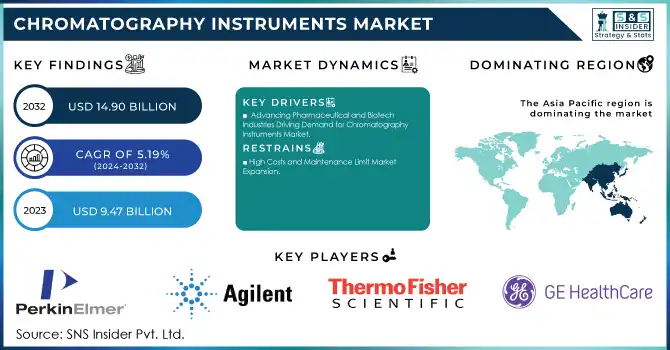

Chromatography Instruments Market Overview:

The Chromatography Instruments Market size was valued at USD 9.47 billion in 2023 and is expected to reach USD 14.90 billion by 2032, growing at a CAGR of 5.19% from 2024-2032.

To get more information on Chromatography Instruments Market - Request Free Sample Report

The chromatography equipment market is witnessing strong expansion fueled by progress in analytical technologies and increasing demand from sectors like pharmaceuticals, biotechnology, food and beverage, and environmental analysis. The growing emphasis on precision and accuracy in chemical analysis has established chromatography as a crucial method in various applications, including drug discovery, food safety, and environmental monitoring.

A major factor propelling this market is the increasing dependence of pharmaceutical and biotech sectors on chromatography for drug formulation, quality assurance, and biopharmaceutical evaluation. As biologics and personalized medicine have emerged, high-performance liquid chromatography (HPLC) and gas chromatography (GC) have become essential methods for analyzing intricate molecular structures. Furthermore, innovations like ultra-high-performance liquid chromatography (UHPLC) and hybrid systems such as liquid chromatography-mass spectrometry (LC-MS) are facilitating quicker and more sensitive analyses.

The food and beverage industry also plays a major role in market expansion, with chromatography widely employed to identify contaminants like pesticides, mycotoxins, and additives. Additionally, heightened regulatory oversight regarding environmental contaminants has broadened the application of chromatography devices in assessing air, water, and soil quality.

Recent market trends highlight the focus on innovation. As an illustration, in February 2024, Thermo Fisher Scientific introduced the Dionex Inuvion Ion Chromatography (IC) system that streamlines ion analysis for laboratories of various capacities. In August 2024, Agilent Technologies similarly launched the J&W 5Q GC/MS columns, which are engineered for ultra-low-bleed efficiency in gas chromatography uses.

The combination of automation, artificial intelligence, and eco-friendly chromatography solutions is reshaping the market landscape, providing improved efficiency and sustainability. These developments, along with heightened investments in R&D, are anticipated to propel continuous growth in the chromatography instruments market across multiple regions and uses.

Chromatography Instruments Market Dynamics

Drivers

- Advancing Pharmaceutical and Biotech Industries Driving Demand for Chromatography Instruments Market

The biotechnology and pharmaceutical sectors are leading users of chromatography equipment, fueling considerable expansion in the market. Chromatography is essential in drug development, formulation, and production, particularly for examining active pharmaceutical ingredients (APIs) and excipients. As chronic diseases like cancer, cardiovascular conditions, and diabetes become more common, the need for new treatments, such as biologics and personalized medicine, is increasing. Moreover, the drive for regulatory adherence from organizations like the FDA and EMA has increased the demand for highly accurate analytical instruments such as high-performance liquid chromatography (HPLC) and gas chromatography (GC). Moreover, incorporating automation and artificial intelligence in chromatography devices boosts productivity and minimizes human mistakes, rendering these instruments increasingly vital for pharmaceutical and biotech firms.

- Growing concerns about food safety and environmental sustainability are propelling the adoption of chromatography instruments across the globe.

Unsafe food causes millions of cases of foodborne diseases annually, highlighting the urgent need for robust testing mechanisms. Chromatography systems play a pivotal role in detecting harmful contaminants, including pesticide residues, mycotoxins, and heavy metals, ensuring compliance with stringent food safety regulations like those set by the US FDA and the European Food Safety Authority (EFSA).

In environmental testing, chromatography is vital for monitoring pollutants in air, water, and soil. For instance, the Environmental Protection Agency (EPA) relies on gas chromatography-mass spectrometry (GC-MS) for assessing volatile organic compounds (VOCs) and hazardous air pollutants. The escalating effects of climate change and industrialization have further heightened the need for real-time, accurate environmental analysis. Emerging trends such as the adoption of green chromatography and the development of portable systems are expanding the application scope, enabling on-site testing and reducing the environmental impact of analytical processes. With increased investment in environmental monitoring technologies, the chromatography instruments market is poised for substantial growth.

Restraint

- High Costs and Maintenance Limit Market Expansion

The high initial costs of chromatography instruments, such as HPLC and GC systems, along with expensive consumables and ongoing maintenance, hinder market growth. These financial barriers particularly affect small labs and resource-constrained sectors like environmental testing and academic research. Regular calibration and servicing demand skilled personnel, adding to operational costs. While manufacturers are introducing cost-effective models and reusable consumables, affordability remains a challenge for broader adoption.

Chromatography Instruments Market Segmentation Analysis

By Chromatography Systems

In 2023, the Liquid Chromatography segment dominated the chromatography systems market, accounting for the largest market share at 49%. LC is a key application in the pharmaceutical industry, especially in drug development, quality control, and ensuring the purity and potency of drug substances. HPLC is widely used to separate and quantify various drug components, supporting consistent and safe manufacturing processes. Additionally, LC is instrumental in measuring specific substance concentrations in patients, enabling healthcare professionals to prescribe accurate dosages.

The gas Chromatography segment is expected to show the fastest growth with a CAGR of 7.73% throughout the forecast period. Gas Chromatography (GC) instruments are highly prized in the analysis of volatile and semi-volatile organic compounds, thus, they become essential in pharmaceutical applications and clinical research. GC is also used largely in forensic analyses to identify drugs, poisons, explosives, and accelerants. SFC, on the other hand, is increasingly preferred due to the faster analysis time and reduced use of solvent than in traditional liquid chromatography techniques.

By Consumables

Column segment dominated the market with the largest share in the chromatography Instruments market in 2023, accounting for 57.26% of the total market share. Advancements in column design and performance have been key drivers in the evolution of chromatography instruments. Innovations, such as narrow bore and capillary columns, have greatly enhanced the efficiency and resolution of chromatographic separations.

The chromatography syringe segment is widely applied in the pharmaceutical and biotechnology industries. Major applications are involved in drug discovery, development, and quality control. With increasing requirements for research activities, including the purification of monoclonal antibodies and green chromatography practices, chromatography syringe demand is likely to rise significantly.

By Application

In 2023, the pharmaceutical firms segment dominated the chromatography Instruments market with a market share of 55.46%. In pharmaceutical companies, chromatography is used to identify and quantify APIs, detect impurities, assess formulations, and monitor stability in drug development and manufacturing. Techniques such as HPLC are used to ensure accurate dosing of APIs and to identify impurities that may be dangerous to patients.

The clinical research organization segment is expected to show the fastest growth throughout the forecast period. Chromatography coupled with mass spectrometry is used for the identification and quantification of analytes with precision, thus simplifying clinical trials and saving associated costs. Chromatography also plays a role in vaccine development, where it helps in selecting the most effective antibodies to combat diseases. In addition, gas chromatography is used in pharmaceutical firms for comprehensive and consistent analysis of intermediates, final drug products, and packaging materials.

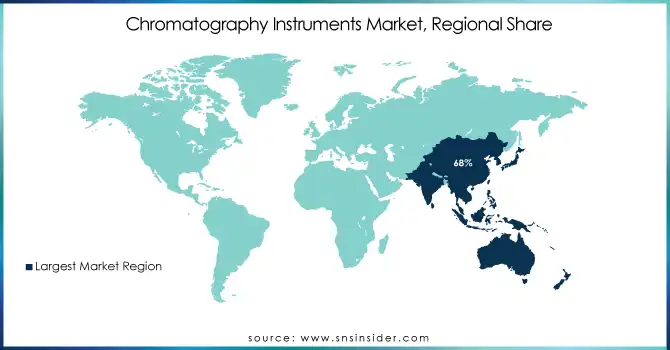

Chromatography Instruments Market Regional Insights

In 2023, Asia Pacific dominated the market with a market share of 66.14%. This is because of high industrialization and more investment in pharmaceutical research. With a growing number of CROs, pharmaceutical manufacturing facility developments in China and India have resulted in increased demand for chromatography instruments. Apart from that, research and development promotional initiatives by governments in the region are further propelling the growth of the market.

North America will hold the fastest growth rate in the chromatography instruments market during the forecast period with a CAGR Of 8.42%. The regulations put forward by agencies like the FDA mandate the use of chromatography techniques for drug products in terms of evaluating strength, purity, quality, and potency, so there will be a large demand in the pharmaceutical and biotechnology sectors. The region also invests more in research and development than other regions. The government has policies and institutions such as the National Institutes of Health that provide funding for research activities that heavily rely on chromatography techniques.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in Chromatography Instruments Market

-

Thermo Fisher Scientific, Inc. (Thermo Scientific Dionex UltiMate 3000 HPLC System, Thermo Scientific TRACE 1310 Gas Chromatograph)

-

Agilent Technologies, Inc. (Agilent 1200 Infinity Series HPLC System, Agilent 7890B Gas Chromatograph)

-

PerkinElmer, Inc. (PerkinElmer Clarus 690 Gas Chromatograph, PerkinElmer Flexar FX-15 HPLC System)

-

Waters Corporation (Waters ACQUITY UPLC System, Waters Synapt G2-Si Mass Spectrometer)

-

ABB Ltd. (ABB Process Chromatography Analyzer, ABB MasterLab Chromatography Systems)

-

F. Hoffmann-La Roche Ltd. (Roche AVENIO Oncology Analysis Software, Roche SeqCap EZ System)

-

Shimadzu Corporation (Shimadzu Nexera XR HPLC System, Shimadzu GC-2010 Plus Gas Chromatograph)

-

Horiba, Ltd. (Horiba Scientific XGT-7200 X-ray Fluorescence Spectrometer, Horiba High-Performance HPLC System)

-

JASCO Corporation (JASCO V-730 UV-Vis Spectrophotometer, JASCO LC-4000 Series HPLC System)

-

SRI Instruments (SRI 310C Compact Gas Chromatograph, SRI 8610C Biogas Analyzer)

-

Biotech Optics Inc. (Biotech Optics HPLC, Biotech Optics Gas Chromatograph)

-

Knauer Wissenschaftliche Geräte GmbH (Knauer Azura HPLC System, Knauer Gas Chromatograph 8100)

-

Thermo Scientific (Thermo Scientific Dionex ICS-5000+ HPIC System, Thermo Scientific EASY nLC 1000 System)

-

GE Healthcare (ÄKTA pure 25M System, ÄKTA ready chromatography system)

-

Gilson, Inc. (Gilson GX-271 Liquid Handler, Gilson 3060 HPLC Autosampler)

-

Restek Corporation (Restek Rxi-5ms Capillary Chromatography Column, Restek RTX-5MS Gas Chromatography Column)

-

Agilent Technologies (Agilent 7890A Gas Chromatograph, Agilent 1200 Series HPLC System)

-

Sartorius AG (Sartorius BioPAT MFCS, Sartorius Octet RED96 System for Bioprocess Monitoring)

-

PerkinElmer, Inc. (PerkinElmer Janus G3 Automated Workstation, PerkinElmer Lamda 365 UV/Vis Spectrophotometer)

-

Eppendorf AG (Eppendorf Chromatography Systems, Eppendorf Biochrom WPA Series UV/Vis Spectrophotometer)

Key suppliers

key suppliers that provide supplies valves, fittings, sample loops, and solvents, reagents, supplies specialized laboratory instruments, and consumables, etc. for chromatography instruments.

VICI Valco Instruments

-

Restek Corporation

-

Sigma-Aldrich

-

Phenomenex Inc.

-

Emerson Electric Co.

-

MilliporeSigma

-

Supelco

-

Merck Group

-

GE Healthcare Life Science

-

Agilent Technologies, Inc.

Recent Developments in Chromatography Instruments Market

-

In February 2024, Thermo Fisher Scientific Inc. unveiled the Thermo Scientific Dionex Inuvion Ion Chromatography (IC) system, designed to simplify and enhance ion analysis for laboratories of all sizes. This innovative analytical instrument offers easy reconfiguration, making it a comprehensive solution for the consistent and reliable determination of ionic and small polar compounds.

-

In August 2024, Agilent Technologies Inc. introduced its Agilent J&W 5Q GC/MS Columns, marking a significant advancement in gas chromatography/mass spectrometry (GC/MS) column technology. With a legacy of 50 years of innovation in gas chromatography, Agilent's new columns combine ultra-inert performance with ultra-low-bleed technology, delivering exceptional performance and durability for demanding applications.

-

In June 2024, Waters Corporation announced several major developments during the American Society for Mass Spectrometry (ASMS) conference in Anaheim, California. Among these was the launch of the Xevo multi-reflecting time-of-flight (MRT) mass spectrometer, building upon the success of the SELECT SERIES MRT introduced in 2021.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 9.47 Billion |

| Market Size by 2032 | US$ 14.90 Billion |

| CAGR | CAGR of 5.19% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Chromatography Systems (Liquid Chromatography, Gas Chromatography, Thin-Layer Chromatography, Supercritical Fluid Chromatography) • By Consumables (Columns, Solvents, Syringes, Others) • By Accessories (Column Accessories, Auto-Sampler Accessories, Pumps, Others) • By Application (Pharmaceutical Firms, Clinical Research Organizations, Agriculture, Environmental Testing) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Agilent Technologies, PerkinElmer, Waters Corporation, ABB Ltd., F. Hoffmann-La Roche, Shimadzu Corporation, Horiba, JASCO Corporation, SRI Instruments, Biotech Optics, Knauer Wissenschaftliche Geräte GmbH, GE Healthcare, Gilson, Restek Corporation, Sartorius AG, Eppendorf AG, and other players. |

| Key Drivers | •Advancing Pharmaceutical and Biotech Industries Driving Demand for Chromatography Instruments Market •Growing concerns about food safety and environmental sustainability are propelling the adoption of chromatography instruments across the globe. |

| Restraints | •High Costs and Maintenance Limit Market Expansion |