Citrus Extracts Market Report Scope & Overview:

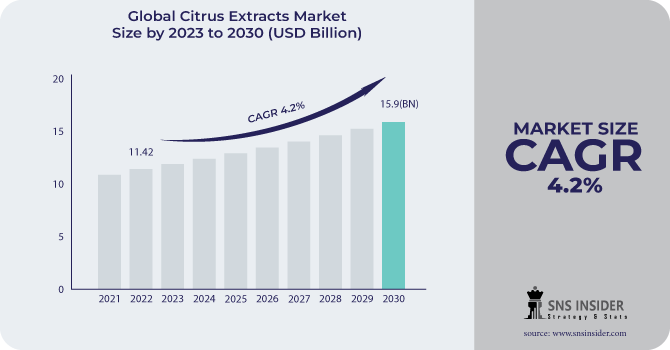

The Citrus Extracts Market size was USD $11.42 Billion in 2022 and is expected to Reach USD $15.9 billion by 2030 and grow at a CAGR of 4.2 % over the forecast period of 2023-2030.

Citrus extracts are concentrated forms of citrus fruits that are used in a variety of applications, including food and beverage, cosmetics, and pharmaceuticals. Citrus extracts are typically obtained by cold pressing or solvent extraction of citrus fruits. Instead of employing synthetic substances, food and beverage businesses now use natural components.

Growing fitness and health concerns among customers worldwide are to blame for this market transformation. A few illnesses, including heart conditions, allergies, diabetes, and cancer, influence individuals to lead better lifestyles using organic, natural foods. The bulk of the approximately 422 million individuals with diabetes globally reside in low- and middle-income nations, and diabetes is directly responsible for 1.5 million fatalities annually. The use of citrus fiber is anticipated to rise due to these reasons in the coming years. Due to their extensive surface areas, natural emulsifier extracts are added by food producers. Emulsifiers can easily bring oil and water together because of their bigger surface areas.

MARKET DYNAMICS

KEY DRIVERS:

-

Citrus extracts complement clean label trends by acting as both natural colorants and flavor enhancers.

-

A consistent supply of extraction raw materials is guaranteed by the world's citrus crop.

The worldwide citrus crop is crucial for ensuring a consistent supply of raw materials for extraction within the citrus extracts market. Citrus fruits, such as oranges, lemons, and limes, are cultivated all over the world in regions including Asia, North America, and Europe. This extensive cultivation not only guarantees a consistent supply of raw materials, but also makes it feasible to extract various tastes, scents, and bioactive ingredients from citrus fruits, satisfying the varied demands of industries ranging from food and beverage to cosmetics and pharmaceuticals.

RESTRAIN:

-

Citrus extracts' short shelf life may cause product loss and deterioration.

-

Trade conflicts and export/import restrictions can disturb international supply networks.

The complex global supply chains for the citrus extracts market are susceptible to disruption from trade disputes and export/import restrictions. These conflicts, which result from economic policies or geopolitical tensions, can cause delays, higher taxes, and ambiguous trading circumstances. Such interruptions can impair the flow of both completed goods and raw materials, which can impact the availability, cost, and dependability of citrus extracts for both producers and consumers throughout the world.

OPPORTUNITY:

-

Untapped potential for rising consumption and market development exists in emerging markets.

-

To meet changing customer tastes, distinctive flavor profiles and combinations are created.

The Citrus Extracts Market fosters innovation by creating unique flavor profiles and combinations to cater to changing consumer tastes. To satisfy a variety of palates, manufacturers combine different citrus extracts to create distinctive flavor sensations. This innovative method makes it possible to create flavors with several dimensions, improve goods in the food, beverage, and cosmetics sectors, and draw customers in with intriguing and original sensory experiences.

CHALLENGES:

-

Supply stability is impacted by crop vulnerability to weather-related crop changes.

-

Chemical residue laws that are strict have an impact on extraction procedures and product quality.

The Citrus Extracts Market's extraction processes and product quality are significantly impacted by stringent chemical residue rules. In order to guarantee that there are no dangerous leftovers throughout the extraction process, compliance with these rules necessitates stringent monitoring and control. This increases production's complexity and expense, affecting the choice of extraction techniques and sourcing strategies.

IMPACT OF RUSSIAN-UKRAINE WAR

The market for citrus extracts is made more unclear by the Russian-Ukrainian conflict. Because Ukraine produces a lot of citrus, any delays to its agricultural activities might have an impact on the availability of raw materials. In order to minimize possible market effects, industry participants may need to reassess their sourcing strategy and supply chain resilience. This might result in supply shortages and price variations.

The supply chain was disrupted by the Russia-Ukraine conflict, which led to a spike in the price of goods like Lime, Grapefruits, Oranges, Lemon, Others, etc. The average cost of lime and limestone for export in 2021 was $159 per tonne, an increase of 8.2% over the previous year. Lime markets throughout the world are evolving as a result of growing prices and a supply-side price increase of 35–55 %. Due to rising fertilizer and logistics costs as well as a decrease in local availability, prices for grapefruit are predicted to rise by 4% in 2022. Oranges increased in price by 25% from the initial 200 per packet.

The Russia-Ukraine war has increased the cost of commodities, which has a negative effect on the market.

IMPACT OF ONGOING RECESSION

The present recession has a negative impact on the citrus extracts business. A shift towards more economical options might result from diminished consumer purchasing power, which would affect the market for more expensive products. In addition, disruptions in the supply chain and financial worries may have an impact on both production costs and price plans, causing market participants to adapt to evolving market dynamics in order to maintain growth.

The price of commodities has grown as a result of the recession, including Bakery Products, Confectionery, Beverages, Savory, and Others. The cost of baked goods has risen by 12.9% in the last year, approximately twice as fast as food and three times as fast as other commodities. Costs for flour and prepared mixes grew 10.3% over the preceding 12 months and 2.9% on a monthly basis. Prices at Good Candy Company have gone up 8–10% for candy bars.

The impact of the ongoing recession has increased the cost of commodities, which has a negative effect on the market.

KEY MARKET SEGMENTS

By Product Type:

-

Lime

-

Grapefruits

-

Orange

-

Lemon

-

Others

By Nature:

-

Natural

-

Artificial

By Sales Channel:

-

Supermarkets

-

Departmental Stores

-

E-retailers

By Application:

-

Bakery Products

-

Confectionery

-

Beverages

-

Savory

-

Others

.png)

REGIONAL ANALYSIS

North America is the largest market for citrus extracts, with a share of 35% of the global market. The market for citrus extracts in North America is being driven by the region's expanding demand for foods and beverages with citrus flavors. The United States and Canada are the two biggest markets in North America for citrus extracts.

Europe is the second-largest market for citrus extracts in 2022, accounting for 25% of the global market. In Europe, there are similar factors that support the development of the citrus extracts sector in a similar way to North America. The UK, Germany, and France are the three main markets in Europe for citrus extracts.

Asia-Pacific: This area is predicted to see the fastest rate of growth in citrus extract sales between 2023 and 2030. The Asia-Pacific region's growing appetite for citrus-flavored goods and beverages is what is driving the market for citrus extracts to grow. In the Asia-Pacific area, China, India, and Japan are the countries with the highest consumption of citrus extracts.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players:

Some major key players in the Citrus Extracts Market are Botanic Healthcare, Global Essence, Kerry, Plantae Extracts Private Limited, XENA BIO HERBALS PRIVATE LIMITED, Qingdao Vital Nutraceutical Ingredients BioScience Co. Ltd (VNI), Citrus Extracts LLC., Green Chem, Henry Lamotte Oils GmbH, CRODAROM SA and other players.

Botanic Healthcare-Company Financial Analysis

RECENT DEVELOPMENT

-

In March 2023, Botanic Healthcare and a major American food and beverage firm came to a distribution agreement. As a result of the agreement, Botanic Healthcare will be allowed to market its citrus extracts to customers in the US.

-

In January 2023, Kerry unveiled a fresh selection of citrus extracts for use in cosmetic and personal care products. The new collection includes extracts from citrus fruits including orange, lemon, lime, grapefruit, and others. The essential oils and beneficial compounds are concentrated in the cold-pressed extracts.

| Report Attributes | Details |

| Market Size in 2022 | US$ 11.42 Billion |

| Market Size by 2030 | US$ 15.9 Billion |

| CAGR | CAGR of 4.2 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Lime, Grapefruits, Orange, Lemon, Others) • By Nature (Natural, Artificial) • By Sales Channel (Supermarkets, Departmental Stores, E-retailers) • By Application (Bakery Products, Confectionery, Beverages, Savory, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Botanic Healthcare, Global Essence, Kerry, Plantae Extracts Private Limited, XENA BIO HERBALS PRIVATE LIMITED, Qingdao Vital Nutraceutical Ingredients BioScience Co. Ltd (VNI), Citrus Extracts LLC., Green Chem, Henry Lamotte Oils GmbH, CRODAROM SA |

| Key Drivers | • Citrus extracts complement clean label trends by acting as both natural colorants and flavor enhancers. • A consistent supply of extraction raw materials is guaranteed by the world's citrus crop. |

| Market Opportunity | • Untapped potential for rising consumption and market development exists in emerging markets. • To meet changing customer tastes, distinctive flavor profiles and combinations are created. |