Pharmaceutical Market Size Analysis:

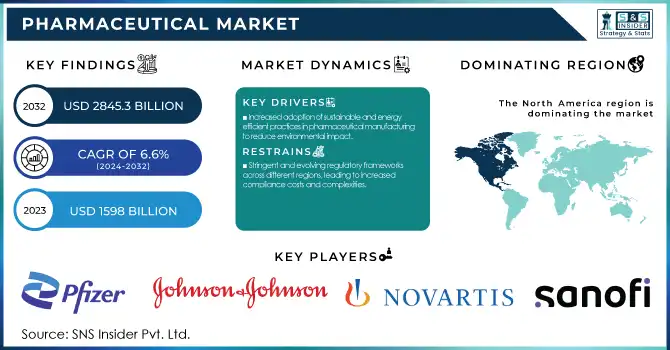

The Pharmaceutical Market size was valued at USD 1598 Billion in 2023 and is expected to reach USD 2845.3 Billion by 2032, growing at a CAGR of 6.6% over the forecast period 2024-2032.

To get more information on Pharmaceutical Market - Request Free Sample Report

The Pharmaceutical Market Report 2023-2024 provides essential statistical insights and pharmaceutical market trends affecting the pharmaceutical industry. It includes disease incidence and prevalence and trends for prescriptions by region and the volume of drugs produced and consumed. The report also examines healthcare spending on pharmaceuticals, describing government, private, and out-of-pocket outlays. It also points out trends in the growing field of biologics and biosimilars and discusses the changing regulatory and compliance landscape impacting drug approvals and pricing.

This report serves as a valuable resource for understanding market dynamics and future opportunities in the pharmaceutical sector. The pharmaceutical market growth is significantly driven by the growing prevalence of chronic disease, the aging population, and increasing healthcare expenditure. Indian Government aims to increase healthcare expenditure from 1.7% to 1.8% of the country's GDP to 2.5% by 2025. India is the largest supplier of generic medicines globally with a 20% global market share by volume and came in the third position in the production of pharmaceutical products globally by volume.

Global Pharmaceutical Market Dynamics

Drivers:

-

Increased Adoption of Sustainable and Energy-efficient Practices in Pharmaceutical Manufacturing to Reduce Environmental Impact

To reduce its carbon footprint, the pharmaceutical industry is increasingly embracing sustainable and energy-efficient practices. For instance, in 2024 Piramal Pharma Limited saw a 29% rise in renewable energy consumption. For instance, in 2024, Piramal Pharma Limited reported a 29% increase in renewable energy consumption. Using 2022 as the base year, Piramal Pharma Limited aims to reduce absolute Scope 1 and 2 greenhouse gas emissions by 42% and Scope 3 emissions by 25% by fiscal year 2030. Glenmark Pharmaceuticals, for instance, reduced its carbon emission intensity by 10% over the last three years, through energy efficiency measures and renewable energy source integration, with 6% of its energy now being sourced sustainably.

AstraZeneca is also working toward sustainability on the product side, with its Breztri inhaler in the pipeline using a propellant with 99.9% less global warming potential than the hydrofluorocarbons traditionally used, aiming to lower its annual greenhouse gas emissions by 1.3 million tons. These projects mirror a widespread industry change toward environmental consciousness, motivated by regulatory pressures and a sense of public health. Pharmaceutical companies are also working to reduce their carbon footprints and promote sustainability by adopting renewable energy, improving energy efficiency, and creating greener products.

Restraints:

-

Stringent and Evolving Regulatory Frameworks across Different Regions, Leading to Increased Compliance Costs and Complexities

The pharmaceutical industry faces significant restraint due to stringent and evolving regulatory frameworks. To facilitate drug safety, efficacy, and quality these regulations differ substantially across regions rendering a complex picture for the pharmaceutical companies working globally. Over 65% of pharmaceutical firms reported increased compliance costs as a result of changing regulatory guidelines in key markets, such as the U.S., EU, and China according to a recent 2024 International Federation of Pharmaceutical Manufacturers & Associations (IFPMA) report.

In addition, the emergence of new treatment modalities such as gene editing and personalized medicine has created new challenges and necessitated a more rigorous assessment of their clinical utility. For example, the European Medicines Agency (EMA) noted a 40% increase in regulatory reviews of advanced therapy medicinal products (ATMPs) from the previous year, a sign of the increasing complexity of compliance obligations. All these trends towards increased regulation, require larger investments in legal practitioners, good quality control systems, and clinical studies, putting even more strain on resources, particularly for smaller biotech companies.

Opportunities:

-

Integration of Artificial Intelligence (AI) and Big Data Analytics in Drug Discovery and Development, Enhancing Efficiency and Enabling Personalized Medicine Approaches

AI and big data analytics are systematically transforming drug discovery and development processes and offering enormous potential to improve efficiency and insight in pharmaceutical research. It typically takes more than 10 years and costs over USD 2 billion to develop a new drug. This complexity is one of the reasons why AI can speed this process up, as it allows for faster and more accurate identification of potential drug candidates based on enormous sets of data. AI models can predict the behavior of molecules and optimize lead compounds, which will considerably reduce the costs and timeline such experiments typically incur within laboratories.

For instance, the AI-designed drug DSP-1181, developed by Exscientia, which reached clinical trials in under a year, significantly faster than traditional timelines. Beyond new drug discovery, AI-enabled platforms have accelerated complex disease treatments, and Regeneron's Evinacumab is a key example of an AI-discovered drug that directly targets rare complex genetic disorders by targeting the ANGPTL3 protein. With the adoption of AI and big data analytics by more pharmaceutical companies, the industry will be able to bring new therapies to readers more effectively, allowing for more unmet medical needs to be addressed and better patient outcomes.

Challenges:

-

High Research and Development (R&D) Costs and Lengthy Drug Approval Processes, Hindering the Timely Introduction of New Therapies

The pharma sector is currently having a challenge with high R&D costs and longer timelines for drug approvals. Top companies in 2024 (Roche & Johnson & Johnson) are estimated to spend nearly USD 9.9 billion on research & development. Despite these substantial investments, the pathway to bringing a new drug to market remains arduous. In the U.S., the Food and Drug Administration (FDA) has a goal under the Prescription Drug User Fee Act (PDUFA) to review New Drug Applications within 10 months with a 6-month goal for priority reviews. However, these target dates are not always achieved, resulting in delays.

In Australia, for instance, patients wait an average of 466 days from the time the Therapeutic Goods Administration approves the drug to its availability on the Pharmaceutical Benefits Scheme. With the soaring R&D costs, long timelines to the market also present a huge challenge to the timely introduction of new therapies, affecting patient access to better therapeutics.

Pharmaceutical Market Segmentation Overview

By Molecule Type

Conventional drugs (small molecules) held the leading revenue share of 54% of the market in 2023. Their prevalence is due in large part to established manufacturing processes and relatively predictable pharmacokinetics, along with oral bioavailability. According to estimates, there are about 3,000 drug companies and over 10,000 manufacturing units in the Indian pharmaceutical industry, which is keenly focused on conventional medicine. The government's push for self-reliance in manufacturing APIs (Active Pharmaceutical Ingredients) which are primarily used in conventional drugs has also strengthened this segment. To encourage local manufacturing of critical Active Pharmaceutical Ingredients (APIs) and cut down on import dependence, the Indian government launched the Production Linked Incentive (PLI) scheme. This effort is likely to contribute to the growth of the conventional drugs segment.

By Product

In 2023, the branded segment held the largest pharmaceutical market share of 66% in terms of revenue. Their reign can be attributed to multiple elements, such as brand awareness, perceived quality, and patient trust. Government initiatives aimed at fostering innovation and R&D in the pharmaceutical space have notably catalyzed the growth of branded products in India. As per experts in the industry, the allocation of 10% or more of the National Research Fund to life sciences can further encourage the establishment of branded pharmaceutical products. Moreover, the government aims to increase healthcare spending to 2.5% of GDP by 2025 and this creates an opportunity for an increase in consumption of branded pharmaceuticals. Branded products are also perceived by healthcare providers and patients to be of better quality than generics, which additionally bolsters their market dominance.

By Type

In 2023, the prescription segment accounted for the largest revenue share of 88% in the pharmaceutical market. This presents a large share that is mainly driven by chronic diseases, the increasing aging population, and growing healthcare expenditure. As India has made great strides with government schemes in targeting healthcare access, the prescription segment experienced significant growth in response. The availability of prescription drugs has increased in India due to health insurance coverage for more than 500 million Indians through the Ayushman Bharat scheme.

With the increase in prescriptions, the natural market has also grown as a direct result. In addition, the Indian pharmaceutical industry has a solid emphasis on R&D as companies earmark around 8.4% of their sales for research, leading to the generation of new prescription drugs. The government's target to increase this allocation to match the global average of 10-11% is expected to further drive innovation in prescription medications.

By Disease

Cancer held a market share of 17% in 2023 and led the market. Such a high share can be credited to the growing prevalence of cancer not only globally but also in India. The Indian Council of Medical Research (ICMR) projects India's cancer cases to rise from 1.39 million in 2020 to 1.57 million in 2025. Since then, the Indian government has made some efforts to cope with the increasing burden of cancers. In addition, the NPCDCS (National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases and Stroke) programme supports early detection, management and referral of cancer cases.

Additionally, the focus of the Indian pharmaceutical industry has gradually shifted towards Oncology research and development. Top Indian pharmaceutical companies are now focusing on specialty portfolios from cancer treatments. The government's thrust towards enhancing healthcare spending and developing R&D in the pharmaceutical sector is likely to propel cancer therapeutics' development further.

By Route of Administration

In 2023, the oral route led the market by accounting for 57% of revenue. Several factors, such as patient preference, ease of administration, and cost-effectiveness have contributed to this dominance. The strength of the Indian pharmaceutical industry lies in the manufacture of generic medicines, particularly in the oral dosage form. The ensuing push from the government to promote API manufacturing in the country, which is used mainly in oral formulations, has additionally helped this segment strengthen. The PLI scheme will help in cutting down reliance on imports and encourage local manufacturers to produce critical active pharmaceutical ingredients (APIs) used in oral medicines. India's strength in making inexpensive oral formulations is in sync with the governments reach out to enrich affordable health care for the huge population.

By Formulation

In 2023 tablets accounted for the largest market share at 27%. Several factors contribute to this dominance, which include ease of manufacturing, cost-effective solutions, and patient compliance. The Indian pharmaceutical industry has a solid manufacturing base, particularly for tablet formulation. The government push to bolster the domestic setup of pharma manufacturing capabilities has added to the already buoyant tablet segment. The Production Linked Incentive (PLI) scheme, which aims to boost domestic production of critical APIs and formulations, is expected to drive growth in tablet manufacturing.

By End Market

The hospitals segment held the largest revenue share of 53% in the pharmaceuticals market in 2023. This success is due to the increasingly large number of hospital admissions, the increasing prevalence of chronic diseases, and the development of healthcare infrastructure in India. Government focus on the healthcare infrastructure in India has also been a significant driver for the growth of the hospital segment. The PMSSY seeks to address regional imbalances in the availability of affordable and reliable tertiary healthcare services.

The creation and upgradation of government medical colleges and new AIIMS (All India Institute of Medical Sciences) institutes through this initiative have also increased the demand for pharmaceuticals in hospital settings Additionally, the government initiative to increase healthcare expenditure to reach 2.5% of GDP by 2025 will inject impetus for further growth in the hospital segment. Moreover, the widening of health insurance coverage and access to hospital treatment under schemes such as Ayushman Bharat have expanded hospital pharmaceutical consumption.

Regional Insights

In 2023, North America was the largest revenue contributor to the global pharmaceutical market, with a revenue share of 45.0%. These factors include healthcare development, healthcare expenditure, high health conditions, and a high level of the pharmaceutical industry. The U.S., in particular, leads the global pharmaceutical market, generating almost half of the world's pharmaceutical revenues. During the forecast period, the Asia Pacific region is projected to grow at a faster CAGR.

Rapid growth is driven by factors, such as increasing healthcare expenditure, growing population, rising prevalence of chronic diseases, and increasing healthcare infrastructure in countries including India and China. The Asia Pacific region has been a key growth area, especially for India. India is the third largest in terms of volume of production of pharmaceuticals 14th in terms of value. With a 20% global supply share by volume, India today as the world's largest supplier of generic medicine has a stronghold on the global pharmaceutical market. This growth can be credited to initiatives taken by the Indian government to boost the pharmaceutical sector. These include allowing 100% FDI under automatic approval for greenfield investments and up to 74% for brownfield investments.

Get Customized Report as per Your Business Requirement - Enquiry Now

Pharmaceutical Market Key Players

Key Service Providers/Manufacturers

-

Pfizer Inc. (Comirnaty, Ibrance)

-

Johnson & Johnson (Stelara, Darzalex)

-

Roche Holding AG (Herceptin, Avastin)

-

Novartis AG (Cosentyx, Kisqali)

-

Merck & Co., Inc. (Keytruda, Gardasil 9)

-

Sanofi (Dupixent, Lantus)

-

AstraZeneca (Tagrisso, Farxiga)

-

GlaxoSmithKline plc (GSK) (Shingrix, Trelegy Ellipta)

-

Eli Lilly and Company (Mounjaro, Trulicity)

-

Bristol-Myers Squibb (BMS) (Opdivo, Eliquis)

-

AbbVie Inc. (Humira, Rinvoq)

-

Moderna, Inc. (Spikevax, mRNA-1273.222)

-

Gilead Sciences, Inc. (Biktarvy, Veklury)

-

Bayer AG (Xarelto, Eylea)

-

Takeda Pharmaceutical Company (Entyvio, Ninlaro)

-

Amgen Inc. (Repatha, Prolia)

-

Biogen Inc. (Spinraza, Aduhelm)

-

Regeneron Pharmaceuticals, Inc. (Dupixent, Eylea)

-

Boehringer Ingelheim (Jardiance, Ofev)

-

Teva Pharmaceuticals (Austedo, Ajovy)

Recent Developments in the Global Pharmaceutical Sector

-

On February 14, 2025, Zydus Lifesciences' subsidiary partnered with Zhuhai Beihai Biotech to market Beizray, an albumin-solubilized docetaxel injection, in the US. Under the agreement, Zhuhai will handle manufacturing, while Zydus will oversee commercialization, targeting cancers such as breast and non-small cell lung cancer.

-

In May 2024, Siren Biotechnology partnered up with Catalent, Inc. for the manufacturing of AAV gene therapies for potential cancer treatment.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1598 Billion |

| Market Size by 2032 | USD 2845.3 Billion |

| CAGR | CAGR of 6.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Pharmaceutical Molecule Type • By Pharmaceutical Product • By Pharmaceutical Type • By Pharmaceutical Disease • By Pharmaceutical Route of Administration • By Pharmaceutical Formulation • By Pharmaceutical End Market |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Pfizer Inc., Johnson & Johnson, Roche Holding AG, Novartis AG, Merck & Co., Inc., Sanofi, AstraZeneca, GlaxoSmithKline plc (GSK), Eli Lilly and Company, Bristol-Myers Squibb (BMS), AbbVie Inc., Moderna, Inc., Gilead Sciences, Inc., Bayer AG, Takeda Pharmaceutical Company, Amgen Inc., Biogen Inc., Regeneron Pharmaceuticals, Inc., Boehringer Ingelheim, Teva Pharmaceuticals. |