Mass Spectrometry Market Size Analysis:

Get more information on Mass Spectrometry Market - Request Free Sample Report

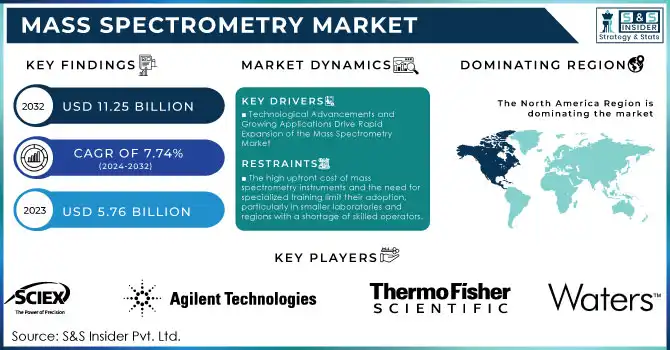

The Mass Spectrometry Market size was valued at USD 5.76 billion in 2023 and is projected to reach USD 11.25 billion by 2032 at a CAGR of 7.74% from 2024 to 2032

The mass spectrometry market is experiencing rapid growth, driven by its critical applications across various industries such as pharmaceuticals, clinical diagnostics, proteomics, food safety, and environmental monitoring. Technological advancements in high-resolution mass spectrometry (HRMS) systems, including Orbitrap and Q-TOF, have significantly boosted adoption rates, with annual growth of 15% in both research and industrial sectors. These advanced systems offer enhanced sensitivity, accuracy, and speed, enabling precise analyses in complex applications. For instance, Orbitrap systems are extensively used in drug discovery to quantify biomarkers with high resolution, while Q-TOF mass spectrometers are vital for proteomics and clinical diagnostics, particularly for detecting low-abundance molecules. These innovations are particularly impactful in personalized medicine, where accurate biomarker identification is essential for developing tailored treatments.

According to the National Library of Medicine, the growing use of mass spectrometry in clinical diagnostics has led to a 12% annual increase in adoption, driven by its role in disease biomarker discovery and therapeutic drug monitoring. Furthermore, proteomics and metabolomics research have contributed to market growth, with 65% of researchers now utilizing mass spectrometry to advance personalized medicine and biological studies. The pharmaceutical industry remains a major market driver, accounting for 30%-35% of total adoption, fueled by rising R&D investments and rigorous quality control standards.

Environmental testing is another rapidly expanding segment, with a 20% increase in mass spectrometry adoption over the past three years. This rise is largely due to growing concerns over pollution, where mass spectrometry's precision in detecting contaminants in air, water, and soil is crucial for meeting stringent environmental regulations. Additionally, integrating artificial intelligence (AI) and automation has improved operational efficiency, reducing data interpretation time by 25%, particularly in high-throughput applications such as genomics and proteomics.

These factors underscore the transformative role of mass spectrometry in meeting the evolving needs of various scientific and industrial fields. As technology advances, it continues to address global challenges, ensuring compliance, enhancing research accuracy, and driving innovation in critical sectors.

Market Dynamics

Drivers

-

Technological Advancements and Growing Applications Drive Rapid Expansion of the Mass Spectrometry Market

The mass spectrometry market is propelled by several key drivers, contributing to its rapid expansion. Technological advancements, particularly the development of high-resolution mass spectrometry (HRMS) systems, have significantly improved sensitivity, accuracy, and speed. These innovations, including hybrid systems like Q-TOF and triple quadrupole mass spectrometers, allow for complex analyses in proteomics, metabolomics, and clinical diagnostics, driving adoption across diverse sectors.

Additionally, growing applications in clinical diagnostics are propelling market demand. Mass spectrometry is increasingly used for disease biomarker discovery and therapeutic drug monitoring, sectors where growth has been robust, with 12% annual adoption rates. The pharmaceutical and biotechnology industries are also major drivers, accounting for a substantial share of the market, as they rely on mass spectrometry for drug development and quality control. Pharmaceutical R&D investments are growing at an annual rate of 10-15%, further boosting demand.

The market is also benefiting from stringent regulatory requirements, especially in food safety, environmental monitoring, and pharmaceutical quality assurance. Governments worldwide are implementing stricter regulations, driving the need for more accurate analytical tools like mass spectrometry for compliance. Furthermore, the rise of AI and automation in mass spectrometry systems has increased operational efficiency, improved data interpretation, and accelerated market growth. Overall, these drivers ensure that mass spectrometry remains integral to advancements in science, healthcare, and environmental testing.

Restraints

-

The high upfront cost of mass spectrometry instruments and the need for specialized training limit their adoption, particularly in smaller laboratories and regions with a shortage of skilled operators.

-

The absence of globally standardized methods for certain applications, combined with complex regulatory requirements, can hinder the widespread use of mass spectrometry in various industries.

Segmentation Insights

By Product

Hybrid mass spectrometry instruments, including Quadrupole ToF (Q-ToF) and Triple Quadrupole, dominated the market in 2023, contributing to nearly 48.0% of the total revenue. These instruments are widely used due to their superior accuracy, sensitivity, and versatility in applications such as proteomics, metabolomics, and clinical diagnostics. The hybrid systems provide enhanced resolution and mass accuracy, making them indispensable for complex sample analyses in pharmaceutical R&D and biomarker discovery.

The software & services segment is the fastest-growing category, fueled by the increasing adoption of data-intensive techniques like high-throughput screening and multi-omics studies. Advanced software solutions optimize data analysis, interpretation, and instrument efficiency, while services such as maintenance, training, and consulting meet growing demands from laboratories.

By Sample Preparation Technique

The LC-MS segment accounted for the largest share, with a dominance of 52.0% in 2023. Its capability to analyze non-volatile and thermally labile compounds makes it ideal for applications in pharmaceuticals, food safety, and environmental testing. LC-MS is integral for detecting contaminants and ensuring compliance with stringent regulations.

ICP-MS emerged as the fastest-growing sample preparation technique due to its high precision in detecting trace elements and isotopes. Its applications in environmental testing, toxicology, and metal analysis in biological samples are driving growth, supported by advancements in sensitivity and automation.

Regional Analysis

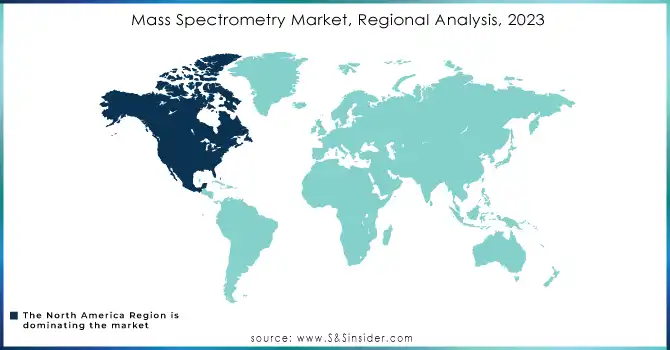

North America accounted for the largest share of the market in 2023, led by substantial investments in pharmaceuticals, biotechnology, and research areas. The U.S., one of the primary contributors to this market, also has a strong demand for mass spectrometry in clinical diagnostics, drug development, and environmental testing. Growth in this market is further bolstered by North America's solid healthcare infrastructure and government initiatives, as spending on R&D annually grows at 10-15%. The region is likely to remain in the leadership position, accounting for more than 40.0% of the global market share in 2023.

Europe followed closely, benefiting from a strong pharmaceutical industry as well as an increasing focus on clinical diagnostics. The European market is rapidly expanding due to stringent regulations in food safety, pharmaceuticals, and environmental monitoring. From a geographical standpoint, the leaders in mass spectrometry system adoption would be countries like Germany, the UK, and France. Demand for personalized medicine and precision diagnostics, along with influence from both research labs and hospitals, is further driving the growth of the European market, which should experience a CAGR of 8% during the next few years.

Large growth was observed in the Asia-Pacific region, with large countries driving this growth. Technological advancements and demand in clinical diagnostics and environmental testing are the drivers for the growth of this market. Pharmaceutical and biotechnology research, primarily in China and India, are on a high growth trend, and the region will grow at a CAGR of 10.0% for the next few years.

Need any customization research on Mass Spectrometry Market - Enquiry Now

Key Players

-

Orbitrap Series (e.g., Orbitrap Exploris)

-

Q Exactive Series

-

TSQ Altis (Triple Quadrupole Mass Spectrometer)

-

Exactive Plus

-

ISQ EC (Single Quadrupole MS)

-

Agilent Technologies

-

6400 Series Triple Quadrupole LC/MS

-

5977B GC/MSD

-

1290 Infinity II LC with 6470 Triple Quadrupole MS

-

Triple Quad 5500

-

Triple Quad 6500+

-

QTRAP 6500+

-

X500B QTOF

-

SelexION (Ion Mobility Spectrometry)

-

Xevo TQ-XS (Triple Quadrupole Mass Spectrometer)

-

Synapt G2-Si (HDMS for Proteomics)

-

Vion IMS QTOF

-

ACQUITY UPLC H-Class

-

Bruker Corporation

-

TimSTED (Bruker) (TIMS-TOF Pro)

-

amaZon Speed ETD (Ion Trap MS)

-

Solarix XR (FTMS)

-

microTOF Q III (Quadrupole-TOF MS)

-

Shimadzu Corporation

-

LCMS-8050 (Triple Quadrupole MS)

-

LCMS-9030 (High-resolution Q-TOF MS)

-

AXIMA Confidence (MALDI-TOF MS)

-

PerkinElmer

-

Sciex Triple Quad 5500

-

Flexar MS-80

-

Claritas ID (Mass Spectrometry for Cannabis Testing)

-

Rigaku Corporation

-

NexION 2000 (ICP-MS)

-

Z-80 (High-resolution Quadrupole MS)

-

LECO Corporation

-

Pegasus BT (GC×GC-TOF MS)

-

AccuTOF GC-Alpha (GC-TOF MS)

-

JEOL Ltd.

-

AccuTOF-GC (Gas Chromatography-Mass Spectrometry)

-

JMS-T100GC (High Sensitivity Mass Spectrometer)

-

Hiden Analytical

-

HPR-40 (Quadrupole Mass Spectrometer)

-

HPR-60 (High-Resolution Quadrupole MS)

-

MKS Instruments

-

MKS Spectrum 100 (Mass Spectrometry Analyzer)

Recent Developments

In Nov 2024, UMass researchers led to a new method for detecting per- and poly-fluoroalkyl substances (PFAS) in water, using advanced mass spectrometry techniques. This innovation aims to enhance environmental testing and improve compliance with growing regulatory standards for PFAS contamination in water.

In August 2024, researchers at Caltech introduced an innovative fingerprint mass spectrometry method that could revolutionize proteomics. This breakthrough technique promises to enhance the understanding of complex proteomes, potentially leading to new insights into biology and disease mechanisms. By providing a more detailed and precise analysis, it paves the way for more effective diagnostics and treatments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.76 Billion |

| Market Size by 2032 | US$ 11.25 Billion |

| CAGR | CAGR of 7.74% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Instruments, Hybrid Mass Spectrometry, Triple Quadrupole, Quadrupole ToF (Q-ToF), Single Mass Spectrometry, Quadrupole, Time-Of-Flight (ToF), Ion Trap, Software & Services) •By Sample Preparation Technique (GC-MS, LC-MS, ICP-MS, Others) •By Application (OMICS Research (Genomics, Proteomics and Metabolomics), Drug Discovery, Environmental Testing, Food Testing, Pharma-Biopharma Manufacturing, Clinical Diagnostics, Applied Industries, Other) •By End User (Pharmaceutical Companies, Biotechnology Companies, Research Labs & Academic Institutes, Environmental Testing Labs, F&B Industry, Forensic Labs, Petrochemical Industry, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Agilent Technologies, SCIEX, Waters Corporation, Bruker Corporation, Shimadzu Corporation, PerkinElmer, Rigaku Corporation, LECO Corporation, JEOL Ltd., Hiden Analytical, MKS Instruments. |

| Key Drivers | • Technological Advancements and Growing Applications Drive Rapid Expansion of the Mass Spectrometry Market |

| Restraints | •The high upfront cost of mass spectrometry instruments and the need for specialized training limit their adoption, particularly in smaller laboratories and regions with a shortage of skilled operators. • The absence of globally standardized methods for certain applications, combined with complex regulatory requirements, can hinder the widespread use of mass spectrometry in various industries. |