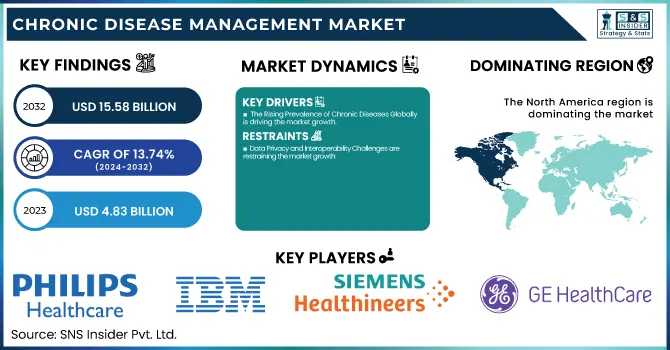

Chronic Disease Management Market Overview:

The Chronic Disease Management Market size was valued at USD 4.83 billion in 2023 and is projected to reach USD 15.58 billion by 2032, growing at a CAGR of 13.74% from 2024 to 2032. This Chronic Disease Management Market report provides exclusive insights by presenting an extensive analysis of the target patient population and chronic disease burden from 2023 to 2032, underpinned by regional and disease-specific trends. It delves into the adoption pattern of digital chronic care solutions, with an emphasis on technological uptake across healthcare ecosystems. It also provides a comprehensive analysis of digital infrastructure penetration, with an emphasis on disparities and developments across global regions. The report also explains healthcare spending by payer category, providing a comparative perspective of government, commercial, private, and out-of-pocket expenditure trends.

Chronic Disease Management Market Size and Forecast:

-

Market Size in 2023: USD 4.83 billion

-

Market Size by 2032: USD 15.58 billion

-

CAGR: 13.74% from 2024 to 2032

-

Base Year: 2023

-

Forecast Period: 2024–2032

-

Historical Data: 2020–2022

To Get more information on Chronic Disease Management Market - Request Free Sample Report

Chronic Disease Management Market Trends

-

Rising prevalence of chronic conditions such as diabetes, cardiovascular diseases, respiratory disorders, and arthritis is driving sustained demand for long-term disease management solutions across healthcare systems.

-

Increased adoption of digital health platforms, including remote patient monitoring, mobile health applications, and connected medical devices, is enabling continuous tracking of patient health and early intervention.

-

Integration of personalized care plans and value-based care models is improving treatment outcomes by focusing on preventive care, medication adherence, and lifestyle modification.

-

Advances in data analytics, AI-driven clinical decision support, and predictive risk modeling are helping providers identify high-risk patients and optimize chronic care pathways.

-

Expansion of home healthcare services and telehealth solutions is enhancing patient convenience, reducing hospital visits, and lowering overall healthcare costs, particularly for aging populations.

-

Government initiatives, reimbursement reforms, and public health programs aimed at reducing chronic disease burden are supporting wider adoption of structured disease management programs.

-

Strategic collaborations between healthcare providers, technology companies, pharmaceutical firms, and payers are accelerating innovation in integrated chronic disease management ecosystems.

The U.S. Chronic Disease Management Market was valued at USD 1.41 billion in 2023 and is expected to reach USD 4.43 billion by 2032, growing at a CAGR of 13.38% from 2024 to 2032. The United States leads the North American Chronic Disease Management Market because of its established digital healthcare infrastructure, high penetration of telehealth solutions, and established presence of large healthcare IT players. The nation also takes a leadership position in adopting value-based care models and population health management programs, further boosting chronic disease monitoring and customized patient care. Moreover, the prevalence of chronic diseases related to lifestyle and ongoing innovation in the delivery systems of healthcare reinforce its prominent position in the region.

Chronic Disease Management Market Dynamics

Drivers

-

The Rising Prevalence of Chronic Diseases Globally is driving the market growth.

The rising prevalence of chronic diseases like diabetes, cardiovascular illnesses, respiratory ailments, and cancer is a key factor fueling the market for chronic disease management. The World Health Organization (WHO) states that noncommunicable diseases contribute to nearly 74% of total deaths across the globe, with cardiovascular diseases causing approximately 17.9 million fatalities each year. The growing burden has increased the need for organized and ongoing care mechanisms. Reacting to this, healthcare payers and providers are investing in tech-enabled chronic care management (CCM) programs that remotely monitor patients, manage medication adherence, and decrease readmissions. Teladoc Health, for example, scaled its Chronic Care Complete program in 2023 to support integrated care for individuals suffering from more than one chronic illness, thus reaffirming the market's acceleration through tech-based disease tracking and proactive care.

-

Integration of Digital Health Technologies in Chronic Care is propelling the market to grow.

The increasing use of digital health technology like electronic health records (EHRs), telehealth systems, and artificial intelligence (AI)-powered analytics is transforming chronic disease care through enhanced patient participation, personalized treatment, and coordinated care. As smartphone penetration and internet usage improve, particularly in developing markets, patients can now communicate in real-time with physicians, access medical information, and receive prompt interventions. A significant development was witnessed in August 2024 when WellnessWits collaborated with IBM's Watsonx Assistant to introduce a virtual chronic care solution that facilitates AI-aided patient-specialist interaction. This transition to digital platforms not only simplifies the delivery of care but also aids healthcare systems in handling large patient populations more effectively, particularly during workforce shortages and increasing healthcare expenses, propelling significant growth in the chronic disease management ecosystem.

Restraint

-

Data Privacy and Interoperability Challenges are restraining the market growth.

One of the key constraints on the Chronic Disease Management Market is the constant worry about data privacy and the absence of interoperability between digital health systems. Chronic disease management is highly dependent on the gathering, sharing, and analysis of patient health information across different platforms—EHRs, mobile health applications, remote monitoring devices, and payer databases. But disjointed IT infrastructures, incoherent data standards, and unlinked systems restrict information flow between stakeholders and providers smoothly. Furthermore, as healthcare data breaches occur more frequently, trust from patients is affected, particularly when it pertains to confidential medical data. Adherence to strict data privacy regulations such as HIPAA in the United States or GDPR in the European Union makes integration processes even more complex. These problems inhibit the seamless implementation of structured care programs, especially in multi-provider networks or cross-border health environments, thereby limiting market scale.

Opportunities

-

The increasing use of artificial intelligence (AI) and predictive analytics is a major opportunity in the Chronic Disease Management Market.

With the increased availability of data from electronic health records (EHRs), wearable devices, and remote patient monitoring devices, healthcare providers can now use AI algorithms to detect risk patterns, forecast disease progression, and create personalized treatment plans. Predictive models allow for early intervention, minimizing hospital readmissions and enhancing long-term outcomes for patients with chronic disease. IBM Watson Health and Health Catalyst are among the companies investing in AI-driven platforms that facilitate proactive, real-time decision-making. This technological change not only increases clinical effectiveness but also enables payers and providers to maximize resource utilization and minimize costs, generating a value-based care setting that facilitates scalable and sustainable chronic disease management across varied healthcare systems.

Challenges

-

Fragmented Healthcare Infrastructure in Developing Regions creates challenges in the market growth.

One major hurdle that is preventing the expansion of the Chronic Disease Management Market is the underdeveloped and fragmented nature of healthcare infrastructure in most low- and middle-income countries. These countries usually have weak digital ecosystems, a lack of trained professionals, and inadequate fiscal support to roll out sophisticated chronic care management systems on a wide scale. Unstable access to primary care, poor internet connectivity, and low awareness of chronic disease technologies further hamper large-scale adoption. Even if digital health technologies are accessible, integration into local healthcare practices and systems continues to be hindered by differences in language, literacy, and regulation. Further, public health priorities in such settings may remain centered on control of infectious disease, with under-prioritization of chronic conditions. These systemic constraints foster inequalities in the management of diseases and impede the worldwide roll-out of technology-enabled chronic care solutions, forcing vendors to offer solutions that are both scalable and affordable.

Chronic Disease Management Market Segmentation Analysis

By Disease Type

The Cardiovascular Diseases segment dominated the Chronic Disease Management Market with a 43.11% market share in 2023, driven mainly by the high prevalence of heart-related diseases like hypertension, coronary artery disease, and heart failure across the globe. Cardiovascular diseases continue to be the most significant cause of morbidity and mortality globally, with the World Health Organization estimating more than 17 million deaths each year due to heart-related complications. This heavy burden has led to increased uptake of chronic disease management solutions, particularly designed to track and manage cardiovascular health. These solutions provide ongoing monitoring of blood pressure, cholesterol levels, and other vital biomarkers, enhancing preventive care as well as decreasing emergency intervention. In addition, healthcare professionals and payers increasingly incorporate digital platforms for remote monitoring and individualized treatment plans, which are especially useful for controlling complicated cardiovascular disease, cementing the segment's leadership in 2023.

By Service Type

In 2023, the Consulting Services segment dominated the Chronic Disease Management Market with a 42.31% market share because of the essential need for strategic advice in deploying and optimizing chronic care solutions. With healthcare organizations increasingly using digital platforms and data-driven tools to manage chronic diseases, they increasingly depend on expert consulting firms to deal with regulatory compliance, workflow integration, infrastructure planning, and change management. Such services play a key role in tailoring care models to meet unique patient populations and disease burdens. Further, the complexity of legacy-to-new interoperability for chronic care software has fuelled the need for professional guidance. The increase in value-based models of care and reimbursement complexity has further propelled providers to look for consultants with the capability to guarantee clinical and financial outcomes, making consulting services an essential element of effective chronic disease management programs.

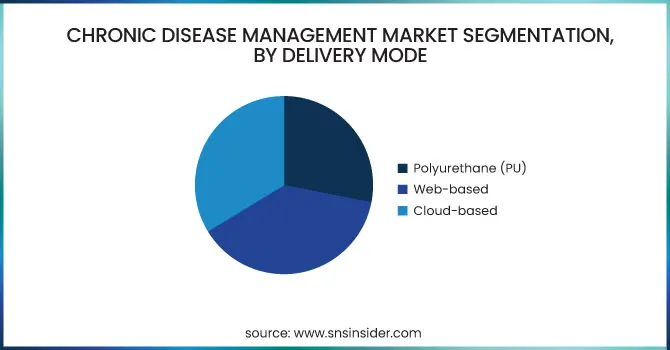

By Delivery Mode

The Web-based segment dominated the Chronic Disease Management Market with a 38.20% market share in 2023 because of its extensive availability, simplicity of integration with current healthcare IT systems, and affordability. Web-based solutions facilitate real-time monitoring of patients, data capture, and interaction between healthcare professionals and patients without necessitating large infrastructure or local installation. They are most appealing to hospitals, clinics, and small-scale establishments that desire instant deployment without the heavy cost of capital. In addition, the COVID-19 pandemic hastened the adoption of digital health, with most providers using web-based tools for virtual care, especially for chronic diseases such as diabetes, hypertension, and cardiovascular illnesses. The potential of web-based solutions to run on different devices and operating systems while being HIPAA compliant was also a driving force behind their dominance in 2023.

The Cloud-based segment is expected to be the fastest-growing delivery mode in the next forecast years because of its scalability, improved data storage, and smooth interoperability. Cloud platforms enable the integration of sophisticated analytics, artificial intelligence, and machine learning tools that are critical for predictive chronic disease management. As healthcare organizations move toward outcome-based care and population health programs, cloud solutions provide unified data access, facilitating coordinated care among various stakeholders. In addition, increasing requirements for telemedicine and remote patient monitoring are compelling providers to implement cloud platforms for data-driven, real-time decision-making. The cost-effectiveness, lower requirement for on-site infrastructure, and frequent updates of software render cloud systems a viable choice for scaling chronic care programs, particularly in areas with limited resources and rural areas.

By End User

The Providers segment dominated the Chronic Disease Management Market with a 78.25% market share in 2023 on account of their pivotal position in providing patient-centered care and managing long-term illnesses across various healthcare facilities. Primary care doctors, clinics, and hospitals are the initial points of contact for patients with chronic diseases like diabetes, cardiovascular diseases, and respiratory diseases. These payers increasingly depend on chronic disease management platforms to automate care coordination, guarantee medication compliance, remotely monitor patient progress, and avoid hospital readmissions. The transition to value-based care models has also pushed healthcare providers to implement digital solutions that enhance clinical outcomes at lower costs. Government programs and reimbursement incentives in favor of chronic care services have also encouraged provider investment in the same, further cementing their commanding position in the 2023 market situation.

Chronic Disease Management Market Regional Insights

North America dominated the Chronic Disease Management Market with a 41.62% market share in 2023 because of its sophisticated healthcare infrastructure, robust regulatory environment, and extensive adoption of digital health technologies. The region enjoys a high incidence of chronic diseases like diabetes, cardiovascular disease, and cancer, which creates demand for efficient management solutions. Also, the pro-active support provided by the U.S. government for remote patient monitoring, value-based care, and reimbursement drives has fueled the growth of chronic disease management platforms. The major industry players present in the region, such as Philips Healthcare, IBM, and Cerner, and the strong investments in healthcare IT and analytics further validate the region's leadership in this space.

Asia Pacific is the fastest-growing region in the Chronic Disease Management Market with 14.51% CAGR throughout the forecast period as a result of a fast-growing aging population, growing burden of chronic diseases, and increased access to healthcare through digitalization. Governments in nations like China, India, and Japan are making investments in telemedicine infrastructure and chronic care initiatives to address growing healthcare needs. The area is also experiencing increasing uptake of smartphones and internet penetration that facilitates scalable mobile health (mHealth) solutions. Moreover, collaborations between multinational players and regional healthcare providers are increasing the affordability and accessibility of chronic disease management solutions, which is driving the market's growth at a very fast pace across the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Chronic Disease Management Market

-

Philips Healthcare (HealthSuite Digital Platform, eCareCoordinator)

-

IBM Corporation (IBM Watson Health, Micromedex Solutions)

-

Siemens Healthineers (teamplay, AI-Rad Companion)

-

GE Healthcare (Mural Virtual Care, Centricity Practice Solution)

-

Allscripts Healthcare Solutions (FollowMyHealth, CareInMotion)

-

Cerner Corporation (HealtheIntent, PowerChart)

-

Epic Systems Corporation (MyChart, Healthy Planet)

-

McKesson Corporation (RelayHealth, InterQual)

-

Oracle Corporation (Oracle Health Management System, Oracle Care Management Cloud)

-

Teladoc Health, Inc. (Chronic Care Complete, Livongo for Diabetes)

-

Medtronic plc (CareLink System, Guardian Connect)

-

Omada Health (Omada for Diabetes, Omada for Hypertension)

-

Health Catalyst (Data Operating System, Care Management Suite)

-

Cognizant Technology Solutions (TriZetto CareAdvance, Health Insights Platform)

-

WellDoc, Inc. (BlueStar for Diabetes, BlueStar Rx)

-

eClinicalWorks (Healow, Chronic Care Management Module)

-

CareCloud, Inc. (Chronic Care Management Tools, CareCloud Central)

-

Lumeon Inc. (Care Pathway Manager, Patient Engagement Suite)

-

NextGen Healthcare (NextGen Population Health, NextGen Care)

-

Virgin Pulse (VP Transform for Diabetes, VP Navigate)

Suppliers (These suppliers provide essential components such as microprocessors, sensors, wireless modules, and connectivity chips. Their technologies enable real-time monitoring, data transmission, and integration of chronic disease management devices with digital health platforms.) in Chronic Disease Management Market.

-

Intel Corporation

-

Qualcomm Life, Inc.

-

Arrow Electronics, Inc.

-

Flex Ltd.

-

Jabil Inc.

-

Texas Instruments

-

Analog Devices, Inc.

-

Broadcom Inc.

-

Murata Manufacturing Co., Ltd.

-

STMicroelectronics

Recent Developments in the Chronic Disease Management Market

-

March 2023: Philips released its Virtual Care Management solution, aimed at providing a comprehensive telehealth experience. The solution is aimed at enhancing patient engagement and simplifying the management of chronic diseases through virtual care integration.

-

April 2024: Siemens Healthineers hosted a webinar entitled "Role of Biomarkers in the Cardiovascular Management of Patients with Cancer," highlighting the role of biomarkers in managing chronic cardiovascular diseases among cancer patients.

-

August 2024: IBM has collaborated with WellnessWits to use watsonx X Assistant to help build an AI-based virtual care platform. The product allows chronic disease experts to remotely connect with patients, raising accessibility to specialist care and customized information.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.83 Billion |

| Market Size by 2032 | US$ 15.58 Billion |

| CAGR | CAGR of 13.74 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Consulting Services, Implementation Services, Educational Services, Other) • By Disease Type (Cardiovascular Diseases, Diabetes, Respiratory Diseases, Cancer, Chronic Kidney Disease, Others [Arthritis, etc.]) • By Delivery Mode (On-premise, Web-based, Cloud-based) • By End User (Providers, Payers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Philips Healthcare, IBM Corporation, Siemens Healthineers, GE Healthcare, Allscripts Healthcare Solutions, Cerner Corporation, Epic Systems Corporation, McKesson Corporation, Oracle Corporation, Teladoc Health, Inc., Medtronic plc, Omada Health, Health Catalyst, Cognizant Technology Solutions, WellDoc, Inc., eClinicalWorks, CareCloud, Inc., Lumeon Inc., NextGen Healthcare, Virgin Pulse, and other players. |