Collectibles Identification Services Market Report Scope & Overview:

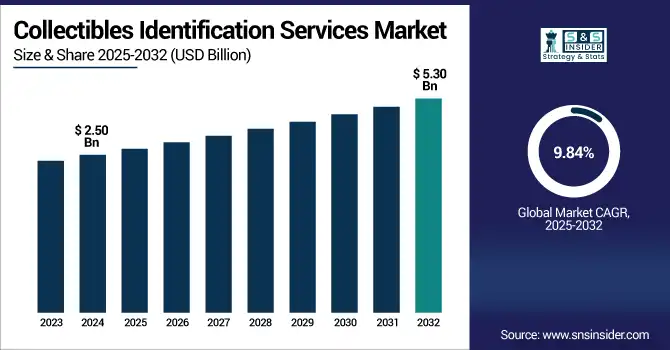

The Collectibles Identification Services Market Size was valued at USD 2.50 billion in 2024 and is expected to reach USD 5.30 billion by 2032 and grow at a CAGR of 9.84% over the forecast period 2025-2032.

To Get more information on Collectibles Identification Services Market - Request Free Sample Report

The market is experiencing robust growth, driven by rising interest in rare and valuable items such as coins, art, stamps, toys, and vintage fashion. These services include authentication, valuation, condition reporting, provenance research, and certification, offered via online platforms, mobile apps, and in-person evaluations. Growing participation from individual collectors, dealers, and investment firms, alongside technological advancements, is fueling demand for reliable identification solutions. Notably, authentication services lead the market, supported by increased digitalization and the global expansion of grading institutions. This market plays a crucial role in preserving asset integrity, boosting buyer confidence, and ensuring long-term value.

According to a study, the growing popularity of collectibles such as coins, artworks, and vintage items has significantly increased the demand for identification services. This surge has made authentication services the most dominant and fastest-growing segment. With a rise in online and mobile-based platforms, over 60% of users now prefer digital identification channels. The expansion of individual collectors and investment firms further drives the need for valuation and certification, ensuring the integrity, provenance, and marketability of high-value collectibles.

The U.S. Collectibles Identification Services Market size was USD 0.59 billion in 2024 and is expected to reach USD 1.07 billion by 2032, growing at a CAGR of 7.68% over the forecast period of 2025–2032. The U.S. market is a rising demand for authentication and valuation of rare items due to increased investment in alternative assets. As a result, service providers are expanding digital offerings to meet collector expectations. The U.S. dominates in North America because of its large base of individual collectors, advanced grading infrastructure, and widespread use of mobile and online identification services across diverse collectible categories.

Market Dynamics

Key Drivers:

-

Escalating Demand for Trusted Authentication Services Driven by Rising Collector Investment in Rare and Valuable Assets

The high-value collectibles, such as coins, artworks, and vintage items, are increasingly seen as alternative investment assets, and the demand for reliable authentication, valuation, and documentation services has surged. This is driven by growing investor interest in physical assets that retain or increase in value over time. As a result, service providers are enhancing their offerings to meet expectations for transparency, security, and expert evaluation. This shift is particularly visible in the U.S., where a large base of collectors and investors exists. Institutions are leveraging digital tools, AI-driven condition reporting, and expanded certification services to ensure buyers and sellers can transact with confidence. The ripple effect is a rising adoption rate among individual collectors, auction houses, and investment firms, further stimulating market growth.

For example, in February 2025, PCGS launched the Online Submission Portal 2.0, significantly reducing turnaround times and improving service accessibility, highlighting how increased collector demand drives operational innovation.

Restraints:

-

Regulatory Ambiguity in Certification Standards Inhibits Market Consistency and Consumer Confidence

There is no universal standard or federal regulatory oversight governing how collectibles are authenticated, graded, or certified in the U.S.; many identification service providers apply differing methodologies and evaluation scales. This inconsistency leads to confusion among collectors, especially newcomers, who may question the legitimacy or accuracy of assessments. As a result, trust in third-party services can waver, limiting widespread adoption. For seasoned collectors or dealers, it complicates resale and reduces value certainty. The lack of regulatory benchmarks also prevents smaller players from gaining industry-wide recognition, thus reducing competition and innovation. While major companies maintain internal grading systems, the absence of enforceable quality standards across the sector restricts market maturation and poses a significant hurdle to scalability.

This regulatory gap forces buyers and sellers to rely heavily on brand reputation rather than industry validation, which restricts entry into global markets and inhibits integration with financial and insurance services that demand standardized documentation.

Opportunities:

-

Expansion Into AI-Powered Condition Reporting Opens New Markets and Spurs Technological Advancements

The rapid advancement of artificial intelligence and its ability to detect minute details with consistency, collectible identification services are beginning to integrate AI-powered tools for condition reporting and authentication. This shift enhances both speed and accuracy, particularly for high-volume assessments involving coins, stamps, and vintage cards. As a result, companies adopting AI gain a significant advantage in operational efficiency, offering faster turnaround times and reducing human error. These tools also democratize access by allowing mobile-based users and remote collectors to receive near-expert-level evaluations without physically shipping items, cutting costs, and opening untapped customer segments.

For instance, in July 2025, a major auction house introduced an AI-based grading system that automatically evaluates coin surface integrity and wear levels within seconds. This innovation streamlined cataloging and authentication processes, showing how AI deployment not only boosts productivity but also makes condition reporting more scalable, accessible, and consistent across user tiers.

Challenges:

-

High Operational Costs for State-of-the-Art Grading Labs Challenge Market Profitability and Accessibility

Because high-quality authentication services require advanced imaging equipment, secure facilities, climate-controlled storage, and experienced graders, the cost of establishing and operating grading labs is substantial. As a result, only a few established players can afford the overhead, creating high barriers to entry for startups and limiting innovation. These costs also translate into expensive service fees for end users, discouraging broader adoption, especially among casual collectors or hobbyists. The impact is twofold: the market remains concentrated among a few large firms, and price-sensitive segments remain underserved. Moreover, maintaining consistent turnaround times and quality under high demand increases staffing and logistical burdens, further straining operational budgets.

This challenge is amplified when trying to expand regionally or internationally, as replicating infrastructure in new markets is capital-intensive. Consequently, the high-cost structure limits scalability, affects profitability margins, and slows down technological rollout, despite clear demand signals from growing segments such as digital collectors and app-based users.

Segmentation Analysis:

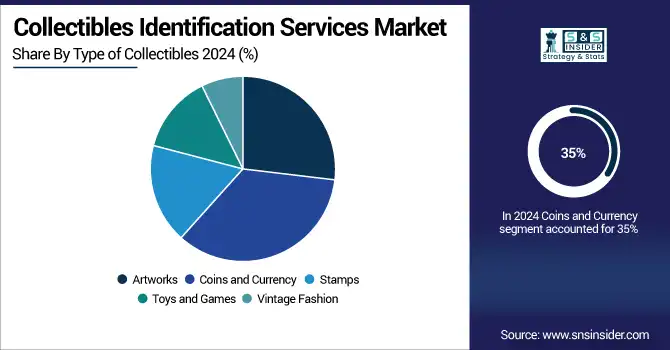

By Type of Collectibles

High investment value and historical appeal have led the Coins and Currency segment to capture 35% of revenue in 2024. This demand has prompted grading firms like PCGS and NGC to enhance secure authentication and encapsulation features. Improved services have elevated buyer confidence, increased transactions, and reinforced trust. As more collectors seek third-party validation, this segment continues driving the Collectibles Identification Services Market, particularly through product innovation and expanded digital platforms tailored to currency collectors.

Surging collector interest in nostalgic items and rising resale values have pushed the Toys and Games segment to grow at a 13.26% CAGR. Service providers have responded with digital grading systems and app-based evaluation tools. For instance, Heritage Auctions expanded grading options for retro toys in 2024. Enhanced tools have simplified authentication and improved collectible value accuracy, accelerated demand, and strengthened the Collectibles Identification Services Market in the pop culture and entertainment niche.

By Service Type

Widespread digital adoption and platform reliability contributed to Online Identification Services leading the market with 37% of revenue in 2024. Identification providers launched instant grading portals, secure uploads, and digital certificates. NGC, in 2024, expanded its online coin grading infrastructure, boosting service accessibility. These innovations support faster, remote evaluations and scalability, resulting in higher engagement among collectors and investors. The shift to digital-first solutions continues to propel the Collectibles Identification Services Market forward.

Strong smartphone penetration and on-the-go user behavior fueled Mobile App-based Identification to achieve a 12.23% CAGR. Developers introduced AI-driven tools for real-time grading via photo input. In 2025, a leading company launched an app offering instant card condition analysis. Greater convenience and instant results have improved customer engagement and broadened reach. These advancements are transforming collector experiences, increasing market participation, and directly boosting the collectibles identification services market growth.

By Customer Type

Growing personal interest in rare items and collectibles drove Individual Collectors to capture 36% of the market revenue in 2024. Tailored services such as subscription grading, online consultations, and digital storage appealed to this segment. In 2024, PCGS introduced flexible pricing tiers for hobbyists. Increased accessibility and personalized tools have deepened engagement, expanded user bases, and strengthened the Collectibles Identification Services Market, particularly among those collecting for passion, legacy, or long-term investment.

High-volume trading and rapid valuation needs helped the Retailers and Dealers segment grow at a CAGR of 11.70%. Service providers developed enterprise dashboards and batch authentication tools. NGC launched a dedicated dealer portal in 2024 to simplify bulk submissions. These solutions streamlined operations, reduced turnaround time, and improved transaction trust. As business clients seek operational efficiency, their demand continues to support the acceleration and scalability of the Collectibles Identification Services Market.

By Features Offered

Increasing counterfeit risks and the need for secure verification positioned Authentication Services as the top contributor, reaching 39% of revenue in 2024. Industry leaders added tamper-evident cases, digital scans, and blockchain-enabled verification. In 2024, PCGS adopted AI-powered fraud detection. These advancements reassured buyers, minimized risk, and expanded global reach. As market participants prioritize authenticity, demand for robust services remains central to the evolution of the Collectibles Identification Services Market.

Investor demand for verified records and long-term value preservation pushed Documentation and Certification to grow at a 13.76% CAGR. Providers began offering blockchain-led certificates and digital recordkeeping systems. In 2024, Sotheby’s launched NFT-backed provenance reports with a tech partner. This transparency and traceability uplifted consumer trust, boosted resale potential, and made documentation a critical component in expanding the Collectibles Identification Services Market, especially for high-value, insurable, and institutional-grade assets.

Regional Analysis:

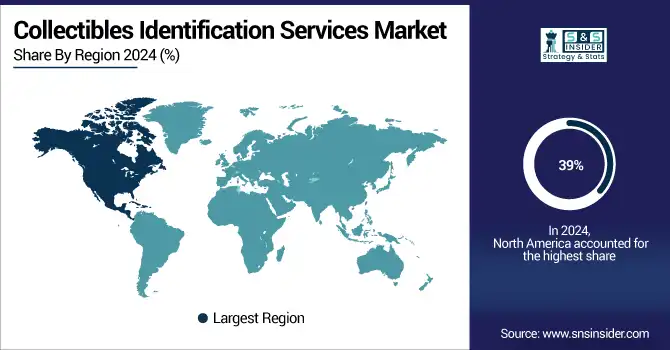

North America is the dominant region in the Collectibles Identification Services Market in 2024, with an estimated market share of 39%. High collector engagement, mature grading infrastructure, and widespread adoption of online identification platforms drive North America’s leadership. The United States leads the region, supported by industry pioneers like PCGS and NGC, digital authentication tools, and a strong network of auction houses and individual investors. In 2024, major providers introduced AI-powered grading systems and secure digital certification portals. These innovations strengthen the U.S. position as the regional hub for high-trust, technology-driven collectibles authentication and valuation services.

Asia Pacific is the fastest-growing region in the Collectibles Identification Services Market in 2024, with an estimated CAGR of 12.92%. Rising middle-class wealth, expanding auction participation, and mobile-first user behavior are accelerating market growth across the region. China dominates this fast-growing region due to deep cultural affinity for collectibles, strong demand for provenance research, and rapid digitization of identification platforms. In 2024, leading Chinese institutions like Rongbaozhai and Duoyunxuan launched mobile-enabled grading services and expanded blockchain-based certification. Backed by cultural preservation initiatives and technology adoption, China is setting the pace for modern identification services across Asia Pacific.

Europe’s strong heritage market and demand for provenance validation drive the Collectibles Identification Services Market in 2024. Institutional collecting, strict authenticity standards, and high-value art transactions support Europe’s market strength. Germany leads the region, driven by its thriving auction ecosystem, emphasis on fine art documentation, and digital transition in grading protocols. In 2024, German firms like Nagel introduced digital provenance reports and AI-supported appraisal systems. With a legacy of cultural stewardship and regulatory alignment, Germany anchors Europe’s trusted and increasingly digitized collectibles identification landscape.

In 2024, the collectibles identification services market in the Middle East & Africa (MEA) and Latin America gains momentum, driven by cultural revival and digitization. In MEA, the UAE leads with growing interest in art authentication and mobile-based verification tools supported by smart city strategies. Dubai’s rising number of private collectors and digital auction platforms highlights regional advancement. In Latin America, Brazil dominates due to a strong market for coins, sports memorabilia, and antique artifacts. In 2024, regional providers invested in localized grading facilities and launched mobile submission services, enabling scalable growth in culturally rich but previously underserved markets.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The collectibles identification services market companies are Professional Coin Grading Service, Numismatic Guaranty Corporation, Nagel, Bonhams, Sotheby's, Christie's Auction, Davids Auction, Skinners, Heritage Dallas, Susanina's Auctions, Bunte Auction, Tom Harris Marshall Town, Leslie Hindman Auctioneers, John Moran Auctioneers Inc, Poly, Guardian Auctions, Rongbaozhai, Duoyunxuan, Council International, Xiling Yinshe, and Others.

Recent Developments:

-

In February 2025, PCGS launched a revamped Online Coin Submission Portal (OSC 2.0), modernizing and streamlining the coin submission and grading experience with improved tools and efficiency for collectors submitting coins for authentication and grading service.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.50 Billion |

| Market Size by 2032 | USD 5.30 Billion |

| CAGR | CAGR of 9.84% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type of Collectibles (Artworks, Coins and Currency, Stamps, Toys and Games, Vintage Fashion) • By Service Type (Online Identification Services, In-Person Evaluation Services, Mobile App-based Identification, Subscription-based Services) • By Customer Type (Individual Collectors, Retailers and Dealers, Museums and Galleries, Investment Firms) • By Features Offered (Authentication Services, Valuation and Appraisal, Condition Reporting, Provenance Research, Documentation and Certification) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Professional Coin Grading Service, Numismatic Guaranty Corporation, Nagel, Bonhams, Sotheby's, Christie's Auction, Davids Auction, Skinners, Heritage Dallas, Susanina's Auctions, Bunte Auction, Tom Harris Marshall Town, Leslie Hindman Auctioneers, John Moran Auctioneers Inc, Poly, Guardian Auctions, Rongbaozhai, Duoyunxuan, Council International, Xiling Yinshe, and Others. |