Marigold Oleoresin Market Report Scope & Overview:

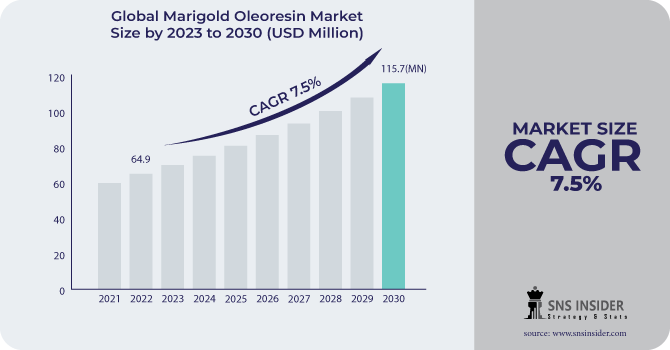

The Marigold Oleoresin Market size was USD 64.9 million in 2022 and is expected to Reach USD 115.7 million by 2030 and grow at a CAGR of 7.5% over the forecast period of 2023-2030.

Marigold oleoresin is a semi-solid extract of marigold flowers high in lutein and zeaxanthin, two carotenoids beneficial to eye health. Antioxidants, which can help guard the body against harm from free radicals, are also abundant in marigold oleoresin.

Solvent extraction is the more traditional method of extraction, which includes dissolving the required chemicals from the marigold flowers in a solvent such as ethanol or hexane. The solvent is subsequently removed, leaving the marigold oleoresin behind. Supercritical fluid extraction is a modern method of extracting the necessary chemicals from marigold flowers by using a supercritical fluid, such as carbon dioxide.

Based on end users, the food & beverage industry segment is considered the largest market for marigold oleoresin, accounting for over 40% of the global marigold oleoresin market in 2022. This growth is due to its increasing use as a natural coloring component in various foods. Marigold oleoresin is utilized in various pharmaceutical products to support eye health, such as eye drops and supplements. Its antioxidant and anti-inflammatory effects make it popular in cosmetics.

MARKET DYNAMICS

KEY DRIVERS

-

The health benefits of marigold oleoresin

Marigold oleoresin is a pure extract of the marigold flower with numerous possible health benefits. The marigold oleoresin contains lutein and zeaxanthin, two carotenoids that are important for eye health. These carotenoids aid in the prevention of age-related macular degeneration and cataracts. Marigold oleoresin has anti-inflammatory and antibacterial properties, making it useful for treating a wide range of skin disorders. The marigold oleoresin contains antiviral and antibacterial characteristics that can help the immune system fight infection. Marigold oleoresin is used in a number of food and beverage goods, as well as cosmetics and personal care products, in addition to its health advantages.

RESTRAIN

-

Limited availability of raw materials

Marigold flowers require specific climatic conditions to be grown, limiting the areas where they can be grown. This might result in supply restrictions and increased costs for market participants. A major difficulty for the marigold oleoresin market is the scarcity of raw resources.

OPPORTUNITY

-

Rising application in various end-user industries

Marigold oleoresin is used in a variety of industries, including food and beverage, cosmetics, and pharmaceuticals. In the food and beverage industry, marigold oleoresin is used as a natural coloring agent and flavor enhancer. In the cosmetics industry, marigold oleoresin is used in skincare and haircare products for its anti-inflammatory and antioxidant properties. In the pharmaceutical industry, marigold oleoresin is used in wound healing and anti-inflammatory products.

-

Expansion of Marigold oleoresin into untapped markets

CHALLENGES

-

Fluctuation of raw materials

Marigold oleoresin is extracted from the marigold flower, which is an agricultural crop. The price of the marigold flower can fluctuate depending on a variety of factors, such as weather conditions, crop yields, and demand from other industries. Fluctuations in the price of raw materials can make it difficult for marigold oleoresin manufacturers to maintain consistent profit margins. It can also make it difficult to plan for future production and sales. In addition to fluctuations in the price of marigold flowers, manufacturers of marigold oleoresin also face fluctuations in the prices of other raw materials, such as solvents and packaging materials. These fluctuations can also have a negative impact on the profitability of the market.

IMPACT OF RUSSIAN-UKRAINE WAR

Russia and Ukraine are producers of marigold flowers, which are the primary raw material for marigold oleoresin. The war has disrupted the supply of marigold flowers from these countries, leading to increased costs for marigold oleoresin manufacturers. Marigold oleoresin manufacturers are sourcing raw materials from alternative suppliers, such as India, China, and Egypt. This is helping to reduce their reliance on Russia and Ukraine. Oleoresin manufacturers are passing on some of the higher costs of raw materials to their customers. Oleoresin manufacturers are investing in R&D to develop new products and applications for oleoresins. This is helping to expand the market and reduce the reliance on traditional applications.

IMPACT OF ONGOING RECESSION

The recession has impacted the marigold oleoresins market. Marigold oleoresin manufacturers may reduce output in order to satisfy lower demand. This will aid in avoiding excess inventory and price decreases. Marigold oleoresin manufacturers may concentrate on developing and marketing high-margin goods. This will assist to counteract the overall drop in demand. Marigold oleoresin manufacturers may enter new markets, such as developing countries. This will assist to compensate for the drop in demand in mature markets.

MARKET SEGMENTATION

By Nature

-

Organic

-

Conventional

By Extraction Method

-

Solvent Extraction

-

Supercritical Fluid Extraction (SFE)

By Distribution Channel

-

Supermarkets/Hypermarkets

-

Speciality Stores

-

Online Sales

-

Others

By End User

-

Pharmaceuticals

-

Food & Beverage Industry

-

Cosmetics

-

Animal Feed

.png)

REGIONAL ANALYSIS

Europe dominates the global marigold oleoresins market, followed by Asia-Pacific. The market for marigold oleoresins in Europe is being driven by the rising preference for natural ingredients and extracts used in the manufacturing of a wide variety of culinary products. In this region, making marigold oleoresins is significantly more profitable than just making raw materials.

Asia-Pacific region is a significant contributor to the oleoresins market, with a CAGR of more than 6% from 2023 to 2030. The increase is due to the region's growing preference for natural ingredients. A variety of spices are preferred in meat and vegetable recipes in nations like China and India. As a result, there is a significant need for spice oils in this area. In addition, rising per capita disposable income and a growing population are a couple of the main factors propelling the marigold oleoresins market in this area.

North America is the largest market for marigold oleoresin, accounting for over 6.8% of the global market share in 2022. The U.S. is estimated to account for a share of approximately 82.5% of this region. Increasing demand from the growing food processing and pharmaceutical industries is also anticipated in this region. Additionally, the market expansion for marigold oleoresin during the anticipated period has been driven by a shift in customer preferences toward healthy alternatives.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Marigold Oleoresin Market are AVT Natural Products, Aturex Nutritionals, Bolise Co. Ltd, DeYuan Bio-Tech Co. Ltd, Olive Lifesciences, Ozone Naturals, Xiamen Boten Biological Technology Co., Ltd, Maker Group, Zhongjin Natural Pigment Co. Ltd, Plant Lipids, Chenguang Biotech Group Co. Ltd., and other key players.

Aturex Nutritionals-Company Financial Analysis

RECENT DEVELOPMENTS

Ozone Natural Pvt. Ltd. has achieved various kinds of quality certifications to improve the global adaptability of its products. It has, for example, obtained FSSAI, organic, HALAL, and ISO certifications from globally recognized certifying bodies.

| Report Attributes | Details |

| Market Size in 2022 | US$ 64.9 Million |

| Market Size by 2030 | US$ 115.7 Million |

| CAGR | CAGR of 7.5 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Nature (Organic, Conventional) • By Extraction Method (Solvent Extraction, Supercritical Fluid Extraction) • By Distribution Channel (Supermarkets/Hypermarkets, Speciality Stores, Online Sales, Others) • By End User (Food & Beverage Industry, Pharmaceuticals, Cosmetics, and Animal Feed) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | AVT Natural Products, Aturex Nutritionals, Bolise Co. Ltd, DeYuan Bio-Tech Co. Ltd, Olive Lifesciences, Ozone Naturals, Xiamen Boten Biological Technology Co., Ltd, Maker Group, Zhongjin Natural Pigment Co. Ltd, Plant Lipids, Chenguang Biotech Group Co. Ltd. |

| Key Drivers | • The health benefits of marigold oleoresin |

| Market Challenges | • Fluctuation of raw materials |