4D Printing Market Size:

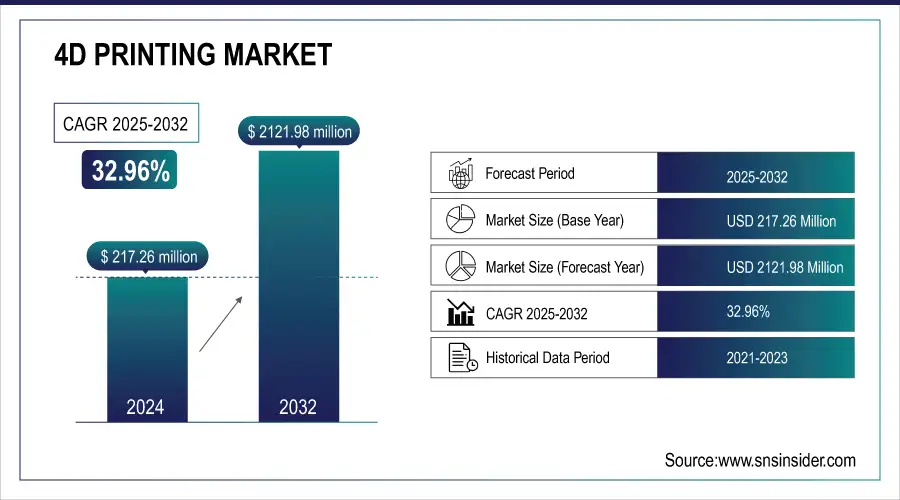

The 4D Printing Market Size was valued at USD 217.26 Million in 2024 and is expected to reach USD 2121.98 Million by 2032 and grow at a CAGR of 32.96% over the forecast period 2025-2032.

The growth of the 4D printing market is being driven by the increasing demand for advanced materials and cutting-edge technologies that enhance production efficiency, reduce costs, and foster innovation. One key factor is the development of adaptive materials used in industries such as aerospace, automotive, and healthcare. In aerospace, 4D printing is revolutionizing the design of adaptive components like airfoils and engine parts, which respond to changing environmental conditions. This smart technology allows parts to morph during flight, optimizing aerodynamics, improving fuel efficiency, and reducing emissions. Supported by organizations like DARPA (Defense Advanced Research Projects Agency), 4D printing is advancing next-generation aerospace technologies, highlighting its potential in the development of environmentally responsive materials.

Get more information on 4D Printing Market - Request Sample Report

Similarly, the automotive sector is leveraging 4D printing to integrate self-healing materials into vehicle designs, enhancing the longevity of parts, reducing maintenance costs, and improving vehicle performance. The integration of these materials in vehicle manufacturing is driving market growth, as the demand for durable, cost-effective solutions continues to rise.

4D Printing Market Highlights:

-

Healthcare Transformation: 4D printing enables personalized medical devices such as self-adjusting stents and smart drug delivery systems, improving patient outcomes and addressing cardiovascular and other critical conditions.

-

Multi-Sector Applications: Aerospace, automotive, and construction sectors leverage 4D printing for adaptive components, lightweight designs, self-healing materials, and enhanced safety under extreme conditions.

-

Sustainability & Circular Economy: 4D printing reduces production waste, uses recyclable/biodegradable materials, and creates energy-efficient components, supporting ESG goals and eco-friendly innovation.

-

Market Growth Drivers: Versatility across industries, demand for patient-specific medical solutions, adaptive manufacturing, and sustainability initiatives are key factors fueling adoption.

-

Knowledge & Awareness Gap: Limited understanding among decision-makers, investors, and consumers hinders adoption and collaboration, slowing market expansion despite technological potential.

-

Innovation Potential: Despite being a nascent technology, 4D printing offers transformative opportunities in material science, design flexibility, and smart structures, encouraging further R&D and investment.

The healthcare industry is another major adopter of 4D printing technology. With the ability to create personalized medical devices, 4D printing is transforming patient care. 4D-printed stents, for example, can expand or contract in response to temperature, offering a customized solution for cardiovascular treatments. Given that cardiovascular diseases (CVD) account for 11% of the EU’s total healthcare expenditure and remain the leading cause of death in many countries, the use of smart implants and drug delivery systems is expected to grow rapidly. These systems can change shape to release medication at precise locations within the body, improving therapeutic outcomes and driving demand for innovative healthcare solutions.

4D Printing Market Drivers:

-

The versatility of 4D printing opens avenues in sectors such as healthcare, aerospace, automotive, and construction, driving market growth.

In healthcare, for instance, 4D-printed medical devices like self-adjusting stents, drug delivery systems, and tissue scaffolds have transformative potential. These innovations address patient-specific needs, reduce surgical risks, and improve recovery times. Similarly, in aerospace and defense, components designed with 4D printing can adapt to extreme conditions, such as temperature fluctuations or mechanical stress, enhancing safety and performance. Automotive manufacturers leverage 4D-printed components for lightweight and adaptability in vehicle designs. The construction industry, too, benefits from the development of adaptive materials that can self-heal or respond to environmental factors like earthquakes or temperature changes. These broad applications illustrate the market's far-reaching potential, encouraging more organizations to explore and invest in the technology, which, in turn, drives its adoption and development.

-

As industries strive to minimize their environmental footprint, 4D printing offers a compelling solution that drives market growth.

The technology reduces waste during production and enables the development of sustainable products. Materials used in 4D printing are often recyclable or biodegradable, aligning with the principles of a circular economy. For instance, self-repairing structures reduce the need for frequent replacements, thereby conserving resources and energy. Furthermore, the lightweight and adaptive nature of 4D-printed products contributes to energy efficiency in industries like transportation and logistics. For example, lightweight components in vehicles or aircraft reduce fuel consumption, which has both economic and environmental benefits. Companies focusing on sustainability are increasingly integrating 4D printing into their operations, viewing it as a pathway to achieving their environmental, social, and governance (ESG) goals. This growing emphasis on sustainability not only accelerates market growth but also positions 4D printing as a transformative force for eco-friendly innovation.

4D Printing Market Restraints:

-

The concept of 4D printing is still relatively new, and many industries are unaware of its potential applications or benefits.

This lack of awareness extends to decision-makers, investors, and consumers, who may perceive the technology as niche or experimental. Without adequate understanding, organizations may be reluctant to allocate resources toward adopting or exploring 4D printing solutions. Additionally, the complex nature of the technology and its reliance on interdisciplinary expertise can make it difficult for stakeholders to grasp its full potential. This knowledge gap hinders collaboration, innovation, and market expansion, posing a significant challenge for the industry.

4D Printing Market Segment Analysis:

By Material

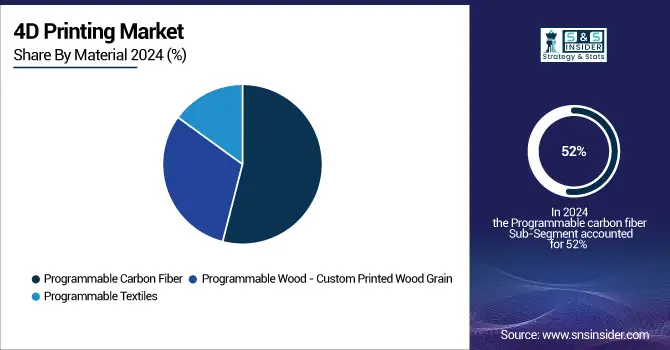

Programmable carbon fiber segment dominated the 4D printing market, holding a 52% market share in 2024. This material is favored for its high strength-to-weight ratio, durability, and flexibility in manufacturing complex, lightweight structures. Carbon fiber's versatility in automotive, aerospace, and construction industries has fueled its growth. The ability to create structures that change shape or respond to external stimuli, such as pressure or temperature, enhances its application potential. In the automotive sector, BMW has explored the use of programmable carbon fiber for car parts, aiming for improved fuel efficiency and better performance.

Programmable wood segment is projected to rapidly emerge as the fastest-growing segment in 4D printing market during 2025-2032, with applications driven by the material's sustainability and natural aesthetic. Programmable wood offers eco-friendly alternatives to traditional materials, reducing waste and promoting sustainability. Companies like ecoLogicStudio are experimenting with programmable wood for architectural applications, where the material can respond to changes in temperature and humidity, contributing to energy efficiency in buildings.

By End User

In 2024, the military & defense segment held the largest market share of the 4D printing market, accounting for 37%. 4D printing's ability to create smart materials that adapt to environmental changes is particularly appealing for defense applications. These materials can self-heal, change shape under specific stimuli, or adjust their properties to ensure durability in extreme conditions. Examples include adaptive camouflage or morphing structures for drones. Companies like MITRE Corporation and Raytheon Technologies are exploring 4D-printed parts for sensors, protective gear, and other strategic uses.

The aerospace segment is projected to grow at the fastest rate from 2025 to 2032, driven by the industry's push for lightweight, high-performance, and sustainable materials. 4D printing enables the creation of morphing components, such as turbine blades or airfoils, that adapt to flight conditions to optimize aerodynamics. The technology also supports advanced material design for extreme temperature resistance and durability, crucial in space missions. Companies like Airbus and NASA are integrating 4D printing into components for satellites, deployable structures, and aircraft interiors.

4D Printing Market Regional Analysis

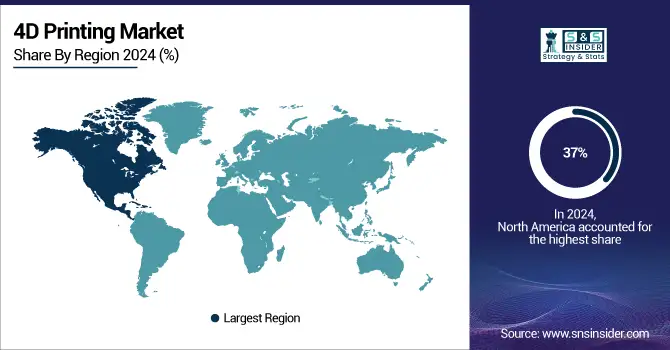

North America 4D Printing Market Trends:

North America led the 4D printing market in 2024 with a 37% market share, due to its advanced technological infrastructure, strong investment in R&D, and presence of key players like MIT Self-Assembly Lab, Stratasys Ltd, and Autodesk Inc. The region’s dominance is driven by the adoption of 4D printing in industries such as healthcare, aerospace, and automotive. For instance, 4D printing in healthcare, companies are leveraging 4D printing to develop shape-changing medical implants and drug delivery systems. The aerospace sector uses 4D-printed components that adapt to environmental changes, enhancing efficiency and durability.

Get Customized Report as per your Business Requirement - Request For Customized Report

Asia-Pacific 4D Printing Market Trends:

Asia-Pacific is anticipated to become the fastest-growing region during 2025-2032, due to increasing industrialization, rising adoption of smart technologies, and significant investments in manufacturing innovations by countries like China, Japan, and South Korea. Companies like Farsoon Technologies and Shenzhen Esun Industrial Co., Ltd. are driving advancements in 4D printing applications for consumer goods, construction, and electronics. For example, the region focuses on 4D-printed self-repairing materials in electronics and responsive building materials in construction. Governments in APAC are also promoting research collaborations, fostering an ecosystem for high growth.

Europe 4D Printing Market Trends:

Europe accounted for a significant share of the 4D printing market in 2024, driven by strong R&D investment, advanced manufacturing capabilities, and sustainability initiatives. Countries like Germany, France, and the UK are adopting 4D printing in aerospace, automotive, and medical sectors. Companies such as Siemens AG, EOS GmbH, and Materialise NV are developing adaptive components, shape-changing prosthetics, and responsive industrial parts, enhancing precision and reducing waste.

Latin America 4D Printing Market Trends:

Latin America is emerging in the 4D printing landscape, with countries like Brazil and Mexico investing in R&D and industrial modernization. Key applications include automotive, healthcare, and consumer goods, with companies focusing on smart polymers, adaptive materials, and 4D-printed components for lightweight structures. Public-private initiatives and academic collaborations are accelerating adoption and innovation.

Middle East & Africa (MEA) 4D Printing Market Trends:

The MEA region is witnessing steady growth in 4D printing, supported by infrastructure development, industrial modernization, and adoption of advanced manufacturing technologies in countries like UAE and South Africa. Sectors such as construction, healthcare, and defense are leveraging 4D-printed adaptive materials, bio-compatible medical devices, and shape-memory components. Collaborations between universities and private firms are fostering innovation and technology transfer.

4D Printing Market Key Players:

-

MIT Self-Assembly Lab (Programmable Material Structures, Shape-Shifting Fibers)

-

Stratasys Ltd. (4D Smart Material Printers, PolyJet Shape Memory Polymers)

-

Autodesk, Inc. (Project Cyborg 4D Design Software, Shape-Adaptive Modeling Tools)

-

Hewlett-Packard (HP) Inc. (HP Multi Jet Fusion Printers, Dynamic Color-Change Materials)

-

ARC Centre of Excellence for Electromaterials Science (ACES) (4D Bio-Printed Structures, Electrostimulated Polymers)

-

Materialise NV (4D Folding Assemblies, Adaptive Prosthetic Materials)

-

3D Systems Corporation (Dynamic SLA Materials, 4D Stretchable Components)

-

Siemens AG (4D Manufacturing Design Suite, Active Shape-Changing Actuators)

-

ExOne Company (Smart Binder Jetting Materials, Adaptive Printed Sand Cores)

-

GE Additive (Shape Memory Alloy Components, 4D Printed Aerostructures)

-

Dassault Systèmes (CATIA for 4D Printing, Abaqus Simulation for Smart Materials)

-

EOS GmbH (4D Metal Printers, Responsive Alloys)

-

Nano Dimension (Dynamic Printed Circuit Boards, Conductive Smart Materials)

-

EnvisionTEC (4D Biocompatible Resins, Shape-Adaptive Dental Components)

-

Organovo Holdings, Inc. (4D Bio-Printed Tissues, Living Cell-Integrated Polymers)

-

VTT Technical Research Centre of Finland (Responsive Textile Materials, Shape Memory Components)

-

Fraunhofer Institute (4D Printed Microactuators, Programmable Hydrogels)

-

Swinburne University of Technology (Smart Shape Recovery Structures, Adaptive 4D Electronics)

-

Tethon 3D (Ceramic-Based 4D Materials, UV-Curing Resins)

-

Carbon, Inc. (4D Digital Light Synthesis Materials, Shape-Memory Elastic Polymers)

Suppliers of Components for 4D Printing

-

BASF (Shape-Memory Polymers)

-

Covestro (Polyurethane-Based Smart Materials)

-

Solvay S.A. (Advanced Thermoplastics)

-

Evonik Industries (High-Performance Polymers)

-

Arkema (Nylon and Smart Composites)

-

Henkel AG & Co. (Adhesive Resins and Dynamic Glues)

-

Eastman Chemical Company (Flexible Polymer Blends)

-

DSM (Photopolymers and Bio-Resins)

-

Nanoscribe GmbH (Microstructure Printing Resins)

-

Sigma-Aldrich (Merck Group) (Hydrogel and Bioprinting Materials)

4D Printing Market Competitive Landscape:

-

November 2024: Siemens and chosen collaborators showcased at Formnext 2024 how additive manufacturing (AM) is increasingly empowering innovation in industrial uses through a functional ecosystem, digitalization, and automation.

-

November 2024: HP Inc. unveiled breakthrough innovations in polymer and metal 4D printing, alongside strategic collaborations that push the boundaries of additive manufacturing across industries.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 217.26 Million |

| Market Size by 2032 | USD 2121.98 Million |

| CAGR | CAGR of 32.96% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Programmable Carbon Fiber, Programmable Wood - Custom Printed Wood Grain, Programmable Textiles) • By End User (Military & Defense, Aerospace, Automotive, Healthcare, Textile, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | MIT Self-Assembly Lab, Stratasys Ltd., Autodesk Inc., Hewlett-Packard (HP) Inc., ARC Centre of Excellence for Electromaterials Science (ACES), Materialise NV, 3D Systems Corporation, Siemens AG, ExOne Company, GE Additive, Dassault Systèmes, EOS GmbH, Nano Dimension, EnvisionTEC, Organovo Holdings Inc., VTT Technical Research Centre of Finland, Fraunhofer Institute, Swinburne University of Technology, Tethon 3D, Carbon Inc. |