Telecom API Market Report Scope & Overview:

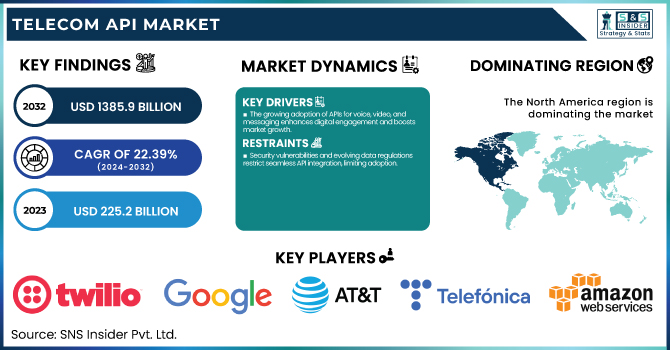

The Telecom API Market was valued at USD 225.2 billion in 2023 and is expected to reach USD 1385.9 billion by 2032, growing at a CAGR of 22.39% from 2024-2032.

To Get more information on Telecom API Market - Request Free Sample Report

This report consists of an in-depth analysis of the Telecom API Market, highlighting key trends, growth factors, and future forecasts. The increasing adoption of API-based communication platforms across various industry verticals, including BFSI, healthcare, and retail, is driving seamless digital communication and enhancing customer experiences. API traffic and monetization opportunities are expanding across regions, fueled by the growing adoption of 5G networks, cloud-based services, and IoT technologies. Security and authentication APIs, including multi-factor authentication and identity verification solutions, are gaining traction as organizations prioritize data protection and user authentication. Additionally, the demand for voice, messaging, and video APIs is rising significantly, with applications in real-time communication for business and consumer interactions witnessing rapid growth.

The U.S. The Telecom API Market was valued at USD 51.2 billion in 2023 and is expected to reach USD 308.0 billion by 2032, growing at a CAGR of 22.20% from 2024-2032, driven by the rapid expansion of 5G infrastructure, increasing adoption of cloud-based services, and growing demand for real-time communication APIs. The surge in IoT connectivity, coupled with rising digital transformation initiatives across industries such as BFSI, retail, and healthcare, further boosts the market. Looking ahead, the market is expected to witness sustained growth due to advancements in API-based monetization strategies, enhanced security and authentication APIs, and increasing integration of voice, video, and messaging APIs in business applications.

Telecom API Market Dynamics

Drivers:

-

The growing adoption of APIs for voice, video, and messaging enhances digital engagement and boosts market growth.

The rising need for real-time communication solutions, such as voice, messaging, and video APIs, is strongly driving the Telecom API Market. To improve customer engagement and streamline their operations, businesses are following the API approach. The adoption of Telecom APIs is also propelled by the surge in the adoption of cloud-based services and the rollout of 5G networks, which broaden the horizons of everyday communication. Furthermore, the increasing range of IoT devices and applications has led to a demand for seamless connectivity that further increases API traffic. APIs facilitating functionality boost, telecom service monetization, and digitised interactions have also been enabling enterprises to spur market growth.

Restraints:

-

Security vulnerabilities and evolving data regulations restrict seamless API integration, limiting adoption.

As the usage of APIs is increasing, security and privacy concerns are major restraints in the Telecom API Market. API issues can range from the recent MOVEIt file transfer vulnerability, which posts sensitive data to network hacks and leak attacks, where uploaders don't care about the amount of encrypted data in the network in exchange for open access points. The growing sophistication of cyberattacks has prompted many organizations to integrate stringent security measures like API authentication, encryption, and access control, which can increase implementation costs. Additionally, compliance with changing data protection laws such as GDPR and CCPA can make API integration more challenging — particularly for smaller enterprises — slowing widespread adoption in certain cases.

Opportunities:

-

Telecom providers can generate additional revenue by offering APIs for payments, location tracking, and IoT services.

The API economy can provide telecom with great monetization opportunities. The increasing trend of integrating APIs with diverse applications such as e-commerce, healthcare, or financial services presents a strong marketplace. Hence, telecommunication operators can earn money through APIs allowing payment gateways, location tracking, or multi-factor authentication. The emergence of smart cities, autonomous vehicles, and industrial IoT ecosystems demonstrates new opportunities created by the combination of APIs. The shift towards digital & API-driven solutions for a growing number of businesses through the API economy offers telecom service providers opportunities to enable innovative models for API monetization, discover new revenue streams, and broaden the usage of their APIs.

Challenges:

-

Compatibility challenges in integrating APIs from multiple vendors hinder seamless telecom operations.

Interoperability is another major challenge in integrating APIs from multiple vendors in the Telecom API Market. As digital ecosystems expand rapidly and more and more applications start adopting open-source APIs, compatibility becomes an issue as telecom services start becoming less seamless. Different API versions, protocols, and coding standards often make it difficult for businesses to integrate. Similarly, in large-scale deployments, keeping the API healthy in terms of quality, performance, and uptime can become an impediment. Solving these problems will necessitate a progressive maturation of API management platforms, industry-wide dialogue, and interoperability standards to ensure that APIs are integrated seamlessly across diverse telecom networks.

Telecom API Market Segmentation Analysis

By Type

The Messaging API segment dominated the market and accounted for 36% of revenue share, owing to their high adoption in various industries, such as e-commerce, BFSI, and healthcare, to create and send SMS notifications, capture leads, and for customer engagement and promotional campaigns. The emergence of over-the-top messaging applications and the need for real-time communication are the other factors contributing to its ascendancy. Moreover, via the rising penetration of smartphones and the rollout of 5G, this segment is anticipated to register the fastest CAGR throughout 2024-2032 due to the use of businesses to improve customer experience with personalized, secure, and scalable messaging solutions.

The IVR API segment is expected to register the fastest CAGR during the forecast period, owing to increasing demand for automated customer service and self-service solutions. Using IVR APIs, businesses in sectors including BFSI, telecom, and retail are pivoting customer interactions by facilitating secure payments, appointment scheduling, and voice-based authentication. AI for IVR Technology is designed to provide efficiency, personalized engagement, and satisfaction to customers.

By End-User

The enterprise developer segment dominated the market and accounted for a significant revenue share in 2023, mainly because more telecom APIs are needed for the enhancement of digital services, operational efficiency, and customer engagement. Many large enterprises, including companies in the BFSI, retail, and healthcare sectors, are turning to APIs for the creation of tailored communication platforms, enhancing application functionalities, and integrating payment gateways. The growing use of cloud-based applications, coupled with the continued rise of API-driven automation, drives this segment’s growth.

The partner developer segment is expected to register the fastest CAGR during the forecast period as telecom providers are teaming up with third-party developers to stimulate API usage. This segment is bolstered by increasing demand for new applications in IoT, payments, and OTT communication services. All of these lead to market growth because telecom creates value-added services with the help of partner developers via open APIs and you already know telecom companies urge this. The proliferation of 5G, which improves API capabilities for real-time data transfer and low-latency applications, is also expected to boost the growth of the segment.

Regional Analysis

North America dominated the market and accounted for 32% of revenue share in 2023 as adoption of advanced communication technologies is high, has a strong presence of telecom providers, and high API usage in various sectors, such as BFSI, healthcare, and retail. With early 5G deployment, the region is ripe for growth in real-time voice, video, and messaging APIs. The growing need for cloud-based applications and API-driven IoT solutions also strengthens market domination.

The Asia-Pacific region is witnessing the fastest CAGR, owing to fast digitization, growing 5G networks, and the growing penetration of smartphones. API adoption is increasingly being driven by countries such as China, India, and Japan to improve digital services, particularly in terms of OTT platforms, payments, and IoT applications. Growth is further spurred by the rise of startups and growing investment in telecom infrastructure. Also, the trend of API-based automation in sectors such as e-commerce, BFSI, and logistics bolsters the growth of this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their products are

-

Twilio Inc. – Twilio Messaging API

-

Google LLC – Google Maps API

-

Cisco Systems, Inc. – Cisco Webex API

-

AT&T Inc. – AT&T Speech API

-

Oracle Corporation – Oracle Communication API

-

Nokia Corporation – Nokia Network API

-

Telefonica S.A. – Telefonica Open API

-

Vonage Holdings Corp. – Vonage Video API

-

Verizon Communications Inc. – Verizon Location API

-

Huawei Technologies Co., Ltd. – Huawei Network API

-

Ericsson AB – Ericsson IoT Accelerator API

-

Infosys Limited – Infosys Communication API

-

Tata Communications – Tata Smart API

-

IBM Corporation – IBM Watson API

-

Amazon Web Services (AWS) – AWS API Gateway

Recent Developments

-

In September 2024, Ericsson announced a joint venture with twelve leading telecom operators, including Verizon, Deutsche Telekom, and Reliance Jio, to sell network software utilizing network application programming interfaces (APIs). This initiative aims to enhance services like credit card fraud prevention and improved gaming experiences. The venture is equally owned by Ericsson and the participating telecom providers.

-

In November 2024, Nokia acquired the world's largest API hub and marketplace from U.S. company Rapid. This strategic move is designed to bolster Nokia's 5G and 4G network offerings by integrating Rapid's technology and R&D capabilities, facilitating better network integration and API management for clients.

-

In December 2024, Gigs, a company offering "MVNO in a box" technology, announced a partnership with Vodafone. Concurrently, Gigs secured $73 million in a Series B funding round led by Ribbit Capital, aiming to expand its services that enable companies to launch wireless offerings through white-label solutions or APIs.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 225.2 Billion |

|

Market Size by 2032 |

US$ 1385.9 Billion |

|

CAGR |

CAGR of 22.39 % From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Messaging API, Web RTC API, Payment API, IVR API, Location API, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Twilio Inc., Google LLC, Cisco Systems Inc., AT&T Inc., Oracle Corporation, Nokia Corporation, Telefonica S.A., Vonage Holdings Corp., Verizon Communications Inc., Huawei Technologies Co., Ltd., Ericsson AB, Infosys Limited, Tata Communications, IBM Corporation, Amazon Web Services (AWS) |