion of the North American brewing enzymes market. The United States is the largest market in North America for brewing enzymes, followed by Canada and Mexico.

The Asia Pacific region is growing rapidly in the market for brewing enzymes, accounting for over 40% of market revenue (178.65 million) in 2022. The area accounts for the majority of market demand because of rising demand for beer and alcoholic beverages, rising disposable income, an urbanized population, and the expansion of prominent corporations in several nations. A series of studies have been undertaken in China to analyze and improve the efficacy, effectiveness, and practicality of brewing enzymes. In addition to the growing number of microbreweries, the country is also participating in major product releases in the alcohol-free and low-alcohol segments as a result of the trend toward a healthier lifestyle. All of these reasons are accelerating market growth.

Europe holds a significant share of brewery enzymes this is attributed to the rising consumption of drinks and a variety of beers. The rise in the manufacture of flavored beers, gluten-free beers, and wine in Europe is responsible for the expansion of brewing enzymes. The rise in craft breweries, consumer preference for such beverages, public awareness of the potential health benefits of beer consumption, and rising disposable income all contributed to the market's expansion.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Brewing Enzymes Market are Amano Enzyme, Novozymes, Aumgene Biosciences, DowDuPont, Enzyme Development Corporation, Chr. Hansen, Enzyme Innovation, Associated British Foods, DSM, Kerry Group, SternEnzym GmbH & Co. K.G., and other key players.

Amano Enzyme-Company Financial Analysis

RECENT DEVELOPMENTS

In 2022, Novozymes and Chr. Hansen, producers of enzymes and food components in Denmark, have agreed to consolidate their businesses. Even though creating enzymes is the primary business of both organizations, Chr. Hansen concentrates more on enzymes and microbes for the food industry, whereas Novozymes' key business sectors include household products, food and beverages, and biofuels.

In 2021, Amano Enzyme launched Umamizyme Pulse, a non-GMO enzyme aimed at use in diverse plant protein products to generate a pleasant, savory umami flavor similar to that supplied by monosodium glutamate (MSG).

In 2020, DSM introduced MaxadjunctTMßL, a high-performance adjunct brewing enzyme. This enzyme breakthrough enables brewers to raise the adjunct level in their beers while also improving resource efficiency by exploiting a variety of locally accessible unmalted ingredients and bypassing the cereal heating step of production for further benefits.

| Report Attributes | Details |

| Market Size in 2022 | US$ 406.5 Million |

| Market Size by 2030 | US$ 672.7 Million |

| CAGR | CAGR of 6.5 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Amylase, Alphalase, Protease, and Others) • By Source (Microbial and Plant) • By Form (liquid and dry) • By process (Malting, Wort Separation & Filtration, Mashing & Fermentation, Maturation) • By Application (Beer, Wine) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Amano Enzyme, Novozymes, Aumgene Biosciences, DowDuPont, Enzyme Development Corporation, Chr. Hansen, Enzyme Innovation, Associated British Foods, DSM, Kerry Group, SternEnzym GmbH & Co. K.G. |

| Key Drivers | • Rising beer consumption in developing company • The increasing number of beer stores, bars, pubs, and restaurants |

| Market Restrain | • Increasing popularity of traditional brewing practices • High cost of brewing enzymes |