Communication Platform-as-a-Service (CPaaS) Market Size & Overview:

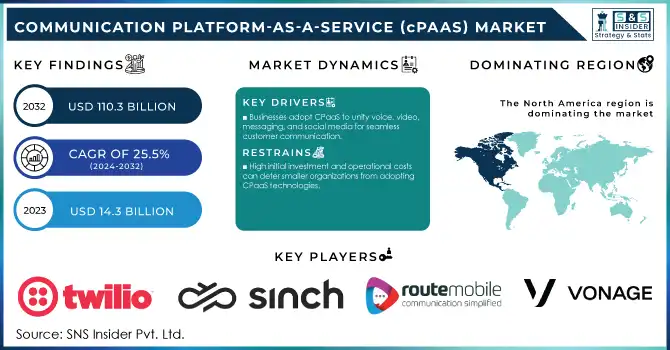

Communication Platform-as-a-Service (CPaaS) Market Size was valued at USD 14.3 Billion in 2023 and is expected to reach USD 110.3 Billion by 2032, growing at a CAGR of 25.5% over the forecast period 2024-2032.

Get more information on CPaaS Market - Request Sample Report

The CPaaS market is experiencing robust growth due to increasing reliance on digital communication solutions, fueled by strategic government policies aimed at digital transformation. For example, the U.S. Bureau of Labor Statistics reported a 2% increase in employment within the telecommunications sector in 2023, signifying a rise in investments to modernize communication infrastructure. The U.S. Federal Communications Commission (FCC) has allocated $9.2 billion under the Rural Digital Opportunity Fund to improve rural connectivity, which directly supports CPaaS growth by enabling widespread adoption of communication technologies. Similarly, India’s Digital India initiative reflects the government’s commitment to enhancing digital accessibility, with an allocation of INR 23,000 crore in FY 2023 for improving digital infrastructure.

These developments coincide with a broader global trend toward using API-driven communication platforms that enable businesses to integrate voice, video, and messaging solutions seamlessly into their existing systems. Increasing customer expectations for instant and omnichannel communication is another major driver, especially as businesses across the retail, healthcare, and education sectors strive to enhance user experiences. CPaaS platforms meet these needs by offering scalable and customizable communication tools, enabling organizations to reduce operational costs while maintaining high service quality. Emerging economies, particularly in Asia-Pacific and South America, are also contributing to the market’s momentum. Governments in these regions are investing in expanding 5G infrastructure and internet penetration to bridge digital divides. For instance, Brazil has committed $1.5 billion to improve 5G coverage, further driving demand for CPaaS solutions that capitalize on high-speed connectivity.

Communication Platform-as-a-Service (CPaaS) Market Dynamics

Drivers

-

Integrating AI-driven chatbots and virtual assistants enhances real-time customer support with personalized, multilingual, and context-aware interactions. This is streamlining communication workflows and improving customer satisfaction.

-

Businesses increasingly adopt CPaaS solutions to unify communication across platforms like voice, video, messaging, and social media, ensuring seamless customer experiences.

-

Rising concerns over data breaches are driving demand for CPaaS platforms with robust encryption, compliance with regulations, and multi-factor authentication to safeguard sensitive communications.

-

Advanced analytics tools in CPaaS enable businesses to gather actionable insights from customer interactions, improving decision-making and response times.

AI-driven customer engagement is a transformative trend in the CPaaS market, offering personalized and real-time communication capabilities. Moreover, AI-powered chatbots, or virtual assistants, and voice bots can be easily embedded into CPaaS solutions, as AI and machine learning will grow rapidly in the future along with voice recognition technology used in various applications to support businesses for an improved interaction with customers. A 2024 industry report states that more than 60% of the organizations are using AI to make customer service tasks automated, AI chatbots can lower 30% of the operation cost and it also helps to improve response efficiency. For example, to help a customer with product recommendation based on browsing behaviour and purchase history, e-commerce companies are now implementing AI-enabled chatbots. For example, there is a retail brand that introduced AI into its CPaaS platform which in turn gives discount and personalized offers via WhatsApp and resolves queries within seconds. This not only leads to more customer satisfaction but also to better conversion rates.

Artificial intelligence also helps increase multilingual support, allowing businesses to reach and service more audiences. An AI-enabled CPaaS solution, for instance, can recognise the language a customer prefers and give personal help, so it overcomes communication barriers. Additionally, AI analytics in CPaaS platforms gives actionable insights to the business. For instance, marketing teams are seizing the opportunity to leverage real-time customer sentiment analysis to dynamically adjust ongoing campaigns resulting in higher impact and engagement. This trend highlights the increasing dependence on AI to transform industry communication and customer experience.

Restraints

-

Implementing CPaaS solutions often requires aligning with existing IT infrastructures and legacy systems, which can be resource-intensive and time-consuming.

-

Stringent data protection laws across different regions pose challenges for global CPaaS adoption, especially for industries like finance and healthcare.

-

High initial investment and operational costs can deter smaller organizations from adopting CPaaS technologies

CPaaS solutions rely on internet infrastructure, and therefore, they require robust and stable infrastructure. In many of the emerging markets, the lack of reliable connectivity or broadband access can have a major obstacle against the CPaaS platforms being adopted or working really well. Features like real-time communication via video, voice, or messaging require high bandwidth and low latency, which are often unavailable in these regions. In addition to preventing businesses from taking full advantage of CPaaS features, this technology gap also has wider implications for user experience, resulting in dissatisfaction. Moreover, the lack of continuous internet connectivity restricts the organizations in using some of the advanced functionalities like real-time analytics or AI-based customer interaction that required continuous connectivity. Overcoming this restraint would require substantial investment in telecommunication infrastructure, which may not always align with the economic priorities of these regions.

Communication Platform-as-a-Service (CPaaS) Market Segment analysis

By Industry

The IT and telecom sector was the largest revenue generator, with a 27% revenue share of the overall global CPaaS market in 2023, as the sector leads in the adoption of advanced communication platforms. The extensive use of CPaaS in this domain is due to the capability of customer engagement, latency reduction, and operational workflow improvements. Telecom operators use CPaaS to maximise the potential of 5G launches and make customer interactions more seamless, such as by using AI-Powered Chatbots and messaging systems. This is in sync with the ever-growing inclination towards personalization and real-time communication in the industry. Governments are enthusiastically backing this trend, through funding to improve infrastructure. Consider the FCC's Broadband Infrastructure Program, which poured significant funds into extending high-speed internet access across underserved areas, creating an ideal environment for CPaaS adoption. Likewise, in India, the Department of Telecommunications has allocated funding for $30 billion to step up the deployment of optical fiber networks as part of BharatNet initiative, offering better access of CPaaS for telecom providers to improve connectivity and customer services.

Further, IT enterprises are deploying CPaaS solutions for flexible and remote work environments which became necessary during the pandemic time and post pandemic period. By implementing voice, video and SMS APIs in their internal and external processes, these companies are making sure that their communication remains seamless. As organizations invest in digital transformation and cloud communication tools, the IT and telecom sector’s dominance in the CPaaS market is expected to persist.

By Deployment

The cloud segment was the largest deployment model in the CPaaS market with 64% market share in 2023 thanks to its unparalleled scalability, cost efficiency, and ease of integration. Cloud-based CPaaS solutions have gained fast-paced traction mainly due to the need for supporting remote operations and flexibility in business communication. Globally, governments are seeing cloud adoption as a key element of larger digital transformation agendas, and providing incentives. As an example, the European Union's Horizon Europe program worth €95.5 billion focuses on cloud technology development to foster innovation and promote member-states' digitalization efforts. Minimum upfront investments with pay-as-you-go pricing models make CPaaS solutions, particularly cloud-based ones, very appealing to small and medium enterprises (SMEs). This flexibility allows businesses to adapt their communication capabilities according to needs, like during peak seasons or emergencies. Similarly, in developing regions like India and Southeast Asia, governments are adopting cloud-first policy for corporate to adopt advanced communication technologies too. As an example, Singapore government will significantly boost the adoption of cloud computing across the region with its Cloud Adoption Strategy, is expected to significantly enhance the penetration of CPaaS solutions in the region.

In particular, the rise of hybrid work models has only increased the demand for cloud-delivered deployments. More and more organizations are also integrating unified communication platforms, driven by CPaaS, so teams, customers, and partners can continue to collaborate seamlessly, regardless of location. With an increasingly globalized workforce, however, the cloud deployment model will likely continue to dominate the CPaaS market.

By Organization Size

Large enterprises dominated the CPaaS market in 2023, accounting for the largest share of revenue share 69%. This is largely because of their substantial budgets that make it possible for them to embed CPaaS solutions into their multi-layer complexity of communication systems. These enterprises use CPaaS to improve customer experience, increase operational efficiency, and enable large-scale communication operations like marketing campaigns or customer support systems. As early adopters of advanced communication solutions, large IT firms contributed to 70% of the CPaaS adoption in the country with a 20% share among other geographical verticals, according to a report by India’s Ministry of Electronics and Information Technology. This trend is also observed in North America where the Fortune 500 companies have already invested billions of dollars in CPaaS to facilitate digital transformation strategies. For example, U.S. companies are using CPaaS to integrate omnichannel communication platforms that enable personalized interactions with millions of customers across various touchpoints.

Large enterprises also utilize CPaaS to support global operations by ensuring consistent communication quality across regions. These organizations can accommodate diverse markets by gaining access to solutions that come with multi-language support, real-time analytics, and AI-driven customer engagements. With an increasing number of enterprises taking customer-centric approaches, the preference for CPaaS solutions in this segment is likely to rise significantly.

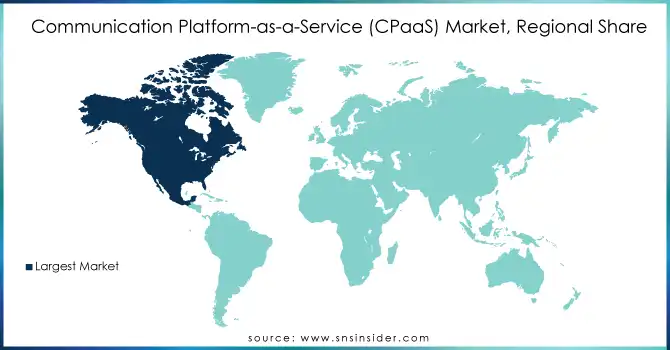

Regional Insights

In 2023, North America dominated the CPaaS market, with the largest market share attributed to its technologically advanced infrastructure as well as investments in varied communication platforms. The U.S., in particular, accounts for a significant portion of the region's revenue, supported by government policies that promote cloud adoption and digital innovation. For instance, the U.S. government’s investment in cybersecurity and communication technologies, amounting to $10 billion in 2023, has bolstered the adoption of CPaaS among businesses.

On the other hand, the Asia-Pacific region is anticipated to witness the highest CAGR, mainly due to government efforts such as the Five-Year Plan in China, which focuses on boosting cloud computing as well as digital infrastructure. Key players in China’s CPaaS market have risen to dominant positions, taking advantage of the growing need for integrated communication solutions, including Tencent’s CPaaS-related businesses. Likewise, China and India are also propelling CPaaS adoption through different government initiatives such as the Digital China campaign in China and the Digital India campaign in India in addition to the 5G rollout which will enable more SMEs to build a digital front to engage with customers.

Need any customization research/data on CPaaS Market - Enquiry Now

Key Players

Service Providers / Manufacturers

-

Twilio Inc. (Twilio Flex, Twilio Verify)

-

Sinch AB (Sinch Contact Pro, Sinch MessageMedia)

-

Route Mobile Limited (Smart Message, Whatsapp Business API)

-

Vonage Holdings Corp. (Vonage Communications Platform, Nexmo API)

-

Plivo Inc. (Plivo Voice API, Plivo Messaging API)

-

Infobip Ltd. (Moments, Answers)

-

Kaleyra Inc. (Kaleyra Messaging API, Kaleyra Video API)

-

Bandwidth Inc. (Bandwidth Messaging, Bandwidth Voice)

-

Voximplant (VoxEngine, Voximplant Kit)

-

CM.com (CM Payments, CM Voice API)

Users

-

Uber Technologies Inc.

-

Amazon.com Inc.

-

Airbnb Inc.

-

Netflix Inc.

-

Coca-Cola Company

-

Facebook Inc.

-

Alibaba Group Holding Ltd.

-

Walmart Inc.

-

Zomato Ltd.

-

Starbucks Corporation

Recent Developments

-

Twilio Introduced Verify Fraud Guard in 2023, which blocked 398 million fraudulent events, saving $46 million. Twilio was also recognized as a leader in the 2023-24 Omdia CPaaS Universe.

-

Route Mobile Expanded globally in 2024, with key initiatives in Kuwait and Saudi Arabia. It launched advanced products like WhatsApp Business and blockchain solutions and implemented citizen engagement platforms, such as for Assam’s government during floods.

| Report Attributes | Details |

| Market Size in 2023 | USD 14.3 Billion |

| Market Size by 2031 | USD 110.3 Billion |

| CAGR | CAGR of 25.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Service) • By Deployment (Cloud, On-premise) • By Organization Size (Large Enterprises, SMEs) • By Industry (BFSI, IT & Telecom, Healthcare, Retail, Logistics & Transportation, Hospitality, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles |

Twilio Inc., Sinch AB, Route Mobile Limited, Vonage Holdings Corp., Plivo Inc., Infobip Ltd., Kaleyra Inc., Bandwidth Inc., Voximplant, CM.com |

| Key Drivers | •Integrating AI-driven chatbots and virtual assistants enhances real-time customer support with personalized, multilingual, and context-aware interactions. This is streamlining communication workflows and improving customer satisfaction. •Businesses increasingly adopt CPaaS solutions to unify communication across platforms like voice, video, messaging, and social media, ensuring seamless customer experiences. •Rising concerns over data breaches are driving demand for CPaaS platforms with robust encryption, compliance with regulations, and multi-factor authentication to safeguard sensitive communications. •Advanced analytics tools in CPaaS enable businesses to gather actionable insights from customer interactions, improving decision-making and response times. |

| Market Opportunities | •Implementing CPaaS solutions often requires aligning with existing IT infrastructures and legacy systems, which can be resource-intensive and time-consuming. •Stringent data protection laws across different regions pose challenges for global CPaaS adoption, especially for industries like finance and healthcare. •High initial investment and operational costs can deter smaller organizations from adopting CPaaS technologies |