Corporate Wellness Market Report Scope & Overview:

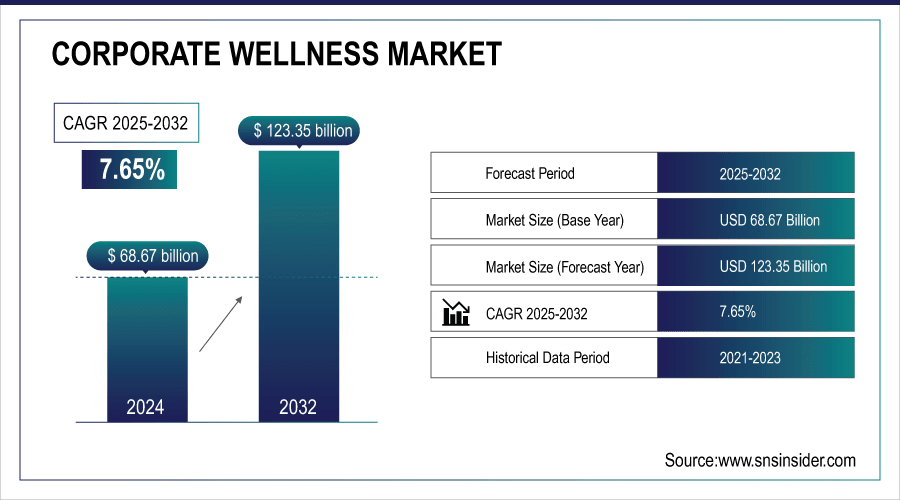

Corporate Wellness Market was valued at USD 68.67 billion in 2024 and is expected to reach USD 123.35 billion by 2032, growing at a CAGR of 7.65% from 2025-2032.

The Corporate Wellness Market is expanding due to rising employer focus on employee health, productivity, and retention. Increasing awareness of mental well-being, stress management, and preventive healthcare drives adoption. Integration of digital wellness platforms, wearable technologies, and personalized programs enhances engagement. Additionally, regulatory support, growing healthcare costs, and competitive workplaces encourage organizations to invest in comprehensive wellness initiatives, fueling market growth.

In March 2024, 44% of private industry workers in the U.S. had access to wellness programs.

According to the Centers for Disease Control and Prevention (CDC), chronic diseases and injuries in the workforce cost U.S. employers USD 575 billion in lost productivity each year.

The CDC further recommends coordinated, systematic, and comprehensive approaches for creating workplace health promotion programs to improve employee well-being and enhance overall health at organizations.

To Get More Information On Corporate Wellness Market - Request Free Sample Report

Corporate Wellness Market Size and Forecast:

-

Market Size in 2024: USD 68.67 Billion

-

Market Size by 2032: USD 123.35 Billion

-

CAGR (2025–2032): 7.65%

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Corporate Wellness Market Trends

-

Increasing focus on employee health and productivity is driving corporate wellness program adoption.

-

Integration of digital health platforms, wearable devices, and mobile apps is enhancing engagement and monitoring.

-

Rising awareness of mental health and stress management is boosting demand for wellness initiatives.

-

Data-driven wellness solutions are enabling personalized programs and improved ROI measurement.

-

Adoption across industries like IT, BFSI, and manufacturing is expanding market reach.

-

Remote work trends are accelerating virtual wellness offerings and flexible program delivery.

-

Partnerships with fitness, nutrition, and mental health service providers are enhancing comprehensive wellness solutions.

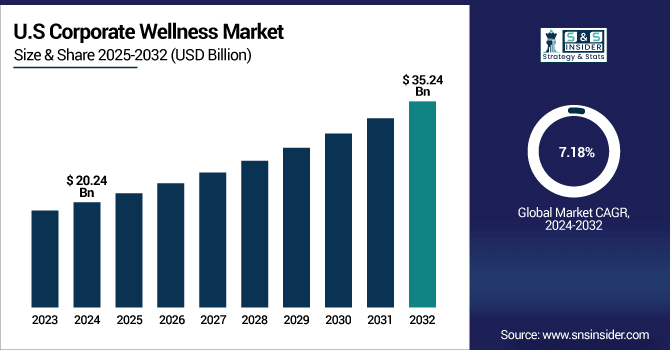

U.S. Corporate Wellness Market was valued at USD 20.24 billion in 2024 and is expected to reach USD 35.24 billion by 2032, growing at a CAGR of 7.18% from 2025-2032.

The U.S. Corporate Wellness Market is growing due to rising employer emphasis on employee health, productivity, and engagement. Increased adoption of digital wellness solutions, preventive healthcare programs, and mental well-being initiatives, along with competitive work environments and cost-saving strategies, drive market expansion.

Corporate Wellness Market Growth Drivers:

-

Rising workplace stress and lifestyle-related illnesses push employers to adopt corporate wellness programs for enhancing employee productivity and health.

Growing cases of stress, obesity, and chronic illnesses among employees are increasing demand for workplace wellness initiatives. Organizations realize healthier employees are more productive, motivated, and engaged, directly impacting business performance. Rising healthcare costs push employers to invest in preventive wellness programs to reduce absenteeism, improve morale, and create a healthier workforce culture. The growing awareness of mental health and balanced lifestyles further drives adoption, with companies offering stress management, fitness plans, and nutrition guidance. Corporate wellness programs are increasingly seen as essential investments for long-term sustainability and competitive advantage in talent retention.

-

In 2024, approximately 30% of U.S. workers reported that they, either always or often, find their work stressful.

-

As of 2023, 42.4% of U.S. adults have obesity, with 9.2% experiencing severe obesity. In the same year, 76.4% of U.S. adults reported having at least one chronic condition, with 51.4% reporting multiple chronic conditions

Corporate Wellness Market Restraints:

-

Managing cultural diversity, dispersed workforces, and varied employee health needs complicates successful implementation of wellness programs in global corporations.

Large multinational organizations face challenges in designing wellness programs suitable for diverse cultures, work environments, and health priorities. A wellness approach effective in one region may fail in another due to differing attitudes, regulations, or resources. Remote workforces further complicate accessibility, requiring flexible digital and on-site solutions. Additionally, employee groups may have varying health concerns—from chronic diseases to mental health needs—making customization critical. Employers must balance inclusivity with cost-efficiency, often struggling to tailor solutions for global teams. This complexity creates significant challenges for corporations attempting to implement universal wellness strategies at scale.

Corporate Wellness Market Opportunities:

-

Growing digital health technologies and AI-based wellness platforms create new possibilities for scalable, personalized, and cost-effective corporate wellness solutions.

Advances in wearable devices, mobile apps, and AI-driven platforms enable companies to offer personalized health insights to employees. Digital wellness technologies provide scalable and cost-effective solutions, making adoption easier across organizations of all sizes. Data-driven insights allow employers to track employee health trends, customize interventions, and improve engagement through gamification and interactive platforms. Virtual counseling, telehealth, and digital fitness programs expand accessibility, especially for remote and hybrid employees. Integration of AI-driven analytics supports better decision-making for preventive care. This technological shift creates significant opportunities for growth in corporate wellness by aligning with digital transformation trends.

-

The CDC's National Institute for Occupational Safety and Health (NIOSH) has explored the use of wearable technologies to monitor exposure to harmful chemicals or substances in the workplace.

-

A study by Alight found that 80% of employees actively seek customized messaging and coaching, with two-thirds willing to share more information in exchange for personalized guidance.

-

A meta-analysis cited by the CDC found that for every $1.00 spent on wellness programs, there was a return of $3.27 in reduced medical costs and $2.73 in absenteeism reductions

Corporate Wellness Market Segment Highlights

-

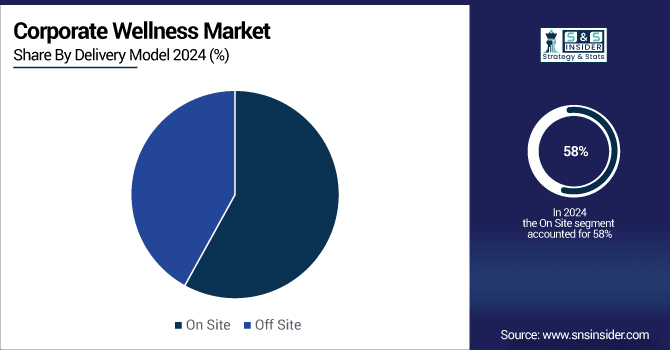

By Delivery Mode, On Site dominated with ~58% share in 2024; Off Site fastest growing (CAGR 7.99%).

-

By Service Provider, Organizations/Employers dominated with ~53% share in 2024; Fitness & Nutrition Consultants fastest growing (CAGR 8.17%).

-

By Organization Size, Large Scale Organizations dominated with ~59% share in 2024; Medium Scale Organizations fastest growing (CAGR 8.26%).

-

By Program Type, Health Risk Assessment dominated with ~22% share in 2024; Stress Management fastest growing (CAGR 9.40%).

Corporate Wellness Market Segment Analysis

-

By Delivery Model, On-site programs dominated while Off-site programs are expected to grow fastest

On-site programs dominated the corporate wellness market in 2024 as organizations prioritized accessibility, convenience, and integrated support within workplaces. Employees benefitted from real-time counseling, fitness facilities, and medical checkups at office premises, ensuring higher participation rates. This model proved effective in boosting engagement, reducing absenteeism, and enhancing workforce productivity.

Off-site programs are expected to grow at the fastest CAGR from 2025 to 2032 as employees increasingly demand flexibility, remote options, and personalized wellness services. Rising hybrid work culture, digital wellness platforms, and partnerships with external gyms and wellness centers fuel growth by offering tailored solutions beyond traditional office settings.

-

By Category, Organizations and employers led while Fitness and nutrition consultants are projected to expand fastest

Organizations and employers dominated the corporate wellness market in 2024 as they were the primary drivers of program adoption and funding. Employers invested heavily to reduce healthcare costs, retain talent, and enhance workforce efficiency. Direct organizational initiatives established structured wellness strategies, ensuring broader coverage and measurable outcomes across industries.

Fitness and nutrition consultants are expected to grow at the fastest CAGR from 2025 to 2032 due to rising awareness of preventive health. Increasing focus on lifestyle-related diseases, demand for personalized diet plans, and professional guidance in fitness drive their importance, especially as employees seek expert-driven wellness interventions for long-term health improvements.

-

By End-Use, Large-scale organizations dominated while Medium-scale organizations are expected to grow fastest

Large-scale organizations dominated the corporate wellness market in 2024 as they had higher budgets, infrastructure, and resources to adopt comprehensive wellness programs. Their focus on employee retention, productivity, and compliance with global health standards positioned them as leaders in implementing diverse wellness initiatives across varied employee demographics and geographies.

Medium-scale organizations are expected to grow at the fastest CAGR from 2025 to 2032 as they increasingly recognize wellness as vital for employee satisfaction. Affordable digital platforms and customizable wellness packages allow them to implement effective programs. Growing competition for skilled talent also motivates mid-sized firms to prioritize structured health and wellness initiatives.

-

By Service, Health risk assessment led while Stress management is projected to grow fastest

Health risk assessment dominated the corporate wellness market in 2024 as organizations emphasized preventive healthcare and early detection of illnesses. Regular screenings, biometric tests, and lifestyle evaluations enabled employers to identify potential risks early, reduce long-term healthcare costs, and create personalized wellness strategies tailored to employees’ unique health profiles and needs.

Stress management is expected to grow at the fastest CAGR from 2025 to 2032 due to rising mental health concerns and workplace pressures. Growing awareness of burnout, anxiety, and work-life imbalance drives demand for counseling, mindfulness, and resilience programs. Employers prioritize mental well-being to improve employee productivity, engagement, and overall organizational performance.

Corporate Wellness Market Regional Highlights

-

By Region, North America dominated with ~40% share in 2024; Asia Pacific fastest growing (CAGR 8.50%).

Corporate Wellness Market Regional Analysis

North America Corporate Wellness Market Insights

North America dominated the corporate wellness market in 2024 due to advanced healthcare infrastructure, strong corporate emphasis on employee well-being, and early adoption of comprehensive workplace wellness programs. High prevalence of chronic diseases, rising healthcare costs, and proactive government initiatives encouraged significant investments in preventive wellness solutions. Additionally, established wellness service providers and integration of digital health technologies further strengthened North America’s leading position in the global market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Corporate Wellness Market Insights

Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2032 as rapid urbanization, increasing workforce size, and growing awareness of employee health drive demand for wellness initiatives. Rising stress levels, lifestyle-related illnesses, and chronic conditions are pushing companies to adopt structured wellness strategies. Expanding corporate sectors across India, China, and Southeast Asia, combined with supportive government measures and rising use of digital wellness platforms, are accelerating regional market growth.

Europe Corporate Wellness Market Insights

Europe holds a significant position in the corporate wellness market in 2024, driven by strong workplace health regulations, employee well-being initiatives, and high awareness of preventive care. Organizations across the region actively invest in mental health support, fitness programs, and lifestyle management. Increasing focus on reducing absenteeism, improving productivity, and aligning with sustainability and ESG goals further strengthens Europe’s market presence.

Middle East & Africa and Latin America Corporate Wellness Market Insights

The Middle East & Africa corporate wellness market is expanding as rising lifestyle diseases, workplace stress, and increasing employer awareness drive demand for wellness initiatives. Governments and large corporations are promoting preventive health programs to enhance productivity.

Latin America is witnessing growth in corporate wellness with rising healthcare costs, urbanization, and employer focus on fitness, nutrition, and mental health programs supporting workforce well-being and efficiency.

Corporate Wellness Market Competitive Landscape:

ComPsych

ComPsych, a leading provider in the Corporate Wellness Market, offers comprehensive employee assistance and wellness solutions focused on mental health, stress management, and work-life balance. The company integrates digital platforms, personalized programs, and counseling services to enhance employee well-being, engagement, and productivity. With a global presence and innovative approach, ComPsych supports organizations in fostering healthier, more resilient workforces while reducing healthcare costs and improving overall organizational performance.

-

2025 — ComPsych launched the Empowered Leadership Coaching Experience, addressing a 42% surge in demand for manager mental health training, offering personalized one-on-one coaching for empathetic, supportive leadership.

-

2025 — ComPsych expanded GuidanceResources Online, tripling video assets and introducing an AI-powered audio reader, creating the industry’s most comprehensive, dynamic digital mental-health and well-being resource library.

-

2025 — ComPsych unveiled refreshed branding alongside an upgraded GuidanceResources digital experience, designed to reflect its mission of igniting human potential through modern, intuitive access to mental-health and wellness tools.

Personify Health

Personify Health is a prominent player in the Corporate Wellness Market, delivering personalized digital health and wellness solutions to organizations. The company focuses on preventive care, chronic condition management, and employee engagement through AI-driven platforms, virtual coaching, and wellness programs. By promoting healthier lifestyles, improving productivity, and reducing healthcare costs, Personify Health empowers companies to enhance workforce well-being and organizational performance effectively.

-

2025 — Personify Health introduced its unified brand after merging Virgin Pulse and HealthComp, delivering an integrated personalized health platform that streamlines health plans, employee wellness, benefits navigation, and engagement into one coordinated solution.

-

2024 — Personify Health partnered with WeightWatchers for Business, embedding its weight-health care platform into employer programs. The collaboration enables scalable, clinical-grade weight management support within Personify Health’s broader personalized wellness ecosystem.

-

2023 — Virgin Pulse’s Homebase for Health platform earned “Best Overall Patient Engagement Platform” at the MedTech Breakthrough Awards, highlighting its advanced benefits navigation, advocacy capabilities, and commitment to driving meaningful member health engagement outcomes.

Corporate Wellness Market Key Players:

-

ComPsych Corporation

-

Wellness Corporate Solutions

-

Virgin Pulse

-

EXOS

-

Marino Wellness

-

Privia Health

-

Vitality

-

Wellsource, Inc.

-

Provant Health Solutions

-

Beacon Health Options

-

Central Corporate Wellness

-

SOL Wellness

-

Truworth Wellness

-

ADURO, INC.

-

Well Nation

-

WellSteps

-

CoreHealth Technologies

-

Vantage Fit

-

Fitbit, Inc.

-

Personify Health

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 68.67 Billion |

| Market Size by 2032 | USD 123.35 Billion |

| CAGR | CAGR of 7.65% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service (Health Risk Assessment, Fitness, Smoking Cessation, Health Screening, Nutrition & Weight Management, Stress Management, Others) • By End-Use (Small-scale Organizations, Medium-scale Organizations, Large-scale Organizations) • By Category (Fitness & Nutrition Consultants, Psychological Therapists, Organizations) • By Delivery Model (Onsite, Offsite) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | ComPsych Corporation, Wellness Corporate Solutions, Virgin Pulse, EXOS, Marino Wellness, Privia Health, Vitality, Wellsource, Inc., Provant Health Solutions, Beacon Health Options, Central Corporate Wellness, SOL Wellness, Truworth Wellness, ADURO, INC., Well Nation, WellSteps, CoreHealth Technologies, Vantage Fit, Fitbit, Inc., Personify Health |