Hemp Seed Market Report Scope & Overview:

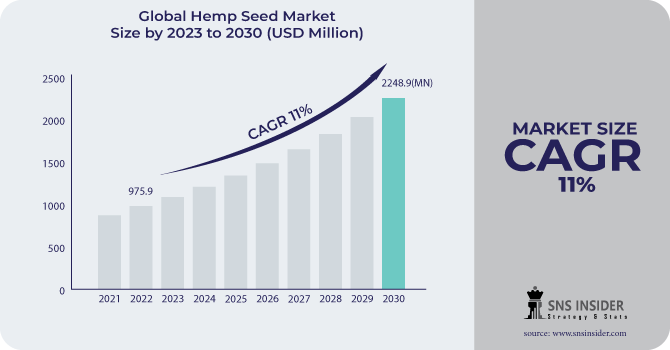

The Hemp Seed Market size was USD 1083.2 million in 2023, is expected to Reach USD 2770.9 million by 2032, and grow at a CAGR of 11% over the forecast period of 2024-2032.

Hemp seed is a nutrient-rich food that offers a variety of health benefits. It is a good source of protein, fiber, omega-3 fatty acids, and vitamins and minerals. Hemp seed is also a sustainable and eco-friendly crop.

Based on form, the whole hemp seed segment dominated the hemp seed market share in 2022. Whole hemp seeds are the intact seeds of the hemp plant. They are small, brown seeds with a nutty flavor. Whole hemp seeds are a good source of protein, fiber, omega-3 fatty acids, and vitamins and minerals. Whole hemp seeds provide a natural and sustainable supply of critical nutrients as consumers become more health-conscious and seek nutrient-dense dietary options. The growing popularity of plant-based and vegan diets has encouraged the use of entire hemp seeds. Manufacturers have more opportunities to find and include whole hemp seeds in their everyday meals to a larger variety of distribution outlets. All of these elements are anticipated to fuel segment growth during the forecast period.

MARKET DYNAMICS

KEY DRIVERS

-

Rising Health Consciousness among Consumers

Hemp seed and its derivatives are becoming increasingly popular and have a variety of applications. Hemp seeds have significant nutritional value as well as medicinal effects. Pharmaceuticals, meals and drinks, alternative nutritional supplements, and protein sources have all used hemp seed products. Hemp seed has been linked to a variety of health benefits and potential cures. Hemp seed, for example, contains an optimum ratio of omega-6 to omega-3 PUFA, which may improve cardiovascular health, reduce osteoporosis symptoms, and alleviate eczema-related disorders. Cannabidiol (CBD) has pharmacological features that make it a promising treatment for central nervous system illnesses such as neurodegenerative diseases, epilepsy, and multiple sclerosis.

RESTRAIN

-

Strict regulatory framework

The stringent regulatory structure that oversees the manufacturing and sale of hemp seed products is one of the constraints. Hemp is still categorized as a restricted substance in many countries, and enterprises must seek specific licenses and permits to produce and sell hemp seed products. These stringent laws have the potential to significantly increase the cost and complexity of the hemp seed sector. Businesses, for example, may need to invest in costly testing equipment and pay expert personnel to comply with all applicable rules. Small firms may find it challenging to compete in the market as a result of this. Furthermore, tight restrictions can cause customer confusion and uncertainty. Customers may be skeptical about the legality of hemp seed goods, or they may be apprehensive about the safety of hemp seed products.

OPPORTUNITY

-

Industrial applications of hemp seeds

Since hemp seed oil is a renewable and sustainable source of energy, it can be utilized to create biofuel. Hemp seeds are used to produce bioplastics that may be composted and biodegraded. Additionally, building products like insulation and composites can be made from hemp seed. Building materials made of hemp are renewable and economical to use. Furthermore, hemp seeds its wide applications in the cosmetic and personal care sector shampoos, conditioners, and lotions among other products using hemp seed oil. Hemp seed oil is well known for its hydrating and calming qualities. Governments from all around the world are encouraging the growth of the industrial hemp sector. Businesses are now able to invest in new technology and increase their production capacity thanks to this.

CHALLENGES

-

Lack of awareness of hemp seeds

The advantages of hemp seeds for health and the variety of hemp seed products are not widely known among customers. Consumers aren't attempting hemp seed goods because of the lack of knowledge, which is causing the market to grow. Because they are unfamiliar with hemp seed products, businesses and consumers may be cautious to try them. Hemp seeds are unfamiliar to many customers, and many have never even tried them. Because they are unaware of what to expect, consumers may be reluctant to try hemp seed products as a result.

-

High Production Cost

IMPACT OF RUSSIA-UKRAINE WAR

Russia and Ukraine are both significant producers of hemp seeds and fertilizers, the war has increased the cost of producing hemp seeds. Additionally, the war has raised demand for goods made from hemp, including CBD oil and hemp fiber. Some farmers who were considering cultivating hemp are now planting more wheat and corn as a result of rising commodity prices. Despite the fighting, a Canadian hemp company buys seeds from Ukraine in 2023. It was intended to cultivate hemp for bast fiber, which is utilized in a variety of goods, including clothing, packaging, and textiles.

IMPACT OF ONGOING RECESSION

The recession has impacted the hemp seeds market. The disruption in the supply chain of hemp seeds decreased the demand for the industrial applications of hemp seeds. Due to the recession, consumers may spend less on hemp seed products as they look for other alternatives of hemp seeds with the same nutritional content. Since the beginning of the war, the cost of hemp seeds has grown by up to 50%. Other food and beverage manufacturers may become more competitive with companies in the hemp seed sector as they aim to draw customers looking for inexpensive and wholesome food options. During a recession, governments might boost the hemp seed sector. This might lessen the recession's detrimental effects on the sector.

MARKET SEGMENTATION

by Form

-

Hemp Seed Oil

-

Hemp Seed Protein

-

Whole Hemp Seed

-

Hulled Hemp Seed

-

Hemp Protein Powder

-

Others

by Application

-

Food and Beverages

-

Cosmetics

-

Nutritional Supplements

-

Industrial products

-

Pharmaceuticals

-

Personal Care Products

-

Others

.png)

REGIONAL ANALYSIS

The Asia-Pacific region dominated the hemp seeds market. China is the biggest hemp seed exporting country, with over USD 116 million in global imports. India was another Asia-Pacific country that ranked ninth in terms of hemp seed exports, with over USD 26.5 million in exports. In terms of total imports of more than USD 57 million, South Korea dominated the Asia-Pacific region.

The European region held the second-largest hemp seed market with a CAGR rate of 14% in 2022. Germany imports hemp seed worth more than US$ 124 million, followed by the Netherlands, which imports hemp seed worth US$ 63 million. The Netherlands was also responsible for being the leading exporter of hemp seeds in the European Region with US$ 72 million worth of exports followed by Austria with US$ 59 million worth of exports.

The United States was the world's largest importer of Hemp Seeds in the year 2022 with USD 172 million worth of imports. This can be attributed to the healthcare and cosmetics industry in the US making more investments to develop the dermatological applications of hemp seeds in healthcare and cosmetics products.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Torpedo Market are Deep Nature Project GmbH, GFR Ingredients Inc., Hempco Food and Fiber Inc., HempFlax Group B.V., Liaoning Qiaopai Biotech Co. Ltd., BAFA Neu GmbH, Manitoba Harvest Hemp Foods, Green Source Organics Inc., Naturally Splendid Enterprises Ltd., Canah International Srl, North American Hemp & Grain Ltd., Navitas LLC and Yunnan Hua Fang Industrial Hemp Co. Ltd. and other key players.

GFR Ingredients Inc-Company Financial Analysis

RECENT DEVELOPMENTS

In April 2023, Manitoba Harvest, the top hemp food company in the world and a subsidiary of Tilray Brands, Inc., will launch its first Regenerative Organic CertifiedTM Hemp Hearts exclusively in a few Whole Foods Market locations around the country. Following the exclusive time, Whole Foods Market and other stores across the United States and Canada will still carry the product.

In July 2022, Applied Food Sciences introduced PurHP-75TM, a hemp seed protein component for "Juicy, Firm, & Authentic" Alt-Meats. The organic ingredient is made from hemp hearts and includes 75% protein, containing all nine essential amino acids.

In Feb 2022, PepsiCo launched Rockstar Energy-branded hemp seed beverage. Pepsi hopes that its new beverage, which contains only 80 milligrams of caffeine and is infused with hemp seed oil, spearmint, and lemon balm, will draw in younger, more feminine consumers.

| Report Attributes | Details |

| Market Size in 2023 | US$ 975.9 Million |

| Market Size by 2032 | US$ 2248.9 Million |

| CAGR | CAGR of 11 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Form (Hemp Seed Oil, Hemp Seed Protein, Whole Hemp Seed, Hulled Hemp Seed, Hemp Protein Powder, and Others) • By Application (Food and Beverages, Cosmetics, Nutritional Supplements, Industrial products, Pharmaceuticals, Personal Care Products, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Deep Nature Project GmbH, GFR Ingredients Inc., Hempco Food and Fiber Inc., HempFlax Group B.V., Liaoning Qiaopai Biotech Co. Ltd., BAFA Neu GmbH, Manitoba Harvest Hemp Foods, Green Source Organics Inc., Naturally Splendid Enterprises Ltd., Canah International Srl, North American Hemp & Grain Ltd., Navitas LLC and Yunnan Hua Fang Industrial Hemp Co. Ltd. |

| Key Drivers | • Rising Health Consciousness among Consumers |

| Market Opportunity | • Industrial applications of hemp seeds |