Automotive Seats Market Report Scope & Overview:

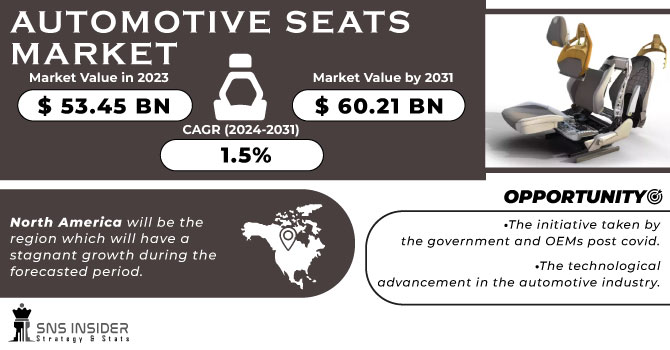

The Automotive Seats Market size was valued at USD 53.45 Billion in 2023 and is expected to reach USD 60.21 Billion by 2031. And grow at a CAGR of 1.5% over the forecast period of 2024-2031.

More vehicles are being produced and sold internationally thanks to the global automotive industry consistent rise over time. The demand for automobile seats rises along with the number of automobiles on the road. When purchasing a vehicle, consumers are progressively placing a higher priority on comfort and convenience. The importance of automotive seats in ensuring the comfort of drivers and passengers has increased demand for seats with cutting-edge ergonomic features, adjustability, and high-end materials. There are many different types of vehicle segments in the automotive market, from compact cars and SUVs to luxury cars and commercial trucks. Since each segment has different seating needs, there are many different seat designs and configurations available.

Get Sampel Report on Automotive Seats Market - Request Sample Report

There has been increase in the production of passenger vehicles by 8% and tis is where the demand fore the automotive seat suppliers will be addressed. To differentiate their automobiles, automakers are putting more attention on interior aesthetics and design. In order to create appealing vehicle interiors, stylish and well-designed seats are a necessity. Modern automotive seats are increasingly outfitted with high-tech features like integrated speakers, massaging features, heating, and ventilated seats, and even seatbelt airbags. These features contribute to increased demand while also improving the overall driving experience. Strict safety laws mandate the installation of cutting-edge safety measures in automobiles, including seats. As safety features like side-impact airbags, seatbelt pretensioners, and anti-whiplash headrests become commonplace, demand for seats with these features increases.

Market Dynamics:

Driver

-

The rise in production of vehicles

Automakers are paying more attention to interior aesthetics and design to differentiate their vehicles. Elegant and well-designed seats are a must for producing appealing vehicle interiors. The demand for the passenger vehicles has increase by 28% which was stated by the industry expert, which is itself the driving factor for market.

The innovations enhance the entire driving experience while also increasing demand. Strict safety regulations require that modern safety features, such as seats, be installed in vehicles. Demand for seats with safety features like side-impact airbags, seatbelt pretensioners, and anti-whiplash headrests rises as they become more prevalent.

Restrain

-

The fragmented needs of different market and the rising cost.

Opportunity

-

The initiative taken by the government and OEMs post covid.

-

The technological advancement in the automotive industry.

Automobile manufacturers diversify their product lines to meet the needs of various market niches and consumer preferences. Offering a variety of automobiles, from small cars to opulent SUVs, helps increase production rates. While Uber and Lyft have changed car ownership trends, they have also increased demand for the vehicles employed in these services. To satisfy client demand, fleet operators require a consistent supply of vehicles. By implementing just-in-time manufacturing techniques and effective logistics, automakers may boost production while lowering costs and inventory.

Challenges

-

The issues faced by the suppliers in terms of fluctuations in operating cost and the constrains of tight labour market.

Impact of Recession

Consumer tastes may change towards smaller, more fuel-efficient automobiles during recessions, which may affect the sorts and designs of seats that are in demand. Smaller cars could have distinct features and seat arrangements. Although sales of new cars may fall, demand in the aftermarket and maintenance industries may rise. Customers might decide to keep and fix their current vehicles rather than buy new ones, which could be advantageous for businesses that deal with seat replacement and repair. As people look for more smart transportation options during economic downturns, demand for used cars frequently rises. This may have an indirect effect on the demand for seats because some second-hand cars may need seat improvements or replacements.

Impact of Russia Ukraine War:

Steel, foam, polymers, and electronic components are just a few of the raw materials and parts that Ukraine and Russia are a source for. For the producers of car seats, any interruptions in the flow of these materials from the area may present supply chain difficulties. Supply chain interruptions, particularly those that influence raw materials, might cause materials used in seat production to be more expensive. This can result in greater production costs for the companies that make the seats, which might raise the cost of the cars that have such seats. The raw materials prices have shown a increase of 26%. This increase is putting pressures on suppliers in terms of increasing the prices of final products.

Market Segmentation

By Material

-

Synthetic Leather

-

Genuine Leather

-

Fabric

By Technology

-

Standard Seats

-

Powered Seats

-

Others

By Sales

-

OEM

-

Aftermarket

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Regional Analysis

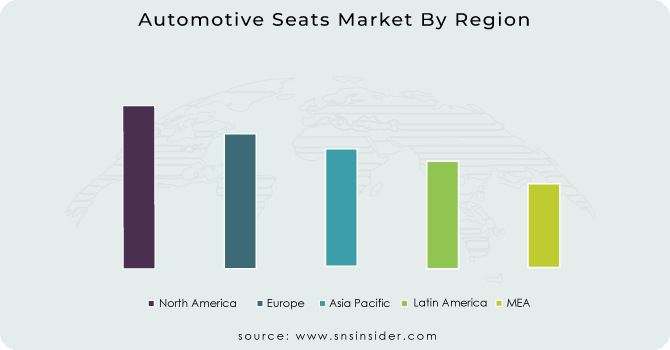

North America will be the region which will have a stagnant growth during the forecasted period. A wide variety of vehicle types, from compact cars to full-size trucks and SUVs, define the U.S. automotive seats market. Comfort, safety, and high-tech amenities are frequently prioritised by consumers. Additionally, there is a rising need for seats that can accept autonomous and electric car technologies. The automotive manufacturing industries in Canada and Mexico are sizable, with a focus on creating seats for both domestic and international markets. Due to strict safety rules, innovative seat features have been added.

Europe will be the region with the second largest share because vehicles of all sizes, including sports cars, luxury sedans, and tiny automobiles, are available on the European market. European customers frequently want seats with premium materials, ergonomic designs, and cutting-edge safety features. Innovative seating options are a major emphasis for several European automakers. A few nations in this region, especially Slovakia and Hungary, have emerged as major hubs to produce seats for automobiles. These nations frequently place a high priority on production that is economical while adhering to EU safety and quality regulations.

APAC will have the highest CAGR growth rate China is both a substantial producer of automobile seats and the largest automotive market in the world. Compact cars, luxury cars, and electric cars are all in demand. Seats with cutting-edge technology and comfort characteristics are frequently sought after by Chinese consumers. South Korean and Japanese automakers are renowned for their cutting-edge technologies and inventive seat designs. Modern materials and ergonomic characteristics are frequently found in the seats in these areas. Cost-effectiveness is a key consideration in seat design because the Indian market is known for its small and compact automobiles. The goal of Indian manufacturers is to offer comfy seats at reasonable prices.

Get Customized Report as per your Business Requirement - Enquiry Now

Key Players

The major key players are Adient Plc, Lear Corp, Forvia, Toyota Boshoku Corp, Magna International and others.

Lear Corp-Company Financial Analysis

Recent Industry Development:

-

The number of EVs on the road increased as a result of various automakers adding new electric models to their lineups. The development of EVs was aided by advances in battery technology, expanded charging stations, and financial incentives from the government.

-

More vehicles now have ADAS technologies like automated emergency braking, lane-keeping assistance, and adaptive cruise control, which improve safety and convenience. Communication between vehicles and everything else (V2X) V2X technology gained popularity because it allows vehicles to interact with one another and with infrastructure, enhancing traffic management and safety.

| Report Attributes | Details |

| Market Size in 2023 | US$ 53.45 Billion |

| Market Size by 2031 | US$ 60.21 Billion |

| CAGR | CAGR of 1.5% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Material (Synthetic Leather, Genuine Leather, Fabric) • By Technology (Standard Seats, Powered Seats, Others) • By Sales (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Adient Plc, Lear Corp, Forvia, Toyota Boshoku Corp, Magna International |

| Key Drivers | • The rise in production of vehicles |

| Market Opportunity | • The initiative taken by the government and OEMs post covid. • The technological advancement in the automotive industry. |