Nutraceutical Excipients Market Report Scope & Overview:

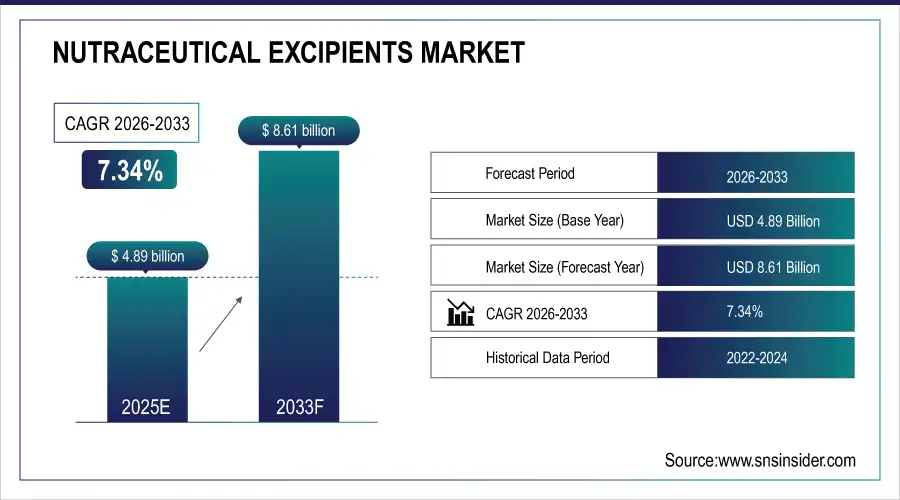

The Nutraceutical Excipients Market size was valued at USD 4.89 Billion in 2025 and is expected to reach USD 8.61 Billion by 2033, growing at a CAGR of 7.34% over the forecast period 2026–2033.

To Get more information On Nutraceutical Excipients Market - Request Free Sample Report

The market is witnessing robust expansion fueled by rising health-conscious consumer demand, increasing adoption of dietary supplements, and growing investments in functional foods. Nutraceutical excipients play a vital role in enhancing product stability, bioavailability, taste, and shelf life, strengthening their uptake across sectors such as vitamins, probiotics, and fortified nutritional products.

The Nutraceutical Excipients Market is experiencing steady growth, driven by rising consumption of dietary supplements, clean-label formulations, and functional food products. Increasing demand for natural and organic excipients, coupled with regulatory focus on product safety and quality, is shaping the market landscape. Emerging applications in protein blends, probiotics, and fortified beverages further amplify opportunities for manufacturers.

Nutraceutical Excipients Market Size and Forecast:

-

Market Size in 2025E: USD 4.89 Billion

-

Market Size by 2033: USD 8.61 Billion

-

CAGR: 7.34% from 2025 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

The Nutraceutical Excipients Market is expanding significantly, fueled by the increasing consumption of functional foods and dietary supplements. Rising focus on clean-label products, formulation stability, and enhanced bioavailability are key drivers. The growing adoption of natural excipients and rising investments in nutraceutical R&D offer lucrative growth opportunities across global regions.

Key Nutraceutical Excipients Market Trends:

-

Rising demand for clean-label and natural excipients is shaping market direction.

-

Growing innovation in excipient functionality improves solubility, stability, and bioavailability of nutraceuticals.

-

Expansion of probiotics and prebiotics supplements drives excipient usage for product viability.

-

Increasing fortification in beverages and protein supplements boosts demand.

-

Advances in encapsulation technology enhance effectiveness of vitamins and bioactive ingredients.

-

Regulatory push toward safety and quality encourages adoption of high-grade excipients.

U.S. Nutraceutical Excipients Market Insights:

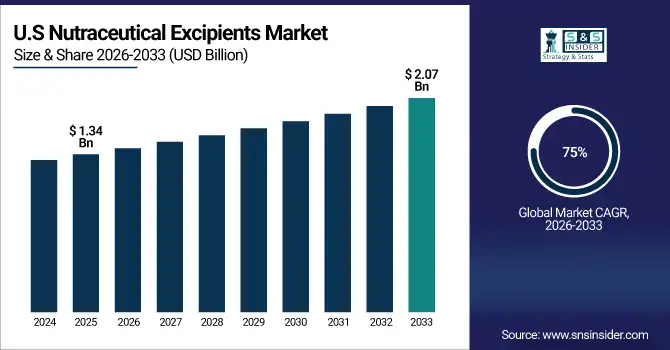

The U.S. Nutraceutical Excipients Market size was USD 1.34 Billion in 2025E and is expected to reach USD 2.07 Billion by 2033. According to a study, over 75% of U.S. adults consume dietary supplements, causing higher incorporation of excipients to improve drug stability, solubility, and shelf life. This cause, rising wellness supplement adoption, effects expanded innovation in disintegrants and binders for tablets and capsules. Nutraceutical firms are integrating excipients to improve delivery efficiency and consumer compliance, ensuring consistent market growth in the U.S.

Nutraceutical Excipients Market Drivers:

-

Growing consumer preference for clean-label nutraceuticals boosts demand for natural excipients in the global market

The consumer shift toward natural and clean-label products has become one of the most significant drivers shaping the nutraceutical excipients market. This cause, increased awareness of ingredient transparency and safety, effects strong demand for natural binders, fillers, and coating agents free from synthetic chemicals. According to consumer surveys in April 2025, more than 60% of nutraceutical buyers in North America preferred products labeled as "natural" or "non-GMO," boosting the adoption of excipients derived from organic starch, cellulose, and plant-based sources. Continuous advancements in excipient design, including multifunctional additives that enhance solubility and disintegration, are fueling industry competitiveness.

In May 2025, a leading excipient manufacturer launched a plant-based binding agent for dietary supplements in the U.S. market, which achieved strong uptake among vitamin and herbal supplement producers seeking to align with clean-label trends.

Nutraceutical Excipients Market Restraints:

-

High production costs and regulatory compliance requirements restrict excipient innovation and market expansion

Despite the rising demand for nutraceutical excipients, the industry faces significant challenges from high production costs and stringent regulatory frameworks. This cause, strict FDA quality guidelines and global health authority norms, effects delayed product launches, higher operating expenses, and restricted affordability for small- to mid-sized nutraceutical companies. Developing excipients with multifunctional properties often requires R&D investments that increase cost pressures. Moreover, since excipients are not just inert fillers but impact drug delivery, compliance with GRAS (Generally Recognized as Safe) standards forces extensive testing. This creates barriers for smaller players seeking to enter the market.

In 2024, several nutraceutical startups in Europe expressed difficulties in scaling capsule excipient innovations due to stringent EFSA quality regulations and high equipment investment, forcing them to rely on standard bulk excipients.

Nutraceutical Excipients Market Opportunities:

-

Expanding innovation in bioavailability enhancement creates growth opportunities in global nutraceutical excipients market

The nutraceutical sector is increasingly focusing on improving bioavailability through excipients that enhance nutrient absorption. This cause, low solubility challenges of vitamins, minerals, and bioactives, effects accelerated development of encapsulation and dispersible excipient systems. Such advancements ensure higher efficiency of nutraceutical products while increasing consumer compliance. Companies are innovating encapsulation technologies that improve controlled release and reduce ingredient degradation. With growing demand for premium functional foods and supplements, excipients enabling bioavailability enhancement stand out as key commercial opportunities.

In June 2025, a U.S.-based nutraceutical firm introduced a microencapsulation excipient system for omega-3 supplements, helping boost nutrient uptake by 40%, strengthening product differentiation in a highly competitive market.

Nutraceutical Excipients Market Segmentation Analysis:

By Functionality, Binder segment leads market while Disintegrants register fastest growth

The Binder segment accounted for 33% revenue share in 2025E due to its critical role in improving the cohesiveness of nutraceutical formulations. This cause, growing consumption of dietary tablets and capsules, effects increased demand for excipients that ensure product durability and shelf life. New binder innovations, such as starch derivatives, are enhancing stability and consumer trust.

The Disintegrants segment is growing at the highest CAGR of 13.22%, driven by demand for fast-release dietary supplements. This cause, increasing consumption of probiotics and vitamins, effects growth in excipients enabling rapid tablet breakage for improved intake compliance. Technological development in super-disintegrants is expanding adoption across global regions.

By Product, Proteins & Amino Acids dominate while Omega-3 Fatty Acids grow fastest

Proteins & Amino Acids segment holds the largest revenue share of 52% in 2025E, supported by their widespread use in sports nutrition and therapeutic diets. This cause, high consumer preference for protein-rich nutraceuticals, effects significant excipient usage for blending, stability, and enhanced absorption.

Omega-3 Fatty Acids segment is growing fastest at 11.73% CAGR, fueled by demand for heart health supplements. This cause, increasing prevalence of cardiovascular issues, effects innovative excipient use for encapsulation and oxidation stability in omega-3 capsules and soft gels.

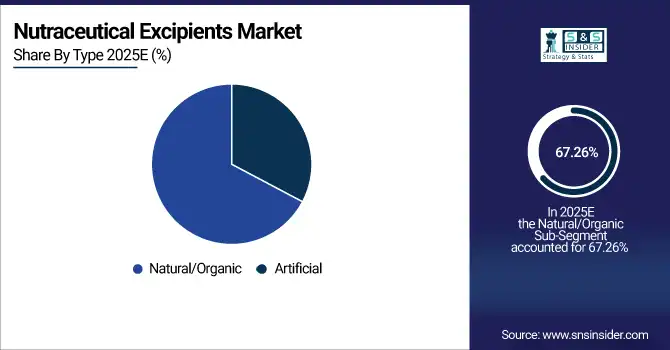

By Type, Natural/Organic excipients dominate while Artificial segment registers fastest growth

The Natural/Organic excipients segment leads with 67.26% share in 2025E, driven by consumer demand for clean-label and plant-based formulations. This cause, preference for non-synthetic ingredients, effects increased use of cellulose, gums, and starch-based excipients in dietary supplements and fortified foods.

Artificial excipients register the fastest growth due to formulation versatility. This cause, need for uniformity, effects greater use of synthetic polymers to ensure controlled release, flavor masking, and color stability in complex nutraceutical formulations.

By Form, Dry excipients dominate while Liquid form grows fastest

Dry excipients dominate with 63% share in 2025E, with tablets and capsules being the most consumed nutraceutical dosage forms. This cause, strong consumer reliance on solid-dose formats, effects increased adoption of dry stabilizers, fillers, and coatings that ensure product durability.

Liquid excipients register the fastest growth, supported by rising popularity of syrups, suspensions, and liquid supplements. This cause, higher adoption among pediatric and geriatric populations, effects demand for excipients that improve solubility, consistency, and bioavailability in liquid nutraceuticals.

By End-User, Vitamins dominate while Prebiotics & Probiotics register fastest growth

Vitamins lead with 35% share in 2025E, driven by high global consumption across demographics. This cause, increasing preventive healthcare focus, effects utilization of excipients to stabilize sensitive vitamin ingredients and extend shelf life.

Prebiotics & Probiotics segment grows fastest, fueled by consumer awareness of gut health. This cause, demand for viable microorganism delivery, effects surge in excipients that maintain shelf stability and improve controlled release of probiotics into the digestive system.

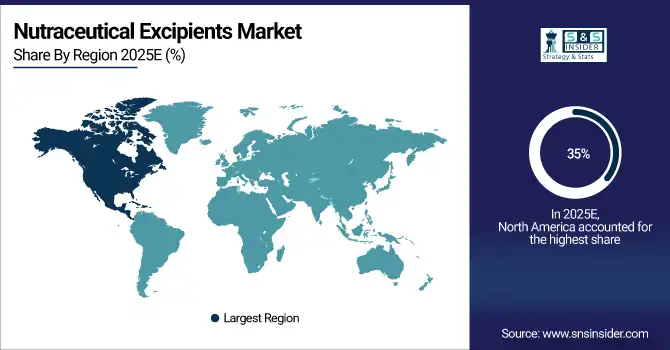

Nutraceutical Excipients Market Regional Analysis

North America dominates the Nutraceutical Excipients Market in 2025E

In 2025E, North America holds an estimated 35% share of the global nutraceutical excipients market, driven by strong demand for functional foods, dietary supplements, and vitamins. The region benefits from advanced R&D infrastructure, high regulatory compliance awareness, and increasing consumer focus on health and wellness. Widespread adoption of clean-label and innovative excipient solutions by leading U.S. manufacturers further strengthens market expansion, positioning North America as the largest contributor to global revenues.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

United States leads North America’s Nutraceutical Excipients Market

The U.S. dominates due to advanced regulatory frameworks, high awareness of supplement safety, and rapid adoption of excipient innovations. Consumer demand for vitamins, probiotics, and sports nutrition products drives adoption, while local excipient manufacturers continually introduce new formulations for improved bioavailability and clean-label compliance. Strong investments in R&D and large-scale production capacities reinforce the U.S. as the leading contributor to North America’s nutraceutical excipient revenues.

Asia Pacific is the fastest-growing region in the Nutraceutical Excipients Market in 2025E

The Asia Pacific market is projected to grow at an estimated CAGR of 14.8% in 2025E, fueled by rising health awareness, increasing functional food consumption, and supportive government nutritional programs. Expanding urban populations and growing middle-class demand for fortified foods and dietary supplements are driving the adoption of advanced excipient solutions in both tablets and liquid nutraceutical formulations. Strong investments in manufacturing infrastructure and innovation make Asia Pacific the fastest-growing region during the forecast period.

-

China leads Asia Pacific’s Nutraceutical Excipients Market

China dominates the Asia Pacific market due to large-scale consumption of fortified foods, government-backed nutritional security initiatives, and rising awareness of functional supplements. Major excipient manufacturers are increasingly supplying advanced solutions for vitamins, probiotics, and protein-enriched products. Strategic investments in R&D, production, and regulatory compliance accelerate adoption across multiple nutraceutical segments, positioning China as the leading contributor to Asia Pacific’s rapid market growth.

Europe Nutraceutical Excipients Market Insights, 2025E

Europe accounted for a significant share in 2025E, supported by clean-label trends, sustainability-focused regulations, and high consumption of dietary supplements. Stringent EU policies on supplement safety, ingredient transparency, and eco-friendly production practices are driving excipient adoption across functional foods and nutraceutical formulations. Manufacturers are increasingly focusing on high-quality, natural excipients to cater to health-conscious consumers and maintain regulatory compliance.

-

Germany leads Europe’s Nutraceutical Excipients Market

Germany dominates Europe due to strong government initiatives promoting supplement safety, eco-centric production policies, and high output of fortified foods for health-focused consumers. The country’s advanced nutraceutical industry, combined with increasing R&D investments, ensures steady adoption of innovative excipients. Leading manufacturers in Germany support premium product launches, reinforcing the country’s position as the primary revenue contributor in Europe.

Middle East & Africa and Latin America Nutraceutical Excipients Market Insights, 2025E

In Latin America, Brazil dominates with growing supplement consumption driven by rising middle-class health awareness and fortified food adoption. Nutraceutical excipient demand is increasing for vitamins, protein-enriched foods, and functional supplements. In the Middle East & Africa, the UAE leads with growing dietary supplement consumption and adoption of clean-label innovations aligned with national health strategies. Regional growth is supported by increasing consumer awareness, healthcare modernization, and investments in high-quality excipient solutions.

Competitive Landscape for the Nutraceutical Excipients Market

Sentek Technologies

Sentek Technologies is a global leader in advanced excipient solutions for nutraceutical formulations, focusing on natural binders, solubility enhancers, and stability agents. The company’s products are widely adopted across dietary supplements and functional foods, ensuring consistency, safety, and optimized performance in nutraceutical delivery systems. Sentek plays a key role in enabling manufacturers to enhance bioavailability, taste masking, and clean-label compliance.

-

In April 2025, Sentek introduced a natural excipient line with improved disintegration properties, specifically designed for vitamins and sports nutrition applications.

Campbell Scientific

Campbell Scientific, based in the U.S., specializes in excipient innovation and performance testing solutions for nutraceutical companies. Its offerings support formulation stability, bioactive delivery, and consumer compliance, optimizing both liquid and solid nutraceutical products. The company enables manufacturers to improve taste masking, bioavailability, and shelf-life of vitamins and dietary supplements, strengthening product efficacy and market acceptance.

-

In March 2025, Campbell launched an excipient portfolio for liquid-based nutraceutical formulations, supporting syrup and suspension manufacturers.

Irrometer Company

Irrometer Company provides cost-effective excipient solutions for tablets and capsules, with a focus on mid-sized supplement manufacturers. Its product range includes disintegrants, fillers, and stabilizers, offering robust performance and affordability. Irrometer’s solutions enable small and emerging nutraceutical companies to maintain product quality while optimizing operational costs and production efficiency.

-

In January 2025, Irrometer introduced a low-cost excipient range for emerging SMEs, catering to economy-level dietary supplements.

Delta-T Devices

Delta-T Devices, headquartered in the U.K., develops specialized excipient systems with precision release and stability profiles. Its products are designed for complex formulations such as probiotics, omega-3, and functional supplements, targeting premium consumer segments. Delta-T focuses on enhancing digestion efficacy, shelf-life, and bioavailability of nutraceuticals through innovative excipient technologies.

-

In June 2025, Delta-T launched an excipient delivery system integrated with microencapsulation for probiotic supplements, improving stability and nutrient absorption.

Nutraceutical Excipients Market Key Players:

-

Ingredion Incorporated

-

Kerry Group plc

-

BASF SE

-

Roquette Frères

-

MEGGLE GmbH & Co. KG

-

Cargill, Incorporated

-

Ashland Global Holdings Inc.

-

Sensient Technologies Corporation

-

Associated British Foods plc

-

IMCD Group

-

Hilmar Cheese Company, Inc.

-

Air Liquide

-

Azelis Group

-

Biogrund GmbH

-

Seppic

-

Innophos Holdings, Inc.

-

JRS Pharma GmbH & Co. KG

-

DFE Pharma GmbH & Co. KG

-

The Lubrizol Corporation

-

Colorcon, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 4.89 Billion |

| Market Size by 2032 | US$ 8.61 Billion |

| CAGR | CAGR of 7.34 % From 2025 to 2032 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Functionality (Binder, Disintegrants, Fillers & Diluents, Coating Agent, Flavouring Agent, Lubricants, Others) • By Product (Prebiotics, Probiotics, Proteins & Amino Acids) • By Type (Artificial, Natural/Organic) • By Form (Dry, Liquid) • By End Use (Protein and Amino Acids, Omega 3 Fatty Acids, Vitamins, Minerals, Prebiotics and Probiotics, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Ingredion Incorporated, Kerry Group plc, BASF SE, Roquette Frères, MEGGLE GmbH & Co. KG, Cargill, Incorporated, Ashland Global Holdings Inc., Sensient Technologies Corporation, Associated British Foods plc, IMCD Group, Hilmar Cheese Company, Inc., Air Liquide, Azelis Group, Biogrund GmbH, Seppic, Innophos Holdings, Inc., JRS Pharma GmbH & Co. KG, DFE Pharma GmbH & Co. KG, The Lubrizol Corporation, Colorcon, Inc, and Others. |