Consumer Foam Market Report Scope & Overview:

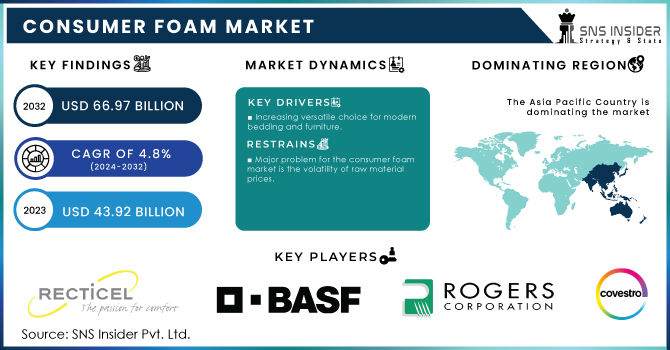

The Consumer Foam Market Size was valued at $43.92 billion in 2023 and is expected to reach $66.97 billion by 2032 and grow at a CAGR of 4.8% by 2024-2032.

Get More Information on Consumer Foam Market - Request Sample Report

Increasing usage of consumer foam in the automotive sector drives market growth. This is owing to higher operational efficiency, weight, and durability requirements, allowing the use of such consumer foam in vehicles. Due to its excellent sound absorption, cushioning, and shock absorption properties, consumer foam finds usage in seats, headrests, armrests, door panels, and acoustic insulation. Moreover, an inclination toward premium and luxury vehicles has increased the demand for better-quality foam which can provide increased comfort, durability, and visual appeal.

The International Energy Agency (IEA) projects that global EV sales will reach 125 million by 2030, indicating a substantial market for advanced materials like foam. Moreover, in Asia-Pacific, countries such as China and India are driving demand.

The increasing need for foam in the packaging sector is driven by its high protective, insulation, and lightweight characteristics, which ultimately makes it a favorable substance for packing products of these kinds for delivery and storage. Polyurethane and expanded polystyrene (EPS) foam packaging is extensively used in the electronics, consumer products, and e-commerce industries. The booming global e-commerce which was estimated to be USD 5.7 trillion, in retail sales in 2022, according to the International Trade Administration, has entailed an increasing demand for protective packaging solutions. Foam can be made to fit any form with a few twists and turns on the foam itself, and its easy shock absorption helps keep products safe, especially those that are more fragile, such as electronics and glassware. Moreover, its adoption has been further propelled by the evolving focus on sustainable & recyclable foam materials by consumer demands and environmental regulations.

Consumer Foam Market Dynamics

Drivers

-

Increasing modern bedding and furniture drives the consumer foam market growth.

The rising demand for contemporary beds and furniture cannot be ignored and is one of the major factors driving the consumer foam market. A few of the major drivers behind this trend are continuous urbanization, increasing disposable income and changing perception of consumers about home furnishings which should be of high quality, ergonomic, and durable. Foam is an essential element found within mattresses, sofas, cushions, and chairs because it provides the best comfort, durability, and look. Additionally, developments in foam, notably memory foam and high-density polyurethane foam, have transformed the bedding market, offering improved support and pressure relief for health-minded consumers. This, in turn, makes it possible for governments across the globe to offer housing and furniture solutions that are more in tune with sustainability. Example: In Europe, rules favoring recyclable and low-emission foam materials in home products boost market growth. With modern spaces valuing a good balance between style and function, there will be an increasing use of foam seen in modern furniture.

Restraint

-

The volatility of raw material prices may hinder market growth.

One of the key challenges faced by manufacturers in the consumer foam market is the volatility of raw material prices. Basic raw materials like polyurethane, polyols, and isocyanates are all petrochemical-based which is directly affected by variations in crude oil price. Global demand, geopolitical tensions, and supply chain disruptions play an important role in these price movements. These fluctuations directly affect foam manufacturing costs, pinching profits for producers and raising prices for consumers. Moreover, changes in regulations and environmental policies, which are implemented to lower carbon emissions, also impact the market as they often push up the cost of acquiring or providing feedstock. As an example, the Green Deal and carbon taxation policies in Europe have also placed an additional financial strain on manufacturers reliant on non-renewable resources. To make matters worse, supply chain woes such as transit delays and shortage of raw materials are also driving costs higher and making the market more unstable.

Opportunity

Sustainable solutions as bio-based polyols are growing in the consumer foam market.

Bio-based polyols products are in rising demand among consumers which is driven by environmental concerns and a desire to move away from fossil fuels, the industry is increasingly turning to bio-derived materials like soy-based polyols. These alternatives offer a double benefit, sustainability, and cost-effectiveness. By adopting bio-based polyols, polyurethane manufacturers can not only reduce their reliance on volatile petroleum sources but also potentially lower overall production costs. This shift presents a significant opportunity for the consumer foam industry to embrace a more sustainable future.

Consumer Foam Market Segmentation Analysis

By Type

Flexible Foam held the largest market share around 68% in 2023. It is driven by the wide application of flexible foam in different industries. Flexible foam mainly composed of polyurethane is widely used in bedding, furniture, automotive, and packaging industries due to its comfort, versatility, and lightweight properties. Over the recent past, the growth of the flexible foam segment can be attributed to the increasing adoption of flexible foam in modern bedding and furniture such as memory foam mattresses. In addition, low-cost flexible foam is widely used in automotive seats, as well as in insulation and soundproofing materials, so it plays an important role in enhancing the comfort and performance of vehicles.

By End-Use Industry

The bedding & furniture sector held the largest market around 28% in 2023. It is because consumers want comfort durability and design in home furnishings. To meet the need for more precisely adjusted cushioning materials, flexible polyurethane foam has been in the trend as one of the best polyurethanes aimed at consumers who spend on high-quality mattresses and cushions, as well as upholstered furniture items. Furthermore, this segment has secured a leading position in the foam market due to increasing automotive industry demand for furniture & bedding products, such as vehicle seats and padding materials. With the buildup demands for more sustainable, comfortable, and durable goods, foam manufacturers are continually advancing the direction of the foam, providing products that are more sophisticated including temperature-regulating or hypoallergenic features, which will help to stimulate additional growth of the bedding and furniture market

Consumer Foam Market Regional Outlook

Asia Pacific held the highest market share around 48% in 2023. The demand for foam factor is growing due to the development of the residential, automotive, and manufacturing sectors in countries such as China, India, and Japan. Asia Pacific has emerged as a manufacturing hub with mass production capacity and cheaper labor. This has helped the region to corner the global market to serve both domestic consumption and international exports. The growing purchasing power of the middle class in the region, combined with growing consumer spending on home furnishing products as well as automotive products, is expected to drive the foam demand. Regional governments are also increasing spending on infrastructure and housing which drives its growth. Consequently, the consumer foam market in the Asia Pacific is projected to hold the majority of the market share as it has a high demand for manufacturing consumer foam-based products and is being served as one of the manufacturing hubs of the world.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

Covestro AG (Baytherm and Bayflex)

-

Rogers Corporation (Poron and BISCO)

-

BASF SE (Elastoflex and Neopolen)

-

Recticel NV/SA (Euromac and Monoblock)

-

Trelleborg AB (Trelleborg Sealing Solutions and Trelleborg Anti-Vibration Systems)

-

DuPont (Kraton and Sorona)

-

Dow Inc. (Innovative Polyurethane Foam and Systech Foam)

-

Chemtura Corporation (Lanxess) (Vulkollan and Bayflex)

-

Huntsman Corporation (Iroflex and Emulsion Polymers)

-

FoamPartner Group (Comfort Foam and High-Performance Foam)

-

Sekisui Chemical Co., Ltd. (Sekisui Foam and Air Foam)

-

Woodbridge International Holdings, Inc. (FlexCell and Thermoplastic Polyurethane Foam)

-

JSP Corporation (STYROFOAM and Neopor)

-

Carpenter Company (Lifeguard and CushionGuard)

-

Armacell International (ArmaSound and ArmaFoam)

-

Huntsman Polyurethanes (Iroflex and Advanta)

-

Synthos (Styrofoam and Synthos EPS)

-

Rogers Foam (Poron Foam and BISCO Foam)

-

UFP Technologies (FoamCore and UFP-Seal)

-

Zotefoams (Airex and Zotek)

Recent Development:

-

In March 2024: Covestro began industrial-scale production of new polycarbonate copolymers in Antwerp, Belgium. This technology allows for new functionalities like enhanced flame retardancy in existing materials.

-

In March 2024: Rogers Corporation offers three distinct silicone brands, each specializing in different areas to meet your engineering needs: BISCO, ARLON, and Silicone Engineering. This guide will give you a quick rundown of what each brand offers, helping you choose the best fit for your specific project.

-

In February 2023: Covestro partnered with Greiner Packaging to develop sustainable molded foam packaging using bio-based materials. This move reflects the growing demand for environmentally friendly solutions in the molded foam market.

-

In February 2023: BAF's expansion of its Neopor insulation material production in China highlighted the continued strong demand for high-performance molded foam in the construction sector

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 43.92 Billion |

| Market Size by 2032 | USD 66.97 Billion |

| CAGR | CAGR of 4.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By End-use Industry (Bedding & Furniture, Automotive, Consumer Electronics & Appliances, Footwear, Sports & Recreational Products, Others (Beauty & Personal care, Apparel, and Household cleaning)) •By Type (Rigid Foam, Flexible Foam) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sekisui Chemical Co., Ltd., ovestro AG, Huntsman Corporation, BASF SE, JSP Corporation, Dow Inc., Saint-Gobain, and other players.. |