Coffee Creamer Market Report Scope & Overview:

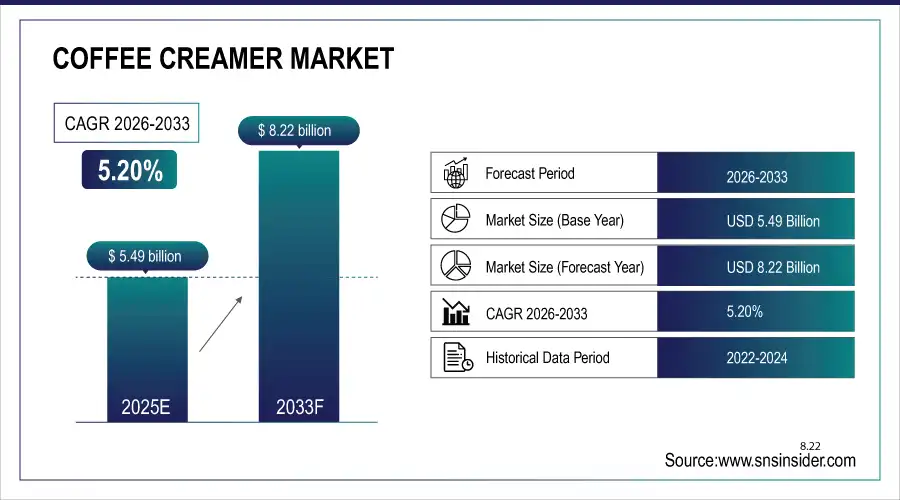

The global coffee creamer market size was valued at USD 5.49 billion in 2025E and is projected to reach USD 8.22 billion by 2033, growing at a CAGR of 5.20% during the forecast period 2026–2033.

The coffee creamer market is witnessing steady growth as consumers increasingly seek convenient, flavorful, and dairy-free alternatives for their daily beverages. Increasing lactose intolerance, a surge in interest in plant-based diets and a desire for indulgent flavors are driving adoption. They come in both powder and liquid, to meet the tastes and preferences on both sides of the home and food-service kitchen. The increasing penetration in the grocery, specialty, and E-commerce channels offers strong prospects for product innovation and increased access to global markets.

Nearly 45% of coffee drinkers prefer using coffee creamers, with a growing shift toward plant-based and flavored options, largely purchased through supermarkets, convenience stores, and online platforms.

Market Size and Forecast:

-

Market Size in 2025: USD 5.49 Billion

-

Market Size by 2033: USD 8.22 Billion

-

CAGR: 5.20% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Coffee Creamer Market - Request Free Sample Report

Coffee Creamer Market Trends:

-

Traditional to non-traditional alternatives (like plant-based and dairy-free creamers), consumers are reaching for more oat, almond and coconut-based choices, with health and a lactose intolerant population on the rise.

-

Flavor innovation including vanilla, hazelnut, caramel and limited-time pumpkin continues to capture consumer attention in both retail and foodservice.

-

Product development thrives with over 900 new coffee creamer launches in 2024, such as low sugar, organic and functional creamers containing probiotics and adaptogens.

-

Distribution is not where dairy creamers dominate like e-commerce and supermarket where e-commerce sales of non-dairy creamers will rise 27.6% in 2025 as consumers’ interest in convenience will remain strong.

-

Sustainability and premiumization are leading to loyalty with over half of top brand products use earth friendly packaging and sourced ingredients responsibly.

U.S. Coffee Creamer Market Insights

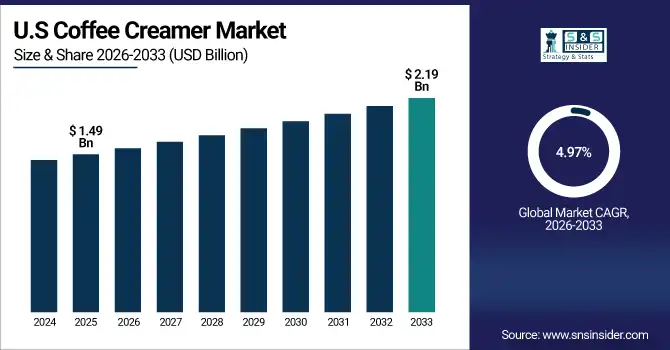

The U.S. coffee creamer market is expected to grow at a CAGR of 4.97% from its 2025E valuation of USD 1.49 billion to USD 2.19 billion by 2033. Growing demand for flavored, plant-based and reduced sugar creamers is driving expansion behind all the new products. Robust retail and e-commerce channels as well as a healthy café scene are driving access and innovation in clean label and functional creamer are boosting consumer confidence and positioning the market for long-term growth.

Coffee Creamer Market Growth Drivers:

-

Rising Demand for Plant-Based and Dairy-Free Creamers is the Key Driver, Fueled by Shifting Consumer Preferences Toward Healthier and Lactose-Free Options.

The rising demand for plant-based and dairy-free creamers is a key growth driver for the coffee creamer market. Driven by a rise in lactose intolerance and the ongoing pursuit of healthier, clean label, vegan-friendly options, consumers are replacing their traditional dairy creamers with almond, oat, soy and coconut varieties. These varieties do not only respond to dietetic requirements, but also meet the taste and health demands of consumers, allowing for permanent market distribution all over the world.

In 2025, over 55% of non-dairy coffee creamer consumers preferred plant-based options like almond, oat, and coconut, making it the fastest-growing segment.

Coffee Creamer Market Restraints:

-

High Sugar Content and Clean-Label Concerns are Major Restraints, As Growing Health Awareness Pushes Consumers to Avoid Artificial Ingredients in Coffee Creamers.

High sugar content and clean-label concerns act as major restraints in the coffee creamer market. Traditional creamers contain artificial flavors, additives, and high sugar contents that are not compatible with the increased demand for natural and healthy substitutes. To the extent that health-conscious consumers are reading labels and looking for low-sugar, organic, non-GMO options, brands that rely on artificial formulas stand to lose market share through exhibiting little brand loyalty.

Coffee Creamer Market Opportunities:

-

Rising Demand for Plant-Based and Low-Sugar Creamers Creates Strong Opportunities for Innovation in Flavor, Functional Ingredients, and Clean-Label Products.

The rising demand for plant-based and low-sugar creamers presents a significant opportunity for market growth. Amid disposable incomes snapping up healthy, clean-label and dairy-free options, brands are able to take a ride in the form of natural sweeteners, fortifying creamers with functional ingredients, and a variety of flavors. This change reflects wellness and sustainability needs, with manufacturers able to distinguish their products in order to attract health-conscious consumers, and reach both retail and foodservice markets across the world.

Over 50% of global consumers are willing to pay a premium for plant-based and low-sugar coffee creamers, boosting demand for clean-label and innovative flavor options.

Coffee Creamer Market Segmentation Analysis:

-

By Product Type, dairy creamers lead in 2025E with 48.37% share, while non-dairy creamers (soy, almond, oat, coconut) are fastest growing at a 6.04% CAGR (2026–2033).

-

By Application, household use dominates with 59.28% share in 2025E, while foodservice grows fastest at a 6.21% CAGR, driven by cafés and specialty outlets.

-

By Distribution Channel, supermarkets & hypermarkets hold 51.32% share in 2025E, while online retail is fastest growing at a 7.12% CAGR.

-

By Flavor, original leads with 62.47% share in 2025E, while flavored creamers (vanilla, hazelnut, caramel, chocolate) grow fastest at 6.48% CAGR.

-

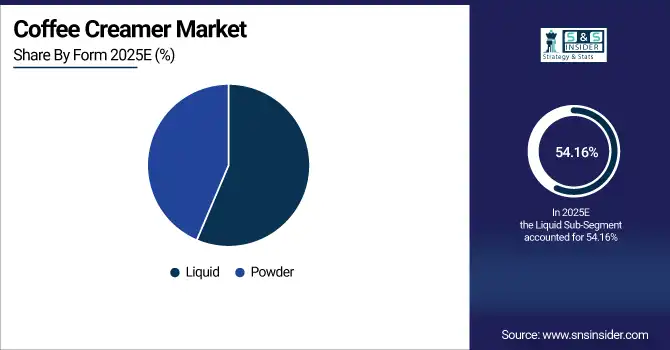

By Form, liquid creamers account for 54.16% share in 2025E, while powdered creamers grow fastest at 5.83% CAGR.

By Product Type, Dairy Creamers Dominate While Plant-Based Creamers Grow Rapidly:

Creamers based on dairy products are still widely used in the market because of a high level of acceptance, creamy mouthfeel and the familiarity for traditional coffee consumers. But nondairy creamers, including those made from oats, almonds, coconuts and soy, are expanding quickly as consumers embrace vegan, lactose-free and health-obsessed lifestyles. And on the flip side, these alternatives can also tout their clean-label positioning, sustainable sourcing and flavor innovation, which is attractive to millennials and anyone looking for healthier coffee-enhancement options.

By Application, Household Use Leads While Foodservice Expands Quickly:

Household consumption continues to be the dominant application, normalizing coffee as part of daily rituals worldwide. Consumers are looking for convenient, hassle-free creamers that add flavor to their coffee without fresh milk. At the same time, foodservice is growing rapidly, driven by the surge of cafés, specialty coffee shops and restaurants serving customization drinks. The expansion of café culture, especially among the youth, is generating high demand for traditional as well as plant-based creamers in the foodservice industry.

By Distribution Channel, Supermarkets Dominate While Online Retail Gains Momentum:

Coffee Creamer Market - Key Retail Formats Coffee creamer is dominated by the supermarkets and hypermarkets that benefit from easy availability and the variety of brands. They need to be seen as that dominant touchpoint that consumers buy through frequently. But online retail is booming as e-commerce sites and subscription-based services take off. Doorstep delivery, an easier way to compare products, and the ability to order niche or specialty creamers not often found in stores are also attracting consumers.

By Form, Liquid Creamers Lead While Powdered Creamers Rise Steadily:

Liquid creamers are next up front for their convenience, flexibility, and widespread popularity in homes and coffee shop for its creamy taste and easy to mix until smooth. But powdered creamers are climbing steadily, because they last longer, are portable and have a shelf life. They have resonated particularly well in food service, at the office and in markets where they have more convenient and occasion-specific usage occasions thanks to ease and versatility of consumption.

Coffee Creamer Market Regional Analysis:

North America Coffee Creamer Market Insights:

North America holds a strong position in the global coffee creamer market, supported by a deeply rooted coffee culture, high per-capita consumption, and rising demand for both dairy and non-dairy creamers. The area has a strong coffee culture and high per-capita consumption, with increased consumption of mst dairy and non-dairy creamers. The US market is also highly penetrative, with strong retail and foodservice, consistent product innovation and an increasing e-commerce presence. Increasing health consciousness and growing consumer preference for clean label and plant-based creamers continue to boost the dominance North America.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Coffee Creamer Market Insights:

The U.S. coffee creamer market is expanding with strong demand for both dairy and plant-based options. Low-sugar, clean-label and flavored creamers are becoming more popular among consumers, while the oat, almond and coconut segments are taking hold. Innovation, strong retail networks and rapidly expanding e-commerce channels, and a health-conscious consumer base, will continue to make the U.S. the primary growth engine of the North America coffee creamer market.

Europe Coffee Creamer Market Insights:

Europe dominates the global coffee creamer market, accounting for 35.92% share in 2025E. Leaders in the region are leading on account of a deep coffee culture, extensive café network, and increasing consumption of dairy and non-dairy creamers. Especially in Western Europe, consumption is driven by having a taste for premium, flavored, and plant-based creamers. Strong retail distribution, new product introductions and increasing demand for clean label and sustainable incorporator have exacerbated Europe’s overall leading position in the global market.

Germany Coffee Creamer Market Insights:

Germany is Europe’s largest coffee creamer market, due to a mature coffee culture, and increasing respective demand for dairy, and non-dairy options. Growing demand for organic, clean label and plant-based creamers, with extensive distribution through retail and e-commerce platforms. Product innovation in flavors as well as functional creamers will further solidify Germany as the largest market in Europe for coffee creamers.

Asia-Pacific Coffee Creamer Market Insights:

The Asia-Pacific coffee creamer market is the fastest-growing globally, projected to expand at a 6.71% CAGR during 2026–2033. Growth in coffee consumption, sharp increase in urbanization, and burgeoning café culture will continue to remain the key drivers for the demand in both dairy and non-dairy creamer markets. Soy, oat, and coconut continue to rise as plant-based options while consumers seek healthy, lactose-free, and clean label options. Growth in the region remains robust on the back of growing retail channels, novelty flavors, and dynamic e-commerce uptake.

China Coffee Creamer Market Insights:

China dominates the Asia-Pacific coffee creamer market, driven by urbanization, rising disposable incomes, and growing coffee culture among younger consumers. Dairy and nondairy creamers are really popular, with soy, oat, and coconut among the latest “healthy,” lactose-free alternatives. Adoption driven by robust e-commerce and premium international brands. The rapid growth of the café culture and the consumer penchant for new, flavored creamers also support China’s leadership of the regional coffee creamer sector.

Latin America Coffee Creamer Market Insights:

Latin America’s coffee creamer market is growing steadily, fueled by rising coffee consumption and increasing demand for both dairy and plant-based creamers. Brazil and Mexico are at the forefront of the region, enjoying strong urban café cultures and a young, health-conscious consumer base. Growing supermarket chains and e-commerce accelerated the reach of the products, and now flavored and lactose free creamers are making gains especially in the big cities which tend to influence surrounding regions, he added.

Middle East and Africa Coffee Creamer Products Market Insights:

The Middle East and Africa Coffee Creamer market is also growing due to urbanization, increasing middle class and preferential shift towards premium coffee products. Dairy-free and plant-based creamers are also on the rise with a predominantly younger health-conscious audience. Distribution is being expanded through modern retail and specialist retailers with growing access and acceptance through e-commerce channels as well.

Coffee Creamer Market Competitive Landscape:

Nestlé dominates the global coffee creamer market through its Coffee-mate brand, which leads both powdered and liquid segments worldwide. Its growth is fuelled by a retail, international, and flavor/sugar-free/plant-based creamer business, it said. Nestlé’s agility in responding to changing consumer trends such as for healthier and sustainable products which has helped keep it ahead. With an established reputation and well-known brand, the brand that consumers know they can trust to enhance their coffee.

-

In January 2025, Nestlé opened a $675 million creamer plant in Glendale, Arizona, expanding production of Coffee Mate, Natural Bliss, and Starbucks creamers to meet growing global demand.

Danone stands out in the coffee creamer market with its plant-based powerhouses like Silk and So Delicious, meeting rising demand for dairy-free, vegan, and clean-label alternatives. Its philosophy of sustainability, high-quality offerings and functional nutrition deeply connects with health-conscious shoppers. Built on strong worldwide network and strategic innovation, Danone’s impact is growing. Its knack for appealing to lifestyle-driven markets has allowed it to establish itself as a dominant player in the creamer category.

-

In March 2025, Danone US announced a $65 million expansion of its Jacksonville, Florida plant, boosting output for International Delight creamers and STōK Cold Brew products.

Chobani has quickly emerged as a top player in the coffee creamer market, leveraging its reputation for high-quality dairy and plant-based innovations. Its natural, non-GMO and clean-label creamers address growing consumer interest in transparency and healthier alternatives. Heavy marketing, premium positioning and rapid movement into flavored and plant-based creamers have turned Chobani into a household name. Its concentration on innovation and consumer confidence will maintain growth and leadership on the creamer category.

-

In July 2025, Chobani was sued by Danone over alleged trademark infringement linked to its La Colombe cold brew and creamer branding.

Coffee Creamer Market Key Players:

Some of the Coffee Creamer Market Companies are:

-

Nestlé S.A.

-

Danone S.A.

-

Chobani LLC

-

Viceroy Holland B.V.

-

PT Santos Premium Krimer

-

Kerry Group plc

-

FrieslandCampina Kievit / FrieslandCampina NV

-

Land O’Lakes, Inc.

-

Fujian Jumbo Grand Food Co., Ltd.

-

Heartland Food Products Group

-

Califia Farms, LLC

-

Laird Superfood, Inc.

-

Mooala

-

Nutpods

-

TreeHouse Foods, Inc.

-

Super Group Ltd.

-

Custom Food Group

-

Almer Malaysia Sdn. Bhd.

-

Shandong Tianjiao Bio-Tech or similar Shandong Tianmei Bio entities

-

Rich Products Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 5.49 Billion |

| Market Size by 2033 | USD 8.22 Billion |

| CAGR | CAGR of 5.20% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Dairy Creamers, Non-Dairy Creamers – Soy, Almond, Coconut, Oat, Others) • By Application (Household, Foodservice, Institutional) • By Form (Liquid, Powder) • By Flavor (Original, Flavored – Vanilla, Hazelnut, Chocolate, Caramel, Others) • By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Direct Sales) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Nestlé S.A., Danone S.A., Chobani LLC, Viceroy Holland B.V., PT Santos Premium Krimer, Kerry Group plc, FrieslandCampina Kievit / FrieslandCampina NV, Land O’Lakes, Inc., Fujian Jumbo Grand Food Co., Ltd., Heartland Food Products Group, Califia Farms, LLC, Laird Superfood, Inc., Mooala, Nutpods, TreeHouse Foods, Inc., Super Group Ltd., Custom Food Group, Almer Malaysia Sdn. Bhd., Shandong Tianjiao Bio-Tech, Rich Products Corporation |