Confectionery Market Report Scope & Overview:

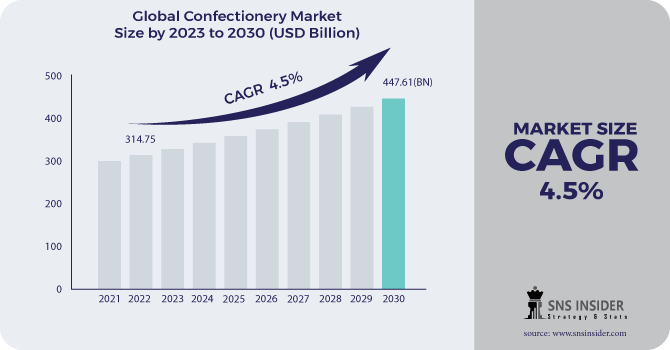

The Confectionery Market Size was valued at USD 314.75 billion in 2022 and is expected to reach USD 447.61 billion by 2030, and grow at a CAGR of 4.5% over the forecast period 2023-2030.

Confectionery alludes to food things that are wealthy in sugar and carbs. It incorporates a wide scope of items like chocolates, treats, bars, chewy candies, mints, and others.

Shopper propensities, tastes, and inclinations are continually advancing. This has prompted development in the field of confectionery that drives market development. Makers are expanding their item range by including useful fixings, natural homegrown fillings, tropical organic products, and nut-based and fascinating flavors in item definitions to fulfill changing shopper needs.

Moreover, the pattern of giving sweet shop items, like treats, chocolates, pastry kitchen things, and others, has empowered to move the market development in the new year. Brands are continually laying out one-of-a-kind connections with procedures to look for customer consideration as ice cream parlor items are essentially bought because of motivation purchasing. These elements have aggregately empowered to drive the market for confectionery items. In any case, the unpredictable idea of unrefined substance costs of sugar and cocoa can hamper the development of the market.

Market Dynamics:

Driving Factors:

-

Customer propensities, tastes, and inclinations are continually developing.

-

The pattern of giving sweet shop items, like treats, chocolates, pastry kitchen things, and others.

Restraining Factors:

-

The volatile nature of raw material prices of sugar and cocoa.

-

Vacillations in the cost of natural substances.

Opportunity:

-

Vacillations in the cost of natural substances.

Challenges:

-

Accomplishing supportability.

Impact of Covid-19:

The episode of COVID-19 seriously affects the sweet shop market. The severe guidelines and lockdown over the span of 2020 have prompted repercussions in the candy parlor business, which caused a differential effects on unrefined substance supply (farming produce, food fixings, and moderate food items), exchange and planned operations, request supply instability, questionable customer interest, and impacted the labor force at the modern level. One of the main considerations that impacted the confectionery industry during the lockdown was deals decline because of decreased giving and motivation purchasing among buyers across the globe.

Market Estimations:

Under the item type, the market is fragmented into chocolate (dull chocolate and white chocolate), sugar candy parlor (bubbled confectionery, mints, pastilles, gums, jams and bites, toffees, caramels and nougat, and other sugar-sweet shop items) and lunchroom (grain bars, energy bars, and another café). The dissemination channel is divided into general stores and hypermarkets, odds and ends shops, online retail locations, expert retailers, candy machines, and other conveyance channels.

Key Market Segments:

By Product Type:

-

Hard-boiled Sweets

-

Mints

-

Gums & Jellies

-

Chocolate

-

Caramels and Toffees

-

Medicated Confectionery

-

Fine Bakery Wares

-

Others

By Age Group:

-

Children

-

Adult

-

Geriatric

By Price Point:

-

Economy

-

Mid-Range

-

Luxury

By Distribution Channel:

-

Supermarket/Hypermarket

-

Convenience Stores

-

Pharmaceutical & Drug Stores

-

Food Services

-

Duty-free Outlets

-

E-commerce

-

Others

.png)

Regional Analysis:

-

North America

-

The USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Europe made the biggest commitment to the worldwide market. The rising prominence and interest in chocolate ice cream parlor items is pushing the development of the market. In addition, the rising customer's inclination for natural, and worth-added normal fixings items are the central point driving the market development. Moreover, consistently changing buyers' ways of life and dietary patterns are speeding upmarket development.

The Asia Pacific is the quickest developing business sector. China, India, and Japan have a gigantic purchaser base for the utilization of dessert shops, which will drive the provincial interest. Also, the area is supposed to develop with the most sped-up development rate over the figure period inferable from the developing discretionary cash flow and rising populace.

Key Players:

Key players of confectionary markets are Mars, Incorporated, Mondelez International, Inc., Nestlé S.A., Ferrero Group, Meiji Co., Ltd., The Hershey Company, Chocoladefabriken Lindt & Sprüngli AG, Ezaki Glico Co., Ltd., Haribo GmbH & Co. K.G., and Pladis.

Incorporated-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 314.75 Billion |

| Market Size by 2030 | US$ 447.61 Billion |

| CAGR | CAGR 4.5% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2022-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product Type (Hard-Boiled Sweets, Mints, Gums & Jellies, Chocolate, Caramels & Toffees, Medicated Confectionery, Fine Bakery Wares, and Others) • by Age Group (Children, Adult, and Geriatric) • by Price Point (Economy, Mid-Range, and Luxury) • by Distribution Channel (Supermarket/Hypermarket, Convenience Stores, Pharmaceutical & Drug Stores, Food Services, Duty-Free Outlets, E-Commerce, and Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, +D11UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Mars, Incorporated, Mondelez International, Inc., Nestlé S.A., Ferrero Group, Meiji Co., Ltd., The Hershey Company, Chocoladefabriken Lindt & Sprüngli AG, Ezaki Glico Co., Ltd., Haribo GmbH & Co. K.G., and Pladis. |

| Key Drivers | •Customer propensities, tastes, and inclinations are continually developing. •The pattern of giving sweet shop items, like treats, chocolates, pastry kitchen things, and others. |

| Market Challenges: | •Accomplishing supportability. |