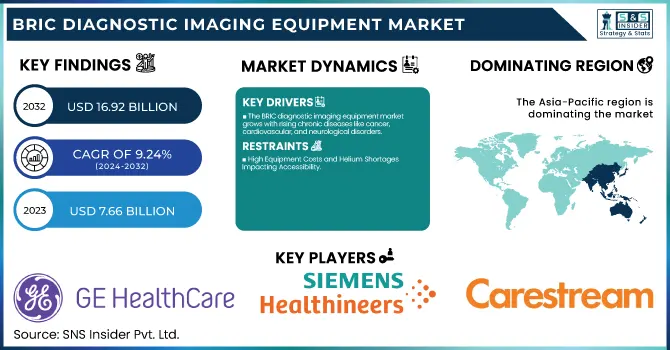

BRIC Diagnostic Imaging Equipment Market Size Analysis:

The BRIC Diagnostic Imaging Equipment Market Size was valued at USD 7.66 billion in 2023 and is expected to reach USD 16.92 billion by 2032 and grow at a CAGR of 9.24% over the forecast period 2024-2032. This report identifies the expanding incidence and prevalence of diseases as a driver for demand for enhanced diagnostic imaging products, in conjunction with growing health expenditures in the BRIC nations, driven by both public and private payors. The study delves into trends in the installation of diagnostic imaging equipment country by country based on differing patterns of infrastructure building and investment drivers. Moreover, it analyzes trends in technological adoption, such as the use of AI, cloud imaging, and point-of-care diagnostic solutions, that are improving accessibility and efficiency. It also evaluates the regulatory environment and policy, analyzing how it affects market growth, product approval, and standardization initiatives across these emerging markets.

To Get more information on BRIC Diagnostic Imaging Equipment Market - Request Free Sample Report

BRIC Diagnostic Imaging Equipment Market Dynamics

Drivers

-

The BRIC diagnostic imaging equipment market is driven by the rising prevalence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions.

With more than 4 million new cancer cases diagnosed in BRIC nations in 2020, the need for early and precise diagnosis has increased. Governments and private enterprises are investing heavily in healthcare infrastructure, which is driving the adoption of sophisticated imaging systems. The use of artificial intelligence (AI) in diagnostic imaging improves accuracy and efficiency, making imaging technology more appealing to healthcare providers. Moreover, widening applications like image-guided interventions and interventional procedures also support the increasing need for diagnostic imaging solutions.

Restraints

-

High Equipment Costs and Helium Shortages Impacting Accessibility

While offering promising expansion, the market has challenges that include the expensive cost of high-tech imaging equipment. MRI devices, for example, are priced above USD 1 million, a cost that small hospitals and clinics cannot meet. Moreover, the lack of helium, a component used in MRI technology, has raised operating costs and maintenance issues. Limited budgets and increasing equipment costs limit the diffusion of advanced imaging modalities, especially in low-budget healthcare institutions. These fiscal and logistical obstacles significantly impede market penetration in some areas.

Opportunities

-

AI-Powered Imaging and Mobile Diagnostics Expanding Access

Growing trends of AI-based imaging and mobile diagnostics services offer viable opportunities in the BRIC marketplace. AI ensures accuracy in interpreting images, avoiding mistakes, and increasing efficiency in the hands of radiologists. Portable X-ray and ultrasound solutions are widening remote and underserved areas' accessibility. The widespread use of teleradiology services further distances radiologists and patients, bringing timely and correct diagnoses. These developments not only enhance the care of patients but also generate additional revenue streams for market participants, driving market expansion.

Challenges

-

Growing Adoption of Refurbished Equipment and System Integration Issues

The growing trend towards second-hand imaging machines presents a challenge to producers of new equipment. Cost-sensitive hospitals tend to prefer second-hand systems, and this impacts the sale of brand-new diagnostic imaging solutions. Standalone imaging devices also tend to have problems with interoperability, which results in inefficiencies in data handling and hospital workflow. Limited integration with hospital information systems creates delays in diagnosis and treatment planning. It demands low-cost new products and better system compatibility with today's healthcare IT infrastructures to overcome such issues.

BRIC Diagnostic Imaging Equipment Market Segmentation Analysis

By Modality

In 2023, MRI systems were the leading modality in the BRIC diagnostic imaging equipment market, with a high market share. This leadership is mainly due to technological innovation that has improved imaging capabilities, resulting in accurate and early detection of diseases. The non-invasive nature of MRI procedures has seen them gain greater acceptance by patients and healthcare professionals. Furthermore, the increase in the occurrence of chronic conditions like cancer and neurological disorders has increased the need for accurate diagnostic equipment, further supporting the use of MRI systems. Furthermore, growing healthcare expenditures in BRIC nations have enabled the acquisition of sophisticated MRI equipment, securing their market dominance.

Nuclear imaging equipment has become the most rapidly expanding sector in the BRIC diagnostic imaging equipment market. Its rapid expansion is fueled by mounting cases of chronic diseases, such as cardiovascular disease and cancers, that require sophisticated diagnostic equipment for proper evaluation and treatment planning. The fact that nuclear imaging can offer information about function at the molecular level provides tremendous benefits over conventional imaging modalities, resulting in its quicker adoption. In addition, advances in technology have made the systems more user-friendly and affordable, prompting healthcare institutions to incorporate them into their diagnostic services. Government efforts towards enhancing healthcare infrastructure and early detection of diseases have also contributed significantly to the growth of nuclear imaging systems in BRIC countries.

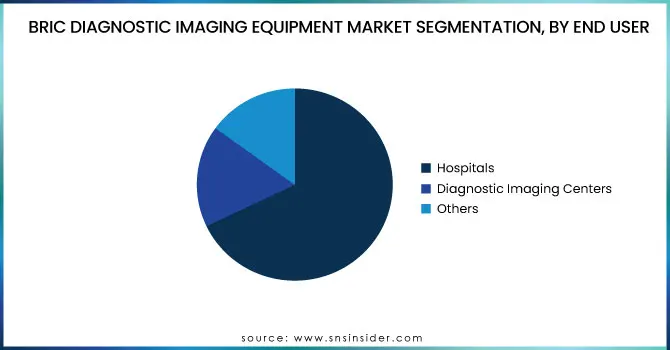

By End User

Hospitals have retained their status as the leading end-users of the BRIC diagnostic imaging equipment market, with a substantial share in 2023. This is because they provide a complete range of diagnostic services, both for inpatients and outpatients. The inclusion of sophisticated imaging technologies in hospital environments guarantees the ready availability of diagnostic information, enabling quick clinical decision-making. Moreover, hospitals tend to have the budget to invest in advanced imaging technology, which guarantees quality patient care. The automation and digitization of radiology processes in hospitals have also increased operational efficiency, further solidifying their position as market leaders in the diagnostic imaging equipment market.

Diagnostic imaging centers are seeing a high growth rate in the BRIC nations, representing the most rapidly growing end-user segment. The rise is a result of growing demands for specialist imaging services and a trend away from inpatient diagnostic operations. The centers have specialized expertise and are generally able to deliver more rapid service than larger hospital facilities, making them appealing to patients interested in streamlined diagnostic solutions. The growth of such centers is also fueled by reduced operational expenses and the capacity to implement new technologies quickly, meeting the changing demands of patients and healthcare professionals. Additionally, favorable government policies and investments in healthcare infrastructure have made it easier to set up and expand diagnostic imaging centers in BRIC countries, leading to their growing market share.

BRIC Diagnostic Imaging Equipment Market Regional Insights

The BRIC Diagnostic Imaging Equipment Market is characterized by varying regional patterns shaped by economic expansion, development of healthcare infrastructure, and advancements in technology. The market is dominated by China based on its enormous healthcare system, high penetration of AI-driven imaging solutions, and robust support by the government for domestic producers such as United Imaging and Neusoft Corporation. The nation leads the market share of diagnostic imaging installations, especially in city-based hospitals.

India is the fastest-growing market, driven by rising healthcare investments, a growing burden of chronic diseases, and increasing access to diagnostic services in rural India. The growth of private diagnostic imaging centers and the adoption of cost-effective imaging solutions from local players such as Allengers and CURA Healthcare further drive the market.

Brazil is experiencing steady growth with support from government efforts to update public healthcare centers and improve imaging access. The need for digital radiography and ultrasound equipment is growing, particularly in private hospitals. Nevertheless, economic fluctuations can create challenges.

Russia boasts a well-developed imaging market, with increased investments in new modalities such as MRI and CT. Domestic producers like NP JSC Amico and government initiatives for local production are fortifying market dynamics. Geopolitical trends, though, affect dependence on imports and price structures.

Get Customized Report as per Your Business Requirement - Enquiry Now

BRIC Diagnostic Imaging Equipment Market Key Players

-

GE Healthcare – Revolution CT, Optima XR646 X-ray System, LOGIQ E10 Ultrasound, SIGNA Architect MRI

-

Siemens Healthineers – SOMATOM Force CT, MAGNETOM Vida MRI, ACUSON Sequoia Ultrasound, MAMMOMAT Revelation Mammography, NAEOTOM Alpha

-

Koninklijke Philips N.V. – Ingenia Ambition MRI, IQon Spectral CT, EPIQ Elite Ultrasound, DigitalDiagnost C90 X-ray System

-

Canon Medical Systems Corporation – Aquilion ONE CT, Vantage Orian MRI, Aplio i-series Ultrasound, Radrex-i Digital X-ray System

-

Carestream Health, Inc. – OnSight 3D Extremity System, DRX-Revolution Mobile X-ray System, Touch Prime Ultrasound

-

Hologic, Inc. – Selenia Dimensions Mammography, Affirm Prone Biopsy System, Fluoroscan Insight FD Mini C-Arm

-

Hitachi, Ltd. – Supria CT Scanner, Echelon Smart MRI, ARIETTA 850 Ultrasound

-

Allengers – MARS 15 CT Scanner, Tesla MRI, Muson Ultrasound, Digital Radiography Systems

-

CURA Healthcare – CURA DicomPACS DX-R X-ray System, CURA Ultrasound Systems

-

Neusoft Corporation – NeuViz CT Scanner, NeuMR MRI System, Ultrasound Diagnostic Systems

-

NP JSC Amico – Magnetom Open MRI, CT Scanners, Digital X-ray Systems

-

SONTU Medical Imaging Equipment Co., Ltd. – Digital Radiography Systems, Ultrasound Imaging Systems

-

FUJIFILM Holdings Corporation – FCT Embrace CT, Arietta 850 Ultrasound, Amulet Innovality Mammography

-

United Imaging Healthcare Co., Ltd. – uCT 780, uMR 790, uMI 780, uDR 780

Recent Developments in the BRIC Diagnostic Imaging Equipment Market

-

In Feb 2025, AsiaMedic Limited and Sunway Equity Holdings launched AsiaMedic Sunway Imaging, a new medical diagnostic imaging center at Royal Square, Novena. This marks a major expansion of their imaging capabilities, strengthening their presence in the medical diagnostics sector.

-

In Feb 2025, Diagnostica e Terapia Centro Aktis in Marano di Napoli expanded its imaging capabilities with new CT and MRI scanners. The upgrade was made possible through a collaboration between diagnostic service provider Fora and advanced imaging company United Imaging.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.66 billion |

| Market Size by 2032 | USD 16.92 billion |

| CAGR | CAGR of 9.24% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Modality [X-ray Imaging Systems (By Technology, By Portability), Computed Tomography (CT) Scanners (By Technology, Conventional CT Market), Ultrasound Systems (By Technology), Magnetic Resonance Imaging (MRI) Systems (By Architecture, By Field Strength), Nuclear Imaging Systems (SPECT Systems, Hybrid PET Systems), Mammography Systems] • By End User [Hospitals, Diagnostic Imaging Centers, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GE Healthcare, Siemens Healthineers, Koninklijke Philips N.V., Canon Medical Systems Corporation, Carestream Health, Inc., Hologic, Inc., Hitachi, Ltd., Allengers, CURA Healthcare, Neusoft Corporation, NP JSC Amico, SONTU Medical Imaging Equipment Co., Ltd., FUJIFILM Holdings Corporation, United Imaging Healthcare Co., Ltd. |