CIP Chemicals Market Report Scope & Overview:

The CIP Chemicals Market Size was valued at USD 2.20 Billion in 2023 and is expected to reach USD 4.76 Billion by 2032, growing at a CAGR of 8.96% over the forecast period of 2024-2032.

To Get more information on CIP Chemicals Market - Request Free Sample Report

The CIP Chemicals Market is experiencing notable growth, fueled by key drivers that shape its evolution. Regulatory compliance plays a crucial role, ensuring that companies adhere to strict safety standards in chemical usage. As industries look to improve efficiency, the cost-saving benefits of Cleaning in Place systems are becoming evident, significantly lowering operational expenses. Cleaning chemical consumption varies by region, with North America and Europe leading in adoption due to stringent regulations. The shift from manual cleaning to automated CIP chemicals is accelerating, driven by efficiency and sustainability. Meanwhile, increased R&D investment is fueling innovation in the sector, with manufacturers focusing on advanced, eco-friendly chemical solutions. Our report offers an in-depth analysis of these key trends shaping the market's future.

CIP Chemicals Market Dynamics

Drivers

-

Rising Regulatory Standards Across the Food & Beverage and Pharmaceutical Industries Drive Demand for Cleaning in Place Chemicals

The growing demand for Cleaning in Place chemicals is significantly influenced by stringent regulatory standards in industries such as food processing, beverages, and pharmaceuticals. Governments worldwide are imposing increasingly stringent hygiene and safety standards to ensure that food, beverages, and pharmaceutical products meet health and safety regulations. To comply with these regulations, manufacturers in these industries are turning to Cleaning in Place systems for their ability to maintain consistent and high-quality cleaning standards. CIP chemicals are critical in ensuring that all surfaces, including production lines, equipment, and storage vessels, are thoroughly cleaned and disinfected. Failure to comply with hygiene standards can lead to significant fines, recalls, or damage to a brand’s reputation, which is why companies are increasingly adopting these chemicals to stay compliant. The regulatory pressure driving this demand will continue to push the growth of the Cleaning in Place chemicals market.

Restraints

-

High Initial Investment in Automated Cleaning Systems Restrains the Widespread Adoption of Cleaning in Place Technologies

Despite the numerous benefits offered by automated Cleaning in Place systems, the high initial investment required to adopt these technologies can be a major restraint, particularly for smaller enterprises or businesses operating in price-sensitive markets. The upfront costs for installing automated systems, training staff, and maintaining these systems can be prohibitively expensive for businesses that are already under financial pressure. Small and medium-sized companies may be hesitant to switch from traditional cleaning methods to automated systems because of the significant capital expenditure involved. Additionally, some companies may already have existing manual cleaning processes in place, and upgrading to more advanced systems could disrupt their operations. This financial barrier limits the adoption of automated Cleaning in Place technologies, particularly in emerging economies where cost considerations are more critical. Overcoming this restraint requires creating cost-effective solutions and offering incentives to encourage investment in automated cleaning technologies.

Opportunities

-

Technological Advancements in Chemical Formulations for Specific Industry Applications Open New Market Segments

Technological advancements in chemical formulations present a significant opportunity for companies operating in the Cleaning in Place chemicals market. As industries such as pharmaceuticals, biotechnology, and high-tech manufacturing become more specialized, there is an increasing demand for cleaning chemicals that are specifically designed for their unique requirements. For instance, pharmaceutical manufacturing requires cleaners that do not leave residue and can be used on highly sensitive equipment. Similarly, biotechnology applications demand chemicals that do not interfere with delicate bioprocesses. By investing in research and development, manufacturers can create tailored Cleaning in Place chemical formulations that meet the precise needs of these specialized industries. These innovations can lead to the emergence of new market segments, enabling manufacturers to diversify their offerings and create a competitive advantage in a rapidly evolving market.

Challenge

-

Resistance to Change and Slow Adoption of Advanced Cleaning Systems in Traditional Industries

Despite the growing advantages of Cleaning in Place systems, many traditional industries remain resistant to adopting newer technologies. Industries such as textiles, agriculture, and chemicals, which have relied on manual cleaning processes for decades, often face challenges in transitioning to automated systems. Concerns about high upfront costs, the complexity of implementation, and the need to retrain employees can delay the adoption of Cleaning in Place systems. In some cases, companies might be comfortable with their existing systems and hesitant to make the necessary investments for modernization. Additionally, businesses in developing economies may be more focused on cost-cutting measures and less willing to adopt automated systems. Overcoming this challenge requires manufacturers to provide clear evidence of the long-term cost savings, operational benefits, and compliance advantages associated with automated cleaning systems.

CIP Chemicals Market Segmental Analysis

By Product Type

Alkaline cleaners dominated the Cleaning in Place chemicals market in 2023, holding a significant market share of 40.2%. Their dominance is attributed to their effectiveness in removing organic materials such as fats, oils, and proteins, which are common in industries like food processing, beverages, and dairy. Regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) have set strict hygiene standards, pushing industries to adopt more efficient and reliable cleaning methods. Alkaline cleaners provide consistent cleaning results in high-temperature environments, which is a key factor in their widespread use across these industries. The growing focus on maintaining hygiene standards and preventing contamination further supports the continued use of alkaline-based chemicals, making them indispensable in CIP systems.

By Process Type

Recirculated cleaning dominated the CIP chemicals market in 2023, accounting for 64.7% of the market share. This process allows for the reuse of cleaning chemicals and water, which makes it highly cost-effective and environmentally sustainable. Many industries, especially in food and beverage production, are increasingly adopting recirculated cleaning systems due to their reduced water and chemical usage. The sustainability movement, backed by environmental regulations, is a significant factor driving this trend. Regulatory bodies such as the Environmental Protection Agency (EPA) and the European Union have emphasized resource conservation, including water and chemicals, reinforcing the preference for recirculated cleaning systems. Their widespread use in industries that require continuous production processes, such as dairy and brewing, further highlights their dominance.

By Form

In 2023, liquid forms of Cleaning in Place chemicals dominated the CIP chemicals market, with a 72.4% market share. Liquid cleaners are highly effective and versatile, making them ideal for automatic and continuous cleaning applications across various industries. Their easy application and ability to cover large surface areas quickly make them a preferred choice for businesses. Regulatory authorities like the FDA and the European Medicines Agency (EMA) have reinforced stringent cleaning standards, further driving the demand for liquid-based solutions. For example, in pharmaceutical and biotechnology industries, liquid cleaners are essential in maintaining the required cleanliness levels without leaving any residue. This widespread application in diverse industries, especially in regulated sectors, solidifies their dominance in the market.

By End-Use Industry

The Food and Beverage industry dominated the Cleaning in Place chemicals market in 2023, holding a 32.8% market share. This industry’s demand for stringent hygiene practices has driven the adoption of Cleaning in Place systems, which help prevent contamination and ensure product safety. Regulatory organizations such as the U.S. Food Safety and Inspection Service (FSIS) and the European Union’s Food Safety Authority have enforced strict regulations that mandate the use of effective cleaning systems to safeguard public health. The high volume of daily cleaning requirements in food production facilities, combined with increasing consumer demand for hygienic products, continues to drive growth in this sector. The Food and Beverage industry’s reliance on efficient, effective cleaning systems ensures its dominance in the market.

CIP Chemicals Market Regional Outlook

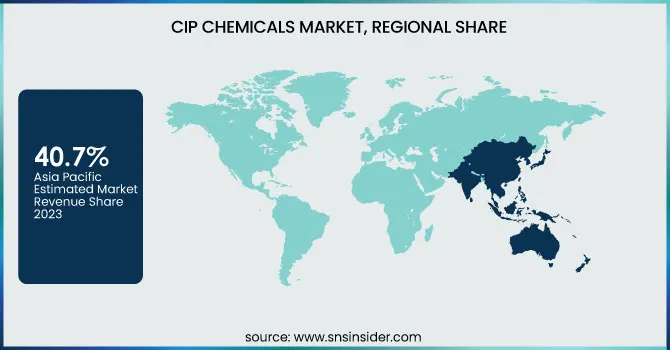

In 2023, the Asia Pacific region dominated the Cleaning in Place chemicals market, accounting for approximately 40.7% of the total market share. The region's growth can be attributed to the rapid expansion of industries such as food and beverage, pharmaceuticals, and manufacturing. Countries like China and India are leading this surge, driven by increasing urbanization, rising disposable incomes, and heightened awareness of hygiene standards. For instance, China's food processing sector has witnessed a significant boom, with the government implementing stricter food safety regulations, thereby boosting the demand for effective cleaning solutions. Additionally, India's dairy industry, one of the largest globally, is increasingly adopting Cleaning in Place systems to ensure compliance with health standards. As the region continues to industrialize and invest in advanced cleaning technologies, its dominance in the Cleaning in Place chemicals market is expected to persist.

The European region emerged as the fastest-growing market for Cleaning in Place chemicals, with a significant growth rate during the forecast period. This growth is primarily driven by stringent regulatory standards surrounding hygiene and safety, particularly in the food and beverage and pharmaceutical sectors. Countries such as Germany, France, and the United Kingdom are at the forefront of adopting advanced Cleaning in Place technologies to meet these regulations. For example, the German food processing industry, known for its high standards, is increasingly investing in innovative cleaning solutions to comply with EU hygiene directives. Moreover, the rising consumer preference for organic and clean-label products is prompting manufacturers to implement rigorous cleaning protocols, further driving the demand for Cleaning in Place chemicals in the region. As Europe prioritizes sustainability and health safety, its market for Cleaning in Place chemicals is set for substantial growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Anderson Chemical Company (ProClean CIP, ProClean Alka CIP)

-

BASF SE (Sokalan CP 5, Trilon M)

-

CCL Pentasol (Pentasol CIP Cleaner, Pentasol Acid Detergent)

-

Christeyns (Acifoam, Neutrafoam)

-

DeLaval Inc. (DeLaval CIP Super, DeLaval Acid Cleaner)

-

Diversey Holdings, Ltd. (Divo CIP, Diverclean Sonic)

-

Döhler Group (Döhler CIP Acid, Döhler CIP Caustic)

-

Ecolab Inc. (Horolith CIP, P3-Ultrasil)

-

FINK TEC GmbH (FINK Alka CIP, FINK Desana CIP)

-

Hydrite Chemical Co. (Hydri-Clean CIP, Hydri-San 100)

-

Kersia Group (CIP Alkaline, CIP Acid)

-

Neogen Corporation (Acid-A-Foam, BioSentry 904)

-

Novozymes A/S (Medley Enzymatic Cleaner, Carezyme)

-

Quat-Chem Ltd. (Quat-Chem CIP 200, Quat-Chem Acid CIP)

-

Sanosil Ltd. (Sanosil S015, Sanosil Super 25)

-

Spartan Chemical Company, Inc. (High Acid Cleaner FP, Spartan CIP Alkaline)

-

Steris Corporation (Steris CIP 200, ProKlenz ONE)

-

Zep Inc. (Zep FS CIP Cleaner, Zep Alkaline CIP)

-

Zschimmer & Schwarz (ZETALON CIP, ZETALON Acid Cleaner)

Recent Developments

-

August 2024: Norges Bank invested in renewable energy, focusing on the Cleaning in Place chemicals sector to enhance sustainability within its portfolio and support eco-friendly practices.

-

March 2024: Lotte Chemical partnered with a consortium to develop blue and green ammonia technologies, promoting sustainable hydrogen production methods and highlighting a shift towards cleaner alternatives in chemical production.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.20 Billion |

| Market Size by 2032 | USD 4.76 Billion |

| CAGR | CAGR of 8.96% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Alkaline Cleaners, Acid Cleaners, Disinfectants/Sanitizers, Enzyme-Based Cleaners, Others) •By Process Type (Single-Use Cleaning, Recirculated Cleaning) •By Form (Liquid, Powder) •By End-Use Industry (Food & Beverage, Dairy Processing, Brewery & Distillery, Pharmaceutical & Biotechnology, Cosmetics & Personal Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ecolab Inc., Diversey Holdings, Ltd., Kersia Group, Neogen Corporation, Spartan Chemical Company, Inc., Quat-Chem Ltd., Zep Inc., Sanosil Ltd., Hydrite Chemical Co., Döhler Group and other key players |