Ceiling Tiles Market Report Scope & Overview:

Get More Information on Ceiling Tiles Market - Request Sample Report

The Ceiling Tiles Market Size was valued at USD 8.7 billion in 2023 and is expected to reach USD 15.5 billion by 2032 and grow at a CAGR of 6.6% over the forecast period 2024-2032.

The ceiling tiles market is expanding and being supported by design and functional improvements, as well as the rising concern for sustainability. Some features that have made ceiling tiles highly sought after in commercial, healthcare, educational, and residential sectors include sound absorption, fire resistance, and thermal insulation. Companies are studying ecologically friendly materials and innovative designs that meet the growing requirements for energy-efficient and acoustically optimized spaces. In this context, for example, ROCKWOOL International A/S's subsidiary, Rockfon has introduced products like Blanka and Sonar that deliver a mixing of superior-class, sound-dampening qualities with aesthetic appeal. These ceiling tiles take care of the rising market demand for ceiling tiles that are both functional and fashionable as architecture requirements from different types.

Recent studies reveal that companies grow and expand to cater to the market's evolving needs. In April 2024, in a school in South Dakota, USA, students painted ceiling tiles within an educational arena as an art project to raise funds for creating art potentials from ceiling tiles in education. By doing this, they met the ceiling tile's flexibility but, above all, improved the aesthetical values of interiors and especially that of educational environments. Saint-Gobain India put up a new plant for manufacturing ceiling tiles at Jhagadia in January 2021. This was an important step in the expansion of its presence in the South Asian market. The new facility will now greatly help Saint-Gobain to satisfy increasing regional demand while reducing supply chain dependencies and strengthening the firm's commitment to sustainability and local production. These developments catch perfectly the dynamic nature of the ceiling tiles market, where companies invest in innovation and local expansion to stay ahead of consumer and industry demands.

Ceiling Tiles Market Dynamics:

Drivers:

-

Growing Demand for High-Performance Acoustic and Thermal Solutions Propels Ceiling Tiles Market Growth Across Commercial Spaces

The increasing need for high-performance ceiling solutions that provide acoustic and thermal insulation is driving the demand for ceiling tiles, particularly in commercial environments like offices, retail stores, and healthcare facilities. With rising concerns about noise pollution and the need for energy-efficient buildings, ceiling tiles have become a preferred choice due to their sound-absorbing and heat-insulating properties. Companies like Rockfon have introduced products that combine functional and aesthetic qualities, such as their Blanka and Sonar ceiling tiles, designed to improve indoor acoustics and provide temperature regulation. The growing adoption of open-plan offices, education centers, and public spaces, where noise control is crucial, has significantly contributed to the surge in demand for these tiles. Additionally, as energy efficiency continues to be a priority for both businesses and government regulations, ceiling tiles that help maintain indoor temperature and reduce energy consumption have become essential in commercial building projects. This has opened opportunities for manufacturers to innovate and create more specialized products tailored to specific needs.

-

Rapid Urbanization and Increasing Construction Activities Drive the Demand for Ceiling Tiles in Residential and Commercial Buildings

Urbanization and an increase in construction activities worldwide are key drivers for the growth of the ceiling tiles market. As cities expand and more residential, commercial, and industrial buildings are constructed, there is a growing need for materials that are both functional and cost-effective. Ceiling tiles, which offer ease of installation, lightweight properties, and various design options, are in high demand for modern building designs. In regions like Asia-Pacific and the Middle East, where rapid urbanization is at its peak, the use of ceiling tiles in both new constructions and renovations is becoming standard practice. Moreover, the rising middle class in emerging economies is pushing the demand for better living conditions, including improved building aesthetics and better soundproofing, which ceiling tiles fulfill. This trend is expected to continue as infrastructure development remains a key focus globally, supported by government policies, making ceiling tiles an integral part of modern architectural practices.

Restraint:

-

High Raw Material Costs and Supply Chain Constraints Pose Challenges for Ceiling Tile Manufacturers' Profitability

A significant restraint faced by the ceiling tiles market is the rising cost of raw materials such as gypsum, mineral fiber, and metal, which are essential components in tile production. With increasing demand for these materials, supply chain constraints and price fluctuations have been exacerbated, particularly in regions that rely on imports for raw materials. This can affect manufacturers’ ability to offer competitively priced products, which in turn impacts profitability. Moreover, logistical challenges such as transportation delays and geopolitical tensions can disrupt the timely supply of materials. Manufacturers are being forced to navigate these issues by either increasing product prices or absorbing the cost hikes, both of which can limit market growth. To mitigate this restraint, manufacturers are looking into alternative materials or more localized production to reduce their dependency on volatile supply chains. The ongoing challenges related to raw material costs and logistics are likely to persist, making it essential for ceiling tile producers to find cost-effective and innovative solutions to remain profitable.

Opportunity:

-

Increasing Focus on Sustainable and Eco-Friendly Building Solutions Presents New Opportunities for Ceiling Tiles Market Expansion

The growing global focus on sustainability and eco-friendly building practices presents a significant opportunity for the ceiling tiles market. As environmental concerns take center stage in construction and architecture, there is an increasing shift toward using sustainable materials in building projects. Ceiling tiles made from recycled materials, or those offering energy-saving properties, are becoming highly sought after. This demand is amplified by the implementation of green building standards, such as LEED (Leadership in Energy and Environmental Design), which incentivize the use of eco-friendly products in construction. Companies in the ceiling tiles market, such as Saint-Gobain and Rockfon, are already innovating by offering products that not only meet these green standards but also contribute to energy savings and improved indoor air quality. These developments open up vast opportunities for manufacturers to expand their product portfolios to cater to environmentally conscious consumers and capitalize on the growing trend of sustainable construction practices. As governments and organizations increasingly push for sustainability in building materials, the ceiling tiles market is positioned to benefit from this trend, leading to new growth avenues.

Challenge:

-

Fluctuations in Demand Across Seasonal Construction Cycles Pose Challenges for Ceiling Tiles Manufacturers

A significant challenge for the ceiling tiles market is the seasonal fluctuations in demand for construction materials, which impact the overall market for ceiling tiles. The demand for ceiling tiles typically rises during peak construction seasons in the spring and summer months when new projects are initiated. However, during colder months or in regions experiencing economic slowdowns, construction activities tend to slow down, leading to a drop in ceiling tile orders. This cyclical demand can create uncertainty for manufacturers, as they have to manage production volumes and inventories accordingly. Manufacturers are also faced with the challenge of maintaining a steady supply of products while managing cost efficiencies, particularly when demand dips. To overcome this challenge, manufacturers often need to diversify their market reach and adapt to regional trends, such as focusing on renovation projects during off-peak seasons or offering products that cater to different building types. Additionally, strategic planning and investment in marketing and partnerships are crucial to managing demand fluctuations in the seasonal construction cycle.

Ceiling Tiles Market Segmentation Overview

By Product Type

Acoustic ceiling tiles dominated the ceiling tiles market in 2023, with a market share of 60%. The growing emphasis on soundproofing and noise control in commercial spaces such as offices, healthcare facilities, and educational institutions has led to the dominance of acoustic tiles. These tiles are specifically designed to enhance sound absorption and are preferred in environments where noise control is crucial. For example, Rockfon’s Sonar ceiling tiles are renowned for their superior sound-damping properties, making them ideal for open-plan offices and classrooms.

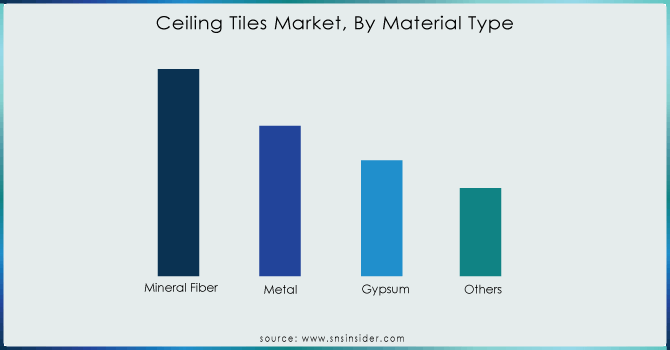

By Material Type

Mineral fiber dominated the ceiling tiles market in 2023, with a market share of 45%. Mineral fiber tiles are widely preferred due to their cost-effectiveness, versatility, and superior acoustic and fire-resistant properties. These tiles are commonly used in commercial spaces, particularly in offices, healthcare, and educational institutions, where performance and aesthetics are essential. Companies like Armstrong World Industries provide a wide range of mineral fiber tiles that cater to both aesthetic and functional demands, contributing to their dominance in the material segment.

By Installation Type

Suspended/Drop dominated the ceiling tiles market in 2023, with a market share of 70%. This installation type is commonly used in both commercial and residential sectors due to its ease of installation, accessibility for maintenance, and versatility. Suspended ceilings offer the flexibility to hide electrical wiring, air conditioning systems, and lighting, making them a popular choice for offices, retail, and healthcare spaces. The demand for suspended ceiling systems is reinforced by their aesthetic flexibility and functional advantages in large-scale construction projects.

By End-User

The commercial segment dominated the ceiling tiles market in 2023, accounting for approximately 50% of the market share. Among the subsegments, the office sector was the leading contributor, with a market share of 35%. The increasing demand for noise control, aesthetic ceiling designs, and energy-efficient building materials in office spaces has fueled the growth of this segment. Companies like Rockfon and Armstrong provide specialized ceiling tile solutions designed for open-plan office environments that improve acoustics and contribute to a healthier working environment, further solidifying the dominance of the commercial segment.

Get Customized Report as per your Business Requirement - Request For Customized Report

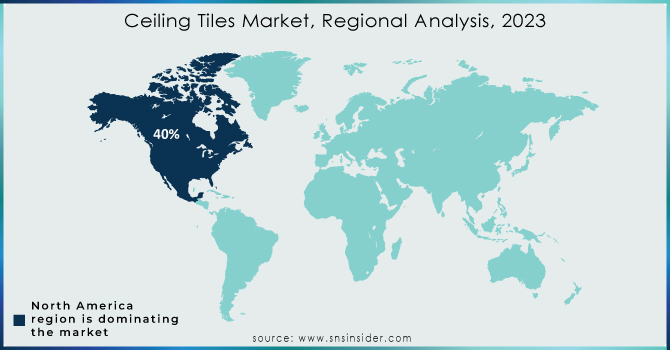

Ceiling Tiles Market Regional Analysis

In 2023, North America dominated the ceiling tiles market with a market share of 40%. The region's leadership in the market can be attributed to the strong demand for ceiling tiles in both commercial and residential buildings, driven by ongoing infrastructure development, especially in the United States and Canada. The preference for acoustic and energy-efficient ceiling solutions in office spaces, healthcare facilities, and educational institutions has contributed to the region's market dominance. Companies like Armstrong World Industries and USG Corporation are based in North America, further fueling the region's leadership by offering innovative and high-quality ceiling solutions. Additionally, the region's focus on green building initiatives and sustainability in construction, with products that meet LEED standards, has solidified North America's dominant position in the global ceiling tiles market.

Moreover, in 2023, the Asia-Pacific region was the fastest-growing region in the ceiling tiles market, with a CAGR of 7.0%. The rapid urbanization, increasing construction activities, and growing middle-class population in countries like China, India, and Southeast Asian nations have fueled the demand for ceiling tiles in residential, commercial, and industrial projects. As infrastructure development accelerates in these emerging economies, there is a rising need for cost-effective and high-performance building materials, including ceiling tiles. The Asia-Pacific region’s focus on modernizing building infrastructure, coupled with the adoption of green and energy-efficient products, has significantly driven the demand for ceiling tiles. Companies are increasingly expanding their manufacturing and distribution networks in the APAC region to cater to this growing demand, further contributing to its rapid market growth.

Key Players in Ceiling Tiles Market

-

AMF Ceilings Ltd. (Thermatex Acoustic, Thermatex Alpha)

-

Armstrong World Industries Inc. (Ultima, Dune, Cirrus)

-

AWI Licensing LLC (Perla, Fine Fissured)

-

BYUCKSAN (Sound Absorption Panels, Cleanroom Ceiling Tiles)

-

DAIKEN Corporation (Fine Acoustic, Wood Wool Acoustic)

-

Grenzebach BSH GmbH (Drywall Ceiling Solutions, Acoustic Panels)

-

HIL Limited (Aerocon Panels, Charminar Ceiling Tiles)

-

Hunter Douglas (Techstyle, HeartFelt)

-

Knauf Gips KG (Knauf Danoline, Heradesign)

-

LafargeHolcim Ltd. (Gyprex, Gypboard Ceilings)

-

Odenwald Faserplattenwerk GmbH (OWAtecta, OWAconsult)

-

Rockfon (a subsidiary of ROCKWOOL International A/S) (Blanka, Sonar)

-

ROCKWOOL International A/S (Rockfon Sonar, Rockfon Tropic)

-

Saint-Gobain Gyproc (Gyptone, Rigitone)

-

SAS International (SAS System 330, SAS System 600)

-

Siniat Ltd. (part of Etex Group) (Siniat Decogips, Siniat LaDura)

-

USG Boral (Echostop, Mars)

-

USG Corporation (Radar, Eclipse)

-

Zentia Group (Bioguard Acoustic, Ultima+)

-

Zhongshan Starleigh Building Materials Co., Ltd. (PVC Gypsum Ceiling Tiles, Acoustic Gypsum Tiles)

Suppliers and Distributors:

-

-

Building Materials Suppliers Inc.

-

ABC Supply Co.

-

Lowe’s Companies Inc.

-

The Home Depot, Inc.

-

Contractors and Installers:

-

-

Turner Construction

-

AECOM

-

Bechtel Group

-

Raw Material Providers:

-

-

Knauf Insulation

-

Owens Corning

-

Saint-Gobain

-

USG Boral

-

Recent Developments

-

April 2024: South Dakota high school art students raised $3,070 by auctioning off painted ceiling tiles. The project, aimed at supporting school programs, showcased students' artistic talents while benefiting the local community.

-

May 2023: Ecophon opened a new manufacturing plant in India to directly address the growing demand in the region. This move enabled the company to offer its award-winning acoustical ceiling tiles to the expanding Indian market, strengthening its presence in the region.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 8.7 Billion |

| Market Size by 2032 | US$ 15.5 Billion |

| CAGR | CAGR of 6.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Acoustic, Non-Acoustic) •By Material Type (Mineral Fiber, Metal, Gypsum, Wood, Others) •By Installation Type (Suspended/Drop, Surface Mounted) •By End-User (Residential, Commercial [Retail, Hospitality, Leisure & Entertainment, Offices, Healthcare, Educational Institutions, Others], Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Odenwald Faserplattenwerk GmbH, Hunter Douglas, Armstrong World Industries Inc., AWI Licensing LLC, USG Corporation, Knauf Gips KG, ROCKWOOL International A/S, Saint-Gobain Gyproc, SAS International, BYUCKSAN, HIL Limited and other key players |

| DRIVERS | • Growing Demand for High-Performance Acoustic and Thermal Solutions Propels Ceiling Tiles Market Growth Across Commercial Spaces • Rapid Urbanization and Increasing Construction Activities Drive the Demand for Ceiling Tiles in Residential and Commercial Buildings |

| Restraints | • High Raw Material Costs and Supply Chain Constraints Pose Challenges for Ceiling Tile Manufacturers' Profitability |