Chip-on-Board LED Market Size & Growth:

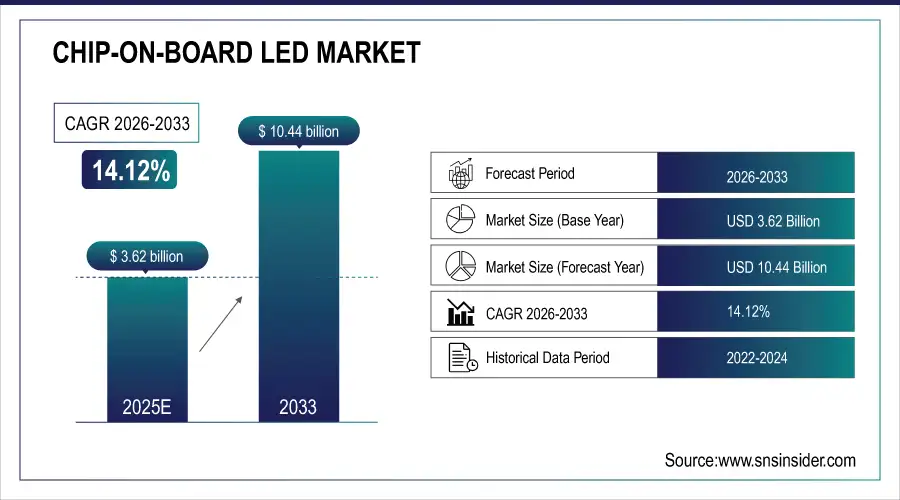

The Chip-on-Board LED Market size is estimated at USD 3.62 billion in 2025E and is expected to reach USD 10.44 billion by 2033, growing at a CAGR of 14.12% from 2026-2033. The growth of Chip-on-Board LED market is attributed to the growing need for smaller, higher-efficiency light sources with good thermal management, brightness uniformity and energy saving in automotive, industrial and smart lighting applications.

Market Size and Growth Projection

-

Market Size in 2025E: USD 3.62 Billion

-

Market Size by 2033: USD 10.44 Billion

-

CAGR: 14.12% from 2025 to 2032

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2021–2024

To Get more information on Chip-on-Board LED Market - Request Free Sample Report

Chip-on-Board LED Market Trends

-

Rising demand for compact, high-efficiency lighting solutions is driving the chip-on-board (COB) LED market.

-

Increasing adoption in residential, commercial, automotive, and industrial lighting is boosting growth.

-

Advancements in thermal management, luminous efficacy, and light uniformity are enhancing performance and reliability.

-

Integration with smart lighting, IoT, and energy-efficient systems is shaping market trends.

-

Expansion of LED-based displays, backlighting, and architectural lighting applications is fueling adoption.

-

Focus on sustainable, long-lasting, and low-maintenance lighting solutions is supporting market growth.

-

Collaborations between LED manufacturers, electronics firms, and lighting solution providers are accelerating innovation and deployment.

Chip-on-Board LED Market is rapidly expanding because of its thermal efficiency, small footprint, and high-lumen density, relative to conventional LEDs. Such applications range from general illumination, automotive and signal lighting, commercial signage, as well as smart city infrastructure using LEDs. Coupled with long lifespan, low power consumption, and uniformity of light, COB LEDs are increasingly considered next-generation light sources. Substrate innovations and the demand for sustainable lighting are other factors driving the market.

Compared with traditional SMD LED, Chip-on-Board LED saves more than 30% energy and it has a lifetime of over 50,000 hours, which leads to greatly reduced maintenance cost and frequency. COB LEDs have been incorporated by automotive manufacturers such as Audi and BMW into their headlights and interior ambient lighting for advantages in heat dissipation and even brightness distribution.

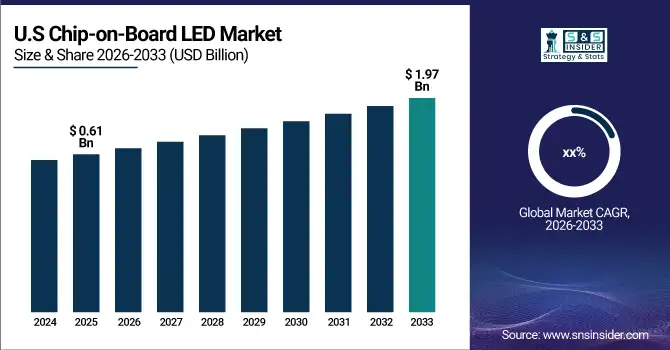

The U.S. Chip-on-Board LED Market was valued at USD 0.61 billion in 2025E and is expected to reach USD 1.97 billion by 2033, growing at a CAGR of 15.68% from 2026-2033. The growth of the U.S. Chip-on-Board (COB) LED market is primarily driven by the rising need for energy-efficient lighting solutions due to the growing government support for sustainability, increasing adoption of electric vehicles requiring advanced automotive lighting, and its combination with smart infrastructure and IoT-enabled devices.

Chip-on-Board LED Market Growth Drivers:

-

COB LED Market Booms with Energy Efficiency Demand and Technological Advances Across Diverse Lighting Applications

The Chip-on-Board (COB) LED market is projected to grow significantly with increasing demand for energy-efficient lighting solutions across numerous end-use industries. Global governments are pushing citizens to adopt LED lighting aggressively to minimize their carbon footprint and energy consumption.

The IEA estimated that if LED technology were to be adopted globally, the amount of electricity used for lighting could be reduced by more than 65%.

Driven by their larger lumen output per watt ratio and better thermal performance, COB LEDs are being preferred for more general illumination, automotive headlights, and commercial purposes. On the other hand, technological progress allows compact, high-brightness COB LEDs to be produced in a variety, which have higher color rendering and a more uniform light source, with relevance in retail and architectural applications.

Chip-on-Board LED Market Restraints:

-

Challenges in COB LED Adoption Include High Costs, Thermal Management Issues, and Sensitivity to Voltage Changes

The high complexity in packaging, along with the advancement of thermal management systems required for COB LED technology, increases production complexity and costs. This renders COB LEDs trickier to implement for industries relying on low-cost designs or for emerging markets. Combined with the fact that they require external heat sinks and more complex drivers compared with conventional LEDs, the total system cost rises significantly. This makes it impossible for small and medium manufacturers to access. Also, because COB LEDs are very sensitive to any changes in voltage supply (which is common in an environment with inconsistent supply), and in case of overheating, the lifespan and overall performance of COB LEDs are affected very adversely.

As the U.S. Department of Energy reveals, approximately 20% of commercial installation outages are related to thermal management failures, an even more significant problem with compact, high-power LED modules, such as chips-on-board (COBs).

Chip-on-Board LED Market Opportunities:

-

Smart Lighting and Automotive Sectors Drive Growth in COB LED Market with New Opportunities

There is an increase in the adoption of smart lighting systems along with growing demand for human-centric lighting (HCL), which is opening doors to growth in the COB LED market. Smart city projects, including street lighting systems by COB LED fixtures that enhance energy management and security in areas like Europe and the Asia Pacific, will be implemented. Furthermore, the automotive sector is also using COB LEDs for adaptive front lighting systems (AFS) and daytime running lights (DRLs), which require small but high-intensity light sources.

With the Global production of more than 85 million vehicles for 2023 according to OICA, the continued demand for automotive-grade LEDs is well supported.

In addition, the consumer electronics and wearable devices miniaturizing and flexible lighting are opening opportunities for COB LEDs in new verticals.

Chip-on-Board LED Market Challenges:

-

Competition from New LED Technologies and Lack of Standardization Hinder Mass Adoption of COB LEDs

The significant barrier regarding competition from new LED technologies like Multi-Chip-on-Board (MCOB) and Surface-Mount Device (SMD) LEDs, which allow for modular design and flexibility. SMD LEDs, specifically, have also gained favour in applications for variable color temperatures and RGB formats where a COB is limited by its fixed optics. In addition, non-standard packaging and testing for COB LED devices raise compatibility issues and reliability concerns for both manufacturers' end users.

A report published by Zhaga Consortium in 2022 described the urgent need for standardized mechanical and electrical interfaces to allow more interoperable lighting.

Lack of standardization results in integration challenges and higher R&D costs for OEMs and lighting designers, as well as longer development cycles. Combined, these problems limit the mass adoption of COB LEDs in some segments and delay the time-to-market of the next generation of lighting solutions.

Chip-on-Board LED Market Segments Analysis

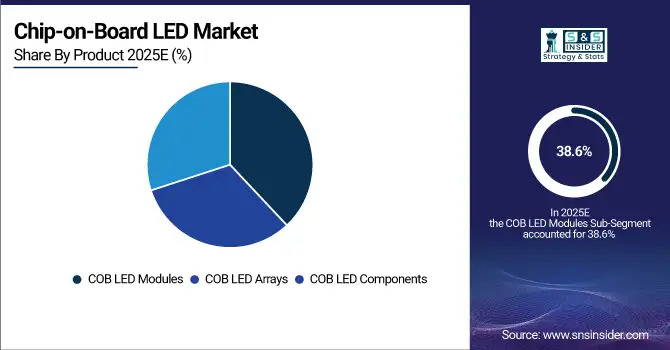

By Product, COB LED Modules lead the market with 38.6% share, driven by compact design, high luminous efficacy, and ease of integration.

In 2025E chip-on-board LED market was led by COB LED Modules with a significant 38.6%, thanks to their compact form factor, high luminous efficacy low mass production cost. They are commonly used in general lighting, downlights, and track lights where high light output with low glare and good light uniformity is needed. Manufacturers looking for effective thermal management and simplified fixture designs also appreciate the ease of integration of HLGs into lighting systems and the lower component count required for their implementation. COB LED Modules have been widely used in both commercial and residential sectors as an indoor lighting solution with high energy efficiency.

From 2025E to 2033, COB LED arrays will grow the fastest 2026-2033. The growth is primarily due to their increasing usage in high-power and high-brightness lighting fixtures like stadium lighting, industrial bays, and automobile headlights. Their good thermal performance and the possibility of generating a higher lumen density (Particle Meter) make them a solution for harsh environments that deserve strong and stable lighting for longer. Further, the increasing focus on material science and chip packaging technologies is improving the performance and lifespan of COB LED Arrays, fuelling their usage in emerging smart lighting and adaptive illumination applications, especially in automotive and outdoor infrastructure projects.

By Substrate Material, Ceramic substrates dominate with 57.8% share, offering superior thermal conductivity, reliability, and electrical insulation for high-power applications.

The Ceramic Substrates led with the larger share of the total Chip-on-Board (COB) LED market, with 57.8% in 2025E, due to their thermally conductive, highly reliable, as well as excellent electrical insulation properties. It is because of this that ceramic substrates are ideal for high-power LED applications where superior thermal conductivity is critical for maintaining performance and reliability over time. With ceramic devices being more robust in extreme operating conditions, ceramic-based COB LEDs are gaining traction for automotive, industrial, and medical lighting applications over the years.

Metal Core PCBs (MCPCBs) are anticipated to have the highest growth in the market during the forecast timeframe of 2026-2033. The lower cost and appropriate thermal performance of the mid-power LEDs make them attractive for their applications in many segments of consumer electronics, signage and general lighting, driving this growth. With LED lighting poised to be the preferred technology for new installations as well as the technology used for building new capacity in emerging economies, finding affordable and scalable substrate solutions is increasingly becoming a necessity.

By Application, Illumination applications hold 46.5% market share, while automotive lighting is projected to grow fastest due to high-tech, adaptive LED requirements.

The Chip-on-Board (COB) LED market focused extensively on the management of COA illumination, which comprised 46.5% market share in 2025E, fuelled by its rising applications in both commercial and industrial settings. COB LEDs cast high-lumen output with even light output and little glare, which are essential in illumination applications, hence, COB LEDs are dominant in the illumination segment. The reduced form factors, coupled with superior thermal management, also make them suitable for recessed downlights, track lighting, and panel lights.

The automotive segment is expected to grow at the highest rate from 2026 to 2033. Growth in the automotive sector is mainly influenced by the demand for high-tech Oriental lighting used in electric and autonomous vehicles. Chip on board (COB) LEDs are high power density, compact, and have much larger potential for modular designs for applications such as adaptive headlights, daytime running lights (DRLs), and interior ambient light. COB LEDs with higher illumination level, greater life-cycle and configurability are the best suited for vehicle manufacturers focusing more on safety & aesthetics. This trend is expected to generate more substantial adoption growth in this space, due in part to connected and smart vehicle trends.

Chip-on-Board LED Market Regional Analysis

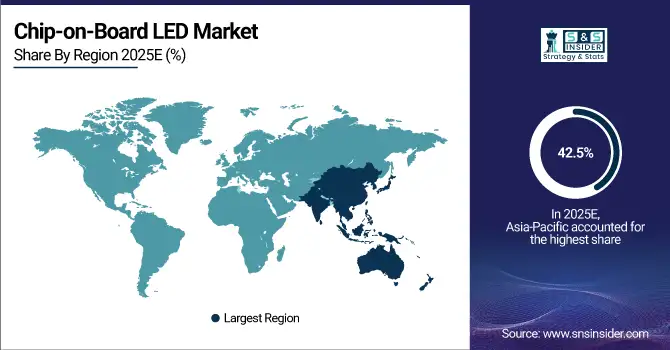

Asia Pacific Chip-on-Board LED Market Insights

Asia-Pacific accounted for the highest market share of the Chip-on-Board (COB) LED market, which was 42.5% in 2025E, due to having a robust manufacturing ecosystem in the region, increasing urbanization, and high government support for energy-efficient technologies. A fair share of these manufacturing worksites come from within China, Japan, and South Korea, where major LED manufacturers, including Samsung Electronics, Nichia Corporation, and Seoul Semiconductor, reside. Especially China has remained the leading producer of the COB LED, which is mainly due to the availability of cheaper labor, increasing investment in smart city infrastructure, and its huge export capability of LEDs.

Public infrastructure and automotive LED lighting are still driving growth in Asia-Pacific, where China retains the position of fastest-growing country in the region, thanks to massive rollouts of public infrastructure lighting in China.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Chip-on-Board LED Market Insights

North America is estimated to grow at the fastest CAGR of 15.3% from 2026 to 2033, owing to the rising adoption of smart lighting systems, development in penetration of electric vehicles, as well as strict regulations on energy efficiency. The USA spearheads this growth, as COB LEDs are gaining pace in numerous residential retrofitting programs and automotive innovations by businesses like Tesla and Ford. In addition, the trend toward sustainable building certifications like LEED is requiring high-efficiency lighting.

The US is categorized as the fastest-growing country in the North America region, owing to government incentives and technological innovation in lighting systems.

Europe Chip-on-Board LED Market Insights

The European Chip-on-Board (COB) LED Market is experiencing a major boom owing to the high demand for energy-efficient lighting solutions across different sectors, like automotive, commercial, and industrial applications. The region is highly driven by sustainability and energy-efficient technologies because of the stringent energy and carbon emission regulations. The push towards using such technologies has been driving the market for COB LEDs due to their high and long-term efficiency and small size.

Germany is the leading country in the European COB LED market, attributed to an established automotive sector in the country that is steadily adopting COB LED for advanced automotive lighting applications such as headlights, interior lights, and other lighting systems.

Middle East & Africa and Latin America Chip-on-Board LED Market Insights

The Chip-on-Board (COB) LED market in the Middle East & Africa and Latin America is growing due to increasing demand for energy-efficient, high-brightness lighting solutions in commercial, industrial, and automotive sectors. Rapid urbanization, infrastructure development, and rising adoption of LED technology for sustainable lighting drive market expansion. Technological advancements, government initiatives promoting energy efficiency, and investments in smart lighting solutions further accelerate the growth of the COB LED market across these regions.

Chip-on-Board LED Market Competitive Landscape:

Cree LED

Cree LED, founded in 1987 and headquartered in Durham, North Carolina, is a leading innovator in LED lighting and semiconductor technology. The company develops high-performance LEDs and lighting solutions for commercial, industrial, and display applications, emphasizing energy efficiency, color accuracy, and long-term reliability. Cree LED focuses on advancing illumination technology for digital displays, signage, and specialty lighting, providing brighter, more uniform, and sustainable lighting solutions to meet global demand.

-

November 2024: Cree LED launched the CV28D LEDs featuring FusionBeam Technology, offering enhanced brightness and color uniformity for high-resolution LED signs and displays.

Philips (Signify)

Philips, founded in 1891 and headquartered in Amsterdam, Netherlands, is a global leader in lighting solutions and electronics. Through its Philips brand (now Signify), the company provides innovative automotive, consumer, and professional lighting technologies. Philips emphasizes energy efficiency, superior illumination, and durability in its products. The company focuses on enhancing safety and visibility in automotive applications while driving advancements in LED technology for reliable, long-lasting, and high-performance lighting solutions.

-

April 2024: Philips launched the Ultinon Pro7000 LED Signaling Bulbs, offering superior brightness, instant illumination, a 360° beam angle, and long lifespan for enhanced car and truck lighting safety.

Chip-on-Board LED Companies are:

-

ProPhotonix Limited

-

Excelitas Technologies

-

Lextar Electronics Corporation

-

Citizen Electronics

-

Philips Lumileds

-

Samsung LED

-

Osram Opto Semiconductors

-

Seoul Semiconductor

-

Luminus Devices

-

Toyoda Gosei

-

Epistar

-

Shenzhen Lepower Opto Electronics Corp., Ltd.

-

Foshan Nationstar Optoelectronics Co., Ltd.

-

Yuji Lighting

-

Edison Opto

-

COLORS

-

Mingxue Optoelectronics

-

SignliteLED

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 3.62 Billion |

| Market Size by 2033 | USD 10.44 Billion |

| CAGR | CAGR of 14.12% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (COB LED Modules, COB LED Arrays, COB LED Components) • By Substrate Material (Ceramic Substrates, Metal Core PCBs) • By Application (Backlighting, Illumination, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | ProPhotonix Limited, Excelitas Technologies, Lextar Electronics Corporation, Cree Inc, Citizen Electronics, Philips Lumileds, Bridgelux, Samsung LED, Osram Opto Semiconductors, Seoul Semiconductor, Luminus Devices, Toyoda Gosei, Epistar, Shenzhen Lepower Opto Electronics Corp., Ltd., Foshan Nationstar Optoelectronics Co., Ltd., Yuji Lighting, Edison Opto, COLORS, Mingxue Optoelectronics and SignliteLED. |