Polyurethanes (PU) Market Size Analysis:

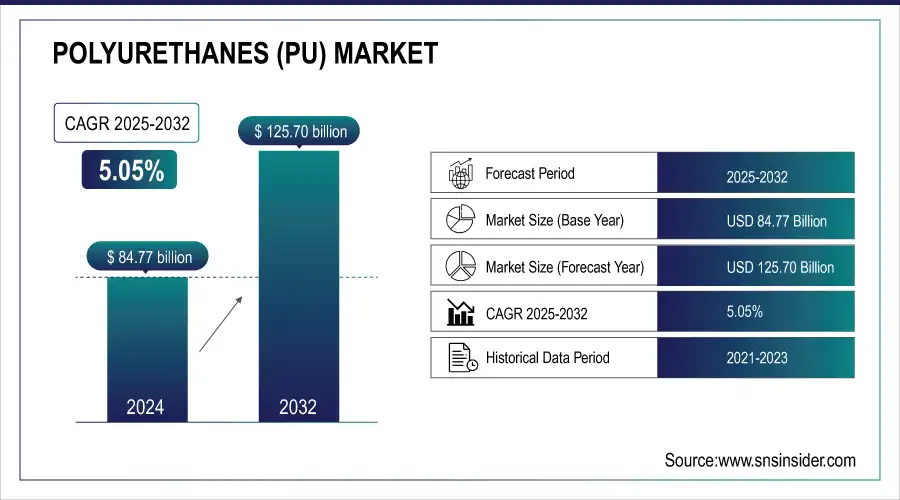

The Polyurethanes Market Size was USD 84.77 billion in 2024 and is expected to reach USD 125.70 billion by 2032 and growing at a CAGR of 5.05% over the forecast period of 2025-2032. Polyurethanes (PU) market demand is increasingly used in the electronics industry, owing to their better properties as an encapsulant and adhesive that serve the purposes of waterproofing and thermal insulation.

Get E-PDF Sample Report on Polyurethanes Market - Request Sample Report

India, for example, is on track to become the third-largest construction market globally by 2025, fueled by projects like the "Housing for All" initiative, which aims to build affordable homes for urban populations. This push for housing and infrastructure development is expected to boost the demand for PU-based products, including insulation and sealants, due to their energy-efficient and cost-effective properties.

Key Polyurethanes (PU) Market Trends

-

Growing demand for bio-based and sustainable polyurethanes to reduce environmental impact.

-

Rising adoption of thermoplastic polyurethanes (TPU) in automotive, footwear, and electronics applications.

-

Increasing use of PU in lightweight and energy-efficient construction materials.

-

Innovations in high-performance PU foams and coatings for insulation and protective applications.

-

Expansion of PU applications in emerging sectors such as flexible electronics, medical devices, and sports equipment.

-

Focus on digital manufacturing, automation, and smart PU materials for improved efficiency and customized solutions.

Polyurethanes Market Growth Drivers

-

Polyurethane's versatility and unique physical qualities drive the market growth.

The inherent properties of polyurethane, which allow for multiple different uses within many markets, largely drive growth for it across multiple industries. Thanks to its versatility and adaptability, it can come in the form of foams, coatings, sealants, and adhesives; meeting the different application requirements in automotive, construction, furniture, and packaging. The flexibility and individualized structure of polyurethane, along with its lightweight and durability, have a rich culture of use in producing items as advanced as automotive parts, as simple as insulation panels, and as every day as mattresses. Moreover, in terms of building and construction, its property of sound insulation has led to the significant demand as insulation material for energy efficiency solution where heat retention is important. China was the number user of polyurethane in 2023, a key material in the country's construction and auto industry, according to Chinese government statistics.

Additionally, the recent need for the use of environmentally friendly products has created novel innovations and the advent of bio-based polyurethanes that provide sustainability with performance. Such introduction of bio-based polyurethane resins that are high-performance are changing the landscape of the coatings & insulation market and are promoting a shift towards more efficient & sustainable materials.

Polyurethanes (PU) Market Restraint

-

Environmental Concerns may hamper the market growth.

The challenges of environmental concerns are also among the top restraints of the growing polyurethane (PU) market. Most polyurethanes come from petrochemicals, so there is sustainability concerns related to the manufactured methods and the environmental impact of the waste that remains for a long time. Polyurethane (PU) materials include foams, coatings and adhesives, which can lead to plastic pollution when not disposed of properly or recycled. Recent growing awareness of climate change and resource depletion has pushed regulatory bodies around the world (e.g., REACH regulations by the European Union and national environmental standards) to impose more and more severe rules on the production and disposal of chemical products, including PU.

Polyurethanes (PU) Market Opportunity

-

Growing demand for low-VOC, environmentally friendly, and long-lasting polyurethane

The growing demand for low-VOC (volatile organic compounds), environmentally friendly, and long-lasting polyurethane is driven by increasing awareness of health, safety, and sustainability in various industries. Low-VOC polyurethane reduces harmful emissions, making it safer for indoor applications and compliant with stricter environmental regulations. Its long-lasting durability ensures extended product life, reducing the need for frequent replacements and minimizing waste. Industries such as construction, automotive, furniture, and coatings are increasingly adopting eco-friendly polyurethane formulations to meet regulatory standards and consumer preference for green products. This trend not only supports sustainable practices but also drives innovation in high-performance, environmentally responsible polyurethane solutions.

Polyurethanes Market Segment Highlights:

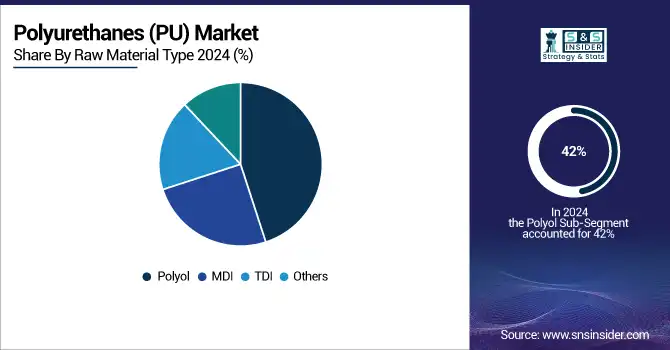

By Raw Material Type, Polyol Dominates Raw Material Segment with 42% Share in 2024

Polyol held the largest market share around 42% in 2024. Its volume in the formulation of practically all types of PU products, including foams, coatings, adhesives, and sealants. Polyols are one of the two main building blocks used in synthesizing polyurethane (the other being isocyanates), and polyols are very versatile and widely used in the automotive, construction, and furniture industries. This prominence can be attributed to the growing demand for polyols where flexible and rigid foams account for a major share of the market. The global flexible foams segment, which is widely used for furniture cushions, mattresses, and automotive seating, as well as rigid foams, used for insulation, are also expanding at a steady pace.

By Product Type, Rigid Foam Leads Product Segment in 2024, Driven by Insulation Applications

Rigid foam held the largest market share around 32% in 2024. It is extensively used in various insulation applications in the construction, refrigeration, and automotive industries. Due to its low thermal conductivity and specific lightweight features, it is perfect for thermal insulation applications where good energy efficiency combined with a saving space concept are criticaligid polyurethane foam is widely used by the construction industry for building insulation as it provides incredible thermal insulation and energy conservation, which, subsequently, is influencing its demand, particularly for energy-efficient construction, across the globe.

By End-User, Building and Construction Sector Holds Largest Market Share in 2024 Due to Energy-Efficient PU Applications

The building and construction sector held the largest market share around 27% in 2024. Due to the growing need for energy-efficient materials and advanced construction technologies, the building and construction sector accounts for the largest PU market share. Polyurethanes in particular in rigid foam and coatings help, through insulation and sealing applications in buildings, to reduce energy consumption in buildings. Rigid polyurethane foam is one of the main materials that are used in thermal insulation while maintaining the building's temperature control, and reducing energy loss. PU product demand in the construction industry has increased with the global movement towards sustainable construction practices along with stringent energy codes.

In addition, rapid housing and infrastructure growth also taking place in emerging countries like India and China further contributes to boosting this sector. Moreover, the promotion of green building practices and energy-efficient solutions through government incentives is another factor that is likely to fuel the demand in the coming years, thereby further stimulating the adoption of polyurethane-based materials.

Polyurethanes Market Regional Analysis

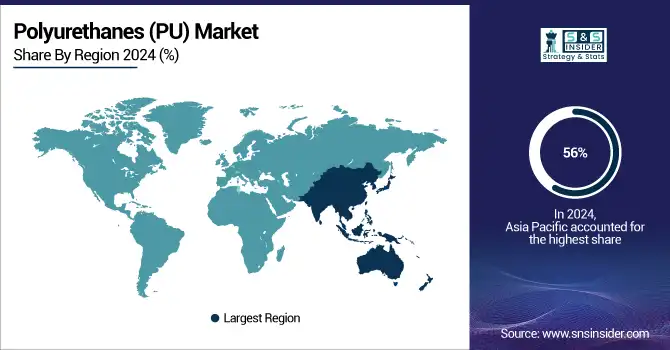

Asia Pacific Polyurethanes Market Insights

Asia Pacific held the highest market share around 56% in 2024. It is driven by the construction, automotive, and electronics sectors. This increase in demand is predominantly seen for PU products, most notably, rigid and flexible foams due to their application in thermal insulation and packaging, which is further driven by the healthy economic growth in the region and robust infrastructure development, especially in the emerging economies such as China and India. Such growth in urbanization, population, and government investments in housing and commercial infrastructure projects drives the booming construction industry in these countries. Asia Pacific is also the hub of a few global automotive manufacturers wherein PU applications for seating, insulation, and soundproofing are predominant, thereby augmenting regional growth.

Get Customized Report as per your Business Requirement - Request For Customized Report

Moreover, the growing Asia Pacific emphasis on energy conservation and environmental protection has propelled the demand for PU-based products from key industries in insulation applications, including building materials and refrigeration. In addition, the availability of key PU manufacturers in the region along with supportive government policies such as subsidies for energy-efficient technologies and green building projects are supporting the market growth over the upcoming years. For example, the PU has garnered continued growth due to the market investing in green construction materials and China being the largest PU consumer.

Europe Polyurethanes Market Insights

In 2024, Europe is one of the prime contributors in the polyurethanes market due to burgeoning requirements in the construction, automotive, furniture and insulation applications. Stringent environmental code and the EU emphasis on energy efficiencies are contributing to the increased use of polyurethane-based insulation materials in green building initiatives. Germany, France and Italy, among them are in the lead in adopting bio-based polyurethanes to support circular economy objectives. Europe has a very competitive position because the market has access to top-flight manufacturers and technology on lightweight, high-performance PU products.

North America Polyurethanes Market Insights

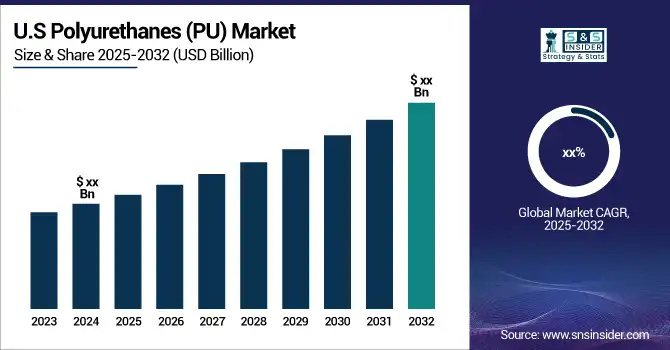

Polyurethanes market is constantly increasing in North America banking on construction, automotive, packaging and electronic applications. The US is the largest market in the region on account of robust demand of spray polyurethane foams in residential and commercial buildings, increasing use of PU elastomers in automotive to reduce weight and enhance fuel efficiency. Increasing consumer inclination toward energy-efficient residential buildings and sustainable technologies in residential sector will drive the industry growth by 2024.

Latin America (LATAM) Polyurethanes Market Insights

Moderate growth in the polyurethanes market in LATAM will be supported by increasing infrastructure construction and automotive manufacturing. The largest markets are Brazil and Mexico, where there is extensive consumption of PU foams for the building sector, furniture and appliances. Demand is being driven by government-sponsored housing projects and rising investment in industrial development. Further, growing demand for bio based and recyclable polyurethane solutions is slowly influencing the market landscape in the region.

Middle East and Africa (MEA) Polyurethanes Market Insights

MEA is anticipated to witness substantial gains in 2024 on account of high scale construction activities, urbanization and increasing demand for cost-effective and thermal insulating materials. Among Gulf region, countries such as Saudi Arabia, UAE and Qatar are the leading contributors due to infrastructure development and smart cities projects running in these countries. PU foams and coatings find worldwide applications in the construction, automotive, and packaging industries. Furthermore, the area’s expansion tactics and efforts towards sustainable material usage favor the growth of high-end polyurethane markets.

Polyurethanes Market Competitive Landscape:

Recital

Recital is a manufacturer specializing in sustainable polyurethane solutions, focusing on eco-friendly insulation and construction materials. The company emphasizes carbon reduction, circular economy initiatives, and innovative product development to support energy-efficient and environmentally responsible applications.

-

In June 2023, Recital launched a line of PU insulation boards based on 25% bio-circular raw materials as part of its initiatives to reduce carbon emissions by 43%, reinforcing the company’s commitment to sustainable polyurethane manufacturing.

Covestro AG

Covestro AG is a global leader in high-performance polymer materials, including polyurethanes and thermoplastics, serving industries such as automotive, construction, electronics, and renewable energy. The company prioritizes innovation, sustainability, and high-quality material solutions to meet evolving industrial demands.

-

In May 2023, Covestro AG opened a new production line and launched the Desmopan UP thermoplastics polyurethane (TPU) series for protective films in automotive and wind applications, highlighting its focus on durable, high-performance, and environmentally responsible materials.

Polyurethanes Market Key Companies

-

Eastman Chemical Company (U.S.) (PU Adhesives)

-

BASF SE (Elastollan Thermoplastic Polyurethane)

-

Tosoh Corporation (Japan) (PU Raw Materials)

-

Huntsman Corporation (Rubinate Polyurethane Systems)

-

The Dow Chemical Company (VORANOL Polyether Polyols)

-

Covestro AG (Desmodur Isocyanates)

-

DIC Corporation (Polyurethane Dispersions)

-

Mitsui Chemicals (Admer Polyurethane Adhesives)

-

Wanhua Chemical Group (Wannate Isocyanates)

-

Lubrizol Corporation (Estane Thermoplastic Polyurethane)

-

Lanxess (Adiprene and Vibrathane Polyurethanes)

-

Perstorp Group (Capa™ Polyols)

-

Recticel (Flexible PU Foams)

-

Woodbridge Group (Polyurethane Foam Systems)

-

INOAC Corporation (Automotive PU Foams)

-

Manali Petrochemicals (PU Systems for Coatings)

-

Bayer MaterialScience (Baytherm PU Systems)

-

Armacell (Armaflex Insulation Foams)

-

Mitsubishi Chemical (Hyperthane Polyurethane)

-

Trelleborg AB (PU Coatings and Seals)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 84.77 Billion |

| Market Size by 2032 | US$ 125.77 Billion |

| CAGR | CAGR of 5.05% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material Type (Polyol, MDI, TDI, Others) • By Product Type (Flexible foam, Rigid foam, Coating, Adhesive & sealants, Others) • By End User (Building & construction, Automotive & transportation, Bedding & furniture, Footwear, Appliances & White Good) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Eastman Chemical Company (U.S.), BASF SE (Germany), Tosoh Corporation (Japan), Huntsman Corporation (U.S), The Dow Chemical Company (U.S), Covestro AG (Germany), DIC Corporation (JAPAN), |