Precision Diagnostics Market Report Scope & Overview:

Get More Information on Precision Diagnostics Market - Request Sample Report

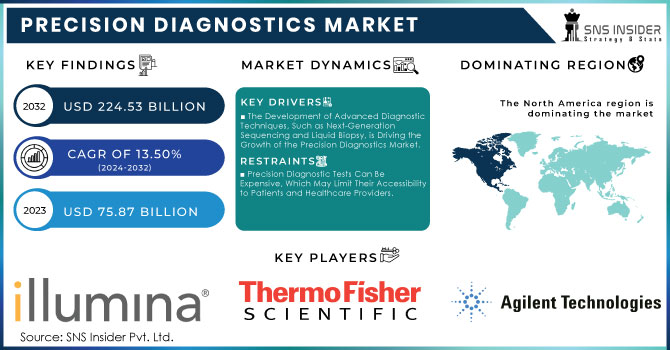

The Precision Diagnostics Market Size was valued at USD 75.87 Billion in 2023, and is expected to reach USD 224.53 Billion by 2032, and grow at a CAGR of 13.50%.

The most crucial driver of market growth is advancements in genomic and proteomic sciences. The continued research and development in precision diagnostics have led to the integration of new technologies with improved precision rates. Besides, there is a growing prevalence of chronic diseases across the globe, and early detection can enhance the quality of life for the affected individuals. As such, healthcare professionals currently rely on precision diagnostics to develop personalized treatment plans for various conditions. Regarding tests and platforms, there have been various developments that have integrated AI and machine learning algorithms to enhance their precision and speed of operation. On the part of healthcare professionals and patients, there is a growing awareness and acceptance of precision diagnostics approaches and technologies. Therefore, the factors above have been beneficial in supporting the growth and expansion of the market. It is significant to note that the driver with the most significant potential is the government investment as it creates avenues for integrating precision diagnostics in public health systems.

Another key driver of the market is the increasing aging population and the subsequent market demand. The World Health Organization reports that by the year 2050, the global population aged 60 years and above will double to 2.1 billion. Additionally, the population of people aged 80 years and older will increase by three times to about 426 million individuals. As people grow older, it becomes inevitable to contract various diseases and health conditions, which have to be diagnosed early to develop a suitable treatment plan. The tests for the conditions in question fall under precision diagnostics and include testing technologies such as genetic and molecular tests and advanced analytical tools such as big data computing to provide personalized and precise diagnostic information. Consequently, older adults provide a critical driver of the global market because of increased demand for advanced diagnostic solutions to manage old age diseases more effectively. It is important to note that the inclusion of other factors that can drive the global market expansion can be explored in case the report is for an African market.

Market Dynamics:

Key Drivers:

-

The Development of Advanced Diagnostic Techniques, Such as Next-Generation Sequencing and Liquid Biopsy, is Driving the Growth of the Precision Diagnostics Market.

-

The Rising Incidence of Chronic Diseases, Such as Cancer and Autoimmune Disorders, is Increasing the Demand for Precision Diagnostic Tests to Identify and Treat These Conditions Effectively.

Restraints:

-

Precision Diagnostic Tests Can Be Expensive, Which May Limit Their Accessibility to Patients and Healthcare Providers.

-

Obtaining Regulatory Approval for New Precision Diagnostic Tests Can Be Time-Consuming and Costly, Which May Hinder Market Entry.

Opportunity:

-

There is a Growing Trend Towards Personalized Medicine, Which Relies on Precision Diagnostics to Tailor Treatment Plans to Individual Patients.

-

Precision Diagnostics is Being Applied to A Wider Range of Diseases, Including Infectious Diseases and Rare Genetic Disorders, Which Presents New Opportunities for Market Growth.

Precision Diagnostics Market Segmentation Analysis:

By Type

The genetic tests segment led the market. It accounted for 55% of the share in 2023. The dominance of genetic tests in the market is attributed to various factors such as advancements in technology, improved understanding of genetic disorders, the advent of personalized medicine, increasing prevalence of chronic diseases and cancer, consumer curiosity to understand more about their ancestry, and regulatory support. The sector has also observed numerous investments and partnerships between diagnostic, pharmaceutical companies, and academic institutions. These collaborations are focused on developing new genetic tests and incorporating them into clinical applications to propel market growth. For example, in January 2024, DNAnexus, Inc. and TMA Precision Health announced a collaboration to support diagnostic processes and treatment options for individuals affected by rare diseases. The focus of the deal is on developing more accurate and effective tests that will help provide more personalized treatment plans for individuals with rare diseases.

The direct-to-consumer tests segment is expected to register the fastest CAGR from 2024 to 2032. Consumers are becoming increasingly aware of the importance of early disease detection and health information. DTC tests are a convenient method for individuals to access opportunities to improve their health and learn about potential concerns with their health without having to visit a healthcare provider. Moreover, advancements in genomic sequencing technologies as well as bioinformatics have made it easier and more cost-effective to launch such tests directly to the consumer. As a result, an increased variety of tests are available that possess greater accuracy ranging from genetic predispositions to lifestyle suggestions related to nutrition and exercise. In addition, regulatory bodies in some regions have begun to provide more concrete frameworks and guidelines concerning DTC genetic testing. This has benefitted firms by streamlining approval procedures, which has enabled them to launch products in the market.

By Application

The oncology segment was leading the market, based on application, with the largest revenue share of 25% in 2023. This is mainly attributed to the growing prevalence of cancer worldwide and the escalating need for early detection and monitoring of such diseases. According to the American Cancer Society, it is estimated that 1.96 million cases of cancer diagnosed in the U.S. alone in 2023. In this regard, such high prevalence is propelling the demand for personalized and more accurate diagnostics to target exact cancer types and know their genetic identities. In addition, the future expenditure of governments in this segment will enhance the growth of the market over the forecast period. For example, in the U.S., the National Cancer Institute has a budget allocation of USD 7.8 billion, and in the Fiscal Year 2023, there was a USD 500 million increment for personalized medicine.

The genetic disease application segment is estimated to be the fastest-growing segment over the forecast period. This is because of the surging prevalence of genetic disorders worldwide, which is fueling the demand for personalized diagnostic solutions. For example, among people of Caucasian origin, illness carriers are the highest, estimated at 16, which include Tay-Sachs among the Ashkenazi Jewish individuals, and one for Asians, including that for alpha- and beta-thalassemia. Therefore, since diseases such as cystic fibrosis, sickle cell anemia, and some types of cancer are genetic, cases of genetic disease are rising, hence the need for advanced diagnostics. The advent of next-generation sequencing and other high-throughput technologies has played a vital role in this sector. Therefore, these innovations can scrutinize and interpret copious amounts of genetic data swiftly and cost-effectively, thereby propelling the rapid growth of precision diagnostics to help in identifying genetic diseases.

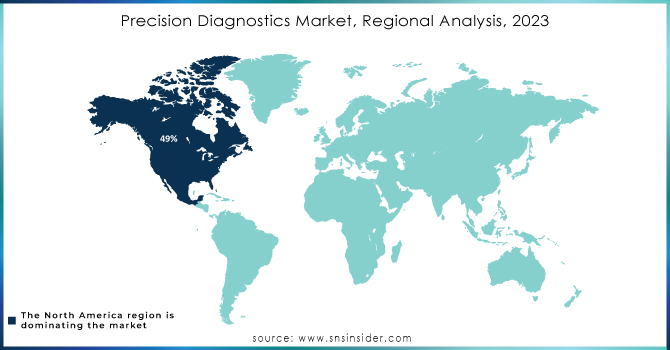

Regional Analysis:

In terms of revenue, North America was the leader of the Precision Diagnostics Market in 2023, with a 49% share, notably the U.S. The presence of advanced healthcare infrastructure and robust biotechnology research in the U.S. has ensured continuous investments in the field, which in turn has resulted in the development of more efficient and reliable personalized diagnostics technologies. Moreover, government measures to improve the quality and accessibility of healthcare as well as the continuous funding of research and development in the diagnostics field on the whole had a significant, positive effect on the market growth.

Moreover, the U.S. Precision Diagnostics Market is expected to demonstrate the highest CAGR in the following years. This trend can have several sources, including advances in the genomic medicine field and the growing understanding and awareness of personalized healthcare benefits. Another factor that influenced it was the increasing use of artificial intelligence in precision diagnostics and the steady and substantial market demand for earlier and more reliable detection of diseases. Furthermore, the sector is growing as a whole – while it is most often associated with genetic testing, precision diagnostics include such technologies as molecular diagnostics, companion diagnostics, and immunoassays. These technologies are employed to detect specific markers and connect various types of detecting equipment. Finally, the trend influences both the U.S. government and the private sector, and various programs and institutions have been supported in the country in the interest of developing the area. The most famous is the All of Us Research Program, which is considered to be a part of the Precision Medicine Initiative.

Need any customization research on Precision Diagnostics Market - Enquiry Now

Key Players

The players operating in the precision diagnostics market are the following:

-

Illumina: NovaSeq, NextSeq, TruSight Tumor 170

-

Thermo Fisher Scientific: QuantStudio, Oncomine, Ion Torrent

-

Roche Diagnostics: cobas x 4800, Cobas 6800, Her2 test

-

Qiagen: QIAamp, QuantiGene, Neuromarkers

-

Agilent Technologies: SureSelect, SureTarget, SureSeq

-

Becton, Dickinson, and Company (BD): FACSCalibur, BD Oncura, BD VeriQuest

-

Abbott Laboratories: m2000, Alinity m, ID NOW

-

Siemens Healthineers: MAGNETOM, SOMATOM, Admera Health

-

Bio-Rad Laboratories: CFX96, S1000, ddPCR

-

Myriad Genetics: BRCA1/2 test, Hereditary Cancer Panel

-

Invitae Corporation: Genetic testing for hereditary diseases, carrier screening

-

Guardant Health: Guardant360, Guardant Omni

-

Foundation Medicine: FoundationOne CDx, FoundationOne Heme

-

Exact Sciences Corporation: Cologuard, Oncotype DX

-

Natera, Inc.: Panorama, Harmony, Mirabilite

-

Quest Diagnostics: Genetic testing for various conditions, newborn screening

-

LabCorp: Genetic testing for various conditions, newborn screening

-

Cepheid: GeneXpert System, Xpert MTB/RIF

-

Genomic Health: Oncotype DX, Oncotype DCIS Score

-

Adaptive Biotechnologies: Adaptive TCR, clonoSEQ

Recent Developments

-

In January 2024, Siemens Healthineers and the Indian Institute of Science opened a joint laboratory for AI in Precision Medicine. The lab’s official name is Siemens Healthineers-Computational Data Sciences Collaborative Laboratory for AI in Precision Medicine. The laboratory focused on developing open-source AI tools for neurological diseases. It is critical for the development of AI for India, the primary focus of India being neurovascular diseases

-

In May 2023, HALO Precision Diagnostics, Inc. signed a partnership with Agamon Health. The partnership was intended to improve the quality of treatment and patient experience with HALO Precision Diagnostics.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 75.87 Billion |

| Market Size by 2032 | USD 224.53 Billion |

| CAGR | CAGR of 13.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Genetic Tests, Direct-to-Consumer Tests, Esoteric Tests, Others) • By Application (Oncology, Respiratory Diseases, Skin Diseases, CNS Disorders, Immunology, Genetic Diseases, Others) • By End-Use (Hospitals, Clinical Laboratories, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott Laboratories, F. Hoffmann-La Roche Ltd., Siemens Healthineers AG, Thermo Fisher Scientific Inc., bioMérieux SA, Becton, Dickinson and Company, Danaher Corporation, QIAGEN N.V., Hologic Inc., and Agilent Technologies Inc & other players |

| Key Drivers | • The Development of Advanced Diagnostic Techniques, Such as Next-Generation Sequencing and Liquid Biopsy, is Driving the Growth of the Precision Diagnostics Market. • The Rising Incidence of Chronic Diseases, Such as Cancer and Autoimmune Disorders, is Increasing the Demand for Precision Diagnostic Tests to Identify and Treat These Conditions Effectively. |

| Restraints | • Precision Diagnostic Tests Can Be Expensive, Which May Limit Their Accessibility to Patients and Healthcare Providers. • Obtaining Regulatory Approval for New Precision Diagnostic Tests Can Be Time-Consuming and Costly, Which May Hinder Market Entry. |