E-Discovery Market Report Scope & Overview:

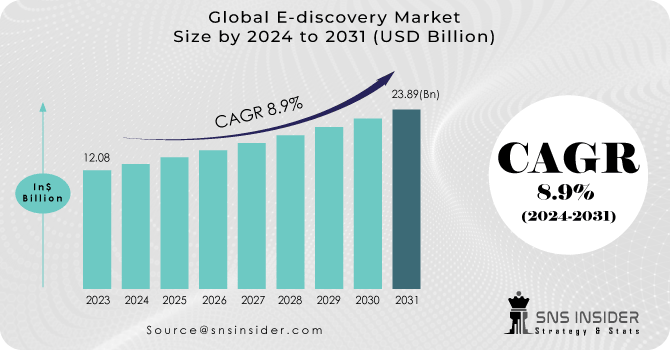

The e-discovery market size was valued at USD 13.58 billion in 2023 and is expected to reach USD 31.40 billion by 2032, growing at a CAGR of 9.80% over the forecast period of 2024-2032.

Get more information on E-discovery Market - Request Sample Report

The e-discovery market analysis highlights how the growing amount of electronic data being generated and stored, increasing compliance requirements, and growing adoption of cloud-based solutions are propelling the market expansion. From emails, documents, and social media postings to chat logs organizations in all sectors are creating huge volumes of electronically stored information (ESI). With legal disputes, regulatory investigations, and corporate audits becoming much more data-intensive, organizations are turning to e-discovery solutions that collect, process, review and produce relevant information quickly and accurately.

In addition, the global data privacy legislation including the GDPR, CCPA, and HIPAA is increasing the requirement for advanced e-discovery that provides compliance along with reduced legal risk and expense. In 2024, the world is set to create 402.74 million terabytes of data each day and global data storage is projected to surpass 200 zettabytes by 2025. Approximately 87% of organizations have difficulties meeting the compliance standards of the GDPR, and 722 healthcare data breaches were registered in 2022, which exposed millions of protected health records.

The second big driver for the e-discovery market growth is the accelerating application of AI and automation across e-discovery workflows. Legal teams and companies are now doing the document review and litigation support to a whole different level using AI-powered analytics, Predictive coding, and Machine learning algorithms. These technologies help minimize manual work, boost accuracy, and resolve cases faster.

Additionally, with increased cybersecurity risks and data breaches, the requirement for e-discovery processes that are secure and defensible has increased even further. Manufacturing, healthcare, and BFSI sectors are progressively adopting e-discovery solutions for better governance, risk and compliance management amid changing legal and regulatory environments. In 2024, 34% of legal professionals are incorporating generative AI into their practice in 2024, and 17.5% are using it directly on live matters. The healthcare sector experienced 677 large-scale breaches impacting 182.4 million people.

E-Discovery Market Dynamics:

Key Drivers:

-

Rising Data Complexity Drives Demand for Advanced E-Discovery Solutions and Strategic Industry Investments

The growing complexity of legal cases is driving the demand for advanced e-discovery solutions. As sectors such as intellectual property, financial fraud, and class action lawsuits face ever-increasing complexities, the magnitude of data is making legal disputes much more advanced. With organizations capturing more information on-premises, in the cloud, and in hybrid environments, the ability to search effectively across platforms becomes imperative. Such complexity compels organizations to look for e-discovery solutions that are capable of handling various data types such as multimedia, social media content, and cloud-based files.

This makes hundreds of legacy e-discovery tools obsolete, resulting in investing by legal firms and corporates in automated and advanced e-discovery tools, quicker preparation of the case by fewer people required for manual review, and quicker access to necessary documents. Everlaw saw data complexity burst the document versions per user to a 17% increase in 2024. Faced with the growing challenges created by increasingly large and complex volumes of data, the e-discovery industry reported 21 mergers, acquisitions, and investment activity.

-

AI and ML Revolutionize E-Discovery Workflows Enhancing Efficiency Accuracy and Legal Compliance

The rapid development of AI and ML technologies is reshaping the experience of discovery. AI tools make it possible for organizations to process a lot of information to pick relevant content and topics with fewer human inputs. By processing large datasets, AI algorithms can highlight important documents, find e-discovery market trends, and predict likely outcomes, which minimizes the time and expenses involved in e-discovery. Additionally, machine learning models keep improving case-by-case, and this enables such systems to learn from their past experiences and deliver more accurate results in the long run.

This ongoing evolution not only serves to improve the productivity of legal teams but also underpins the entire-discovery process ensuring defensibility that allows an organization to comply with regulations while at the same time reducing potential legal risks. With the addition of AI (Artificial Intelligence) and ML (Machine Learning) to the e-discovery workflows, the year 2024 already seems to be bringing the e-discovery industry the twin benefits of great efficiency and accuracy. More than 43.21% of the respondents have adopted and deployed these technologies with only 4.94% not planning on doing so, a positive sign of adoption.

Restraints:

-

Addressing Security Challenges and Data Complexity in E-Discovery for Sensitive Information and Compliance

With organizations having sensitive information in several places, the possibility of data breaches, cyber threats, and unauthorized access grows. Keeping electronic discovery (ECA/ESI) secure during collection, processing, and review is a major issue extremely vital in industries including healthcare, BFSI, and the government, as they need to be compliant with numerous stringent data protection laws. The need to manage untapped and diverse data is another big challenge. Analyzing information across siloed data sources efficiently is a challenge as e-discovery solutions have to ingest data from multiple sources, including emails, social media, messaging apps, cloud storage, and IoT devices. Worse, legal teams must contend with data integrity, chain of custody, and other interoperability issues, ultimately slowing investigations and introducing increased risk of litigation and compliance errors.

E-Discovery Market Segmentation Analysis:

By Component

The solutions segment accounted for the largest e-discovery market share of 56.3% in 2023 as organizations are adopting more e-discovery software platforms that include features, such as automation, AI-driven analytics, and cloud-based offerings. To help organizations and legal firms meet e-discovery demands, significant investments are being made in e-discovery software solutions to automate data collection, processing, review, and analysis steps, enabling more efficient management of legal and regulatory challenges. There has been a surge in demand for AI-led and self-service utilities for catering the growing need for moving away from the dependence on external legal teams and to improve the use of in-house e-discovery resources.

The services segment is expected to expand at the fastest CAGR over 2024-2032 owing to the surging demand among organizations for managed e-discovery services, litigation support, and consulting. Not all organizations have the knowledge and resources to do e-discovery in-house, especially on the scale and complexity e-discovery often requires, so they will bring in service providers who specialize in complex data analysis. Apart from this, increased cross-border litigation and stricter data privacy regulations necessitate compliance management, forensic investigation, and expert witness services.

By Organization Size

Large enterprises accounted for the largest market share of 54.8% in 2023 as they typically have higher litigation risks and regulatory compliance requirements, and greater financial resources to invest in high-value e-discovery solutions. Corporations, in particular, deal with enormous amounts of electronically stored information (ESI) in multiple locations and platforms such as banking, healthcare, IT, and government. That puts them closely reliant upon AI-based e-discovery software, predictive analytics, and cloud-based legal administration tools that very thoroughly process and analyze data through legal disputes, audits, and compliance investigations.

Small to medium-sized enterprises (SMEs) are anticipated to achieve the highest growth CAGRs (2024-2032) because cloud-based e-discovery services are becoming progressively more affordable and accessible to smaller organizations. Although onboarding e-discovery solutions was a challenge for small and medium enterprises due to high implementation costs and limited IT infrastructure, the cloud-based solution is a boon for these companies. With the advent of SaaS-based e-discovery platforms, a growing number of SMEs are now able to afford solutions that scale as their needs grow, without the need for an oversized initial investment. They have also been exposed to compliance and legal risks as they are growing, so they need e-discovery tools to become compliant and avoid any costly litigation.

By Deployment mode

In 2023, the e-discovery market was dominated by the on-premises segment accounting for a 52.3% share owing to its advantages of higher security, data control, and regulatory compliance. These e-discovery solutions are usually geared toward those organizations that need to retain access and control over sensitive data that lay in their custodian's cellular phone data archives, computer drive, business documents, and emails, cases in highly regulated industries (banking, government, healthcare, and legal services). Such on-premise deployment aids in enhanced data privacy, cybersecurity risk reduction, and adherence to stringent regional laws including GDPR, HIPAA, and CCPA, which often place restrictions on cloud storage.

The cloud-based e-discovery segment is anticipated to achieve the highest CAGR from 2024-2032, owing to the growing need for e-discovery solutions that are cost-effective, scalable, and equipped with AI functionalities. Cloud deployment allows organizations, especially SMEs and remote teams, to access e-discovery tools from anywhere, minimize instance costs without any initial capital expenses, and scale up effortlessly. The growing adoption of hybrid work practices, exploding data growth, and the increasing need for real-time partnership have compelled companies to migrate to cloud-based e-discovery solutions. Additionally, cloud security controls have matured with encryption and data compliance automation tools increasing the trust factor in cloud-based solutions to mitigate data privacy concerns.

By Vertical

In 2023, legal was the most significant end-use sector in the e-discovery market, accounting for 31.7% of the total revenue owing to its heavy dependence on digital evidence, litigation support, and regulatory compliance. Lawyers conduct matters that generate and handle all forms of electronically stored information (ESI), including emails, contracts, court filings, and case documents, and corporate legal departments and government agencies also conduct ESI matters. As litigations rise, more mergers & acquisitions, and more intellectual property disputes take place, legal professionals are turning towards sophisticated e-discovery solutions to enable them to collect, review, and analyze data for investigations and case preparation.

The manufacturing segment is projected to expand at the highest CAGR over 2024-2032 owing to the rising number of litigation cases including but not limited to product liability, theft of intellectual property (IP), and supply chain disputes. As manufacturers expand globally, they have found themselves subjected to complex regulatory requirements and cross-border legal challenges, all of which require efficient e-discovery solutions that allow manufacturers to properly manage compliance and mitigate risk. E-discovery has become critical for internal audits, regulatory investigations, and dispute resolution, too, due to the explosion of digital data resulting from the rapid adoption rate of Industry 4.0, IoT, and digital supply chain management.

E-Discovery Market Regional Outlook:

In 2023 North America held the largest e-discovery market share of 43.4%, with the region being home to stringent regulatory environments, active litigation, and high adoption of technology in the legal market. Large enterprises and top-tier law firms and government agencies in the U.S. and Canada looking for AI-based e-discovery solutions to address complex legal and compliance requirements have been driving demand.

With stringent data preservation and retrieval policies being mandated by regulators including the U.S. Federal Rules of Civil Procedure (FRCP), the Freedom of Information Act (FOIA), and the California Consumer Privacy Act (CCPA), e-discovery is a critical process. Furthermore, adoption from North America by larger technology and cloud service providers such as Microsoft, OpenText, and Relativity have been headquartered there, significantly increasing market growth.

Asia-Pacific (APAC) region is predicted to grow at the highest CAGR in the e-discovery market 2024-2032, driven by the rapid digital transformation, growing regulatory enforcement, and the growing number of class action cases with cross-border implications. The Personal Information Protection Law (PIPL) in China and the Digital Personal Data Protection Act (DPDP) Act in India, along with a few other countries, such as Japan and Australia also tightening data privacy laws, which require the implementation of e-discovery solutions to be compliant with such regulations.

At the same time, the growth of multinational corporations and the rise of IP conflicts have led to increased demand for AI-based cloud e-discovery solutions. For instance, Samsung has made large investments into e-discovery tools to streamline the handling of its IP litigation and trade secret disputes, which indicates how quickly e-discovery is becoming critical for key players in the manufacturing and technology verticals across APAC.

Key players:

Some of the major E-discovery Companies in the Market are:

-

Relativity (Chicago, Illinois, U.S.)

-

OpenText Corporation (Waterloo, Ontario, Canada)

-

Exterro, Inc. (Beaverton, Oregon, U.S.)

-

Microsoft Corporation (Redmond, Washington, U.S.)

-

IBM Corporation (Armonk, New York, U.S.)

-

Nuix Limited (Sydney, Australia)

-

Lighthouse (Seattle, Washington, U.S.)

-

Conduent (Florham Park, New Jersey, U.S.)

-

FTI Consulting, Inc. (Washington, D.C., U.S.)

-

Logikcull (San Francisco, California, U.S.)

Recent Developments:

-

In January 2024, Relativity announced expansions to its aiR suite, introducing aiR for Review, aiR for Privilege, and aiR for Case Strategy, leveraging generative AI to enhance legal workflows, document review, and case management.

-

In January 2024, Exterro introduced Exterro Assist, a generative AI tool designed to automate e-discovery tasks, enhance data insights, and improve productivity by up to 75%, initially available for Legal Hold customers.

-

In August 2024, Microsoft launched an updated, user-friendly eDiscovery interface, streamlining workflows and enhancing efficiency for legal professionals.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 13.58 Billion |

| Market Size by 2032 | USD 31.40 Billion |

| CAGR | CAGR of 9.80% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions, Services) • By Organization Size (Large Enterprises, SMEs) • By Deployment mode (On-premises, Cloud) • By Vertical (Government & Public Sector, Legal, Banking, Financial Services, and Insurance, Energy & Utilities, Healthcare & Life Sciences, Retail & Consumer Goods, Manufacturing, IT & Telecommunications, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Relativity, OpenText Corporation, Exterro, Inc., Microsoft Corporation, IBM Corporation, Nuix Limited, Lighthouse, Conduent, FTI Consulting, Inc., Logikcull. |

| Key Drivers | • Rising Data Complexity Drives Demand for Advanced E-Discovery Solutions and Strategic Industry Investments • AI and ML Revolutionize E-Discovery Workflows Enhancing Efficiency Accuracy and Legal Compliance |

| Restraints | • Addressing Security Challenges and Data Complexity in E-Discovery for Sensitive Information and Compliance |