Collapsible Tube Packaging Market Scope & Overview:

Get More Information on Collapsible Tube Packaging Market - Request Sample Report

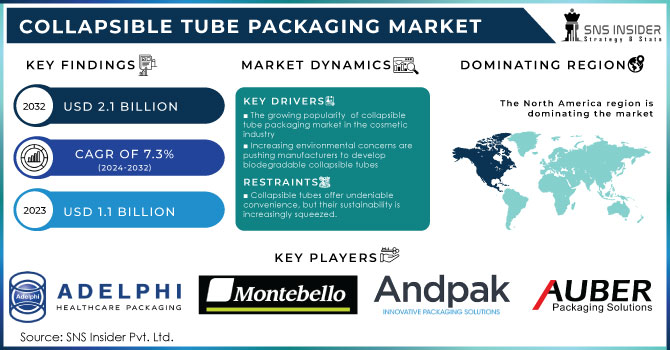

The Collapsible Tube Packaging Market size was estimated at USD 1.1 billion in 2023 and is expected to reach USD 2.1 billion by 2032 at a CAGR of 7.3% during the forecast period of 2024-2032.

The collapsible tube packaging market is experiencing robust growth, driven by increasing consumer demand for lightweight, portable, and sustainable packaging solutions across key industries such as personal care, pharmaceuticals, and food. According to research, approximately 75% of collapsible tubes are made from aluminum, reflecting a strong preference for recyclable materials due to rising sustainability concerns. Additionally, over 40% of consumers prioritize eco-friendly packaging when making purchasing decisions, a trend that continues to shape innovation in this sector.

The personal care industry is a dominant end-user, accounting for nearly 50% of the total demand for collapsible tubes, with products like toothpaste, creams, and lotions leading the adoption. In the pharmaceutical segment, collapsible tubes are extensively used for ointments and gels, with pharmaceutical-grade tubes comprising more than 20% of the market share. The food industry also shows growing adoption, particularly for condiments, sauces, and edible gels, contributing to the market’s expansion. Emerging trends in the market include the adoption of laminated tubes, which combine the strength of aluminum with the flexibility of plastic, making up 30-35% of the current market production. Furthermore, 90% of collapsible tube manufacturers are now integrating advanced printing technologies, such as digital and offset printing, to meet growing demand for customizable and visually appealing packaging. Sustainability remains a pivotal driver, with manufacturers increasingly investing in bio-based plastics and refillable tube designs. In 2024 more than 50% of the market is projected to adopt these sustainable materials, reflecting the sector's commitment to reducing environmental impact. The rise of e-commerce and consumer preference for tamper-proof, hygienic packaging solutions is further accelerating the demand for collapsible tube packaging globally

Collapsible Tube Packaging Market Dynamics

DRIVERS

-

The collapsible tube packaging market is growing rapidly, driven by demand for lightweight, convenient, and sustainable solutions in the personal care and cosmetics industry.

The collapsible tube packaging market is witnessing rapid growth, primarily fueled by rising demand in the personal care and cosmetics industry. Consumers now prefer lightweight, portable, and convenient packaging solutions for products like skincare creams, haircare items, and cosmetics. Collapsible tubes align with these needs, offering ease of use and efficient dispensing that minimizes product wastage. Additionally, the emphasis on hygienic and tamper-proof packaging is further driving their adoption in the beauty sector.

Personal care brands are utilizing collapsible tubes to enhance product safety, maintain freshness, and create visually appealing designs that attract consumers. The increasing popularity of travel-sized and single-use cosmetic products, driven by busy lifestyles, has also boosted demand for compact and flexible packaging formats. Furthermore, the shift toward sustainable packaging is shaping the market, with manufacturers adopting recyclable and biodegradable materials. Combined with technological advancements in design and functionality, collapsible tube packaging is becoming the preferred choice for modern consumers and brands alike.

RESTRAIN

-

The collapsible tube packaging market faces strong competition from versatile alternatives like flexible pouches, sachets, and rigid containers, which cater to diverse needs and appeal to environmentally-conscious consumers.

The collapsible tube packaging market faces significant competition from alternative packaging solutions such as flexible pouches, sachets, and rigid containers. These alternatives are gaining traction due to their versatility, lightweight nature, and ability to cater to diverse consumer and industrial needs. Flexible pouches, for instance, are popular in food, cosmetics, and personal care due to their convenience, resealability, and ability to hold a wide range of product types, including liquids and semi-solids. Similarly, sachets are preferred for single-use applications in the personal care and pharmaceutical sectors, offering precise portioning and minimal wastage. Rigid containers, on the other hand, provide durability, enhanced protection, and a premium appeal, making them suitable for high-end products.

The rising adoption of these alternatives creates challenges for collapsible tube manufacturers, particularly in differentiating their products in an increasingly crowded market. While collapsible tubes excel in product preservation and minimizing wastage, they may struggle to match the functionality or aesthetic appeal offered by competing solutions. Additionally, the flexibility of pouches and the reusability of rigid containers often resonate more with environmentally-conscious consumers, intensifying the competitive landscape.

Collapsible Tube Packaging Market Segmentation

By Material Type

The Laminated Tubes segment dominated with the market share over 38% in 2023. This dominance is primarily due to the versatility and durability of laminated tubes, which are made by combining multiple layers of materials such as plastic and aluminum. These layers provide superior protection, ensuring that the contents remain secure and fresh over extended periods. Laminated tubes are particularly popular in the packaging of cosmetics, personal care products, and food items, as they offer an ideal balance between strength, flexibility, and aesthetic appeal. Their ability to preserve the integrity of sensitive contents, while also being lightweight and easy to use, makes them an attractive option for a variety of industries.

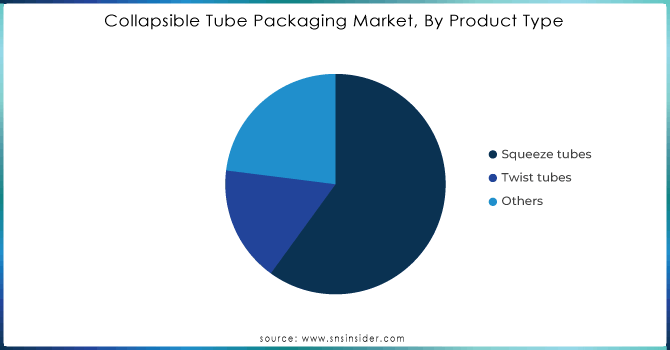

By Product Type

The squeeze tubes segment dominated with the market share over 65% in 2023. This trend is expected to persist, especially in industries like personal care, oral care, and healthcare. Plastic squeeze tubes are highly popular due to their lightweight, durability, and leak-proof properties. In healthcare and oral care sectors, laminated and aluminum collapsible tubes are preferred for their ability to maintain their collapsed form, making them ideal for packaging ointments and creams. These features contribute to the continued growth and preference for squeeze tubes in various product categories.

Get Customized Report as per Your Business Requirement - Request For Customized Report

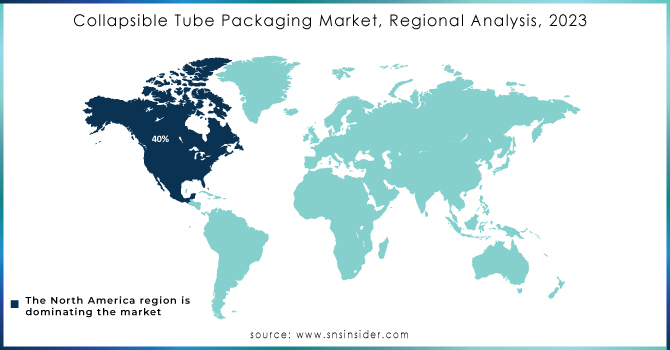

Collapsible Tube Packaging Market Regional Analysis

North America region dominated with the market share over 42% in 2023, driven by its well-established packaging industry and the presence of major players. The region’s dominance is largely attributed to the high demand for collapsible tubes in sectors such as cosmetics, personal care, and pharmaceuticals, where packaging plays a key role in product presentation and preservation. North America benefits from advanced manufacturing capabilities, ensuring high-quality production and the ability to meet diverse consumer needs. Additionally, the region's robust infrastructure, which includes efficient distribution networks and supply chains, further enhances its position in the market.

The Asia-Pacific region is the fastest-growing in the collapsible tube packaging market, driven by rapid industrialization and rising demand in emerging economies like China and India. The growing consumer base, especially in the cosmetics and pharmaceutical sectors, is fueling this growth. Additionally, there is an increasing demand for sustainable and cost-effective packaging solutions, with collapsible tubes offering both benefits. The rising awareness of eco-friendly packaging options further supports the adoption of collapsible tubes in the region.

Some of the major key players of Collapsible Tube Packaging Market

-

Essel Propack Limited (Collapsible Tubes for Cosmetics, Pharmaceuticals)

-

Adelphi Healthcare Packaging (Aluminum Collapsible Tubes, Pharmaceutical Tubes)

-

Montebello Packaging (Plastic and Aluminum Collapsible Tubes for Cosmetics, Food, Pharmaceuticals)

-

Andpak (Aluminum and Plastic Collapsible Tubes, Custom Packaging)

-

Antilla Propack (Aluminum Collapsible Tubes, Cosmetic Packaging)

-

Auber Packaging Co., Ltd (Plastic Collapsible Tubes, Cosmetic Packaging)

-

CONSTRUCT Packaging (Cosmetic Collapsible Tubes, Customized Packaging Solutions)

-

Paket Corporation (Aluminum Tubes, Cosmetic and Pharmaceutical Packaging)

-

Perfect Containers Group (Plastic Collapsible Tubes, Personalized Packaging)

-

PIONEER GROUP (Aluminum and Plastic Tubes for Pharmaceuticals and Cosmetics)

-

SUBNIL (Pharmaceutical and Cosmetic Collapsible Tubes)

-

Montebello Packaging (Collapsible Tubes for Personal Care and Pharmaceuticals)

-

Global Closure Systems (Collapsible Tubes for Cosmetic and Personal Care Applications)

-

Albea Group (Plastic Collapsible Tubes, Custom Cosmetic Tubes)

-

Hoffmann Neopac (Plastic and Aluminum Collapsible Tubes for Personal Care and Food)

-

Tubex GmbH (Aluminum Collapsible Tubes for Cosmetics and Pharmaceuticals)

-

VisiPak (Plastic Collapsible Tubes for Food, Cosmetic, and Personal Care Markets)

-

Toyo & Juri Tube (Collapsible Tubes for Pharmaceuticals and Cosmetics)

-

Shreeji Plastic (Plastic Collapsible Tubes for Pharmaceuticals and Cosmetics)

-

Raepak Ltd (Aluminum Tubes for Cosmetics, Pharmaceuticals, and Household Products)

Suppliers for (High-quality and innovative packaging solutions, particularly in the cosmetics, personal care, and pharmaceutical sectors. Known for offering eco-friendly and sustainable packaging options) of Collapsible Tube Packaging Market

-

Albea Group

-

Essel Propack Ltd.

-

Hindustan Tin Works Ltd.

-

Montebello Packaging

-

Kimpak (India) Pvt. Ltd.

-

Cospak

-

Aerosol Service & Distribution

-

Lumi Industries

-

VisiPak

-

Huhtamaki

Recent Development

In 27 August 2024: Hannah Hogan reported that Adelphi's partner, elm-plastic, has expanded its range of Short Form Oral Dosing Syringes by introducing a 1.5ml syringe, enhancing the flexibility for oral dose products. These syringes are available in various sizes and can be customized with specific graduations and branding.

In April 2024: Linhardt, a European packaging manufacturer, acquired India's Pioneer Group through a share purchase agreement. The deal includes Pioneer Extruders and Jeevanlakshmi Packaging Solutions, spanning four locations in India. The acquisition, expected to conclude by June 2024, strengthens Linhardt’s position in the global market for high-quality aluminum tubes, especially in the pharmaceutical industry. The company also welcomes over 500 Pioneer employees into its global operations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.1 Billion |

| Market Size by 2032 | US$ 2.1 Billion |

| CAGR | CAGR of 7.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material Type (Laminated Tubes, Plastic Tubes, Aluminum Tubes) • By Product Type (Squeeze tubes, Twist tubes) • By Application (Cosmetics, Pharmaceuticals, Food & Beverage, Cleaning products) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Essel Propack Limited, Adelphi Healthcare Packaging, Montebello Packaging, Andpak, Antilla Propack, Auber Packaging Co., Ltd, CONSTRUCT Packaging, Paket Corporation, Perfect Containers Group, PIONEER GROUP, SUBNIL, Montebello Packaging, Global Closure Systems, Albea Group, Hoffmann Neopac, Tubex GmbH, VisiPak, Toyo & Juri Tube, Shreeji Plastic, Raepak Ltd, and Others |

| Key Drivers | • The collapsible tube packaging market is growing rapidly, driven by demand for lightweight, convenient, and sustainable solutions in the personal care and cosmetics industry. |

| Restraints | • The collapsible tube packaging market faces strong competition from versatile alternatives like flexible pouches, sachets, and rigid containers, which cater to diverse needs and appeal to environmentally-conscious consumers. |