Cattle Feed Market Report Scope & Overview:

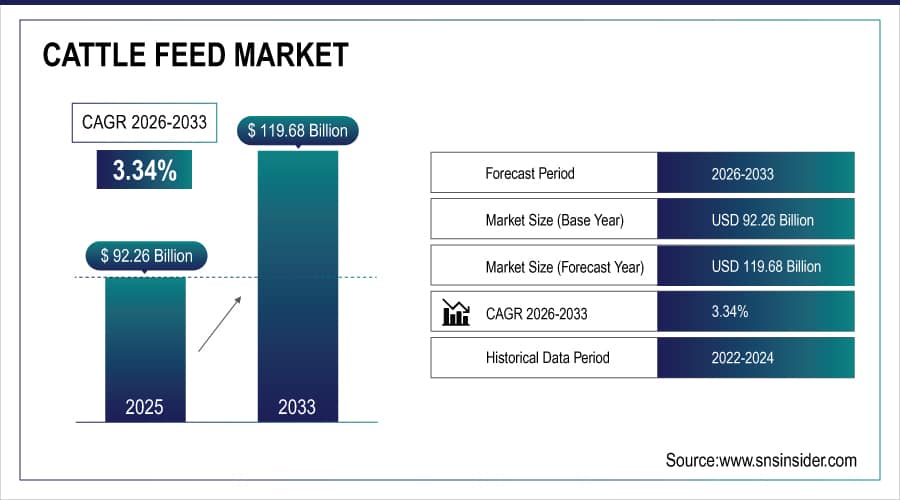

The Cattle Feed Market Size is valued at USD 92.26 Billion in 2025E and is projected to reach USD 119.68 Billion by 2033, growing at a CAGR of 3.34% during the forecast period 2026–2033.

The Cattle Feed Market analysis report offers a detailed overview of industry trends, highlighting rising demand for high-quality, nutrient-rich feed and sustainable livestock practices. Increasing dairy and meat consumption, farm intensification and focus on animal health are expected to drive market growth.

Cattle Feed consumption reached 235 million metric tons in 2025, driven by rising livestock populations and growing demand for nutrient-rich feed.

To Get More Information On Cattle Feed Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 92.26 Billion

-

Market Size by 2033: US 119.68 Billion

-

CAGR: 3.34% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Cattle Feed Market Trends:

-

Growing focus on livestock health and productivity is driving demand for nutrient-rich and fortified cattle feed products.

-

Increasing adoption of specialized feed types such as silage, concentrates and mineral supplements is expanding the application scope across dairy and meat cattle.

-

Awareness of animal nutrition and feed efficiency is boosting consumption among commercial and smallholder farms.

-

Wider market penetration is being enabled by online platforms, cooperatives and specialty agro-stores.

-

Demand for convenient feed formats such as pellets, crumbles and blocks is rising, especially among large-scale farms.

-

Sustainable sourcing, eco-friendly production and organic feed formulations are trending, reflecting growing emphasis on environmentally conscious livestock farming.

U.S. Cattle Feed Market Insights:

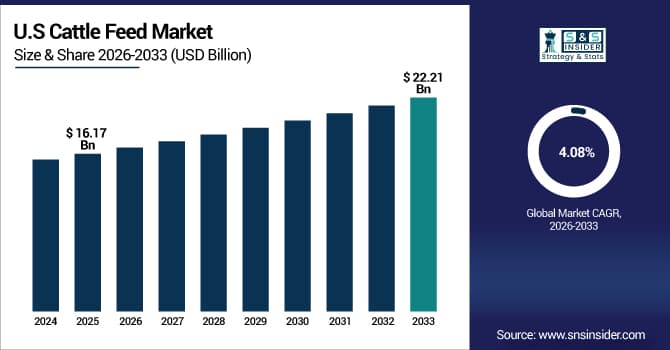

The U.S. Cattle Feed Market is projected to grow from USD 16.17 Billion in 2025E to USD 22.21 Billion by 2033, at a CAGR of 4.08%. Market growth is driven by rising demand for high-quality dairy and beef products, increasing adoption of fortified and specialty feed and strong focus on livestock productivity, animal health and sustainable farming practices.

Cattle Feed Market Growth Drivers:

-

Rising demand for high-yield livestock and nutrient-rich feed formulations driving cattle feed market growth.

Rising demand for high-yield livestock is a key driver of the Cattle Feed Market Growth. Farmers are increasingly adopting nutrient-rich and fortified feed formulations to enhance milk, meat and overall animal productivity. Specialized feed types, including concentrates, silage and mineral supplements are being integrated into daily livestock diets. This focus on animal nutrition and efficiency is improving herd health, reducing mortality and supporting sustainable farming practices, thereby driving market expansion.

Cattle feed demand grew 3.6% in 2025, driven by rising livestock productivity needs and adoption of nutrient-rich feed.

Cattle Feed Market Restraints:

-

Fluctuating raw material costs and limited access to high-quality feed ingredients are constraining market growth.

Fluctuating raw material costs and limited availability of high-quality feed ingredients pose significant restraints for the Cattle Feed Market. Feed production depends on consistent supply of grains, protein meals and mineral supplements, which are impacted by climate, crop yields and commodity prices. Quality standards, fortification requirements and regulatory compliance further limit scalability. These challenges increase production costs, affect affordability for smallholder farmers and create entry barriers for new players aiming to compete in the nutrient-rich and specialty feed segments.

Cattle Feed Market Opportunities:

-

Growing demand for fortified, organic and specialty cattle feed offers opportunities for innovative and high-value products.

Growing demand for fortified, organic and specialty cattle feed presents a significant opportunity for the market. Farmers are seeking high-quality, nutrient-rich feed to improve livestock productivity, health and product quality. Manufacturers are innovating with mineral-enriched, probiotic and sustainable feed formulations to meet these needs. This focus on premium, value-added feed solutions enable brand differentiation, expands market reach and creates new product segments, supporting long-term growth in the livestock nutrition and sustainable farming sector.

Fortified and specialty cattle feed accounted for 28% of new product launches in 2025, driven by rising demand for nutrient-rich, high-performance livestock feed.

Cattle Feed Market Segmentation Analysis:

-

By Feed Type, Compound Feed held the largest market share of 38.25% in 2025, while Mineral & Vitamin Supplements are expected to grow at the fastest CAGR of 5.18% during 2026–2033.

-

By Form, Pellets accounted for the highest market share of 42.13% in 2025, while Liquid is projected to expand at the fastest CAGR of 6.24% during the forecast period.

-

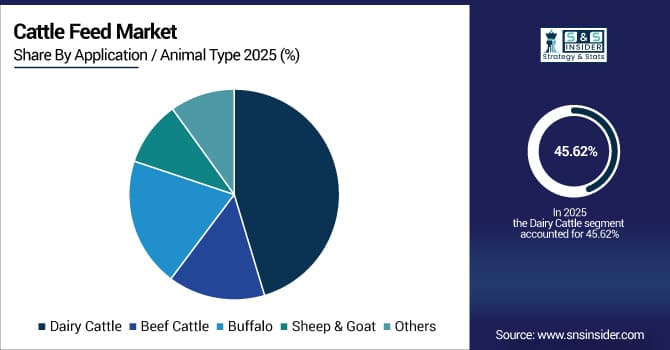

By Application / Animal Type, Dairy Cattle dominated with a 45.62% share in 2025, while Buffalo is anticipated to record the fastest CAGR of 5.32% through 2026–2033.

-

By Distribution Channel, Feed Mills held the largest share of 50.14% in 2025, while Online Retail is expected to grow at the fastest CAGR of 7.11% during 2026–2033.

-

By End-Use, Commercial Farms accounted for the largest share of 47.86% in 2025, while Organic Farms are forecasted to register the fastest CAGR of 6.45% during 2026–2033.

By Feed Type, Compound Feed Dominates While Mineral & Vitamin Supplements Grow Rapidly:

Compound Feed segment dominated the market due to its balanced nutrition, consistent quality and suitability for large-scale dairy and beef operations. It is widely adopted to enhance milk yield, weight gain and feed efficiency. In 2025, compound feed consumption exceeded 88 million metric tons globally.

Mineral and Vitamin Supplements is the fastest growing segment, driven by rising focus on herd immunity, reproductive health and productivity optimization. In 2025, supplement consumption crossed 29 million metric tons, reflecting increased precision nutrition practices.

By Form, Pellets Dominate While Liquid Feed Expands Rapidly:

Pellets segment dominated the market owing to its high digestibility, reduced wastage, ease of storage and suitability for mechanized feeding systems. Commercial farms favor pellets for consistent nutrient delivery and operational efficiency. In 2025, pellet-based cattle feed volume surpassed 102 million metric tons.

Liquid is the fastest growing segment, supported by rising adoption in high-performance dairy farms for improved palatability and nutrient absorption. Liquid feed usage reached 21 million metric tons in 2025, driven by precision feeding trends.

By Application / Animal Type, Dairy Cattle Dominate While Buffalo Feeding Grows Rapidly:

Dairy Cattle segment dominated the market due to continuous demand for milk production and year-round feeding requirements. Feed optimization for lactation, fertility and yield efficiency remains a priority. In 2025, dairy cattle feed consumption exceeded 110 million metric tons.

Buffalo is the fastest growing segment, particularly in Asia-Pacific regions, supported by rising buffalo milk demand. In 2025, buffalo feed demand crossed 34 million metric tons, reflecting expanding commercial buffalo farming.

By Distribution Channel, Feed Mills Dominate While Online Retail Expands Rapidly:

Feed Mills segment dominated the market due to bulk production capacity, standardized formulations and long-term supply contracts with commercial farms and cooperatives. Centralized manufacturing ensures consistent quality and cost efficiency. In 2025, feed mills supplied over 145 million metric tons of cattle feed.

Online retail is the fastest growing segment, driven by digital adoption among farmers and demand for specialty feed products. Online cattle feed sales reached 18 million metric tons in 2025, supported by improved logistics and rural connectivity.

By End-Use, Commercial Farms Dominate While Organic Farms Grow Rapidly:

Commercial Farms segment dominated the market due to large herd sizes, mechanized feeding systems and consistent demand for high-volume feed consumption. These farms prioritize productivity, feed efficiency and performance optimization. In 2025, commercial farms consumed over 128 million metric tons of cattle feed.

Organic Farms are the fastest growing segment, driven by rising demand for organic milk and meat. Organic cattle feed usage reached 27 million metric tons in 2025, supported by clean-label and sustainability trends.

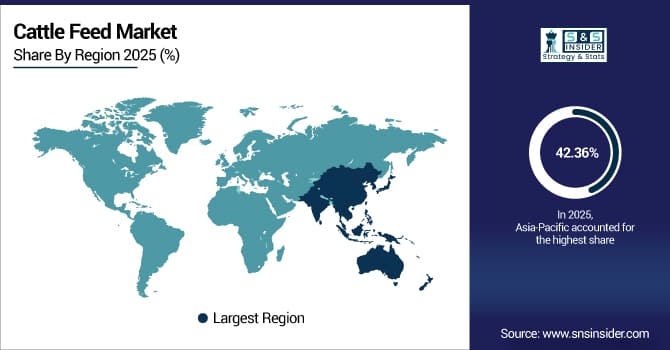

Cattle Feed Market Regional Analysis:

Asia-Pacific Cattle Feed Market Insights:

The Asia-Pacific Cattle Feed Market dominated with a market share of 42.36% in 2025, driven by large livestock populations, expanding dairy and meat production and rising adoption of nutritionally balanced feed. Strong demand from China, India, Australia and Southeast Asia supports market growth. Increasing commercialization of livestock farming, focus on productivity enhancement and government support for feed quality improvements position Asia-Pacific as the largest and most influential cattle feed market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China Cattle Feed Market Insights:

China’s Cattle Feed Market is driven by large-scale dairy and beef production, rising focus on livestock productivity and growing adoption of nutritionally balanced feed. Increasing commercialization of farming, government emphasis on feed quality standards and expanding use of fortified and specialty feed position China as a key growth contributor in the Asia-Pacific cattle feed market.

North America Cattle Feed Market Insights:

North America is the fastest-growing Cattle Feed Market, projected to expand at a CAGR of 4.28% during 2026–2033. Growth is supported by advanced livestock management practices, strong demand for high-quality dairy and beef products and increasing adoption of fortified and specialty feed. Rising focus on animal health, feed efficiency, sustainability and digital procurement channels positions North America as a key hub for innovation, premium feed formulations and new product development within the cattle feed industry.

U.S. Cattle Feed Market Insights:

The U.S. Cattle Feed Market is driven by advanced livestock farming practices, rising demand for high-quality dairy and beef products and increasing focus on animal nutrition and productivity. Growing adoption of fortified, specialty and sustainable feed formulations, along with digital procurement and large-scale commercial farming, reinforces the country’s dominance in the North American cattle feed market.

Europe Cattle Feed Market Insights:

The Europe Cattle Feed Market is growing due to increasing focus on animal health, feed quality and sustainable livestock practices. Rising demand for high-quality dairy and meat products is supporting adoption of nutritionally balanced and specialty feed. Germany, the UK, France and Italy are key contributors, driven by advanced farming systems, strict feed regulations and growing emphasis on organic and traceable feed solutions, positioning Europe as an important growth market.

Germany Cattle Feed Market Insights:

Germany is a key Cattle Feed market due to high focus on livestock productivity, animal health and sustainable farming practices. Strong demand for high-quality dairy and meat products, adoption of fortified and specialty feed and strict feed regulations further strengthen Germany’s position as a leading contributor to the European cattle feed market.

Latin America Cattle Feed Market Insights:

The Latin America Cattle Feed Market is anticipated to register growth driven by rising demand for high-quality dairy and meat products in Brazil, Mexico and Argentina. Increasing adoption of fortified, specialty and sustainable feed, along with modernization of livestock farming and improved supply chains, is expected to boost regional market expansion.

Middle East and Africa Cattle Feed Market Insights:

The Middle East & Africa Cattle Feed Market continues to grow with rising demand for high-quality dairy and meat products and modernization of livestock farming. Expansion of fortified, specialty and sustainable feed, along with increasing consumption in Saudi Arabia, UAE and South Africa, is driving regional market growth.

Cattle Feed Market Competitive Landscape:

Cargill, Inc., headquartered in Minneapolis, USA, is a leader in agricultural and livestock nutrition. The company dominates the cattle feed market with a diverse portfolio of feed products, including fortified, specialty and sustainable formulations tailored for dairy, beef and mixed livestock operations. Cargill’s vertically integrated supply chain ensures consistent quality from raw materials to finished feed. Strong R&D, advanced feed technologies and distribution networks have positioned Cargill as a preferred supplier for large-scale commercial farms and high-performance livestock producers.

-

In March 2025, Cargill launched Micronutrition and Health Solutions, including Biostrong and Notox, significantly enhancing livestock growth, digestive health, immunity and overall nutrition, showcasing innovation in advanced feed solutions across markets.

Archer Daniels Midland Company (ADM), based in Chicago, USA, is a major player in agricultural processing and livestock nutrition. ADM dominates the cattle feed market through its wide range of feed solutions, including concentrates, premixes and fortified rations designed to enhance productivity and animal health. The company leverages its sourcing, state-of-the-art processing facilities and research capabilities to develop innovative and high-quality feed products. Strategic partnerships and strong presence in North America, Latin America and Asia ensure ADM maintains its market leadership in the cattle feed industry.

-

In September 2025, ADM introduced Digest Carb, an innovative dairy nutrition solution improving rumen fermentation, fiber digestibility, animal health and milk performance, debuting at SPACE 2025 and targeting widespread adoption for high-efficiency dairy operations.

Land O’Lakes, Inc., headquartered in Arden Hills, USA, is a leading provider of livestock feed and dairy nutrition solutions. The company has secured its dominance in the cattle feed market with high-quality, nutritionally balanced feed products for dairy and beef cattle. Land O’Lakes combines advanced R&D, feed formulation expertise and a robust distribution network to serve commercial and smallholder farms. Emphasis on sustainability, animal health and innovative feed technologies has allowed the company to strengthen its market share and maintain a strong presence.

-

In October 2025, Land O’Lakes Purina expanded basemix blending and micro-nutrient premix capacity, significantly strengthening supply reliability, improving feed quality and supporting large-scale livestock nutrition across North American dairy, poultry and emerging livestock farms.

Cattle Feed Market Key Players:

Some of the Cattle Feed Market Companies are:

-

Cargill, Inc.

-

Archer Daniels Midland Company (ADM)

-

Land O’Lakes, Inc.

-

Alltech, Inc.

-

Nutreco N.V.

-

Purina Animal Nutrition (Nestlé)

-

ForFarmers N.V.

-

Charoen Pokphand Foods PCL

-

De Heus Animal Nutrition

-

Kemin Industries, Inc.

-

DSM Nutritional Products

-

Zinpro Corporation

-

Ridley Corporation Limited

-

Trouw Nutrition (Nutreco)

-

AB Agri Limited

-

Evonik Industries AG

-

Olam International Limited

-

Wilmar International Limited

-

New Hope Group

-

Provimi (Cargill)

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 92.26 Billion |

| Market Size by 2033 | USD 119.68 Billion |

| CAGR | CAGR of 3.34% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Feed Type (Compound Feed, Concentrates, Silage & Forage, Mineral & Vitamin Supplements, By-Products & Additives, Others) • By Form (Pellets, Mash, Crumbles, Blocks, Liquid, Others) • By Animal Type / Application (Dairy Cattle, Beef Cattle, Buffalo, Sheep & Goat, Others) • By Distribution Channel (Feed Mills, Online Retail, Cooperatives, Agro Stores/Specialty Stores, Wholesale Distributors, Others) • By End-Use (Commercial Farms, Smallholder Farms, Organic Farms, Government/Institutional Farms, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Cargill, Inc., Archer Daniels Midland Company (ADM), Land O’Lakes, Inc., Alltech, Inc., Nutreco N.V., Purina Animal Nutrition (Nestlé), ForFarmers N.V., Charoen Pokphand Foods PCL, De Heus Animal Nutrition, Kemin Industries, Inc., DSM Nutritional Products, Zinpro Corporation, Ridley Corporation Limited, Trouw Nutrition (Nutreco), AB Agri Limited, Evonik Industries AG, Olam International Limited, Wilmar International Limited, New Hope Group, Provimi (Cargill) |