Healthy Food Market Report Scope & Overview:

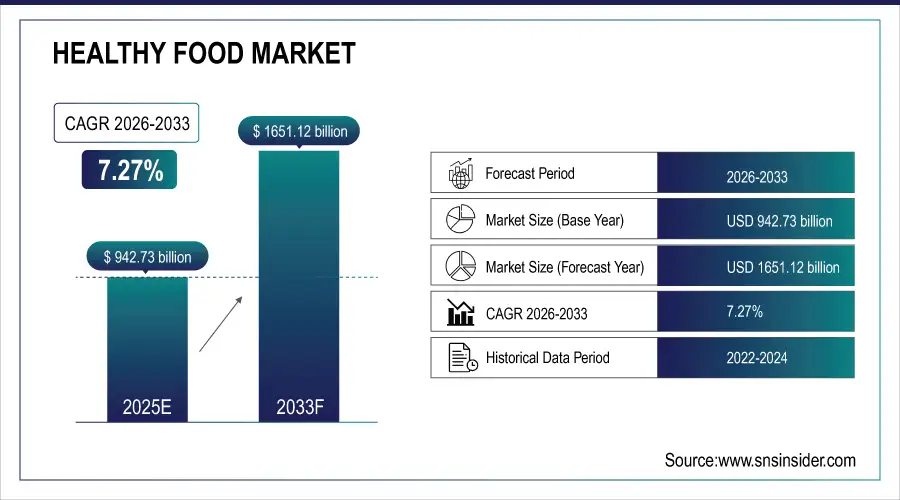

The Healthy Food Market size was valued at USD 942.73 Billion in 2025E and is projected to reach USD 1651.12 Billion by 2033, growing at a CAGR of 7.27% during 2026-2033.

The Healthy Food Market analysis highlights the rising consumer awareness of health, wellness, and nutrition. Increasing demand for plant-based, low-sugar, and fortified products is reshaping product offerings across snacks, beverages, and bakery categories. E-commerce and modern retail channels are accelerating accessibility and convenience for consumers.

In 2025, over 70% of global consumers actively checked nutrition labels, with 60% prioritizing products labeled “low-sugar,” “high-protein,” or “no artificial ingredients” during grocery purchases.

Market Size and Forecast:

-

Market Size in 2025E: USD 942.73 Billion

-

Market Size by 2033: USD 1651.12 Billion

-

CAGR: 7.27% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Healthy Food Market - Request Free Sample Report

Healthy Food Market Trends

-

Rising consumer demand for plant-based and vegan products drives innovation in alternative proteins, meat substitutes, and dairy-free offerings globally.

-

Increasing focus on clean-label, organic, and non-GMO products encourages manufacturers to provide natural, minimally processed, and preservative-free food options.

-

Growth of functional and fortified foods with added vitamins, minerals, probiotics, and proteins supports health-conscious and immunity-focused consumer preferences.

-

Expansion of online retail, direct-to-consumer platforms, and subscription models enhances accessibility, convenience, and personalized healthy food experiences.

-

Sustainability and eco-friendly packaging adoption gain prominence, as consumers prioritize environmentally responsible production and ethical sourcing in healthy food products.

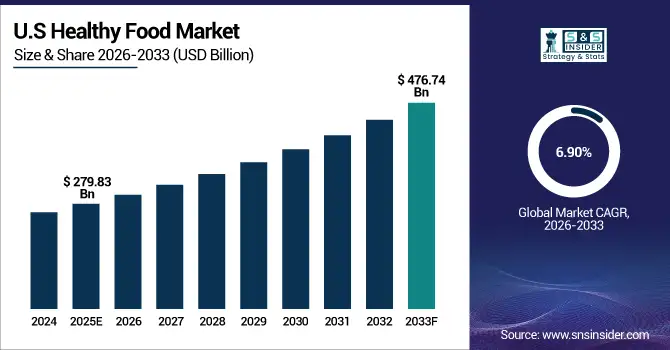

The U.S. Healthy Food Market size was valued at USD 279.83 Billion in 2025E and is projected to reach USD 476.74 Billion by 2033, growing at a CAGR of 6.90% during 2026-2033. Healthy Food Market growth is driven by increasing consumer awareness of nutrition, wellness, and lifestyle diseases. Demand for plant-based, organic, and functional foods is rising rapidly across snacks, beverages, and bakery segments. E-commerce and modern retail channels are expanding product accessibility and convenience.

Healthy Food Market Growth Drivers:

-

Growing Consumer Awareness and Preference for Health-Conscious, Nutrient-Rich, and Organic Food Products

Rising health consciousness, increasing lifestyle diseases, and the shift toward wellness-focused diets are driving the healthy food market. Consumers are actively seeking plant-based, fortified, low-sugar, and organic products. This trend encourages manufacturers to innovate with functional foods, snacks, beverages, and bakery items. E-commerce growth and easy access to health-focused products further support market expansion. Increasing disposable incomes and urbanization are enabling higher adoption of premium healthy food products, boosting revenue across global and regional markets.

By 2025, 55% of healthy food buyers actively chose organic-certified or plant-based options, with clean-label claims influencing over 70% of purchasing decisions in snacks and beverages.

Healthy Food Market Restraints:

-

High Product Costs, Supply Chain Complexity, and Regulatory Compliance Challenges

High pricing of organic, plant-based, and fortified foods limits adoption among cost-sensitive consumers, restraining market growth. Complex supply chains, perishable ingredients, and sourcing challenges create operational inefficiencies for manufacturers. Additionally, strict regulatory standards, certifications, and labeling requirements increase production costs and delay product launches. Lack of standardization across regions and compliance variations further hinder expansion. Consumer skepticism regarding health claims and low awareness in emerging markets also restricts market penetration, especially for premium or specialty healthy food offerings.

Healthy Food Market Opportunities:

-

Expansion in Emerging Markets and Rising Demand for Innovative, Functional, Sustainable Foods

Emerging markets present significant growth potential for healthy food products due to rising disposable incomes, urbanization, and growing health awareness. Companies can introduce fortified, plant-based, and clean-label offerings to meet consumer demand. Innovation in functional snacks, beverages, and bakery products provides differentiation opportunities. Additionally, sustainable sourcing, eco-friendly packaging, and direct-to-consumer channels can enhance brand loyalty. Strategic partnerships, collaborations, and regional expansions enable manufacturers to capture untapped market segments, driving revenue growth while aligning with evolving consumer lifestyles and global health trends.

By 2025, 60% of new healthy food launches in emerging markets featured fortification (iron, vitamin D) or plant-based ingredients to address nutritional gaps and align with global wellness norms.

Healthy Food Market Segment Analysis

-

By free form, gluten-free products led the market with a 36.27% share in 2025, while lactose-free products were the fastest-growing segment with a CAGR of 11.69%.

-

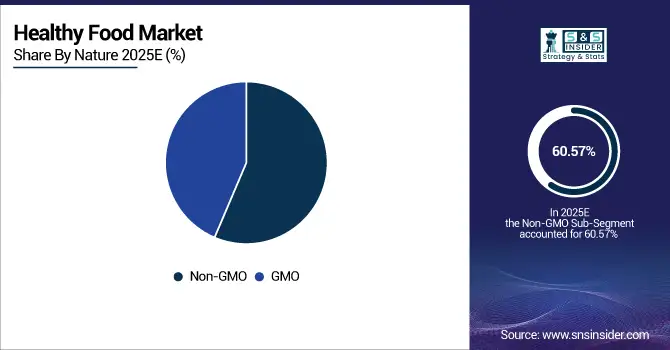

By nature, non-GMO products dominated 60.57% of the market in 2025, whereas GMO products were the fastest-growing segment with a CAGR of 10.35%.

-

By type, functional foods led the market with a 34.81% share in 2025, while healthy snacks were the fastest-growing segment with a CAGR of 13.50%.

-

By calorie content, low-calorie products held 45.38% of the market in 2025, while no-calorie products were the fastest-growing segment with a CAGR of 12.43%.

By Free Form, Gluten-Free Leads Market While Lactose-Free Registers Fastest Growth

The Healthy Food Market by free form is dominated by gluten-free products, which continue to lead due to growing consumer awareness about digestive health and celiac disease. Gluten-free offerings span bakery, snacks, and beverages, attracting health-conscious consumers globally. Meanwhile, lactose-free products are registering the fastest growth, driven by rising lactose intolerance awareness, dairy alternatives, and plant-based milk adoption. Manufacturers are innovating with fortified, clean-label, and convenient lactose-free options to cater to increasing demand across different regions.

By Nature, Non-GMO Dominate While GMO Shows Rapid Growth

In the Healthy Food Market, non-GMO products hold the largest share as consumers increasingly prefer natural, minimally processed foods free from genetic modifications. Non-GMO offerings include snacks, beverages, dairy alternatives, and functional foods, reflecting strong trust and brand loyalty. However, GMO-based products are witnessing rapid growth due to enhanced nutritional profiles, cost-effectiveness, and availability in emerging markets. Continuous innovation, regulatory approvals, and consumer education are driving acceptance of GMO-based healthy foods globally.

By Type, Functional Food Lead While Healthy Snacks Registers Fastest Growth

Functional foods dominate the market as consumers increasingly seek products offering health benefits beyond basic nutrition, including fortified beverages, protein-rich foods, and probiotic products. Functional offerings improve immunity, digestive health, and overall wellness, driving their adoption. Meanwhile, healthy snacks are the fastest-growing segment, fueled by convenience, on-the-go lifestyles, and increasing snacking trends among urban consumers. Manufacturers are innovating with nutrient-dense, plant-based, and clean-label snacks to capture growing demand across retail and e-commerce channels globally.

By Calorie Content, Low calories Lead While No Calories Grow Fastest

Low-calorie products lead the healthy food market as consumers aim to manage weight, reduce sugar intake, and maintain balanced diets. These include beverages, snacks, and ready-to-eat meals tailored for calorie-conscious consumers. Meanwhile, no-calories products are growing fastest, driven by artificial sweetener alternatives, sugar-free beverages, and zero-calorie snacks. Increased health awareness, dieting trends, and fitness lifestyles encourage adoption. Manufacturers are focusing on innovation in taste, flavor, and convenience to expand no-calorie options and meet diverse consumer preferences.

Healthy Food Market Regional Analysis:

North America Healthy Food Market Insights

In 2025 North America dominated the Healthy Food Market and accounted for 40.69% of revenue share, this leadership is due to the Strong consumer awareness of nutrition, wellness, and lifestyle diseases drives demand for plant-based, organic, and functional foods. E-commerce and modern retail channels facilitate convenient access. Innovation in clean-label and fortified products supports differentiation. Regional players and international brands continuously launch new products to capture evolving health-conscious consumer segments.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Healthy Food Market Insights

The U.S. Healthy Food Market is witnessing robust growth as consumers increasingly prioritize wellness, immunity, and nutrition. Plant-based alternatives, organic foods, and functional snacks are gaining popularity. Retail expansion, e-commerce, and subscription models enhance product accessibility. Manufacturers focus on clean-label, fortified, and convenient products.

Asia-pacific Healthy Food Market Insights

Asia-pacific is expected to witness the fastest growth in the Healthy Food Market over 2026-2033, with a projected CAGR of 7.96% due to rising health awareness, urbanization, and increasing disposable incomes. Consumers are adopting plant-based, organic, and fortified foods across snacks, beverages, and bakery products. E-commerce and modern retail channels are expanding product availability and convenience. Local manufacturers are innovating with functional and clean-label offerings.

India Healthy Food Market Insights

India’s Healthy Food Market is witnessing rapid growth due to rising health awareness, urbanization, and increasing disposable incomes. Consumers are adopting plant-based, organic, low-sugar, and fortified foods across snacks, beverages, and bakery products. E-commerce and modern retail channels are expanding product accessibility and convenience.

Europe Healthy Food Market Insights

In 2025, Europe emerged as a promising region in the Healthy Food Market, due to rising health consciousness, aging populations, and regulatory support for organic and functional foods. Consumers are adopting low-sugar, gluten-free, and plant-based alternatives. E-commerce and modern retail channels expand market reach. Local and international brands focus on innovation, clean-label products, and fortified offerings.

Germany Healthy Food Market Insights

Germany is one of Europe’s key markets for healthy foods, driven by strong consumer preference for organic, plant-based, and functional products. Retail penetration, e-commerce adoption, and convenience-focused product formats support market growth. Manufacturers emphasize clean-label, fortified, and low-calorie offerings. Health-conscious lifestyles and aging demographics increase adoption.

Latin America (LATAM) and Middle East & Africa (MEA) Healthy Food Market Insights

The Healthy Food Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the high-growth region for healthy foods, fueled by increasing health awareness and urbanization. Consumers are adopting plant-based, fortified, and functional foods. E-commerce and retail modernization improve accessibility. Local and international brands are launching innovative and convenient offerings. Government initiatives promoting nutrition, coupled with rising disposable incomes, support market expansion across these regions.

Healthy Food Market Competitive Landscape:

Nestlé is a global leader in healthy foods, offering plant-based, organic, and fortified products across snacks, beverages, and dairy alternatives. The company focuses on nutrition, wellness, and clean-label initiatives. Nestlé invests in research, product innovation, and sustainable sourcing to meet growing consumer demand for health-conscious and functional food options globally.

-

In June 2024, Nestlé Health Science launched a comprehensive GLP-1 nutrition support platform, offering tailored nutritional guidance and product options for individuals undergoing weight management, including those using GLP-1 medications.

Danone specializes in dairy, plant-based, and functional food products, emphasizing gut health, probiotics, and nutrition. The company leverages innovation in organic and fortified offerings to meet evolving health-conscious consumer preferences. Danone’s strong global presence, sustainability initiatives, and focus on wellness position it as a key player in the expanding healthy food market.

-

In August 2025, Danone introduced Oikos Fusion, a cultured dairy drink designed to support muscle retention during weight loss. This product features a patented blend of nutrients and is available in select U.S. retailers, including Walmart and Target.

Kellogg’s offers a wide range of nutritious cereals, snacks, and plant-based products targeting health-conscious consumers. The company emphasizes whole grains, low sugar, and fortified ingredients. Kellogg’s focuses on innovation, clean-label products, and global distribution to cater to growing demand for convenient, healthy, and functional foods across retail and e-commerce channels.

-

In March 2025, Kellogg’s launched a new line of high-protein, low-sugar cereals under its WK Kellogg Co spin-off, targeting fitness-conscious consumers. The range features clean-label ingredients and recyclable packaging, aligning with the company’s 2025 sustainability goals and expanding its presence in the functional breakfast segment.

Unilever provides a diverse portfolio of health-focused foods, including plant-based, fortified, and low-calorie options. The company emphasizes nutrition, sustainability, and clean-label innovation. By leveraging global reach, R&D, and strategic brand positioning, Unilever addresses rising consumer demand for convenient, healthy, and functional foods while supporting wellness and environmentally responsible production.

-

In February 2025, Unilever expanded its plant-based portfolio with the global rollout of a new pea-protein-based meat alternative under The Vegetarian Butcher brand. The product emphasizes clean-label formulation and reduced environmental impact, supporting Unilever’s “Future Foods” initiative and commitment to achieving net-zero emissions by 2039.

Healthy Food Market Key Players:

Some of the Healthy Food Market Companies are:

-

Nestlé

-

Danone

-

Kellogg’s

-

Unilever

-

Impossible Foods

-

PepsiCo

-

General Mills

-

Alnatura

-

Beyond Meat

-

Kashi

-

Amy’s Kitchen

-

Primal Kitchen

-

RXBAR

-

Dave’s Killer Bread

-

Bob’s Red Mill

-

Califia Farms

-

Vital Farms

-

Siete Family Foods

-

Spindrift

-

Jeni’s Splendid Ice Creams

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 942.73 Billion |

| Market Size by 2033 | USD 1651.12 Billion |

| CAGR | CAGR of 7.27% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Free Form (Gluten-Free, Dairy-Free, Soy-Free, Nut-Free, Lactose-Free, Artificial Flavor Free, Artificial Color Free, Others) • By Nature (Non-GMO, GMO) • By Type (Functional Food, Fortified and Healthy Bakery Products, Healthy Snacks, BFY Foods, Beverages, Chocolates) • By Calorie Content (No calorie, Low calories, Reduced calorie) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Nestlé, Danone, Kellogg’s, Unilever, Impossible Foods, PepsiCo, General Mills, Alnatura, Beyond Meat, Kashi, Amy’s Kitchen, Primal Kitchen, RXBAR, Dave’s Killer Bread, Bob’s Red Mill, Califia Farms, Vital Farms, Siete Family Foods, Spindrift, Jeni’s Splendid Ice Creams |