Cable Glands Market Report Scope & Overview:

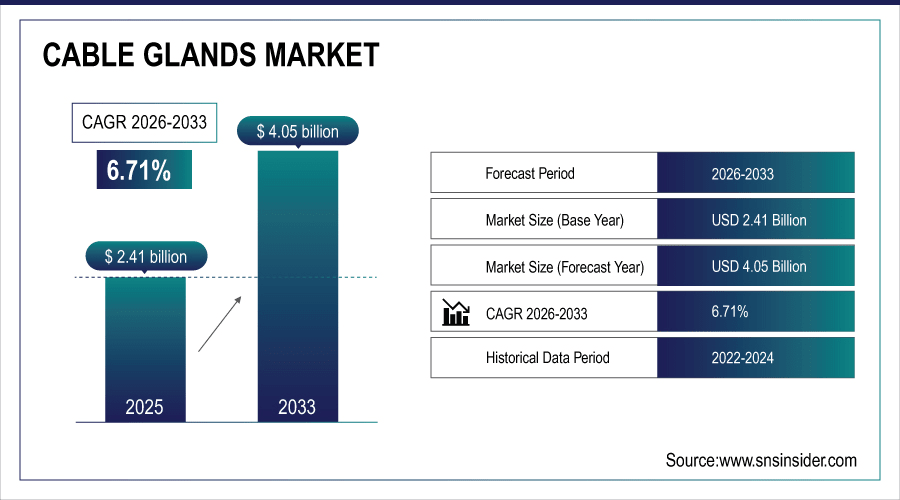

The Cable Glands Market size was valued at USD 2.41 Billion in 2025E and is projected to reach USD 4.05 Billion by 2033, growing at a CAGR of 6.71% during 2026-2033.

The Cable Glands Market analysis highlights the increasing demand in response to rising automation and infrastructure. Armored and All-Stainless Cable Glands Are the Most Common Option The most commonly used types are armored and all stainless-steel glands, because they are durable and meet safety requirements. The industry is relatively concentration, the key brand includes IBRICK HOLDING, General Shale and Boral, Limited etc. Online and offline channels of distribution are also adapting to face the increasing demand from consumers in all sectors.

Over 60% of new industrial facilities commissioned in 2024–2025 (especially in energy, oil & gas, and manufacturing) specify armored cable systems, driving demand for compatible cable glands.

To Get More Information On Cable Glands Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 2.41 Billion

-

Market Size by 2033: USD 4.05 Billion

-

CAGR: 6.71% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Cable Glands Market Trends

-

Rising automation in manufacturing, oil & gas, and power industries is boosting the requirement for durable and high performing cable glands worldwide.

-

There has been an upsurge in e-commerce platforms as well as digital sales channel, leading to easier availability of cable glands and faster delivery times.

-

Stainless steel, brass and high-performance polymers provide corrosion resistance and boost safety in harsh environments.

-

Increasing focus on IECEx, ATEX and UL certifications drive product design and increase industrial uptake.

-

Quick industrialization of Asia-Pacific and Latin America region fuels the infrastructure projects in turn boosting demand for cable gland.

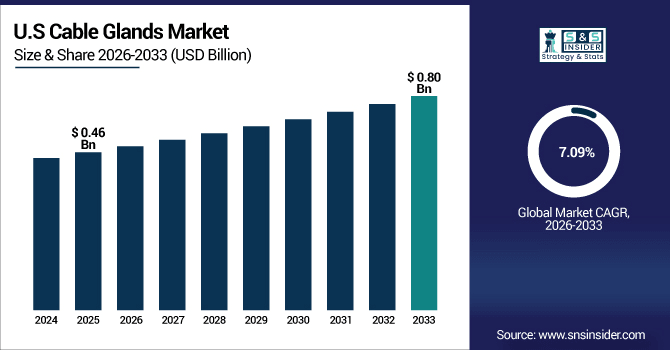

The U.S. Cable Glands Market size was valued at USD 0.46 Billion in 2025E and is projected to reach USD 0.80 Billion by 2033, growing at a CAGR of 7.09% during 2026-2033. Cable Glands Market growth is driven by rising demand for heavy machinery, impact resistant machinery, and weather-roof construction will support expansion of this industry. They are molybdenum disulfide coated and 316 stainless steel cable glands most commonly used because they are resistant to corrosion, last longer versus standard models in industrial use and satisfy safety requirements.

Cable Glands Market Growth Drivers:

-

Growing Industrial Automation and Infrastructure Development Driving Cable Glands Market Demand Globally

Growing penetration of industrial automation as well as rising infrastructure projects, especially in oil & gas, power, and manufacturing industries is driving the need for robust and long-lasting cable glands. Industries need hardworking solutions for safety, efficiency and quality. These developments are also driven by technological progress, resulting in the availability of high specification cable glands which can be used in severe and hazardous duty areas.

Global industrial automation installations are projected to exceed 3.2 million robotic units by end of 2025, with each robot requiring 15–30+ cable glands for motor, sensor, and control wiring

Cable Glands Market Restraints:

-

High Raw Material Costs and Volatile Pricing Hampering Cable Glands Market Growth

Changing raw material prices, particularly of the likes of stainless steel and brass as well as high-performance polymers, are having an effect on the overall price of cable glands. Small and medium companies struggle with maintaining profitability while keeping their ear to the ground about safety compliance. Moreover, heavy regulations and certification requirements escalate production costs that are not easily passed on to consumers; this constrains growth of the market to some extent in cost sensitive regions and developing countries.

Cable Glands Market Opportunities:

-

Emerging Markets and Smart Industrial Applications Present Growth Opportunities for Cable Glands Market

Quick industrialization in APAC, Middle East and Latin America is promoting infrastructure development and boosting requirement for cable glands. Rise in demand for automation and industrial internet of things (IIoT)-based solutions from the power sectors such as smart grids is expected to create huge opportunities. Opportunity exists for manufacturers to leverage this trend, with advanced certified products, enhanced distribution networks and customized solutions geared toward specific industrial applications in low-penetrated markets.”

China and India together accounted for 58% of global industrial construction output in 2023, with over 12,000 new industrial parks and special economic zones (SEZs) under development across APAC as of early 2024.

Cable Glands Market Segment Analysis

-

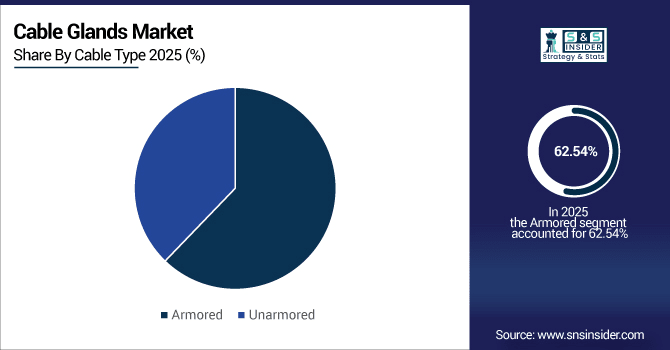

By Cable Type, armored cable glands are projected to hold a 62.54% market share in 2025, while unarmored cable glands are expected to be the fastest-growing segment with a CAGR of 8.50%.

-

By Material, stainless steel cable glands are expected to dominate the market with a 45.27% share in 2025, whereas plastic/nylon cable glands are growing fastest at a CAGR of 9.20%.

-

By Type, industrial cable glands are projected to lead with a 67.56% share in 2025, while hazardous-type cable glands are the fastest-growing segment at a CAGR of 8.70%.

-

By End-User, the oil and gas sector is expected to hold 55.12% of the market in 2025, whereas the mining sector is the fastest-growing end-user segment at a CAGR of 10.20%.

By Cable Type, Armored Leads Market While Unarmored Registers Fastest Growth

Armored cable glands are ruling the marketplace because they have been designed to be sturdy and durable hence certified for hazardous or industrial settings. They are commonly used in safety critical industries, including oil & gas and chemical processing. Nevertheless, unarmored cable glands are projected to record the fastest growth on account of their lightweight, low cost and easy installation especially in commercial and residential applications which is boosting adoption in developing as well as developed economies.

By Material, Stainless Steel Dominate While Plastic/Nylon Shows Rapid Growth

Stainless steel cable glands are so popular among the users due to their outstanding property of resistance against the corrosion for a long life, high strength and designed as per universal safety standards, ideal for industrial and outdoor use. Despite this, there's significant growth in Plastic and nylon cable glands. They're light weight, cheap and nonconductive. keeping them an interest in applications including residential, commercial and low voltage situations. This trend is particularly evident in emerging markets which are increasingly developing their infrastructures.

By Type, Industrial Lead While Hazardous Registers Fastest Growth

Industrial Cable Glands are becoming very popular as they are used in manufacturing and energy industries, heavy industry and also the protection offered to for dust, water exposure or chemical influences from recent storms Industrial cable Glands dominate the market. Hazardous-type cable glands are expected to be the fastest growing segment due to the strong regulations for safety measures in Oil & Gas, chemical and mining industry. Rising awareness about safety of work place and adherence to the international standards is expected to drive demand for specialized cable glands in hazardous environment across the world.

By End-User, Oil and Gas Lead While Mining Grow Fastest

Oil & gas industry accounts for largest end-use application of cable glands as it is in requirement of high performance, certified and corrosion-resistant products. The fastest growth is in the mining industry but all industries are expanding their mining operations and need more rugged cable glands that can take a beating underground. Rising industrialization, exploration of resources and the rise of automation in mining underpins this rapid rate of take-up.

Cable Glands Market Regional Analysis:

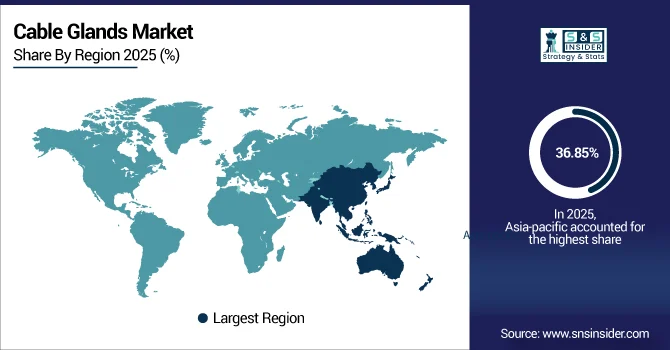

Asia-pacific Cable Glands Market Insights

In 2025E Asia-Pacific dominated the Cable Glands Market and accounted for 36.85% of revenue share, this leadership is due to the strong growth based on fast industrialization as well as infrastructure development. Growing use in manufacturing, power and construction applications in counties such as India, Japan, South Korea is fuelling the demand for cable glands. The market is supported by strong demand for industrial automation and smart grids in the region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China Cable Glands Market Insights

China is the leading market in Asia-Pacific region on account of significant industrial and power projects establishment. Cable glands are an essential product for the manufacturing, oil & gas and renewable energy sectors in the country.

North America Cable Glands Market Insights

North America is expected to witness the fastest growth in the Cable Glands Market over 2026-2033, with a projected CAGR of 7.26% due to industry is mature, and the growth depends on each country mainly U.S demand grows steady Industrial as oil &gas Chemical are driving markets. Stringent safety and certification requirements such as UL approval make choosing and installing a product challenging. Ongoing demand is being helped by infrastructure improvements and automation projects.

U.S. Cable Glands Market Insights

The U.S. cabling glands market in North America is largest and supported by industrial automation and energy infrastructure projects. The downstream demand is dominated by the oil & gas and manufacturing industry.

Europe Cable Glands Market Insights

Europe remains a major market for cable glands with Germany, France and the U.K. being lead consumers in the region End users active within industry automation, renewable energy and in manufacturing are ranked as key consumers of such product (cable glands). Stainless steel type cable glands are more prevalent due to its robustness and also meets the certain safety standards.

France Cable Glands Market Insights

Automotive, energy and manufacturing are the major industries in France which is Europe's largest market of cable glands. Quality guarantee of ATEX and IECEx certification for operating in explosive atmosphere. Chemical and industrial environments favor armored high performance cable glands.

Latin America (LATAM) and Middle East & Africa (MEA) Cable Glands Market Insights

The Cable Glands Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the growing requirement of cable glands in industrial and energy sectors. Mining, oil & gas and construction industries are the major end-users. Infrastructure growth and increase in automation are the key factors that expanding the market. The advent of stainless steel and plastic/nylon cable glands are becoming more popular because they combine the advantages of: Inexpensive, durable fittings and construction.

Cable Glands Market Competitive Landscape:

Amphenol Corporation is a multinational pioneer in electrical and electronic connector products like industrial cable glands. The firm specializes in providing rugged performance and high-quality products for use in harsh environments. Its range includes both armoured and unarmored stainless steel cable glands. Good R&D and global distribution network to expand the market.

-

In August, 2025, Amphenol announced a $10.5 billion acquisition of CommScope’s Connectivity and Cable Solutions business. This strategic move aims to enhance Amphenol’s position in the U.S. wireless infrastructure market and expand its capabilities in fiber-optic interconnect technologies.

Bartec Group is a company that focusses on explosion protection and safety and provides an extensive portfolio of cable glands for hazardous environments. When you choose a product with the Peli name on, you'll get products that are ATEX and IECEx certified to tolerate use in all atmospheres. The firm's clients serve in oil & gas, chemical and mining industries.

-

In August 2025, BARTEC introduced the ComEx Global product line, marking a milestone in its history. The new series brings together innovative minds to create a product portfolio that meets the highest technical and normative standards for hazardous areas.

CMP Products Limited offers and manufactures industrial cable glands, cleats and accessories for the electrical construction industry. The brand is dedicated to high standard gates hardware product series and office since its inception, such as stainless steel/brass Pull push Handles, Stair Handrail brackets Patented designed- glass balustrade, Glass Clamps etc. High quality materials - stainless steel 304 guarantees quality and reliability.

-

In May 2025, CMP Products announced a strategic partnership with TEC Sales, a Texas-based electrical manufacturer representative. This alliance aims to enhance cable management support in the Southern U.S., following CMP’s 25th anniversary celebrations in the Americas.

Eaton Group offers high performance cable glands and electrical systems for industrial and hazardous environments. Their lines consist of expovable and non-expovable product ranges for ease and safe usage. Eaton emphasizes energy efficiency and innovation, as well as conforming to such global standards as IECEx and UL. Powerful distribution channels drive extensive market penetration in sectors like oil & gas, manufacturing and utilities.

-

In April 2024, Eaton signed a Memorandum of Understanding (MoU) with the Tamil Nadu Government to expand its Crouse-Hinds and B-Line operations in India. This expansion aims to bolster Eaton's manufacturing capabilities and support the growing demand for electrical infrastructure in the region.

Cable Glands Market Key Players:

Some of the Cable Glands Market Companies are:

-

Amphenol Corporation

-

Bartec Group

-

CMP Products Limited

-

Eaton Group (Cooper Crouse-Hinds Electric Company)

-

ABB Ltd

-

Cortem SPA

-

Emerson Industrial Automation

-

Elsewedy Electric

-

Hubbell Incorporated

-

Jacob GmbH

-

R. Stahl AG

-

Quanguan Electric

-

Warom Technology Incorporated

-

TE Connectivity Ltd

-

Lapp Group

-

Mencom Corporation

-

3M

-

Hummel AG

-

Prysmian Group

-

Schneider Electric

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 2.41 Billion |

| Market Size by 2033 | USD 4.05 Billion |

| CAGR | CAGR of 6.71% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Cable Type (Armored, Unarmored) • By Material (Brass, Stainless Steel, Plastic/Nylon, Others) • By Type (Industrial, Hazardous) • By End User (Oil and Gas, Mining, Aerospace and Defense, Manufacturing and Processing, Chemical, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Amphenol Corporation, Bartec Group, CMP Products Limited, Eaton Group (Cooper Crouse-Hinds Electric Company), ABB Ltd, Cortem SPA, Emerson Industrial Automation, Elsewedy Electric, Hubbell Incorporated, Jacob GmbH, R. Stahl AG, Quanguan Electric, Warom Technology Incorporated, TE Connectivity Ltd, Lapp Group, Mencom Corporation, 3M, Hummel AG, Prysmian Group, Schneider Electric |